Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Major Technical Challenges Hindering Global Blockchain Adoption

Having certain benefits, which have already been thoroughly discussed since its emergence, the blockchain technology has particular limitations. Some of them are cultural, some are political, and some are technical. In this article, we are going to focus on the technical challenges that blockchain is faced with on its way to global adoption by small business.

1. Energy consumption

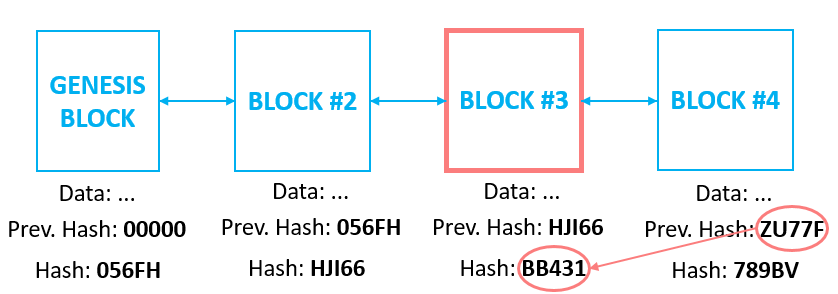

The issue of energy consumption has always been a major stumbling block in the original proof-of-work-based blockchain of Bitcoin. The projected total energy consumption of the Bitcoin network for 2018 stands around 73 TWh, which puts Bitcoin in the 39th position in the world’s ranking of countries by energy consumption according to www.digiconomist.net.

Source: etherhttps://digiconomist.net/bitcoin-energy-consumption

Source: etherhttps://digiconomist.net/bitcoin-energy-consumption

The amount of energy consumed by the Bitcoin network has grown multifold from December 2017 to October 2018. Thus, in order to join the Bitcoin network and get financial benefits from it any business will need a substantial amount of energy, which may be costly.

Since the emergence of blockchain other far less energy avid algorithms for achieving distributed consensus has appeared, the most famous of which is proof of stake. They have a chance to make blockchains more applicable in businesses of different scale.

2. Immutability

One of the uses of blockchain regularly brought up in community discussions is that of information storage. However, there is an issue of immutability with that, which makes blockchain less appropriate for data management. That is so because the nature of blockchain excludes the possibility of change in the data previously entered into it. And that is a serious drawback in its competition with centralized information storage systems because business-wise the ability to manage data is very important.

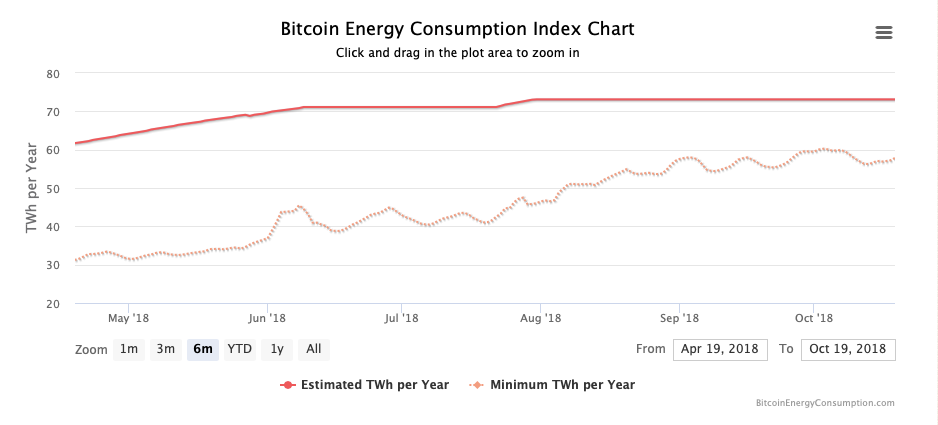

Here the technical explanation :

If someone tempers the data in a blockchain then the hash of that block will change. What does it mean? That the cryptographic hash link will no longer work. Which means the hash values in the neighbouring blocks will differ.

if the data is changed then the hash of the block changes as well. The hash pointers are broken. So the hacker has to change the hash in that node as well. But then the next node in the blockchain will not work properly. So the hacker has to change that too … So if something happens to a block then all the next nodes will not be valid. It means that unlike the centralized architecture, it is extremely hard to hack blockchains.

So this is why it is called immutable ledger. As soon as data has gone into a given block, it is very very difficult to change it and end up with a valid blockchain again.

Thus, the blockchain in its present design as a registry of information would be more applicable somewhere, where only the basic record of information is required, which leaves area not very much for its application by enterprises.

3. The 51% attack

The 51% attack requires over 50% of the blockchain’s computational power in case of PoW blockchains accumulated by one miner or one group of miners. The 51% attack allows to acquire centralized control over the blockchain and falsify the registry of transactions entered in the main branch of the blockchain. But it is only theoretically possible in the massive networks of Bitcoin and Ethereum. But if we think about blockchain networks used on the level of a startup, it appears that the 51% attack is very possible as a relatively small amount of power will be enough to implement it (the number of blocks created are really low in compared to BITCOIN, ETHEREUM etc..).

A successful 51% attack on a blockchain will give the attackers who implemented it the power to control the confirmations of transactions including their reversal. If such a thing happens in a small company it may cause a massive damage to the business.

Big company with a massive volume of transaction won’t be safe in a few years. Why? Because of the power of quantum computers that could easily crack the system.

This system uses factorials and exponentials in algorithms (based on the use of qubits instead of bits). In clear English, this means the speed of calculation will increase exponentially and will easily cover the 51% network level to modify the entire chain of blocks created. Quantum algorithms will crack all the chain of hash and be able to rehash the entire chain in implementing any modification (or hack) anywhere in the chain.

This means a massive amount of money hacked, transaction modified or cancelled etc…See this source if you want to know more.

According to MIT Technology Review, this type of quantum computing can hack the cryptography hash that universally secures the blockchain and in general the internet.

A potential solution could be to add a Quantum cryptography merely in another word, add a quantum layer to the standard blockchain protocol. Del Rajan and Matt Visser at the Victoria University of Wellington in New Zealand suggest making the entire blockchain a quantum phenomenon…

4. Designed to be slow: A scalability problem

Every transaction that happens on Bitcoin’s blockchain leaves quite a lot of informational residue which is not required for trustworthy operation of the whole network. However, that information takes up a substantial amount of space on the network and makes the blockchain cumbersome and slow.

Here are what we have to keep in mind: The time taken to put a transaction into a block and the time taken to reach a consensus

The Bitcoin blockchain can currently support only seven transactions per second (tps). PayPal network can support 193 tps and the Visa network can support more than 1,600 tps.

There have been created much faster blockchains than Bitcoin’s one but remaining the dominant cryptocurrency Bitcoin propagates its intrinsic flaw through the largest blockchain network and projects the conception of the slowness of blockchain to the public.

Let’s take Ethereum platform, the total number of transactions is increasing approximately every 10–12 seconds with each new block. This platform depends on a network of nodes. Each of them stores the entire transaction history and the current state of account balances, contracts and storage. This is a tremendous volume of data. That’s why the system is slow when you have to much transactions (Volume of users) and the “gas” you pay for the transaction increase.

On top of that these transactions are expensive as this requires more time, resources and energy to validate the blockchain (Hardware requirements for miners and more nodes in charge to secure the blockchain and process transactions).

The solution should be improved with Casper (Proof Of Stake): Instead of powerful miners verifying transactions on the network, users will be able to ‘stake’ their Ether.

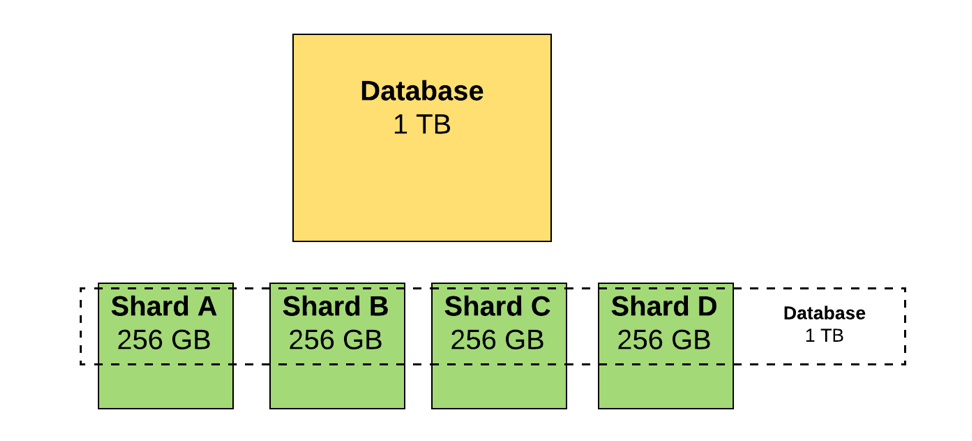

Another technic is to use the sharding: Partition the data (table) horizontally and store it in different database servers; or in other words, Sharding of the database. It reduces the time of accessing/searching for data but also reduces causes scalability problem.

Another point to add is that if developers raise the size of each block to fit more transactions, the data that a node will need to store will grow larger (Hardware will not be enough to face this volume) and prevent users to use the network. If each node grows large enough, only a few large companies will have the resources to run them.

Conclusion

The blockchain technology, as we have it today, has a certain global potential which is more likely to be exploited by large communities. However, when it comes down to its implementation on the level of an emerging business, the business owners will far more likely opt for better-known solutions with a long record of usage by businesses of various scale.

Business Concept should be so far aligned with platform capacity or supported with a new technical solution that should be clearly explained in the roadmap of the blockchain project.

Major Technical Challenges Hindering Global Adoption was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.