Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

What Is the Request Network?

The Request Network (Request for short) is an Ethereum-based, decentralized payment system in which anyone can request a payment and receive money in a secure way. It removes the need for trusted third parties to provide a cheaper and more secure payment solution that works with all global currencies.

Request also integrates with legislation across the world to remain compliant with the trade laws of each country. Moving beyond just payments, the Request Network capitalizes on the immutability of the blockchain to produce accurate auditing and accounting services.

In a nutshell, the Request Network is trying to compete with PayPal as the number one, global payment system. But, it’s much more than that. Request wants to be involved in all types of payments (Invoices, IoT, B2B, Government, etc…) across the payment lifecycle – everything from the initial request to accounting afterward.

In this Request Network guide, we’re going to discuss:

- How Does the Request Network Work?

- Request Network Ecosystem

- Request Network Team & Progress

- Trading

- Where to Buy REQ

- Where to Store REQ

- Conclusion

- Additional Request Network Resources

How Does the Request Network Work?

Payments

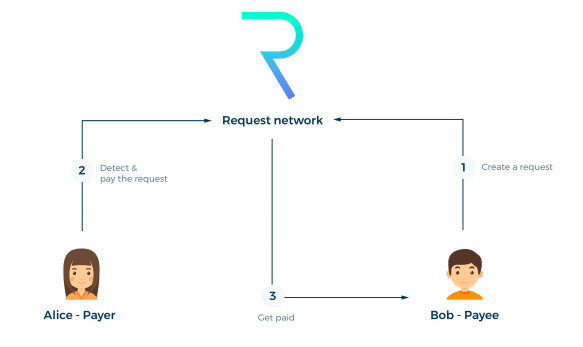

The process involved with requesting and receiving a payment (Request Invoice) is relatively simple:

- Bob broadcasts a request invoice to Alice through the blockchain.

- Alice detects the request and pays it in 1-click.

- Bob gets his money.

Simple Request Payment Example

This is a simple example of a peer-to-peer payment but it can be expanded further. Request payments can also be used for online purchases, business to business invoices, and eventually IoT payments between machines.

The Request Network offers some significant advantages over the current systems. Because payments are push generated (instead of pull), there’s no need to share your bank account information. Also important, the use of blockchain technology means there’s no need for third-party processors which greatly reduce transaction costs.

Auditing & Transparency

Other than payments, the Request Network is also tackling auditing and budget transparency. Businesses have the ability to track invoices to audit payments as well as record transactions for accounting purposes.

Governments, nonprofits, and other organizations can also use Request to bring transparency to their budget and expenditures.

REQ token

REQ is an ERC20 token that you spend to use the Request Network. You may have to pay additional REQ fees when creating more advanced invoices as well. The team originally stated in their whitepaper that fees would stay between 0.05% and 0.5% and decrease as the system grows. However, with the v2 release, this fee structure changes. Once released, Request v2 will charge fees based on the size of the data of each request, not the amount itself. The fee starts at $0.10 up to 10kB of data and then increases $0.03 per each additional 10kB. The team may adjust these fees in the future.

A portion of the REQ fees is burned at a rate that’s determined by the current supply and the exchange rate with the other currencies on the platform.

Although not yet confirmed, the Request Network may use a Proof-of-Stake consensus algorithm. This would mean that you, as a REQ holder, would receive dividends for holding the token. The development team is open to this mechanism and will most likely implement it if they choose Ethereum’s Plasma as the network’s scaling solution.

Other purposes of the REQ token include acting as an intermediary for cross-currency exchanges and forming governance in community voting.

Request Network Ecosystem

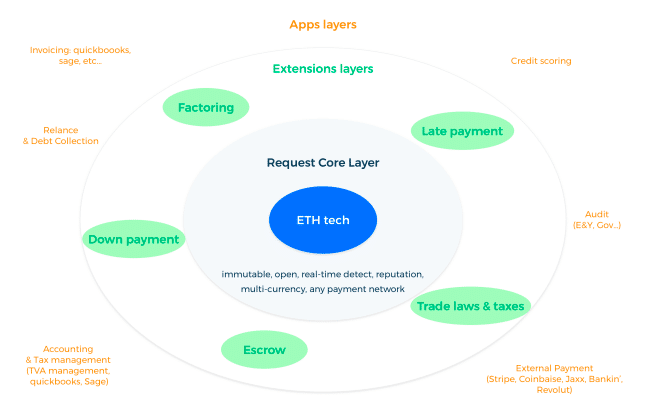

The Request Network is built as a layer on top of the Ethereum network. In order to accommodate the flexibility needed for the different use-cases, the team is using a three-tiered architecture for the platform:

- The Core layer

- The Extensions layer

- The Applications layer

Request Network’s Three-Tiered Architecture

The Core layer

The Core is the foundation of the Request Network and takes place on the Ethereum blockchain. Because of this, it can automatically detect ERC20-based invoices. Other types of invoices can be automatically detected as well but require an Oracle.

This layer manages the most basic payment types. It includes smart contracts for simple invoices and tracks when they’ve been completed.

The Extensions layer

The Extensions layer brings taxes, escrow, advances, and other more advanced payment terms into the picture. These are added as extensions to standard invoices.

Some extension examples include:

- Giving 1% of all payments to a certain charity

- Untraditional rent payments (e.g. weekly instead of monthly)

- Daily salary payments instead of normal 2-week paychecks

Extensions remove the need for lump-sum payments and bring more liquidity to your bank account. The Request Network also ensures you pay the appropriate taxes even when using a non-traditional process.

In addition to the Request team, outside developers can build on the Extensions layer. Each extension costs a REQ token fee in which a portion will be burned and the rest will be given to the extension developer.

The Applications layer

The Applications layer resides outside of the blockchain. Third-party applications can plug into this layer to interact with invoices or view any associated information. This layer also includes a reputation system to mitigate phishing attacks and dock those who don’t pay accepted invoices on time.

The Request Network team has dedicated a $30 million fund to incentivize app developers to build on the network. In order to tap into this fund, you need to apply with your project information and get approval from the team.

Request Network Team & Progress

Team

The majority of the Request leadership team previously created Moneytis, a global money transfer platform. Although Moneytis had a 20% monthly growth-rate, the team chose to pivot and create the Request Network. In their work with Moneytis, they found that the majority of money transfers were invoices and wanted to focus their business on the problems involved with them.

Christopher Lassuyt and Etienne Tatur founded Request and lead the team as CFO and CTO. Both Lassuyt and Tatur have extensive experience in these positions holding similar roles in previous companies in their career.

The team is seemingly one of the most transparent in the industry regarding development updates. They post bi-weekly updates and remain active on Reddit and other social channels. The project achieved a critical milestone in March 2018 with the official launch of their mainnet. Additionally, the team released a Javascript library for interested developers and expanded coin support to include Bitcoin and all ERC20 tokens.

Next on the project roadmap: additional currency support, data encryption and sustainability, a payments dashboard, and a crowdfunding app among other things.

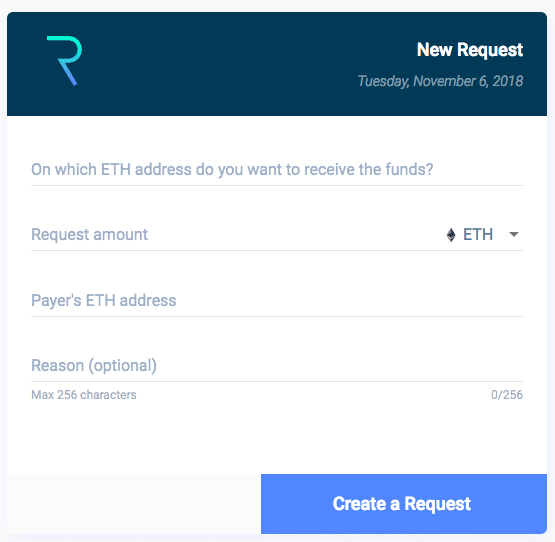

Request Network App Interface

Partnerships

The team entered Y Combinator, an exclusive start-up accelerator, as Moneytis but continues to receive mentorship and support from the program. Y Combinator has a 1-2% acceptance rate, so being in the program says a lot about the credibility of the project and team.

Request has also partnered with the Kyber Network to help with cross-currency payments. Additionally, the platform’s smart contracts have been audited by Quantstamp and it’s using iExec to accommodate smart auditing services. Most notable, however, is the project’s partnership with accounting firm PwC France to provide blockchain solutions for their business clients.

Request Network Partners

At one point, the Request team stated that they’d also be working with 0x, Aragon, and Civic, but this appears to no longer be the case.

Competitors

Because the Request Network is targeting the entire payments space, they have quite a few competitors. The most similar blockchain competitor is OmiseGo, although the Request team has stated that they believe the two products to be complementary rather than predatory.

Although approaching invoices with a different strategy, Request may take clients from Populous, an invoice financing solution. And, normal payments functionality may see competition from popular crypto cards like TenX and Monaco.

There are several blockchain companies targeting auditing and accounting but none encompass an overall payment system as Request does.

The Request Network will also face competition from behemoths in traditional finance like PayPal. Request aims to offer a cheaper, safer, and more transparent solution that will hopefully be enough for users to switch over.

Trading

REQ began trading in October 2017 at a price around $0.05 or 0.000009 BTC. Until December 2017, the price remained relatively flat at that level. It then rose steadily to $0.30 (~0.0002 BTC) before skyrocketing at the end of the year.

The price reached an all-time high of ~$1.15 (~0.0007 BTC) before falling in January along with the rest of the market.

Even in the bear market, the REQ price saw an appropriate increase in March-April 2018 coinciding with the mainnet launch. Since then, however, REQ has slowly fallen to its current price of just under $0.05 (~0.000008 BTC). It’s been at this price for four months.

The development team has consistently achieved the milestones on their roadmap, so it may be worthwhile to pay attention to any announcements. Now that the product is available, users will be the primary driver of the price. The launching of the crowdfunding app and other third-party applications could bring in the adoption needed to bring the price back to its former glory.

Where to Buy REQ

The recommended exchange to purchase REQ is Binance. Binance offers REQ as a trading pair with BTC and ETH. If those aren’t currently part of your portfolio, you can pick some up for USD on a platform like GDAX (now Coinbase Pro).

If you’re more interested in decentralized exchanges, REQ is available on IDEX, although the trading volume is comparatively low.

CoinMarketCap provides a complete list of exchanges that offer REQ.

Where to Store REQ

REQ is an ERC20 token, so you can store it in any wallet with ERC20 support. The most popular online options are MyEtherWallet or MetaMask.

Ideally, you should use a hardware wallet like the Ledger Nano S to store the majority of your funds. The Ledger Nano S holds all ERC20 tokens including REQ.

Conclusion

The Request Network is attempting to bring blockchain solutions to every aspect of payments. More than just a product, Request is a platform that developers can build upon to create their own apps and services. The roadmap is audacious, to say the least, and it may be tough for the team to accomplish everything without a simple, singular focus.

That being said, the team has years of payments experience (working together nonetheless) and has the support of arguably the best start-up accelerator in the world. On top of that, they’ve consistently hit the product development milestones they’ve set for themselves.

If the Request Network can continue to hit development milestones and produce a great platform, they have a good shot at dethroning the current payment platform kings.

Editor’s Note: This article was updated by Steven Buchko on 11.06.2018 to reflect the recent changes of the project.

Additional Request Network Resources

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.