Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

W e now live in a world where the most valuable assets are no longer physical. While virtual assets have been in existence for years it’s only recently that these digital goods have emerged as a new asset class.

Now with the combination of blockchain technology virtual assets have the opportunity to no longer be limited to traditional use cases such as gaming.

In today’s sharing economy as more assets, both physical and virtual are tokenized a new kind of protocol is necessary to ensure security, transparency, ownership, liquidity and shared use.

As a quick recap, tokens are virtual assets on Ethereum that serve similar functions to cash or existing bearer instruments — e.g. tickets, coupons, stock and bond certificates, vouchers, food stamps, and deeds — that entitle holders to different things, similar to how we use cash.

Organizations operating on Ethereum may issue tokens in order to grant holders access to their goods and services, entitle them to company dividends, and to participate in governance of their business model.

Here we introduce the next generation of the token economy: the Fractional Non-Fungible Token (F-NFT). If you’re new to the concept of tokens no worries as we’ll briefly review the major types and the role that they play as virtual assets.

Do F-NFTs currently exist? Yes and no. There has been some recent buzz in the official Ethereum Improvement Proposal (EIP)community on a similar solution to fractionalize a NFT:

Divisible non-fungible tokens (Shared ownership over NFTs) · Issue #864 · ethereum/EIPs

There is also a very well thought-out post by billy rennekamp on some of the potential applications and theory of a fractional token.

It is the intention of the co-authors of this article to explore the possibilities, stakes and use cases for this potential new class of asset. Our article is based on the initial thread from Should We Barter NFTs? A great quick read for understanding some of the current limitations of today’s NFTs.

The Limitations of the Non-Fungible Token (NFT) Today

To begin with, let’s quickly remember what an NFT (aka “ERC721”) is. This is a new class of tokens handled and stored on the Blockchain. After Security Tokens and Utility Tokens, (which are standard “ERC20” tokens) non-fungible tokens are defined by the following characteristics:

- One NFT is not interchangeable by another

- Each token has characteristics that make it unique

To take a few simple and concrete examples, NFTs can be: a piece of land in a virtual world, a unique collectable card, your character in a role play, the sword used by your character, a (digital or not) artwork, … the use cases are practically infinite. Here is a great article about what are NFTs if you want to know more about it.

Today, most of these NFTs are thought of as proprietary and exclusive. That is, once you have acquired the token, you are the sole owner. Similarly, you are the only one who can benefit from these services.

This state of affairs today represents a limit in the use of NFTs and proves to be in opposition to the idea of decentralization proposed by Blockchain technology.

How Could We Imagine a Fractional NFT (F-NFT) ?

Why wouldn’t it be possible to have multiple co-owners of a single NFT? A fractional non-fungible token (F-NFT) would be a variety of non-fungible token that is expressly designed for decentralized ownership and use.

This token will be based on the following foundations:

- The co-ownership of the NFT is not enough. The benefit of the features and/or services offered by the token must also be shared.

- The purchase or resale of all or part of the token held by other stakeholders shall not in any way prejudice the other owners.

- The use of the token by one or other of the stakeholders must not in any way prejudice the other owners. Ideally, simultaneous use of the token by the different owners must be possible.

What Is and What Is Not Fractionable?

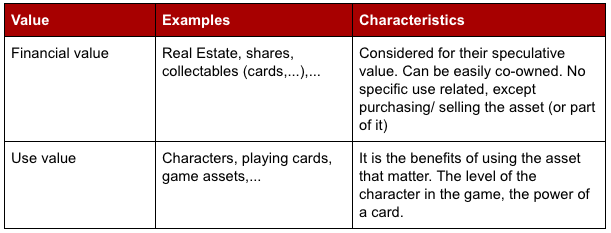

To go further in defining these F-NFTs, we need to look at practical use cases and make a quick typology of assets:

Almost every asset can carry two values independently. This typology puts into perspective any kind asset, and focuses on the fraction of value and use.

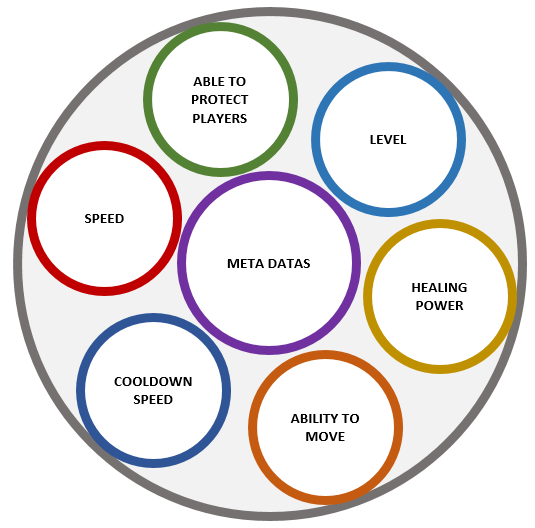

In this schematic representation, the financial value of the asset is the grey circle. This value is of course defined by the elements that compose it, namely the meta data. This grey circle can be co-owned, from a value point of view, completely independent of the meta-data or the characteristics that compose it. Metadata and characteristics cannot be split in the same way.

Value is fractionable.

Skills or characteristics aren’t necessary.

This state of affairs today represents a limit in the use of NFTs and proves to be in opposition to the idea of decentralization proposed by Blockchain technology.

How Could a F-NFT Be Designed?

These fractionable NFTs only require one thing: to have been thought and designed for a shared use. The token design is key during an ICO, the same way the NFT design is key to making it an F-NFT.

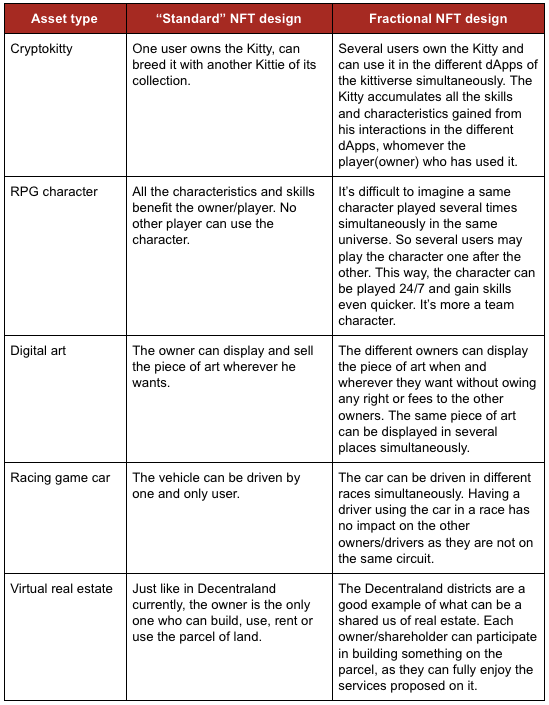

To illustrate our thinking, we have chosen to confront this principle of F-NFTs with concrete use cases in order to clearly draw the line between a token designed for individual use and a token designed for decentralized use.

NFT versus Fractional NFT asset type examplesWhat Industries Could a F-NFT Disrupt?

NFT versus Fractional NFT asset type examplesWhat Industries Could a F-NFT Disrupt?

While initial adoption of F-NFTs would have the most practical and easier to implement use cases with virtual goods, there will be cross-over to real-world goods such as art, collectibles and traditional investments. We imagine that an increasing amount of the world’s assets will be tokenized opening the floodgate to fractionalization use cases.

Arts and Collectibles (A&C)The global art market represents approximately $50 billion worldwide. Unfortunately they are some of the most illiquid assets. If one wishes to sell a Degas valued at $1 million it’s not as simple as listing it on eBay. In fact more than likely one would need to go through a middleman or auction house like Sothebys or Christies which would charge a premium of up to 25% for selling the painting. These two auction houses alone control 80% of the secondary art market. They retain their sales information from the public, preventing accurate market-based price discovery and forecasting.

Most A&C increase in value as it ages and if tokenized it could be an opportunity to benefit from this value appreciation. If that $1m Degas was fractionalized into 100 units this would allow 1000 investors to each own a share. These shares can be traded and its ownership and authenticity would be validated via smart contract. This solves a second problem in the A&C world: liquidity. Instead of waiting weeks or months for an individual buyer to purchase a high-ticket item, once converted to a F-NFT it would then be offered on the secondary market for investors to purchase as an addition to a well-balanced portfolio.

Here the benefit to each token owner would be value transfer from the artwork, portfolio diversification, potential appreciation via the limited tokens and faster liquidity. In this case even the smallest of investors could be a Degas owner. Of course there will need to be the typical authentication and escrow of the original artwork however this would be a small price to pay for the benefits of the token appreciation and asset liquidity. Of course unlike digital art one cannot physically divide that painting into a thousand pieces therefore the value here would be for asset owners and speculators hoping to use the A&C category to help balance their financial portfolio.

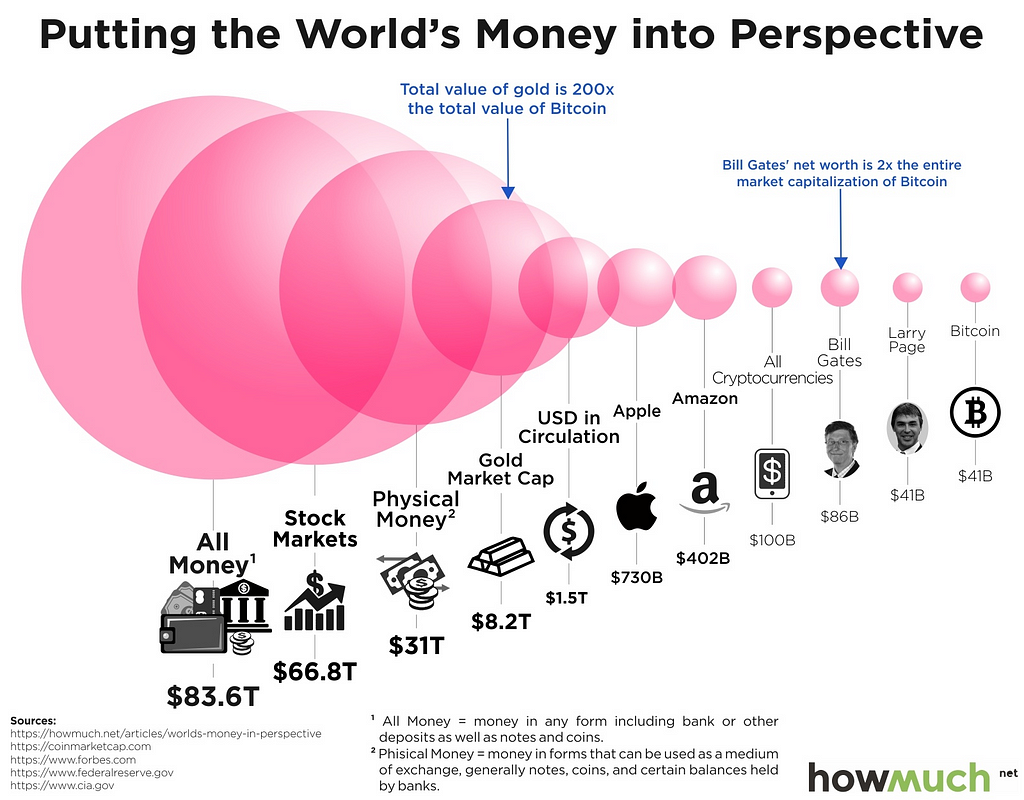

Traditional Investments:Cryptocurrency is a rather nascent market compared to traditional assets like A&C, stocks, bonds, derivatives, or gold. This new asset class represents less than a thousandth of 1% of total global wealth today:

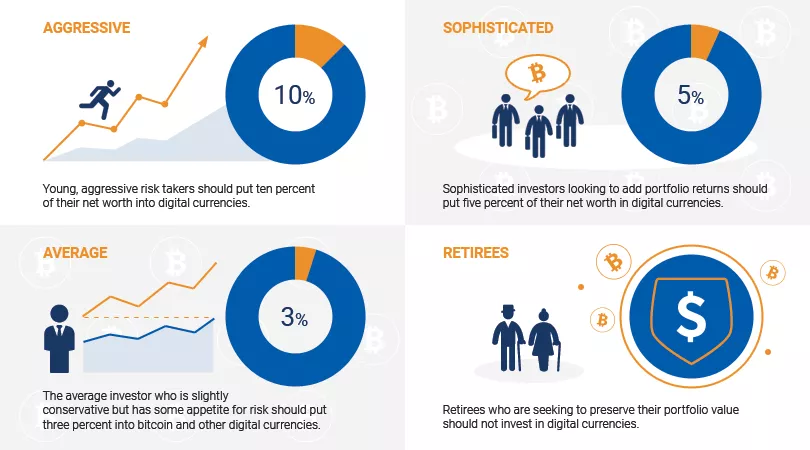

Due to its volatility and short track record financial experts are at odds as to how much of one’s total financial portfolio should be comprised of cryptocurrency (if any!). Deciding how much to invest in cryptocurrency assets largely depend on your risk tolerance among other factors:

A F-NFT would be an emerging sub-asset class that could be used as a further hedge against primary crypto market volatility. Just as crypto may be used as a portion of a well-balanced portfolio, a F-NFT may be used as a portion of crypto in respect to its growth and risk tolerance.

Gaming

Virtual goods are now worth upward of $50 billion today. While it may not be worth the trouble to fractionalize a $100 CryptoKitty, you may want to pool resources on more expensive items. Just recently a gaming virtual good was one of the most expensive items ever sold — a virtual planet for $6 million.

Making a gaming virtual good into a F-NFT means that you can now pool resources to crowdfund and co-own this asset. While there may not be many that can afford to later individually buy that $6m planet F-NFT shares would allow for faster liquidity at the same time democratizing access to otherwise prohibitively expensive virtual goods.

Token economics is needed to give us a clear taxonomy, standard and well defined vocabulary to understand what we are talking about. We need to understand that different types of tokens raise different economic questions.

-Dr. Shermin Voshmgir

A Future Marketplace for F-NFTs?

Today there are many exchanges that provide liquidity for standard ERC20 and ERC721 (NFT) tokens. A F-NFT would require a new kind of exchange capable of providing services to validate the non-fungible assets seeking to be fractionalized. It would need to be able to help make markets for trading these F-NFTs for maximum exposure and liquidity to this new asset class.Here are a few of the functions that this new kind of exchange could provide:

- Asset Authentication: Each asset whether it’s a physical piece of art or a high-value digital asset would need to be verified for authenticity. Once verified the record will be placed on-chain for any other party to reference.

- Fractionalization Smart Contract: This would allow the asset creator and owner to specify the properties or metadata of the token including how many shares to create and ownership details.

- F-NFT Listing: This function would list the FNFT on the exchange and provide traditional exchange functionality such as order books, matching and selling/buying of the token. It would also provide full transparency and inform owners of the new ownership or rights repartition on the asset.

Today’s centralized exchanges specialize in higher volume ERC20 tokens while decentralized exchanges (DEX) provide liquidity for ERC20 and ERC721 tokens. Since liquidity is one of the largest challenges for DEXs promising new protocols such as KyberNetwork, 0x and Loopring Protocol enable the pooling of liquidity amongst DEXs. A pooling capability for FNFTs would also allow greater liquidity at the same time providing market makers with arbitrage opportunities.

For a quick primer on the pros and cons of a DEX see this overview:

A Visual Way to Understand the Pros and Cons of a Decentralized Exchange

Conclusion and Next Steps

To propose a standard for fractionable NFTs could bring very interesting solutions about value and asset liquidity. The overall NFT market could be highly stimulated with this new generation of asset. Beyond financial stakes, the use cases proposed by those fractional NFTs are promising as well.

Several questions are raised, regarding this new class of assets:

- What assets would make the best use-case as an F-NFT and why?

- What real-world assets cannot be supported as F NFTs?

- What will be the technical components / characteristics of this new standard (the overall UX of marketplaces, games, and of the assets themselves have to be reconsidered and redesigned for a decentralized use)?

Feedback is welcome!

Special thanks for previewing and early feedback from Shermin Voshmgir, Director of the Research Institute for Cryptoeconomics.

Introducing the Co-Authors

Marc is founder of AlgoHive, a crowdsourced cryptocurrency prediction bot and former Head of Growth and Data Analytics at Emerge, an AI-based virtual advisor for preventing medical debt. As an American who has lived in five countries and currently residing in Taiwan, he is obsessed with researching emerging blockchain and AI use cases while democratizing the global financial system.

Blockchain entrepreneur at night and digital transformation consultant the day. Gauthier is co-founder of Nonfungible.com: the reference site for news and market analysis for all kind of non-fungible tokens. He is not crazy about speculation on cryptos. He is passionate about use cases and the almost infinite possibilities offered by this new medium.

If you have enjoyed this article please give Claps and support the authors by following them here on Medium!

The Future of Virtual Assets: Introducing the Fractional NFT was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.