Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The recent low in cryptocurrency morale has given our community a rich opportunity for reflection. The vast majority of us crypto enthusiasts have a genuine heart for marrying technology and social action, and I believe it’s time we reflect on where we wanted to go with digital currencies, honestly take stock of the state of blockchain technology today, and rigorously plan how to improve digital currencies moving forward.

I’ve been fortunate enough to sit in on many lectures discussing blockchain technologies and incentive structures in computer science at Stanford University, and it’s led me to the conclusion that crypto incentives have driven a lust for global consensus which obscures the important goals we originally had in mind. Although the trajectory of digital currencies is somewhat depressing right now, I believe that with some more compassion and creative thinking, cryptocurrencies can evolve toward the egalitarianism and liberation that inspires us so deeply.

Reflecting on the goals of cryptocurrencies

Cryptocurrencies were designed in response to corruption bleeding out in the form of unfair financial transactions and social inequality. To be clear: cryptocurrencie were concerned with resolving equality of transactions, not equality of outcomes (indeed, cryptocurrencies are far-fetched from economic socialism).

Airtime remittances have become a common unit of exchange in Africa, where governments often fail to maintain stable currencies.

Airtime remittances have become a common unit of exchange in Africa, where governments often fail to maintain stable currencies.

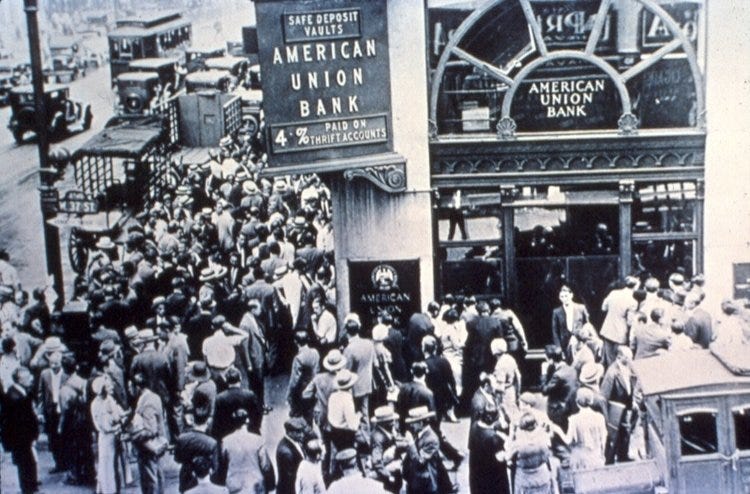

The promise of cryptocurrencies was to bank unbanked Afghan women, who are disempowered from managing (or even having) their own financial assests. It was to provide a stable unit of exchange, so that citizens of Côte d’Ivoire, Egypt, Ghana and Uganda need not worry that the government or banks would render their life’s savings worthless. It was so that credit card companies couldn’t ravage the lives of 43% of Amercian debt holders, who are subject to immediate interest-rate hikes. It was to put a check on the trickle-down wealth creation that happens when people with low-risk profiles (i.e. the rich and/or the government) get access to printed money before its inflation aftershock is felt by families struggling to make ends meet.

We thought that these goals could be met if only we let an algorithm that relies on decentralized consensus protocols manage ledgers of finite coins. But how are we doing now?

Taking stock

Nearly 10 years since Bitcoin’s legendary launch, we have to wonder if we’ve made progress toward these aims. And it seems to me that some very important and good progress has been made in the way of banking the unbanked. As of 2014, Women’s Annex Foundation enabled 2,000 Afghan girls to write and be paid in Bitcoin for their blogs. Further, slow progress has been made in cryptocurrency adoption among third-world populations and local users seem to be somewhat undeterred by Bitcoin’s volatility. Still, cryptocurrencies have failed on many long-term fronts.

Bitcoin and Ethereum use a blockchain to maintain a global, public ledger. Here’s what happens: One person manages a block of financial transactions for a limited period of time. Then, they play hot potato: they close up their block, toss it to the next block holder to temporarily manage the ledger, and so on ad infinitum. Their reward for managing the hot potato is the coinbase transaction — i.e. money that’s created in the system — as well as transaction fees.

The rub is choosing who gets to manage the block and reap the rewards. Bitcoin relies upon proof-of-work to do this. Bitcoin mining rigs solve computational puzzles, and (if they are behaving honestly) the probability that they will manage a block is equivalent to their fraction of all bitcoin-mining computational power. But, this causes some unforseen side effects.

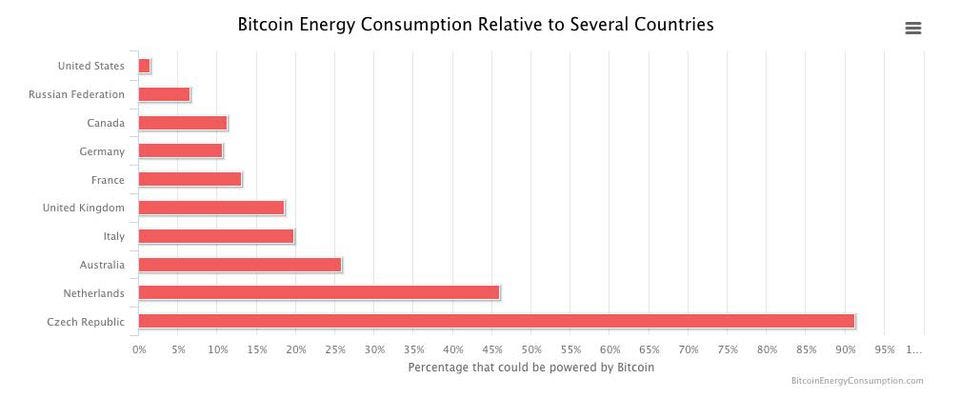

It’s led to a slew of hardware developments aimed at specializing in bitcoin mining, and these suckers take a lot of energy to run. At some points, the cost of energy it took to mine a bitcoin actually exceeded the value of the bitcoin itself. To put this into perspective, the amount of energy being spent on bitcoin mining today could power a small country.

Taken from Forbes.

Taken from Forbes.

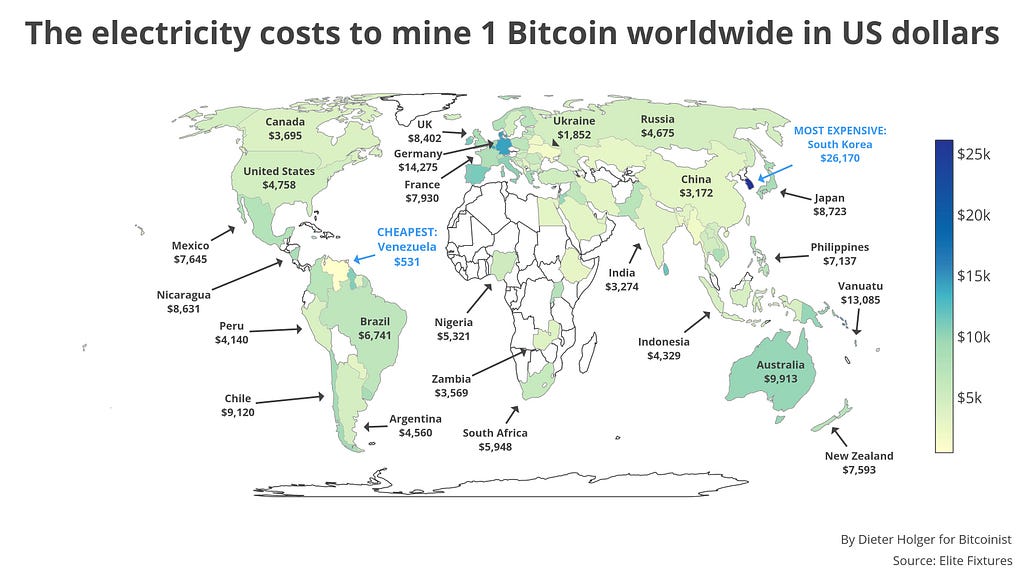

Though unforseen, this side effect is not innocent. While many fear the effects of Bitcoin on climate change, my concern is with the accidental eclipsing of Bitcoin’s egalitarian aims. In pragmatic terms, it means that those who manage the ledger are those who can afford to purchase and operate mining rigs — and this is not a trivial detail. Consider the following provocative world map of how much it costs to mine a Bitcoin by region.

At first glance it is impressive that the cheapest place to mine bitcoin is third-world Venezuela, and the most expensive is first-world South Korea. But a quick second glace quickly provides reason for alarm: If we exclude Venezuela and South Korea as low and high outliers, respectively, then there appears to be a pattern such that historically advantaged countries can mine bitcoin much more cheaply when cost of living is accounted for. For example, the cost of mining 1 Bitcoin is only 7.86% of the average US citizen’s purchasing power; but it is 49.92% of a Mexican citizen’s. It seems that if widespread Bitcoin adoption continues, the rich countries will get richer, and the poor countries will get poorer (not to mention that much of Africa will pay an extra late-adoption penalty; not to mention that some countries are denied access to nuclear energies that could be used on mining). This means that rich miners and wealthy countries will be awarded control over blocks more frequently than their less financially-abled counterparts. Plus they will be choosing which (large) transaction fees are worth selecting from the mempool. This sounds so much like banks, albeit with far more turnover.

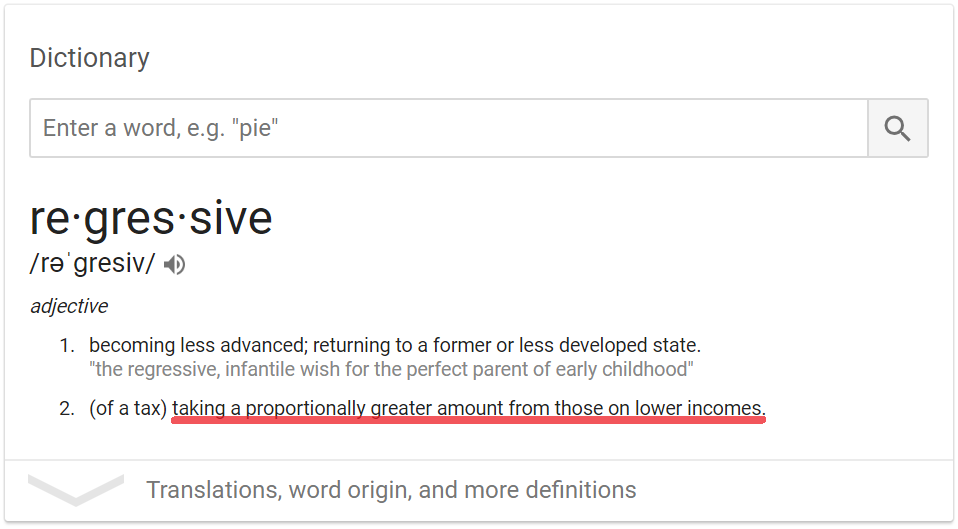

Ethereum tried to get around the excessive need for energy by developing the proof-of-stake paradigm. Whereas Bitcoin’s proof-of-work requires miners to put their skin in the game by basically throwing their computing power away, Ethereum takes an energy shortcut by assigning block management based on the miner’s total percent of the coin network they own. While this certainly is a greener approach, it’s also ethically cringeworthy to crypto-social activists. If Ethereum is adopted widespread, this is basically saying, “the richer you are, the more likely you are to win block management, and the transaction fees and coinbase awards associated with it.” But in all honesty, this is just a more transparent statement of what’s going on in Bitcoin’s proof-of-work as well.

To be clear: Proof-of-work and proof-of-stake are economically regressive.

Now what?

So, here we are, back where I left you at the beginning of this article. Cryptocurrency morale is low, and I’ve not made the outlook brighter. But now I want our community to roll up its sleeves, and do the less-than-glamorous work of putting the pieces back together. How can we build cryptoeconomic systems that value all persons, equally? I have a few suggestions.

Unchain us from blocks.

Many of the issues I’ve noted above revolve around power grabs at the block. If we step back, it’s easy to note that without a block, even wealthy cryptocurrency adopters wouldn’t be at a relative advantage to manage the ledger (and also receive relatively more of the system’s coins). Thus, without a block, the regressive work and stake incentives vanish. It may seem bizarre to imagine a cryptocurrency without a blockchain, but it is feasible to remove the block while maintaining the crypto advantages of digital currencies in a series of transactions linked together (i.e. one ledger per coin). This brings me to my next suggestion.

Decentralize the ledger.

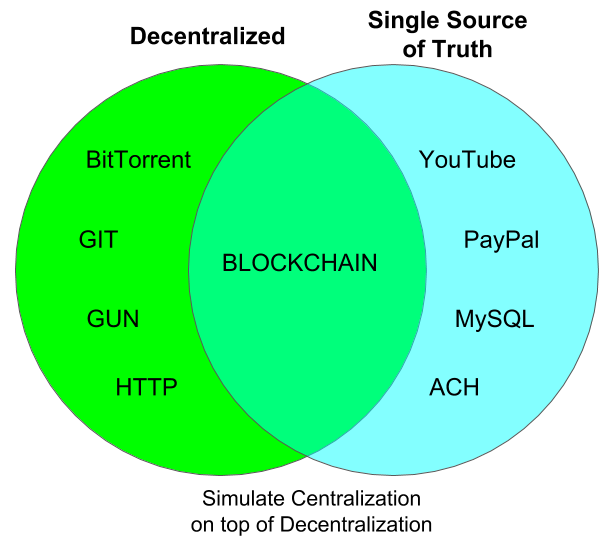

Bitcoin and Ethereum are talked about as though they are decentralized. But a careful examination reveals that they are more accurately described as serially centralized. At any given moment only one peer is managing the ledger. Although the blocks are passed on to many different peers over time, if we were to take a snapshot, or consider any one given moment, it would look as if there is a banking dictator being bribed by competing auctions to document a transaction.

Strong decentralization would instead entail the ledger residing in many peers simultaneously. This is distinct from copies existing in many places — I instead mean that no one person has a complete picture of the ledger because it exists scattered among peers on the network. This sounds alarming only if we assume that no cryptographic proofs of coin legitimacy can be provided in such a setting. However, all that matters in a given transaction is the legitimacy of the coins involved in the transaction — not the legitimacy of all coins on the network.

By unchaining crypto and removing blocks* (as mentioned above), we can validate transactions in realtime on a coin-by-coin basis. There is no need for a big man to paint a given transaction in the context of all transactions throughout the currency’s history.

*But won’t this allow for double spend? No, you can fix this too.

Have finite numbers of coins from the outset.

While coins likely need some incentives to drive adopters away from fiat, we can at least aim to do away with excessive inflation. Awarding coins to block managers inherently means that people who are able to mine (i.e. powerful persons) get the fruit of that value before the inflation in the system is felt by the people who are unable to mine (i.e. the marginalized in the system). It is true that this issue will eventually go away in Bitcoin as the block awards diminish, but we can still aim to do better with future currencies. All coins that will be in the ecosystem should exist at the system’s genesis.

As much as possible, lower the cost of entry (think smartphones).

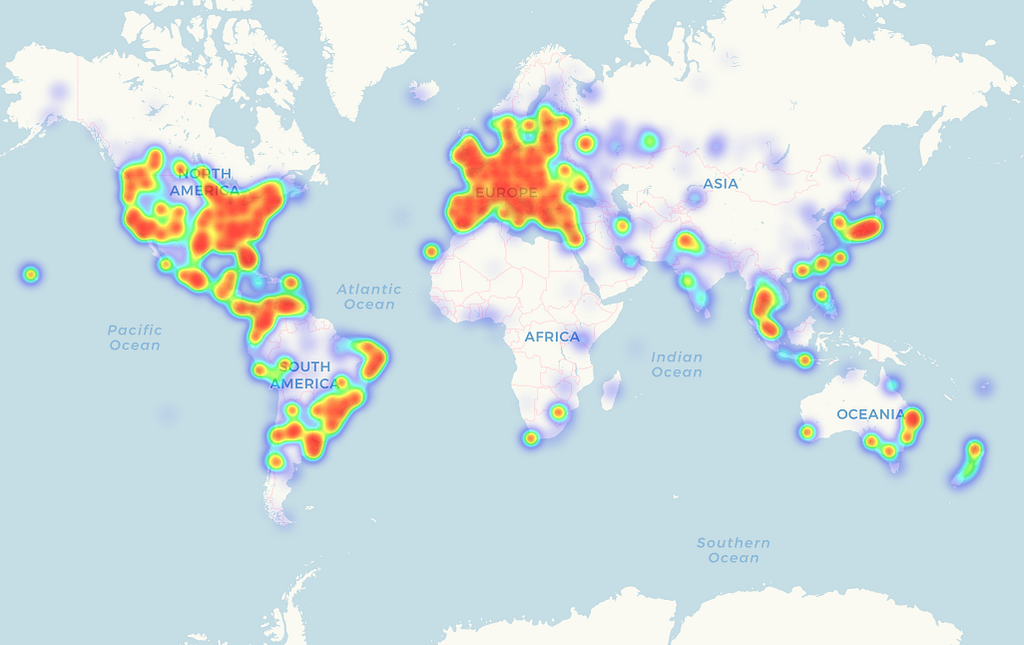

Heat map of retailers accepting bitcoin, taken from coinmap.org November 2018.

Heat map of retailers accepting bitcoin, taken from coinmap.org November 2018.

We want people to be able to have full access to all the ins and outs of a currency without specialized equipment. Bitcoin mining does not allow for this. Unfortunately, some level of sophisticated technology will be required to operate currencies. Although only 36% of the world has a smartphone, we will at least be one step better if we can make all the features of a currency available on such devices. As it stands currently, the percent of the world that owns a Bitcoin mining rig is unknown, but best estimates back in 2015 put it at about 100,000 people, or .00001% of the world’s population. Even if that number has increased 10X since that time, it is inexcusably small for running a currency that keeps tyrants at bay.

Get rid of transaction fees.

If we get rid of the block and lower the cost of entry, it’s natural to get rid of transaction fees. Here we can start to get a picture of a currency that focuses on local exchanges between a person and a merchant. I’m tired of going grocery shopping, inserting my credit card into the stupid chip reader that never works, and waiting around for ages while different ends of the earth talk to each other and approve my spending. I miss the good ol’ days when I skipped down to the local neighborhood market to buy my Spice Girls lollipop, gave cold hard cash to the clerk at the register, and was immediately able to rip open the package to see if I got the collectible sticker I wanted. The clerk knew I had money, no need to check in with the foreign financial big man, and pay him transaction fees for his big-mansiness. And this frustration is only more serious when sustenance is on the line — not just a frivolous lollipop.

Bitcoin transaction fees peaked late last year at an average of $55.16. This is nearly 1% of the average US citizen’s income. Chart taken from bitinfocharts.com.

Bitcoin transaction fees peaked late last year at an average of $55.16. This is nearly 1% of the average US citizen’s income. Chart taken from bitinfocharts.com.

I want a financial system that works like exchanging cash works (or better, go beyond monetary exchange all together). With no chains and no blocks, but with deeply decentralized ledgers, the local clerk would give me the lollipop, and I would give them money for the good (no need to place a transaction fee bid to the mempool and wait for further notice).

Dreaming big

Blockchain has been more than a wake-up call to the power of incentives in economic transactions. It’s also been a wake-up call about how easily incentives can defeat their own purpose. Let’s refuse to let the community become blinded by the allure of power and wealth at the expense of our original philanthropic intents. Proof-of-work and proof-of-stake center the conversation too much around the fear of loss, and not enough around what we’re trying to gain. The future of cryptocurrencies doesn’t concern itself with competition over blocks and transaction fees. It concerns itself with cooperation between Ugandan citizens and their government. It aims at equal opportunity for the established Silicon Valley venture capitalist and the young girl blogging in Afghanistan.

I am building out the egalitarian infrastructure of the decentralized web with ERA. Want to know more about my ideas for cryptocurrencies? Check out my article: Behavioral Cryptoeconomics: The Secret of Digital Currencies (or The Additive-only Future: Release the Banana Hostages!).

If you enjoyed this article, it would mean a lot if you gave it a clap, shared it, and connected with me on Twitter! If you’re interested in the intersection of tech, econ, and ethics, take a look at my new video series, where I talk to entrepreneurs on the frontlines.

Proof-of-Work and Proof-of-Stake are Regressive was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.