Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bollinger Band breakouts, squeezes, and divergences are powerful volatility-based trade setups. Bollinger Bands are standard deviation-based price envelopes that you can use to trade range bound and trending markets. They can also help time price/momentum divergence trades. Bollinger Bands (BB) are normally set two standard deviations away from a 20-period simple moving average (SMA).

These volatility-based setups appear in all crypto markets. Each uses the standard BB settings found in most charting/trading platforms. All crypto markets regularly transition from ultra-low volatility phases to high volatility phases. There’s never a long wait for a new BB trade to appear.

Editor’s note: Check out our glossary on technical analysis terms if you find yourself wrestling with definitions or need some clarity 🙂

Definitions:

- Bollinger % B measures the relationship between price and the BB’s. Values above .5 indicate that price is closer to the upper band and values below .5 signify that price is closer to the lower band. Values greater than 1.00 confirm a bullish breakout, values less than zero confirm a bearish breakout.

- Bollinger bandwidth indicator identifies the relative width of the BB’s over an X-bar period.

- Divergence refers to the disconnect between price action and price momentum. When price increases as momentum weakens, negative divergence occurs, and when price decreases as momentum weakens, positive divergence occurs. Most trend reversals are preceded by price/momentum divergences.

Summer 2018: Four Bollinger Band Breakout Trades in Cardano

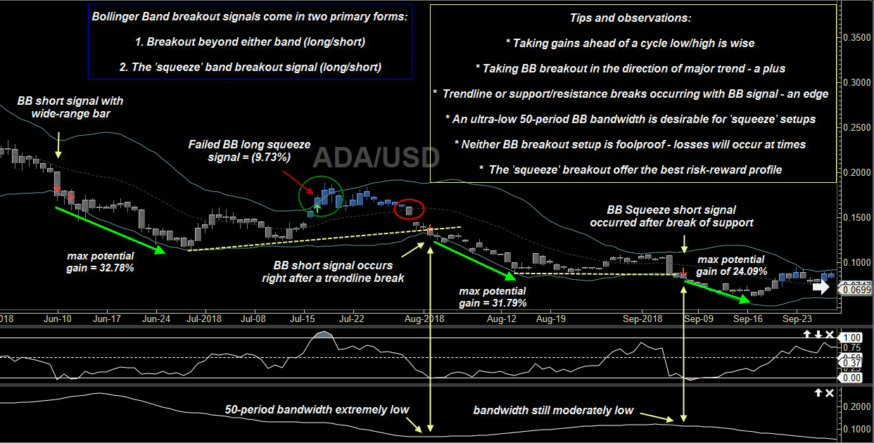

Cardano’s (ADAUSD) daily chart reveals four BB setups between June and September 2018. Three were short trades, one was a long and two qualified as BB squeeze trades. Three were big winners and one had a moderate loss. Here’s the rundown on each one:

Figure 1. Cardano/USD, daily. Four BB trade setups appeared in ADAUSD during summer 2018. Three produced substantial gains. Chart graphic by Motivewave.com

Trade #1, short breakout: A wide-range breakout bar closed below the lower band. You would enter short one tick below the breakout bar low. Gained as much as 32.78 percent before reversing higher.

Trade #2, long squeeze: A modest-range breakout bar closed above the upper band. You would enter long one tick above the breakout bar high. This one gained a few percentage points before reversing for a 9.73 percent loss (on a cross of the BB centerline, the 20-period simple moving average).

Trade #3, short breakout: A small-range breakout bar closed below the lower band. The breakout bar also closed below key trendline support, giving you added directional confirmation. Fifty-period BB bandwidth was very low: a trading edge. Another big winner resulted, gaining nearly 32 percent before reversing higher.

Trade #4, short squeeze: A small-range breakout bar closed below the lower band. The 50-period BB bandwidth was relatively low: an edge. This trade gained as much as 24.09 percent in only ten days before reversing higher.

Will all winning Bollinger Band breakout trades net 20 to 30 percent? Sorry, but no. However, the profit potential of BB breakout and squeeze setups can be substantial. Keep your per-trade account risk small, be aggressive with profit taking, and BB trading success is possible.

Key Takeaways:

- Crypto markets regularly shift from low to high volatility phases, perfect for BB trading.

- Be aggressive in capturing your open gains. Never assume that a winning trade will keep going.

- Trendline breaks and ultra-low BB bandwidth can give you extra confidence when entering a BB trade.

- BB squeeze setups offer you the best risk/reward profile of all BB trade types.

Stalking the Big-Potential BB Squeeze Play

We’ve looked at two BB squeeze setups already, but another squeeze variation, one with big profit potential, is also worth a look.

Figure 2. EOSUSD, daily. Some BB squeeze trades are so powerful that they produce secondary buy/sell signals. Chart graphic: Motivewave.com

This particular squeeze featured an abnormally narrow set of BB’s. The resulting long squeeze breakout signal rallied a maximum of 158 percent in only 18 trading sessions. If the stop loss had been placed a few ticks below the breakout bar, the ultimate risk/reward ratio of the trade would have been nearly ten to one. No, winners like this aren’t common, but they certainly make a strong case for trading BB squeezes, especially when:

- An ultra-wide breakout bar launches from the ultra-narrow squeeze pattern. Should be at least 3 times bigger than the 14-period Average True Range (ATR (14)).

- The 21-period Chaikin Money Flow (CMF (21)) is above its zero line.

- The 89-period Chaikin Money Flow (CMF (89)) is above its zero line.

- The 50-period EMA quickly turns in the direction of the breakout bar.

- Subsequent breakout buy signals appear as the trend gathers strength.

Trade Management

The two additional buy signals could have been used in different ways. Traders who were convinced an extended rally was underway might have added more positions in EOSUSD. And traders who were more risk-averse might have taken a third of their position off at each secondary buy signal, letting the final third run higher to a predetermined target. To each their own, but most pro-traders scale-out of winning trades rather than scale-in (add additional positions), as it offers better performance metrics.

The BB Squeeze is one of the most effective volatility breakout trade setups ever conceived. Stalking the very best of these powerful setups provides you with a superior trading edge.

Key Takeaways:

- Stalk the best BB squeeze setups. Seek ultra wide-range breakout bars from abnormally narrow BB squeeze patterns.

- The 21 and 89-period CMF histograms must be in agreement with the breakout direction.

- Set your stop loss just beyond the extreme of the breakout bar.

- Scale-out of winning trades on subsequent buy/sell signals or other profit target criteria.

Taking Profits at %B Price/Momentum Divergences

The Bollinger %B indicator helps identify high-probability price/momentum divergences. These divergences identify excellent profit-taking opportunities. They can also pinpoint low-risk, mean-reversion trading ops at cycle highs/lows.

The next chart depicts two %B divergence signals that could’ve been used to scale-out of a big winning BB squeeze trade.

Figure 3. Bitcoin Cash/USD, daily. Always take at least partial gains at every new price/momentum divergence. Chart graphic: Motivewave.com

The squeeze entry parameters were similar to the previous long trade in EOSUSD. However, no subsequent breakout buy signals printed. Instead, you would have been tracking the negative price/momentum divergence pattern on the %B indicator. Two distinct divergence signals printed, and each would have been an excellent place to harvest partial gains.

Newer traders may wonder why a pro trader wouldn’t have held on until point 2 was reached. After all, the extra gains would have been substantial. They were, but at point 1 no one, not even a market pro, knew what was going to happen next! Pros take at least partial gains when a price momentum divergence appears. And they will completely exit all positions when the second divergence shows up.

Key Takeaways:

- BB squeeze setups can be powerful, but you still need an exit strategy to capture gains and limit risk.

- When a price/momentum divergence appears, take partial profits.

- If/when a subsequent price/momentum divergence appears, exit completely.

- Pro traders harvest gains based on what the chart says, not based on the emotions of fear or greed.

Summary

Bollinger Bands are one of the most powerful technical tools available for traders. For best results, trade Bollinger Band breakout signals in the direction of the 50-period EMA slope. Always take partial/full profits at each %B price/momentum divergence. Never let fear or greed override a sound exit strategy. Even the most perfect BB breakout/squeeze setup can fail, so always keep your per-trade risk small.Disclaimer:

Speculation in the financial markets involves substantial risk and therefore only risk capital should be used when trading or investing. Always consult your licensed financial advisor before deploying risk capital in the financial markets.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.