Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The Profit Leak You Might Not Be Tracking — And How to Fix It

Photo by Michael Jasmund on Unsplash

Photo by Michael Jasmund on Unsplash

When you’re running a subscription business, churn is just part of the game. Granted, you want it to be as low as possible, and you probably work hard on reducing your churn month to month…but how much attention are you paying to your involuntary churn?

While you’ll never be able to entirely eliminate churn — involuntary or not — you can decrease it as much as possible.

In particular, involuntary churn, when a previously happy customer is lost due to circumstances like an expired credit card or declined transaction, is typically preventable.

And not only is it preventable…it’s potentially costing you much more money than you’ve realized.

On average, most debit and credit cards issued expire after three years, with some US card issuers shortening the cycle even more in response to the new EMV “chip & pin” mandates. That means that, at minimum, 1/36th of all cards in circulation (or 2.8 percent), expire every month. This doesn’t account for cards that are canceled due to theft or other circumstances, but we’ll use it as a baseline to discuss the costs of involuntary churn.

Here’s an example of how much involuntary churn can affect a subscription business:

- Let’s say you start with 1,000 subscribers, and aren’t making any effort to earn new subscribers or reach out to customers as their cards expire (unlikely, but we’ll run with it so that we have round numbers for the sake of this example).

- In just one year, you’ll lose 34% of your revenue, compared to the prior year (or 336 subscribers).

- In your second your, you’ll 336 more subscribers, and take a 50% drop in revenue over the prior year.

- By the end of the third year, you’ll have lost virtually all of your revenue and subscribers — all over declined credit card transactions and involuntary churn.

In a real world situation, your sales and marketing engines are hopefully adding new subscribers at a much faster rate than you’re losing them. But either way, it’s worth setting up systems to decrease involuntary churn. That lets you be covered in case something happens that throws off your sales and marketing goals (like your primary social media platform changing the way it shows posts).

It’s also worth noting that it’s much more affordable to reduce churn than it is to acquire a new customer. So no matter how quickly you’re adding subscribers, it’s still costing you more than keeping the ones you already have.

Let’s look at another example…

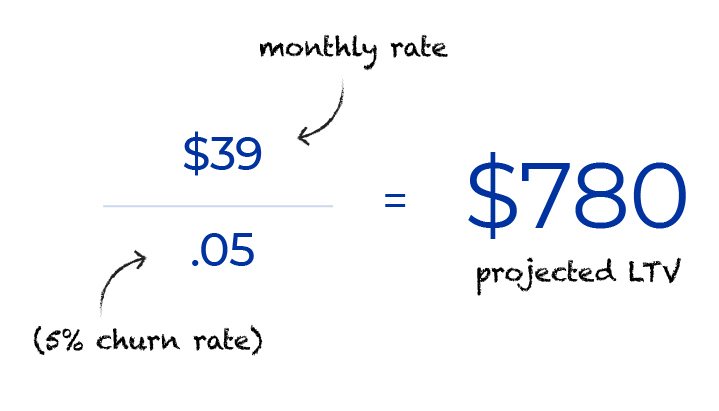

If your churn rate is 5% per month, and you charge a monthly subscription fee of $39, your projected lifetime customer value (LTV) is $780. ($39 divided by .05 = $780)

If you look at it from a different angle, that means your average customer lifetime is 20 months. By reducing your rate of involuntary churn, you can, in turn, increase your average customer lifetime (and your average LTV).

If, for the purposes of this example, we assume that 2% of your total churn rate is voluntary — customers actively choosing to cancel their subscription — that means that the remaining 3% is involuntary churn. If you can cut that in half, to a new rate of 1.5% of involuntary churn or 3.5% total churn, you can increase your customer lifetime value by quite a bit, to $1,114 (or nearly 43% more).

Using revenue to decrease involuntary churn — yes or no?

If I were to tell you that it would cost 2% of your revenue to cut your involuntary churn by 1.5%, would you want to take the deal? Probably not, right? It sounds like a bad deal, at first glance. But if you break down the math, you’ll find a different story.

When you invested nothing in churn reduction, your customer lifetime value was $780. If you invest two percent of your revenue into strategies that, in turn, reduce churn by 1.5%, you end up with an LTV of $1114 — at a cost of $22.28 ($1114 x .02).

In other words, it would cost you just over $22 to earn $334, which is a 15x return on investment.

How quickly do you achieve that ROI? It takes 29 months to fully realize it, but the first “earnback” usually happens after a few short months.

Even with more conservative returns, it doesn’t make sense to not invest in reducing churn. If your 2% investment results in a .01% reduction in monthly churn, you’ll still save 1 out of 1000 customers every month, and completely break even on the investment.

In extreme cases, we’ve had customers come to us with monthly churn rates as high as 20%. These companies were literally bleeding out, and in their cases, very small investments in churn reduction not only saved them, but for some of them, made them wildly profitable again.

So…how do I get started fixing it?

There are a lot of ways you can approach the problem of involuntary churn — but what’s the fastest way to start making headway today?

Get proactive with your customers who have cards expiring soon, and make the updating process as easy as possible for them.

The expiry data is all there, it’s just a matter of automating a process to act on it. For example, in Rebilly, you can set up automatic card update reminder emails to your customers. You’ll create a custom event and schedule it to run before the payment card expires by a certain amount of time (for example, 30 days). Then, you’ll add a rule to the custom event with an email action (and compose the email).

Most other subscription softwares have a similar feature, but even if they don’t, you can still reach out to people, as long as you’re using an email marketing tool (like MailChimp, Aweber, Drift, etc.). Just run a search of customers with cards that are expiring in the next two months and then export that list of customers. Then, you can use that to create an email list and schedule series of emails reminding them to update their payment card.

It’s a simple action that will only take a few moments to set up (and some maintenance over time), but you’ll see the dividends before you know it.

This post was originally published on the Rebilly blog.

The Profit Leak You Might Not Be Tracking — And How to Fix It was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.