Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

TL;DR Aligning stakeholders’ interests in an organization is hard. The current fundraising models (ICO or private fundraising) impose significant limitations on the mechanisms available to align stakeholders’ interests. A Continuous Organization (CO) is a new model designed to make organizations more fluid and more robust by overcoming those limitations. Using the Continuous Organization model, organizations can set themselves in continuous fundraising mode while benefiting from solid and flexible mechanisms to align stakeholders’ interests in their financial success. A detailed (ICO-less!) white paper is available here.

This post focuses on presenting the Continuous Organization model. Feel free to head over to this section of our white paper to get more context about the problems that exist with today’s organizations.

What is a Continuous Organization?

A Continuous Organization is an organization that sets up a Decentralized Autonomous Trust (DAT) and gives it value by funneling part or all of its present or future cash-flows to it.

The Decentralized Autonomous Trust (DAT) is a specific immutable smart-contract that implements a bonding curve contract with sponsored burning to automatically mint, burn and distribute fully digital security tokens that we call FAIR securities (FAIRs). These FAIRs represent a claim on the future cash-flows handled by the DAT.

It is important to note that the DAT is not the organization; like an irrevocable Trust, it is a contract external to the organization.

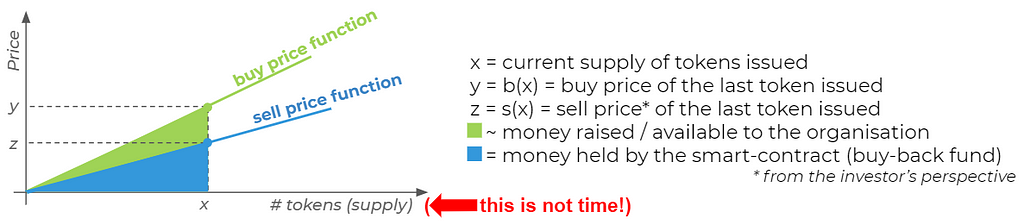

Click on the image for an explanation of the bonding curve contract model used in Continuous Organization

Click on the image for an explanation of the bonding curve contract model used in Continuous Organization

A detailed description of the inner working of a DAT and the specific functions it implements (buy, sell, pay & dividends) is available in this section of the white paper but the logic goes like this:

- When an investor buys FAIRs, new FAIRs are minted by the DAT, which increases the price of FAIRs. Part of the money invested goes to the organization and part of it is held back by the DAT in its buy-back reserve.

- When an investor sells FAIRs, the FAIRs sold are burnt by the DAT, which decreases the price of FAIRs, and the DAT refunds the investor with ETH using its buy-back reserve.

- When the DAT receives a payment, a fraction of the payment is used by the DAT to mint new FAIRs (increasing both the price of FAIRs and the buy-back reserve). Those newly minted FAIRs are distributed to the current FAIRs holders. The rest of the payment is transferred to the organization.

- When the DAT receives a dividend payment by the organization, the amount sent is used to mint new FAIRs (increasing both the price of FAIRs and the buy-back reserve). Those newly minted FAIRs are distributed to the current FAIRs holders.

A concrete example

A team is working on a decentralized social network, let’s call it “Peepith” (any resemblance with Peepeth is purely coincidental 😉). Peepith needs to raise funds and bootstrap its community (the chicken-and-egg problem). They have no legal entity other than an Aragon DAO.

They decide that the business model for Peepith will not be ads but a one-time fee of $1 (paid in ETH). They create a DAT, point the payment address of Peepith to the address of the DAT and point the beneficiary address of the DAT to their Aragon DAO wallet address.

Peepith buys or pre-mints the first 100,000 Peepith FAIRs (let’s call them PITH). 10% of those PITHs are distributed to the team and the other 90% are kept to reward people who will invite friends to Peepith.

From now on, the Peepith community can support the project by investing in Peepith via the dedicated page of the Peepith DAT. Every time a new user pays $1 worth of ETH to Peepith, the price of the PITH rises slightly and some PITHs are distributed to current PITH holders.

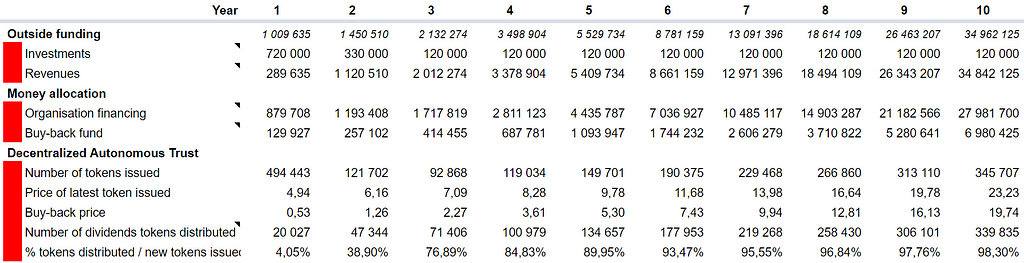

For the sake of the example, let’s model the financial performance indicators of Peepith using a simple model with the following simple hypothesis:

Parameters of the DAT:

- Investments. When an investor buys PITH, 10% of the amount invested is held by the buy-back reserve

- Payments. When a user pays $1 to Peepith, 20% ($0.20) are kept by the DAT to mint new PITHs that are distributed to current PITH holders.

Business hypothesis:

- Investments. Peepith raises $10K the 1st month and then $10K more each month until the 10th month ($100K raised during the 10th month). Then the investments start to decrease at a rate of -$10K per month and, at the 20th month, investments stagnate at $10K / month forever.

- Revenues. Peepith generates $0 the 1st month, $1K the 2nd month and then revenues have a month-over-month growth of 100% for month 3, 90% for month 4, 80% for month 5, etc… until growth flattens at 5% MoM forever starting in month 13.

Under those assumptions, after 10 years:

- Peepith has raised $2M through fundraising

- Peepith has 134M users who generated $134M in total revenues

- Value of the 90,000 PITHs that were distributed to incentivize the community: ~$10M

- An investor A who bought $1K of PITH in the 3rd month now holds ~$45K of PITH, a ~42% IRR / ~45x ROI.

- An investor B who bought $10K of PITH in the 13th month now holds ~$140K of PITH, a ~32% IRR / ~14x ROI.

KPIs of the Peepith Continuous Organization

KPIs of the Peepith Continuous Organization Performance of an investor who invested $1000 in the 3rd month

Performance of an investor who invested $1000 in the 3rd month

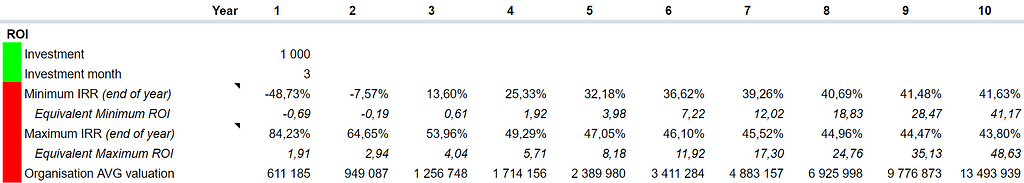

To sum up, here is a graph showing the PITH buy and sell price (at the DAT level) over time as well as the cumulative funds raised and the cumulative revenues generated.

Peepith’s PITH buy and sell price over time

Peepith’s PITH buy and sell price over time

Just to be clear:

- The Token Buy Price shows the price at which an investor can buy a PITH from the DAT (which happens at the moment when demand > supply on the second market).

- The Token Sell Price shows the price at which an investor can sell their PITH to the DAT (which happens at the moment when supply > demand on the second market).

Conclusion

With what one could argue is a very cheap business model by today’s standards ($1 for a lifetime of service access), Peepith’s DAT was able to raise funds and provide a solid return to its investors while at the same providing Peepith with PITH that proved very useful to boost their community building efforts. Not bad 😎

Of course, the above figures are to be taken with a grain of salt as the model assumes that nobody ever sells, for example, which is why the token price invariably goes “up and to the right” with time. In real life, it won’t be as smooth since Peepith will more than likely experience turbulences during its lifetime (growth will stall, mistakes will be made etc…) which will make investors lose confidence and decide to sell.

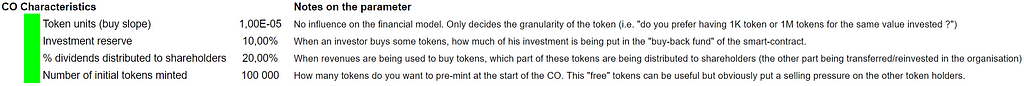

Also, Peepith could have created a DAT with totally different parameters (# pre-minted PITH, % of investment put in reserve, % of payment distributed as token dividends…) which would also have changed this graph. The parameters used for this model were the following:

Finally, the above example is based on a pure crypto project, but it is easy to adapt the model to traditional organizations by simply replacing the Aragon DAO by the organization of your choice, be it for-profit or non-profit, startup or Fortune 500. The main difference will be the assets and/or cash-flow that the organization decides to put in the DAT and from which FAIRs will derive their value.

Why are Continuous Organizations a better model?

The Continuous Organization model displays many interesting properties that make it much more aligned with the need of organizations in the digital economy (if you haven’t already I encourage you to read HEDGE from Nicolas Colin, a great source of inspiration for the Continuous Organization model).

- ️📈Continuous Fundraising. The DAT offers a continuously open primary market where tokens get minted whenever demand exceeds supply, thus providing ongoing funding and making the organization less fragile.

- 🏄🏻Fully liquid. The bonding curve guarantees that an investor will always be able to buy or sell their FAIRs (though not necessarily at the price they wants), even in the absence of being listed on the public market.

- 🌳Attractive to long-term investors. By construction, the DAT limits short-term speculators and attracts long-term investors.

- 💲 Securities. FAIRs are a claim on the future cash-flows handled by the DAT and should be valued as such.

- 🤗 Permission-less, friction-less & supra-national. Anybody can easily buy and sell any amount of FAIRs from anywhere in the world without asking for permission from anyone.

- 💬 Governance agnostic. FAIRs provide no governance rights. The DAT is immutable and doesn’t enforce any particular type of governance on the organization: it’s BYOG, “Bring Your Own Governance”.

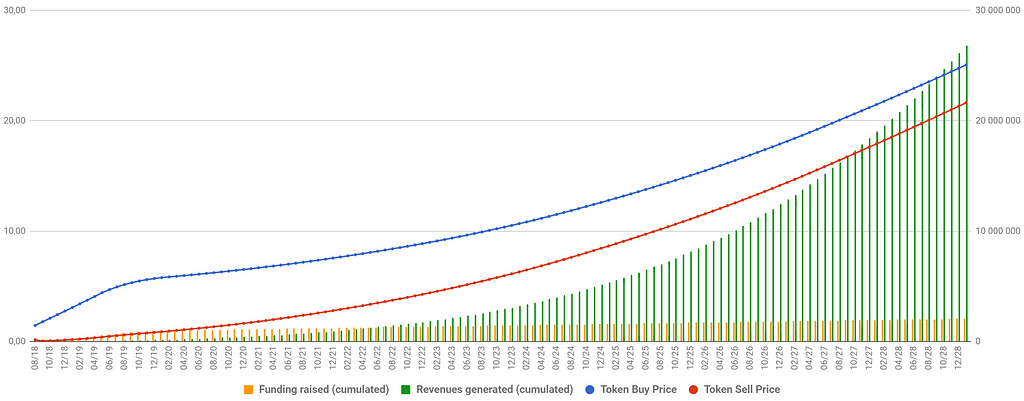

What are the benefits for stakeholders?

Benefits stakeholders gain from the Continuous Organizations

Benefits stakeholders gain from the Continuous Organizations

The elephant in the room: Regulation

Security tokens are regarded as securities and, as such, must comply with the securities laws of their jurisdiction. The risk is that if a DAT is required to comply with current securities laws, it could very well denature the Continuous Organization model by adding frictions, restrictions & limitations where there could be none. Here are our current thoughts about this:

First off, to which jurisdiction does the DAT belong? The DAT is not the organization. Like a trust, the DAT is only a contract, it has no legal entity and, once established, the organization has no power over it (the Trustee being the code). So one could reasonably argue that it belongs to the Ethereum jurisdiction. In which case, it should comply to the securities laws of the Ethereum jurisdiction…

That being said, it would be interesting to study whether a DAT could exist within today’s securities laws or not. This would take a country-by-country study but if we look at the US for example, one could think that the concept could perhaps be “viably” implemented within the Reg CF / Reg A+ offering rules?

A better option would be to work with a pro-innovation, forward-looking country/regulator to create a specific regulation for Decentralized Autonomous Trusts. This is clearly the long-term objective.

Another option is to use the DAT as a utility token issuer only. After all, if the organization does not transfer any assets to it and does not funnel any cash-flow to it, then the tokens issued by the DAT are pure utility tokens.

As you can tell, we are still in the exploratory phase on the regulation side of things, but we feel that rather than being a problem for the regulator, the Continuous Organization is a solution.

So far, most regulators are facing a real dilemma regarding how to regulate ICOs (or how not to regulate them). On the one hand, they obviously want to attract innovators and investors but on the other hand they also need to provide investors with some level of protection against scams. This is why the Continuous Organization model could be a solution: it keeps the “good parts” of ICOs while significantly limiting their bad parts. We are convinced that regulating DATs would be extremely beneficial, not only by unlocking massive innovation but also as an important source of revenues for the jurisdiction through taxes and investments.

Conclusion

The Continuous Organization model is in infancy but it is our belief that it could very well become the next killer app for crypto. If we can create organizations that align stakeholders 10x better than they are today, on top of being simpler to setup and cheaper to run, there is the potential to become the de-facto standard for entrepreneurs when it comes to launching a new venture.

And by decoupling governance from financial interests and by being more inclusive, we hope that the Continuous Organization model will help organizations become much more long-term focused than today.

If you want to learn more, please read the white paper, and let us know what you think. It is very important that we get as much constructive feedback as possible so that we can improve and refine the model. You can join the conversation around Continuous Organizations on our forum:

Finally a huge thanks to everyone who contributed to taking this new concept so far already. First and foremost The Family, who has sponsored this research, but also everybody who took the time to help me through their code, discussions, reviews and feedback, most notably: Pierre-Louis Guhur, Marie Ekeland, Tonje Bakang, Joris Delanoue, Solomon Hykes, Andrea Luzzardi, Tibor Vass, Samuel Alba, Oussama Ammar, Alexandre Obadia, David Fauchier, Minh Ha Duong, Florent Artaud, Willy Braun, Franck Le Ouay, Duc Ha Duong, Dimitri De Jonghe, Jérôme de Tychey, Kyle Hall…

Introducing Continuous Organizations was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.