Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Satoshi’s 2nd Gift — “Part 3” : ICO Research

Using BitcoinTalk for Evaluating ICOs and STOs

In my previous articles on BitcoinTalk, we’ve covered what the forum can be used for and how to get started. We discussed that the Forum created by Satoshi has been home to multiple milestones and it continues on today as a treasure trove of research, discussion, services, and bounties.

In this article, we’re going to take a look at how to use the information on BitcoinTalk in evaluating ICOs.

First, its always important to do a very comprehensive and ridiculous amount of research before even remotely considering investing any money in any ICO projects. This is a highly unregulated area, with multiple ways for schemers to disappear and stay hidden after running away with your money. This is the highest level of risk in the world of investments you can possibly find. Proceed with caution.

Now, not every project will be on BitcoinTalk. As I mentioned in my previous articles, despite its importance in the crypto world, many still don’t know of its existence.

A project not having an Announcement on BitcoinTalk is not necessarily a negative. A project that has no presence whatsoever when you do a search on BitcoinTalk, means they are probably way too early in their development to warrant investment at this point.

This article will focus on

- how to easily spot the scams

- how to report the scams

- how to evaluate the strength of discussion for further evaluation

There are multiple ways to evaluate an investment and I dont want to make it seem that using BitcoinTalk is all you need to determine if a project is investment worthy. The discussion below will help save time on determining what is most DEFINITELY a ponzi scheme, and what kind of projects merit further investigation.

On the forum — you’ll be able to

- Find scam reports

- See Announcement threads

- Locate previous discussions and mentions

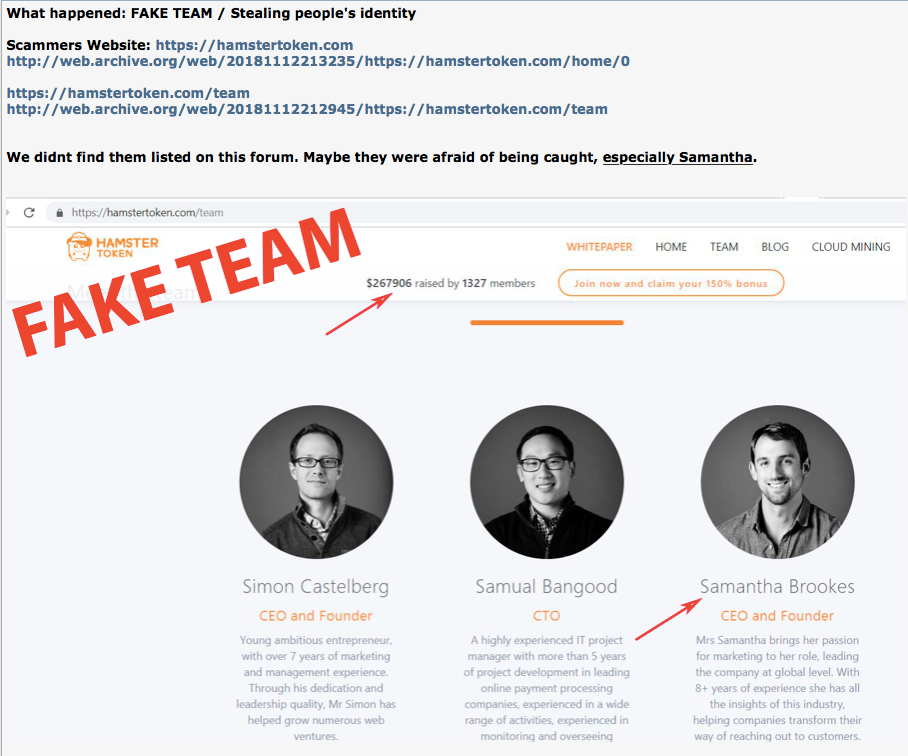

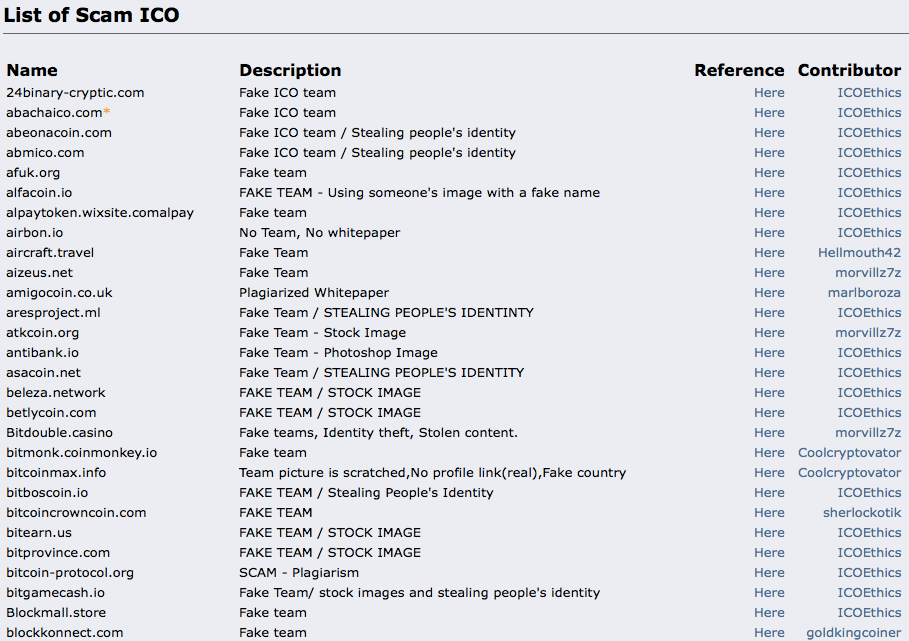

Known Scams

This is your easy homework — your cheat sheet for finding the cheats. Some great contributors like ICOEthics, Coolcryptovator, and morvillz7z have spent a great deal of time proving that this ⚠ List of SCAM ICO! [PROVED] is 100% dependable. Your first line of defense in evaluating an ICO is to make sure its not already a proven MLM/Ponzi scheme.

You might be wondering how they can know beyond a shadow of a doubt that an ICO is a fraud. Well… most fraudsters have one trait in common…they are amazingly lazy. Incredibly lazy. Like “Oh my god, I can’t believe people are falling for this scam” lazy. They will plagiarize whitepapers, copy existing websites, and make fake teams.

Can you see the common theme?

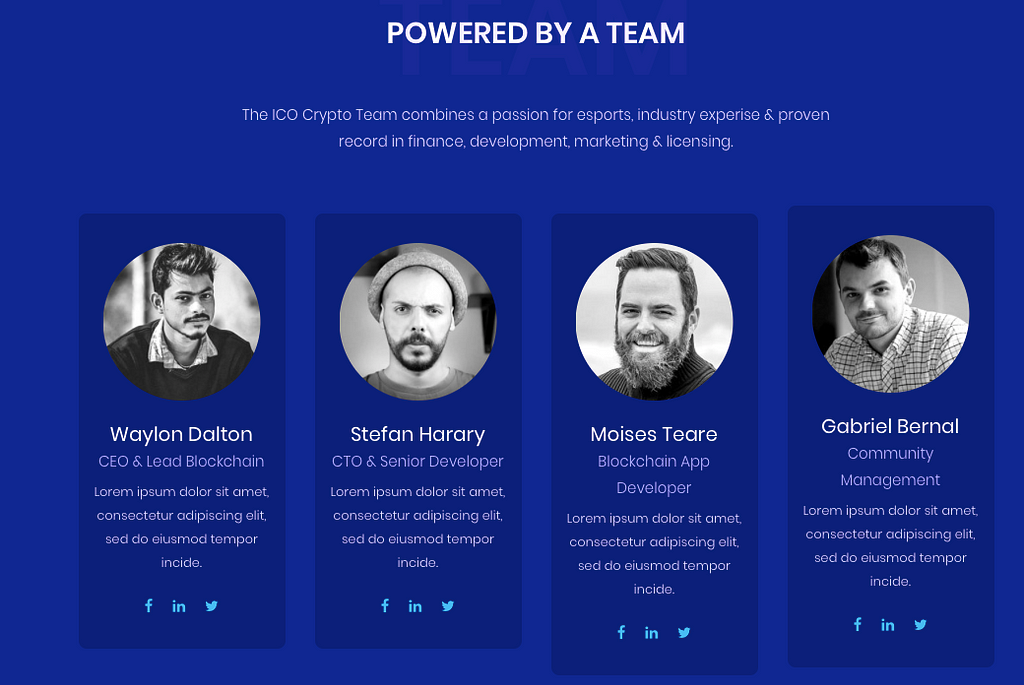

Can you see the common theme? Multiple Scams use this stock image from an ICO template

Multiple Scams use this stock image from an ICO template

“Team” is the number 1 indicator of a ICO scam. It’s the hardest to fake. You can’t magically get a group of high value experienced individuals to come together and agree to work on a common project without a considerable amount of effort and planning. I dont want to imply that a team of lesser known, less experienced individuals is a scam, but schemers will aim high and try to pass off very accomplished people as part of their team.

The lazy part comes in when they copy existing teams in their totality from another project. With a quick google search or reverse image lookup you can find the original source in most cases. Some of the criminals will take it a step further and swap out pictures, but again these can be quickly identified. (I love seeing the pictures of a bearded man named Maria as the CTO)

Stolen identities are one level higher, where fraudsters will post real people’s information and social links. They are betting that you wont bother to click on the links. They are betting that people wont look to see if there is actual involvement. Check twitter and LinkedIn whenever you can. Make sure that the people are at least actually working on the project. Take it one step further and reach out or follow their social media accounts. This is the easiest part of the work for us, and the hardest part for them.

Scam Reports

The raw amount of detective work that goes into each accusation is astounding. This forum really is your best friend in doing research into ICOs. The Scam Accusations thread is where there is an ensuing investigation into an ICO. It’s not a 100% known that they are a fraud, but the fact that they are on the thread is a really bad start. Use this resource to read more and see what people don’t like about each project.

If you happen to discover an ICO, service, or other member of the crypto community that is 100% a scam artist(or suspect that they are) it is your responsiblity to inform the community.

This format has become the recommended template, and you can submit the thread here:

ICO Name:Scammer Website:Archived Website:ICO status: (Exit / Live / upcoming )Bitcointalk Profile:ANN Tread:Archived ANN:Bounty Thread : Archived Bounty:Valid Reason of Accusation:Describe briefly about accusation with solid proof/image/screenshots : Source links:

Linkedln/profile Link of team with name:Domain Information:

Some great resources for scam detection on BTT:

- ⚠ List of SCAM ICO! [PROVED]

- 🌍 Guidelines, how to spot a scam ICO & report effectively. ✔

- A simple search could save lot of money from ICO scammers

- [EDU] How to spot a scammer (Read this before doing any transactions!)

Announcement evaluations

Now that we are safely out of the scam zone (or at least the lazy scam zone), we now need to evaluate the value of the projects that are most likely legit.

Social media presence can be misleading. Facebook likes, Telegram members, Twitter followers can all be manipualted or purchased in bulk. The same goes for BitcoinTalk, albeit it being a lot harder since there is a higher barrier to entry there. Despite all of these factors being malleable with enough cash, what can’t be faked is intelligent activity. What we should be looking for in any discussion in BTT Announcement threads are:

- Accounts commenting that are not newbies. You’ll find most projects that are paying for interaction cannot muster more than a few accounts above the Junior Member level.

- No Evidence of deleted comments from high ranking members. Our motto has to be to “trust in truth”. A serious project doesnt need to delete the posts of anyone in their threads, and should be able to confidently ignore or respond.

- The quality of the posts. You want to see that the discussion is around the technology or the team. Hundreds of “I love this project they will surely moon” is a bad sign of purchased interaction. There will always be a few of these, but if there is no merit in the ICO, then there will be no serious inquisition into the problem and its solution.

- Responses from the team. The more responses you see from the team on an official thread to actual questions is a very positive sign. Fraudsters don’t have the capacity to respond to questions that might expose their empty promises of future tech

Searching the database

As I mentioned before, many highly reputable projects do not have an Announcement Thread on BitcoinTalk. That being said, you will almost always find good projects are mentioned somewhere in the forum. By searching for the name or the domain of the project you are interested (and be careful, many names of projects have been recycled multiple times), you’ll be able to see all the mentions throughout time.

Creator:Graham HaberWhat are we happy to see

Creator:Graham HaberWhat are we happy to see

- Technical discussions. This is the best possible result as it means there is enough interest in the project that people are discussing its tech. Even if the discussions have negative mentions surrounding the viability of the products idea, its a positive sign that this is being seriously discussed instead of being ignored. Remember, even multi-billion dollar projects like Bitcoin have their tech detractors.

- Presence in Top ICO rating lists. This indicator is a little weaker, but look at what other projects are mentioned in that list, and the ranking level of the poster and subsequent posters. Using this information can not only help you decide if the ICO is valuable, it can guide you into better understanding what aspects of the project are the most exciting

What we don’t want to see

- Nothing. If no one on BitcoinTalk is discussing this ICO, chances are its very early and not at a point to consider for retail investment

- Hype talk. The easiest version of this are the common posts that only talk about how excited people are to see this project start, how the ICO will definetely 100x, and how many lambos their new techonology will surely bring to the posters garage. If the bulk of posts are less than 3 lines long, there is a SERIOUS issue in the credibility of the discussion.

Outside of BitcoinTalk

BitcoinTalk is a great resource, but its only one of the many tools in your arsenal for evaluating a new potential investment. There are huge risks involved when looking at putting your money into any project; there are less protections and more ways for people to take off with your money without any repercussion. It is your duty to research intensely. This post by Kristen_Colwell is a great list of directions to follow

In general, the areas of your focus should be:

- Team. We now know that this is the area where scammers fail. Make sure that the team is 100% real and involved.

- Product. There should be a whitepaper and a GitHub link. It’s understandable to see projects in the very beginning to be missing the GitHub link, but no whitepaper should mean no investment in your mind.

- Social media. Teams cannot progress in a vacuum. There will always be other references to their work or to the team’s members. Stealth mode is understandable and serious projects will be able to provide more information when you contact them directly.

- Fundraising and Token economics. If most of the material you can find is about presale discounts and the certainty of return on investment, you should not be involved. If 2017 taught us anything, its that the serious projects are intensely focused on their tech stack.

These are the bare minimum you should expect when evalauting a retail investment. Market fit and execution risk are some of the other factors you will need to evaluate and research. I cannot stress enough how impossible it is to find a “sure bet” in ANY asset class. If you are determined to put your hard earned money here, make sure that the easy areas of evaluation have been passed with flying colors. Not even one red flag should be tolerated when it comes to getting involved. Keep your money and your identity safe.

This was part 3 of the “Satoshi’s 2nd Gift” guides

I’m going to explore the following topics in more detail in subsequent articles:

-BitcoinTalk: A Crypto Marketer’s most essential tool

-Services: What’s available and how to choose them

-Bounties: How to make crypto millions without investing

Thank you for reading and I hope you enjoyed this article

Feel free to add me on Linkedin here, follow my twitter there →@xldean, and send me a Telegram. New article ideas are always appreciated!

Satoshi’s 2nd Gift — “Part 3” : ICO Research was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.