Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

I’ve never seen a B2B company get to anything much under 18 months. — Steve Wood, B2B Serial Entrepreneur

Startups are difficult.

It can take anywhere between 6 months and 3 years to get a business off the ground. To succeed, founders have to be ready to go the distance.

This means shortening your time to product market-fit, being resilient, and extending your startup runway.

I started HireVoice, my previous startup, with little to no money and no income stream.

Quickly, I had to cut spending and use my line of credit.

Although having little to no money keeps you hungry, the stress bears down on you. I can’t say I was completely thinking straight; the financial pressures are one of the core reasons why I shut down the business. It was clear that I had to find ways to increase my ability to take risks.

To help founders go the distance, I created the following list of ways to extend startup runways with their Pros and Cons:

Using Personal Finances to Extend your Startup Runway

Your Own Savings

- Pros: In some ways, tapping into your savings to fund your business is the ideal solution. You keep all control and become your own investor. Since you’re working from cash on hand, you don’t pick up debts, and have a clear picture of your time horizon. This can be a good path however…

- Cons: Self-funding your startup means you’re not accountable to anyone for the way you spend your money. This can mean spending on the wrong things and over-spending, but also not knowing when to pull the plug because of your ego or other reasons. At the end of the day, if your investment doesn’t pan out, you can be left with significantly less savings and little to show for it. As the saying goes, it’s always better to spend someone else’s money than your own.

Credit

- Pros: Using credit gives you the flexibility to decide when you spend and go beyond your own cashflow. It typically doesn’t require approval and can be used very quickly.

- Cons: With yearly interest rates as high as 25%, it’s quite likely that it will take years to repay the investment. In fact, you’ll probably pay multiples of it. Although some founders have managed to fund their business on credit card debt, it’s definitely not the wisest long-term way to extend your startup runway.

Bank Loans

- Pros: Unless you’re willing to mortgage your house or other assets you own, bank loans won’t be an option. Banks rarely fund early tech projects because you need liabilities to get a bank loan.

- Cons: See above.

Extending your Startup Runway with Revenue

Startup Revenue

- Pros: Startup revenue is the healthiest way to create your startup runway. By getting clients or prospects to pre-pay for your product, you can start your business with money in the bank, and a pretty clear sign of product-market validation

- Cons: Depending on the industry and the market, pre-selling may not be an option. Clients may want to see a working solution before making a purchase. More so, to create sustainability, pre-selling requires selling big-ticket items, which may take a long time to sell. All in all, this is the healthiest option because it incorporates validation, but you may need a secondary source of income to get there.

Keeping Your Job

- Pros: Guaranteed income. There’s a lot of built-in waiting time in the early days of a startup. Keeping your job means you can experiment with the comfort of having a full-time wage. As you build and get validation, you can gradually reduce your working hours. Working in an organization is also a great way to find business ideas (Read: How to Find B2B Business Ideas in Your Workplace).

- Cons: Because of work (days don’t always end at 5pm / weeks are tiring) and other life and family commitments, it can be difficult to get a lot going with a full-time job. Splitting your attention can make it difficult to get real results. With a job, you’re almost always choosing between building your startup and your other personal obligations. This is one of the reasons why starting up is easier when you’re young.

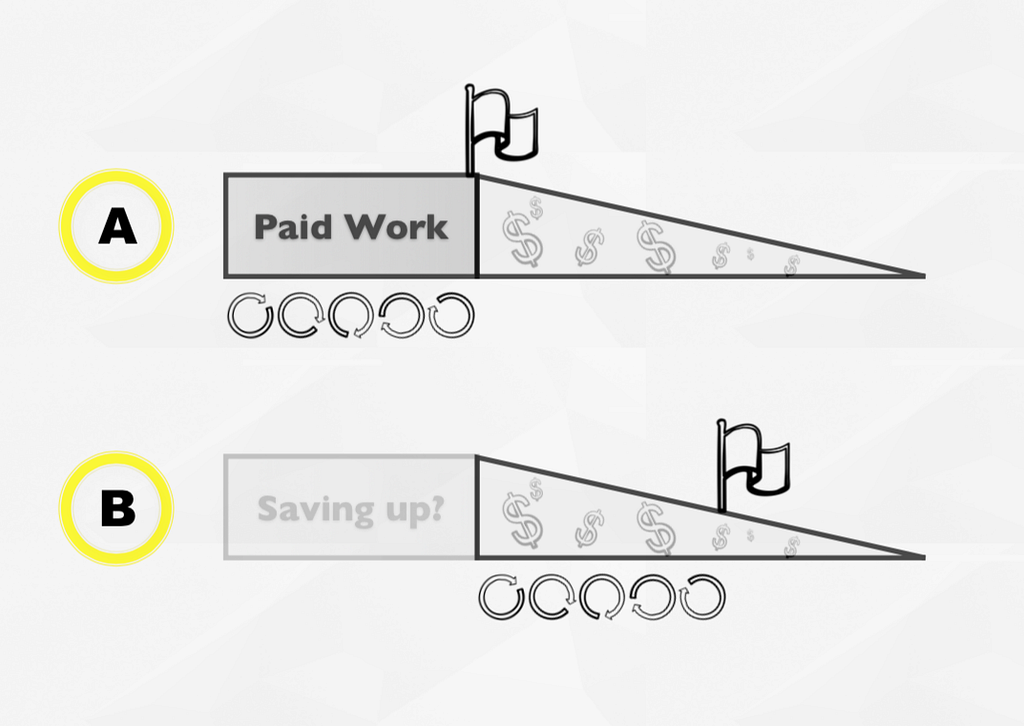

Startup Runway — Finding Product-Market Fit on Savings Vs. While Keeping Your JobConsulting

Startup Runway — Finding Product-Market Fit on Savings Vs. While Keeping Your JobConsulting

- Pros: Consulting is one of the most common ways to extend your startup runway. Depending on you expertise and rate, it can provide a good cash influx when needed. By picking your clients carefully, you might even be able to turn your consulting gigs into a successful product business (e.g. clientstrapping).

- Cons: I funded my work on Flagback and Psykler with consulting. Although you can find ways to get better control over your schedule (e.g. blocking days, only accepting short mandates, etc.), consulting makes it difficult to control your schedule and maintain a high level of focus. It’s also very difficult to turn down money and mandates, which can really sidetrack your business.

Secondary Product Revenue

- Pros: This is how I’m funding my current startup, Highlights; a mix of book and course sales and some affiliation revenue. This reduces the financial pressure, allows me to capitalize on assets I’ve already created and, because sales are very transactional, it gives me freedom to focus on building Highlights.

- Cons: The secondary products take time to build, and surprise, they also take time to maintain (products don’t sell themselves!). If you don’t already have a secondary product that sells, it can mean taking a step back to take 2 steps forward. More so, as your secondary products start to make real revenue, you’ll be tempted to focus exclusively on your secondary products.

Micro-Tasks & Micro-Projects

- Pros: You can do micro-tasks or small projects — logo design, user testing feedback, quick translations, quick development projects, etc. — to earn a side-income. Because of the short duration of the projects, you get better control over the workload and schedule. (Note: Bart Boch created a great list of micro-projects here).

- Cons: Depending on your background and past income, this can feel like working for nothing or cheapen your personal brand. Although there should be less client management, meetings and waiting, it’s also quite likely you’ll have to deal with those.

Investment

Money from Friends & Family

- Pros: Friends and family members will be more likely to invest because they know you better than other investors. Because they’re not professional investors, their expectations of return and the pressure they’ll give you will be a fraction of the pressure you’ll get from investment firms. This can both be good and bad.

- Cons: If your startup works, your friends and family make money (Great!), but if it doesn’t… you run the risk of damaging important relationships in your life. Startups are risky, a lot of them fail to scale past early adopters, beware of raising money from family and friends.

Angel Investors

- Pros: There are a lot more angel investors than there are investment firms. Angel investors can be a nice hybrid between friends and family and an investment firm. Because they often were entrepreneurs themselves they can provide helpful mentorship. Angel investors generally don’t have the same timetable and expectations of return that VCs do.

- Cons: Raising capital from angel investors leads you down a certain path for your business. It comes with expectations for growth and progress. Since angel investors are often solo, they’ll rarely become the lead investor of your funding round, so you’ll need to supplement their investment with other investors or other types of investments.

Venture Capital Funding

- Pros: If your business has the potential to grow big and you want to go fast, venture capital money might be the best path forward for you. There are a lot of good VC funds and accelerators in B2B, so you can find a good partner who will open doors and guide you to the finish line.

- Cons: Not everyone is a fit for VC funding. Even if your business qualifies, it may be a mindset you don’t wish to follow. Raising capital from VCs means going for a home run with all the pressure and expectations that comes with it. Raising this kind of capital is a move you’ll have a hard time coming back from and it can be a significant distraction (raising a round often takes 6+ months of work).

Independent and Bootstrapper-Friendly Funding

- Pros: These past few years, there have been a growing number of investment vehicles for bootstrappers and lifestyle entrepreneurs. Funds like Indie.vc, Earnest Capital and TinySeed invest money without the expectation of a liquidity event (e.g. an acquisition). Their investments come with mentorship from other bootstrapped entrepreneurs.

- Cons: Although these funds’ expectations are different, raising capital takes time and has an impact on your business’s trajectory. Seeing that these options are fairly new, I’ll wait to see how they work out for the founders partaking.

Grants & Contests

- Pros: Grants can come in many shapes and forms. By positioning your business for various grants you can raise equity-free funding. Often times, this money will be tied to certain processes and activities your business needs to do. For example, in Canada you can get grants and credits for hiring people of certain backgrounds, including certain multimedia components, doing research & development, etc., etc.

- Cons: Most grants and contests won’t bring in a ton of capital. Since the pitches will all be different, it will require a lot of work and preparation to get several grants. In some countries, it will difficult to keep on top of all the grants and subsidies your business can benefit from.

Alternate Funding Vehicles

- Pros: The funding landscape is changing quickly. Equity crowdfunding has been one of the most interesting new options for founders these past few years. With equity crowdfunding, you get to raise capital from hundreds of, often smaller, non-professional investors. This usually means maintaining complete control over the decision-making processes as equity owners are more like backers than traditional investors.

- Cons: Equity crowdfunding has not been legalized in all countries and jurisdictions. It typically works best for business to consumer products with strong brands as it requires a lot of campaigning to attract investors. It can be a huge distraction for your business, so you have to consider the pros and cons.

What’s the Best Way to Extend your Startup Runway?

The best way for you will depend on:

- The nature of the project;

- The expected duration (note: it always takes longer than expected!);

- Your expected time commitment and availability;

- Your financial situation;

- The expected velocity (e.g. how fast do you want to go?);

- The financing options at your disposal (e.g. not all businesses can raise VC money)

The right solution will most likely be a mix of the options above (e.g. R&D, grants, and angel funding). For each option, you’ll need to consider the tradeoff between risk and velocity.

No matter the approach you choose, make sure you consider the individual runway of all business partners and the key employees. The more similar their situations, the easier it will be to guarantee that their individual incentives are aligned.

Enjoyed this story? 👏 Clap and get other people to discover it!

Want to Build Products Businesses Need?

The Lean B2B Course 🎥 includes 5 hours of High-Quality Video Lessons, Worksheets and Templates expanding on the Lean B2B book.

The Lean B2B: Build Products Businesses Want Video CourseCurious? Sign up for our Free 2-Week Email️ Course 👇

The Lean B2B: Build Products Businesses Want Video CourseCurious? Sign up for our Free 2-Week Email️ Course 👇

Further Readings on B2B Customer Development

I publish articles on B2B customer development every week on my blog:

- Can The Lean Startup Techniques Work in B2B?

- How Much Time Do You Need to Get to Product-Market Fit in B2B?

- 16 Tips for Better Customer Development Interviews in B2B

Originally published at leanb2bbook.com.

14 Ways Entrepreneurs Can Extend their Runway to Go the Distance was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.