Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

One important way that UK startup culture differs from the US is we Brits are much less keen on stock options (or share options as we call them here) — and that can be a real problem for entrepreneurs.

In the US, founders use options to help attract top talent. ‘Help me build this business,’ goes the thinking, ‘and you can buy a stake in it at a discount rate that will hopefully make you incredibly rich when we get acquired or go public.’

In the UK, tech talent tends to view stock options as a nice bonus, but they still want a significant salary that reflects their skills. Given how less common big-money exits are here, that’s understandable.

What we end up with is a ‘chicken and egg’ situation. Tech talent doesn’t see many exits happening, so doesn’t want to take a risk on equity-based compensation. But founders are less likely to build companies that achieve a significant exit if they don’t bring top talent on board at an early stage, before they can afford the salaries that talent demands.

It doesn’t help that setting up a share option scheme is an enormous headache. Options count as a ‘taxable benefit’ that could leave companies — and their employees — with significant tax bills. The solution is the government’s tax-efficient EMI share option scheme, but that requires a lot of paperwork and can take months of back-and-forth with an accountant to get set up.

The result? Data from more than 200 funding rounds on the SeedLegals platform in 2017, showed that less than half — just 47% — of high-growth UK companies offered stock options to their employees.

Enter the SeedLegals option scheme

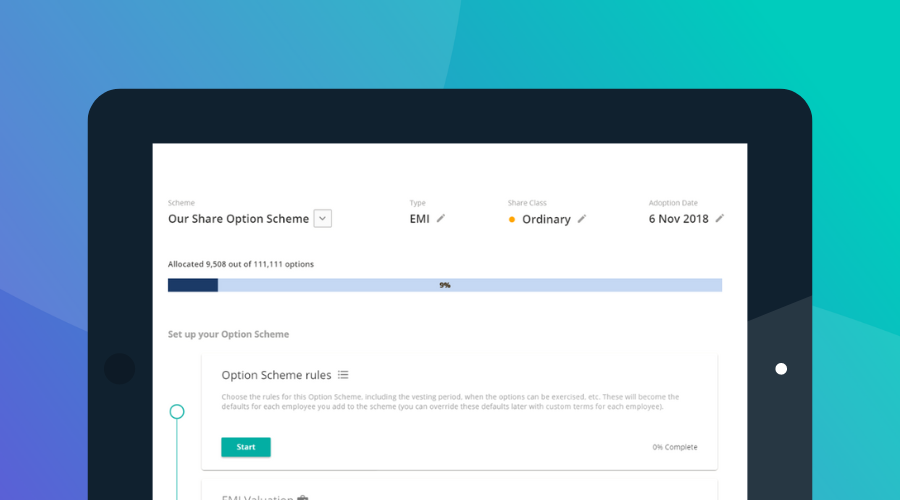

At SeedLegals, we exist to make startups’ lives easier. Our new EMI Scheme takes the pain out of setting up and running a share options scheme for your employees.

It all starts on your SeedLegals dashboard. Just fill a few quick details to get your scheme set up. What was once a serious administrative pain is now simple and easy. It’s 10 times faster than the old way of doing things, too.

Once everything is up and running, you’ll be able to manage your option pool as part of your cap table, and allocate options to specific employees with custom vesting schedules, as and when you need to. Employees can log in and check the details of their options whenever they need to. You can add and remove employees from your scheme in a few clicks — something that used to require more paperwork every time.

While you’d usually expect to pay at least £5,000 to set up an EMI-compliant option scheme, (with schemes for more than 50 employees costing £10,000 — £20,000+) we’ll get you going for just £1,500 and let you add up to 250 employees any time. What’s more, because everything is streamlined and designed specifically to help founders, SeedLegals can stop you making expensive mistakes with your paperwork. Humans make mistakes, machines don’t.

This new scheme won’t change options culture in the UK overnight, but it will help founders offer an efficient, effective options scheme with less stress and expense.

If your early employees believe in your business, the SeedLegals EMI Scheme will help you reward that belief. Slowly but surely, we can shift options culture and attract the best talent to UK startups.

Interested in learning more? Join SeedLegals for free, and let’s get your share options scheme started.

It’s time to change how UK startups think about employee equity was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.