Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

What Is Polymath?

Polymath simplifies the legal process of creating and selling security tokens. It makes a new token standard, the ST20, and enforces government compliance. Only a “list of authorized investors and their Ethereum wallet addresses” can hold ST20 tokens. Therefore, token issuers don’t need to worry about the legal implications of their security falling into the wrong hands.

In order to launch a legally compliant token, the Polymath platform brings together issuers, legal delegates, smart contract developers, KYC verification, and a decentralized exchange. All transactions on the Polymath platform take place using the native POLY token. Due to the continuing government crackdown on initial coin offerings, Polymath hopes to instead provide legal Security Token Offerings.

In our guide, we’ll take a look at:

- The Problem

- How Does Polymath Work?

- About Polymath

- Trading History

- Where Can You Buy POLY?

- Where Can You Store POLY?

- Conclusion

- Additional Resources

The Problem

ICOs

In 2017, ICOs raised over $1.2 billion in funding by selling either utility or security tokens. Utility tokens, such as Waltonchain, give you access to a token’s network and are far more common than security tokens. Security tokens, however, provide equity or a claim to dividends from a company. As a result, security tokens, like any securities, are subject to government regulation.

Polymath’s new standard for blockchain security tokens aims to embed the necessary regulatory requirements into smart contracts and comply entirely with government security regulations. Consequently, Polymath believes financial securities would function better on a blockchain and wants to replace the term shareholder with token holder.

Securities

Government regulations “require investors to receive financial and other material information concerning securities being offered for public sale.” The goal is to “prohibit deceit, misrepresentations, and other fraud in the sale of securities.” It seems like a noble goal given the frequency of ICO scams and at least 46% of 2017 ICOs already failing.

For public offerings, companies must register their securities with the government. Unfortunately, this is an increasingly expensive and complicated process. Securities are then “bought and sold on secondary markets such as stock exchanges with fees ranging from 0.25% to 3%.” Polymath thus believes there is value in helping people legally registering their token while simultaneously providing a decentralized exchange with lower fees.

How Does Polymath Work?

Token Supply and Sustainability

Overall, there are one billion POLY tokens that will ever exist. You could have signed up for the Polymath airdrop before January 10th, 2018. Subsequently, airdrop participants received 240 million tokens.

At this point, the Polymath team retains the rest for future use. If you missed the airdrop, then you’ll need to trade for POLY on an exchange.

Polymath Securities Token Platform

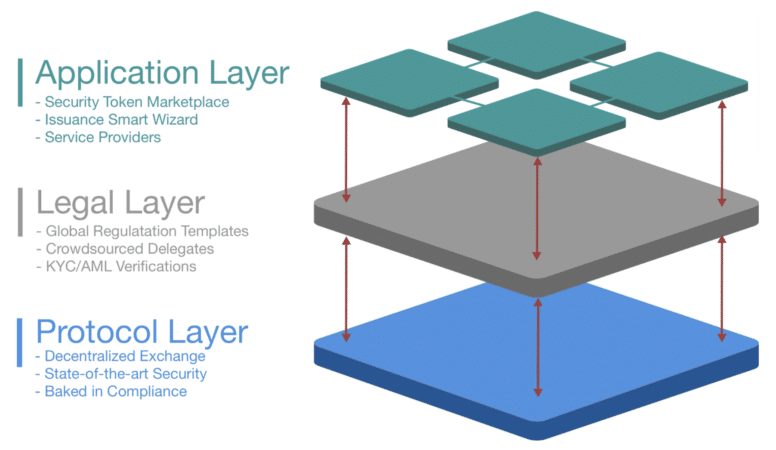

The token platform involves three layers: an application layer, a legal layer, and the protocol layer to ensure your token is compliant and stays compliant. These layers aim to reduce the legal complexity and ambiguity surrounding securities while also minimizing fees and improving the liquidity of assets.

The Polymath Stack

Launching a Security Token

Polymath asks for the following information to instantly create your ST20 standard security token.

- Legal Name:

- Legal Entity Type:

- Type of Security:

- Project Description:

- Logo:

- TOKEN CHARACTERISTICS

- Voting Rights:

- Dividend:

- Dividend Frequency:

- Corporate Governance:

- Governance Integration Partner:

- Additional Features:

- TOKEN ALLOCATION

- Tokens to Create:

- Percentage of Tokens Held by Company:

- Percentage of Company Equity Distributed With Tokens:

- Price per Token in USD:

- LEGAL DETAILS

- Issuing Jurisdiction:

- Offering Security To:

- Investors Must be Accredited:

- Investor KYC Needed:

- KYC Integration Partner:

- Tokens Freely Tradable:

- CONTACT DETAILS

- Contact Name:

- Position at Company:

- Contact Phone Number:

- Contact Email:

- Permit Contact from Polymath:

Choosing a Legal Delegate

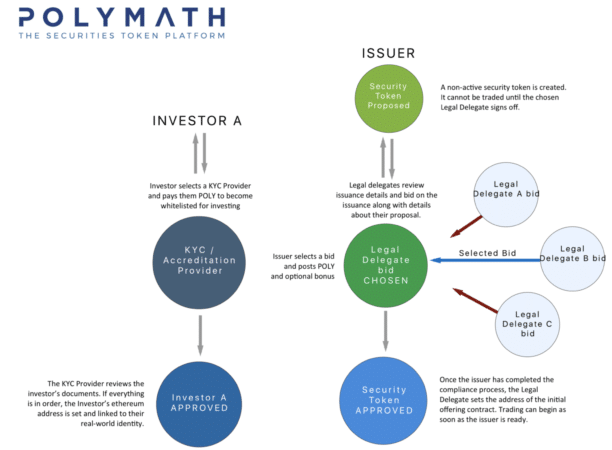

After creating your new token, it’s still non-transferrable until a legal delegate confirms “that the steps have been completed for the token to be issued.”

You’ll receive several bids from legal delegates, lawyers, but it’s up to you to perform due diligence and compare their fees. Once you choose a legal delegate, you send POLY for their fee to a smart contract and begin working together on the Polymath platform by securely sending necessary documents and working through the compliance process.

Part of the process entails delegates working with developers to build a smart contract specifically for your token. Then, the smart contract enforces investor requirements such as jurisdiction of investors, type of offering, hold time before tokens can be resold etc. After the necessary documents are sent and the smart contract completed, the legal delegate will set the address of your initial offering contract. You’re finally ready to start trading.

Becoming an Investor

If you’d like to purchase a token on Polymath’s platform, you first need to have your identity and accreditation status confirmed by a KYC (know your customer) provider. You can search and choose a KYC provider on the Polymath network. Next, you’d send the required number of POLY tokens to escrow until your KYC process is completed. After submitting the necessary documents, the KYC provider can send information to a Polymath smart contract specifying details on your ability to buy securities. The information stored in the smart contract will also determine the amount of money you can invest in securities and where you can trade them.

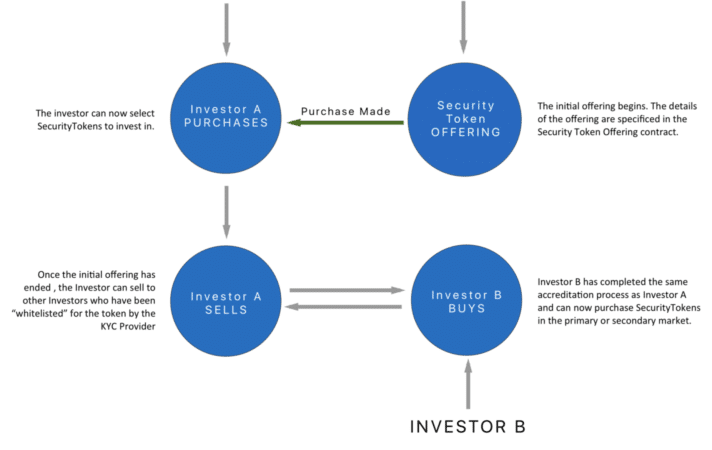

Security Tokens

While most tokens are easily tradable on exchanges, security tokens follow different rules due to numerous legal implications. It’s important to know who owns a security token at all times due to securities potentially providing voting rights, dividends, or other income with tax implications. Exchanges currently avoid listing any token potentially considered a security to avoid security regulators.

However, with a token created through Polymath, the smart contracts verify who can buy and sell the token. Only investors authorized under Polymath’s KYC providers will be able to hold the token. This could, in theory, eliminate the fees associated with centralized exchanges that ensure security compliance.

The Polymath investment process

The Polymath Investment Process

About Polymath

Polymath Tokens (POLY)

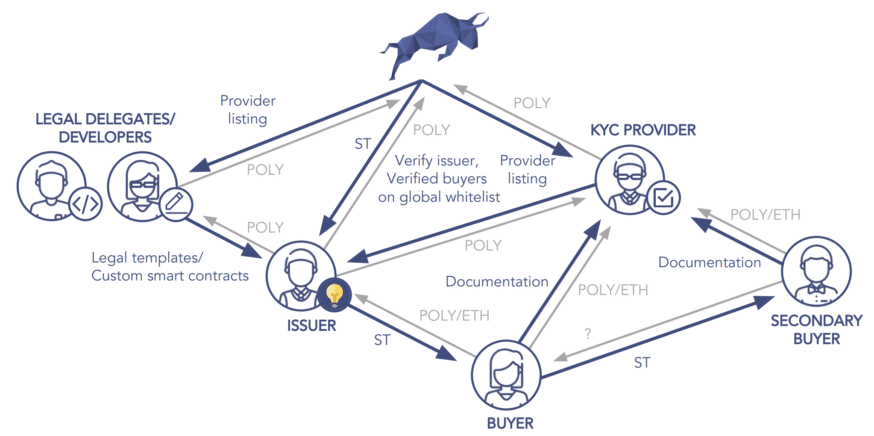

All payments on the Polymath network require POLY, an ERC20 token. Here are some examples of its uses:

Issuers

An issuer can post a bounty in POLY tokens to “encourage legal delegates and developers to bid on providing services.” The more complicated your security, the more POLY you’ll likely need to pay.

Developers

Developers earn POLY for creating STO smart contracts.

KYC Providers

KYC providers pay in POLY to join the network and then earn POLY from verifying investors.

Investors

To join the whitelist of potential investors for a security token, investors must pay KYC providers in POLY tokens for their services.

Legal Delegates

Legal delegates earn POLY by being selected to issue a new security token.

How to Earn POLY as a Legal Delegate

The Team

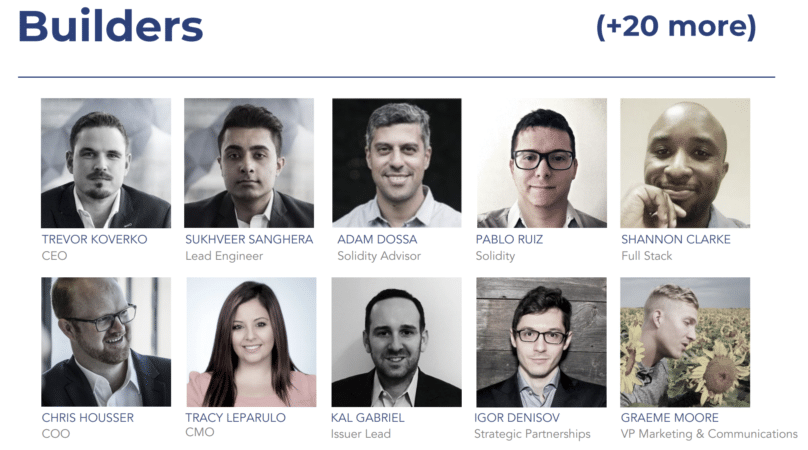

The team is led by Trevor Koverko, a veteran in both Silicon Valley and cryptocurrency. He’s also the founder of DAI, a private equity firm. There’s a saying in business that you want to skate where the puck is going, not where it has been. Given that Trevor was literally drafted by the New York Rangers of the National Hockey League, it’s likely he knows where the puck is going. He’s shown this skill in the past, buying into BTC when it was 20 dollars and Ethereum when 1 BTC would score you 2000 ETH. Along with Trevor, there are more than 30 ‘builders’ and advisors involved with Polymath.

Core Builders of the Polymath Project

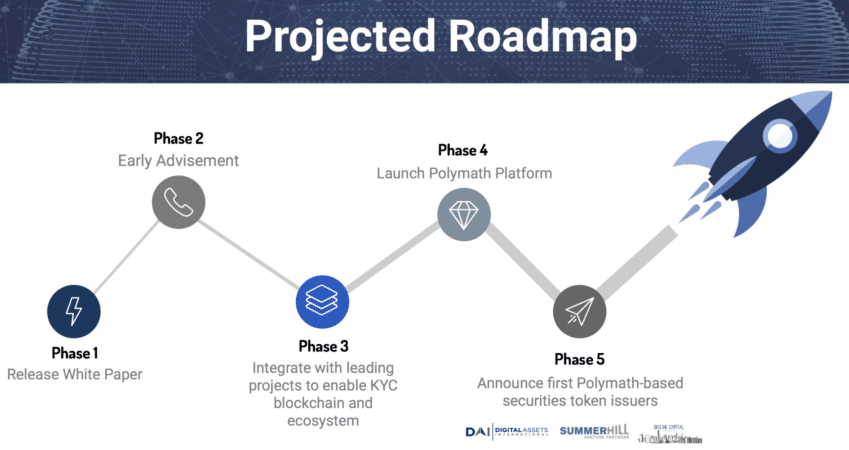

Future Projects and Roadmap

The project is already well-established with new tokens currently being launched on their platform.

Polymath CEO Trevor Koverko recently spoke at the Blockchain Futurist Conference in Toronto and announced the launch of the first five security tokens to be serviced by the platform:

- Minthealth – A patient-centered health ecosystem

- 7Pass – A cannabis investment firm

- Corl – Blockchain financing for startups

- IPwe – Blockchain-enabled patent registry

- BlockEstate – US-based property management fund looking to tokenize assets

Koverko and his team chose a broad range of projects to highlight how Polymath could service the entire market from day one. Besides the launch, Polymath has also been working with a variety of experts to create the first security token standard.

The goal here is that investors and token issuers will have a framework to smooth the process of project launches in the future. You can follow along with this process here.

Partnerships

To be sure, the success of Polymath is dependent on partnerships. Specifically, they need to bring in legal delegates, KYC providers, developers, buyers, and issuers.

With this in mind, they partnered with IdentityMind to bring KYC providers aboard. Soon thereafter, they confirmed thousands of identities in the POLY airdrop.

Both SelfKey, a digital identity system, and BnkToTheFuture, another company associated with KYC, have partnered with Polymath to provide thousands of accredited investors.

To demonstrate, Polymath advised tZERO on their ICO, which raised $100 million in just 12 hours. tZERO aims to also build an exchange to provide liquidity for legal security token holders.

Most noteworthy, in 2018, Corl Financial Technologies, SeriesX, and Ethereum Capital all plan to have securities tokens created on the Polymath platform.

Competition

tZERO is also building an exchange for regulated security tokens. However, it’s likely that their platform would provide more synergy than a competition. The more people involved with developing legally compliant security tokens, the better.

Polymath’s main competitor is the traditional method of registering a security with the SEC. However, you can see it is quite rigorous to file by looking at DropBox’s recent request for an initial public offering here.

Trading History

Polymath airdropped its token on January 24th, 2018. It started trading with a value of US$0.789. However, it soon reached an all-time high of $1.64. Ultimately, the price of POLY will depend on the utility of the Polymath platform. If you see more coins launching on the ST20 standard, keep your eye on the price of POLY.

Where Can You Buy POLY?

Demand for POLY remains high on Asian exchanges with the majority of volume traded on Upbit and Binance. When the coin first launched, only a few exchanges provided access to the token. Fortunately, you now have a wide variety of options including Bittrex if you’re looking for an American exchange.

Where Can You Store POLY?

Since POLY is an ERC20 token, you can use MyEtherWallet for storage. The Polymath team also provides a resource of how to view your POLY tokens here.

You can also use popular hardware wallets, like the Ledger Nano S, to store your POLY.

Conclusion

In Polymath’s ideal world, all forms of securities become programmable tokens. As a result, businesses of any size have access to capital. Investors also have access to transparent information and can avoid scams. The Polymath team identified the inefficiencies of present-day securities. The platform perhaps offers a better alternative. Now, the question is, can they bring investors into their ecosystem?

According to the whitepaper, “the global securities market is composed of three major instrument types: equities, debt, and derivatives. In 2016, these three markets had total notional values of US $67 trillion, $99 trillion, and $1.2 quadrillion, respectively.”

Over the coming years, it will be interesting to see what percentage of the market Polymath can capture.

Editor’s Note: This article was updated by Ryan Smith on November 5th, 2018 to reflect the recent changes of the project.

Additional Resources

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.