Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

As many of you know there is an upcoming hard fork for BCH on 15 Nov and interesting opportunities have cropped up lately. One of them was the introduction of BCH ABC and BCH SV trading by Poloniex. This introduces an interesting arbitrage opportunity that I illustrate in this article.

Note: I share this example to show how the cryptocurrency market has unique arbitrage opportunities as long as you understand the mechanics behind it. It is intended for educational purpose and is by no means a recommendation or investment advice.

The Arbitrage Idea

Premise

- Poloniex is trying to support the fork by allowing tradeable the possible new tokens BCHABC and BCHSV to be tradeable: Poloniex’s Announcement.

- Poloniex is not charging trading fees for USD trades: Circle’s Announcement.

What this mean is that there is a potential arbitrage opportunity, because remember in essence:

BCH Price = BCHABC Price + BCHSV Price

So whenever this relationship does not hold we can look to profit from it.

Example

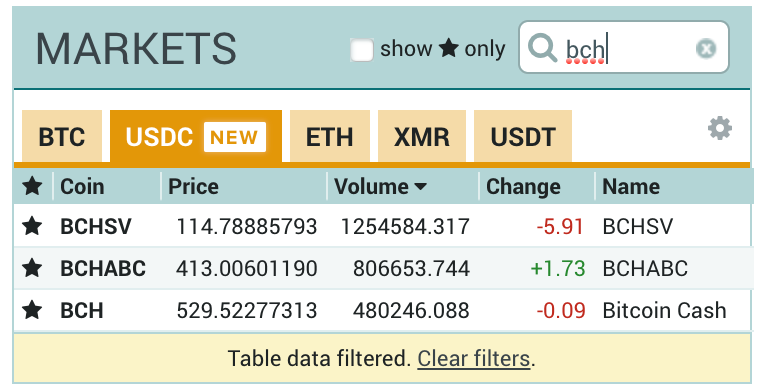

Taking the snapshot of BCH/USDC prices on Poloniex:

If we take the figures above as a trade example, we can see that:

BCH = 529.52BCHABC + BCHSV = 413.01 + 114.79 = 527.8

So BCHABC + BCHSV < BCH

Since we want to sell high and buy low, we would want to:

1. Sell 1 BCH for USDC @ 529.522. Use USDC to buy 1 BCHABC and 1 BCHSV @ 413.01 and 114.79 respectively.3. You end up with 1 BCH plus 1.72 USDC profit.

This gives us roughly 0.16% ROI = 1.72 / (529.52 + 413.01 + 114.79)

Potential Issues

However there are some potential issues with this trading example because:

- My example above does not factor in bid/ask spread which could make your profit go away given the relatively low ROI per trade.

- Our execution speed may be too slow to capture the opportunity and as market prices constantly change between steps 1 and 2, it could mean that the profit can get eroded or even lead to a loss.

Possible Improvements:

- Look at other exchanges that support BCHABC and BCHSV conversions such as HitBTC.

- Use algo/automated trading to improve execution speed and pricing.

Summary

Most likely this trade cannot be done manually given that the ROI is fairly low and that problems such as fees/slippage can easily erode away your profits. But hopefully this gave you some idea of possible arbitrage opportunities that are available in the cryptocurrency space and that many more will occur as the market continues to innovate.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.