Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Three big trends after a review of 140+ startups.

We’re reminded, on an almost weekly basis, that we are in the midst of an affordable housing crisis. Only the top 2% of America can affordably rent an average 2-bedroom apartment in SF. Homeless camps have spread. And the average millennial has just $1,000 in her bank account, spending much of her income on living costs. But amidst this crisis, policy suggestions — while critical — dominate, as promising private-sector solutions often go unmentioned. Indeed, much discussion in community development circles focuses on the sources of housing funds, such as Section 8. While this discussion is needed, more thinking about how to use that money effectively can result in better affordability outcomes.

Here, based on a review of 140+ companies, we discuss a small sampling of those innovations, which serve as windows of opportunity to change housing for the better. These innovations largely fall into three categories: those that make land cheaper, construction cheaper, and financing easier.

A homeless camp in Eugene, Oregon. (From Wikimedia Commons user Visitor7 under a CC-by-SA 3.0 license)

Making land cheaper by building denser and smarter.

Driven upwards by natural shortages or supply-restricting rules and politics, the cost of land itself is a huge obstacle to affordable housing. On average, land accounts for roughly 50% of a real estate development budget.

If the cost of land is a matter of supply and demand, then increasing supply is an obvious first step. But we can’t just build more market- and luxury-rate units, given how expensive those are. Instead, we should adopt new layouts designed to drive down cost, to help people share space, and to live more communally.

New layouts like micro-units, accessory dwelling units (ADUs), and communal living plans upend the spacious and isolationist notions of American housing to increase density and lower costs. Micro-units feature layouts 30 to 50% smaller than average and are correspondingly cheaper. They often use multipurpose furniture, such as murphy beds, to make better use of the limited space. Kasita, an Austin-based startup, sells 1-bedroom micro-units for just $140,000. These micro-units run roughly 352-square-feet per unit (for context, an average studio is about twice the size). Other micro-unit startups, such as Module Housing, allow residents to turn a one-bedroom starter unit into a three-bedroom house when they need more room.

Whereas micro-units increase density by sizing down, ADUs and communal living arrangements target space inefficiencies. Accessory dwelling units (ADUs), like those manufactured by Montana-based Montainer, optimize under-utilized spaces such as rooftops and backyards by adding units to those spaces. ADUs alone may be enough to meet Los Angeles’ modest goal to add 100,000 new housing units by 2021, if all the lots that qualify to add an ADU do in fact adopt them.

An example of a pre-fabricated, micro-unit apartment (L) and of an accessory dwelling unit suitable for backyard use (R). (L, from flickr user seier+seier under a CC-by-2.0 license; R, from flickr user Daniel Ramirez under a CC-by-2.0 license)

Similarly, communal living arrangements require residents to share common areas, such as kitchens, which are key to any residence but do not demand privacy. Increasingly embraced abroad, these communities also improve quality of life by providing strong social support systems. The recent wave of real estate start-ups, communal living companies included, may finally shore up coliving’s popularity stateside. Relatively new SF-based companies, Starcity and Bungalow, are two such start-ups.

Cohousing communities often share childcare (L) and cooking (R) responsibilities to save time and money as well as to build community. (L, from House Planning Help; R, from Nelson Cohousing)

Even if we wanted to build and live more densely however, there are several challenges to overcome.

A preliminary obstacle is “Not In My Backyard” (NIMBY) sentiment. Existing property owners have strong incentives to disapprove much needed housing. Education is not an adequate solution to this phenomenon. A home is an extremely emotional investment, and the myths informing development politics are not always rational. Rather, the financial incentives of local homeowners must be fundamentally rewired. Home equity protection plans, such as those offered by Home HeadQuarters Inc., can at least guarantee that property values will not decrease — a common worry that drives NIMBY sentiment. Incentives can also be extended to existing homeowners in exchange for political support. The latter strategy has been successfully deployed by developers like those behind L.A. Live, a 5.6 million-square-feet complex in downtown Los Angeles.

The right benefits will of course be different for each community, whether they be funding for local schools or crowdfunded investment opportunities. coUrbanize, a member of TechStars’ Boston 2013 class, offers an online platform to help developers more readily assess what those tailored benefits might be. A mixed-use Washington, D.C. project with 22 affordable units is using the platform to determine whether the addition of a full-service grocer will help win community support for its build. Other projects have less specific benefits in mind and are soliciting comments from the local community.

Using crowdfunding sites like Fundrise, developers can easily allow local homeowners to invest in their property and benefit from neighborhood growth. (From Crowdcrux.com)

The challenges of building densely don’t just end with winning the hearts and minds of local communities. As cities get more dense, congestion increases. Many cities do not have the appropriate public transit and parking infrastructure to allow people to live comfortably amidst this growth.

Crowdfunded bus-, carpool-, and bike-only lanes, Boring Company’s underground travel tunnels, and Dahir Insaat’s elevated buses can all help residents avoid congestion, as can new parking systems. In Tokyo, which has the highest population of any metro in the world, neighborhood or backyard automated parking systems free up parking spots and ease parking-related traffic. Such systems are finally being adopted in U.S. cities like San Jose, albeit slowly. These solutions, when built next to high density developments, have the further benefit of promoting affordability by freeing residents from the financial burdens of car ownership.

Bus-only lanes on average cost 10% of metro rail transit and can serve as cost-efficient complements to light rail for areas with less traffic. (From Wikimedia Commons user Raysonho under CC0 1.0)

Building cheaper.

The construction industry has been slow to optimize the building process, eschewing widespread adoption of new construction methods at the expense of affordable housing. The simplest of these recent innovations are mass-produced units, also known as modular homes or prefabricated units. Because these units are created in controlled, factory environments, developers like Panoramic Interests can decrease costs by 30% and completion times by 40%. Whereas most factories employ assembly line workers to create these units, Blueprint Robotics, a Baltimore-based startup, creates even greater efficiencies by using industrial robots common in automotive production lines.

Blueprint Robotics mass producing housing units. (From Blueprint Robotics)

But while mass-produced units are great in theory, local building and zoning codes prevent true standardization. Those costs can be reduced by automating compliance. Prefab startups, like Cover, use algorithms to suggest legally-compliant designs based on user-generated inputs, such as geographic location or number of rooms.

We are likely to see even more automation across the board. Despite long-standing resistance from the industry, it now has little choice. Labor shortages are at all-time highs. Many workers left the industry during the last recession and have not returned, preferring employment in less cyclical industries. To address these issues, innovations that largely dominate tech news today — drones, robots, and 3-D printing — are all being applied to the construction industry.

Drones can be deployed to survey and report on progress, and on-site robots automate and significantly accelerate highly repetitive tasks like bricklaying. Komatsu, the world’s second largest construction company, and Skycatch, a Silicon Valley drone start-up, are successfully combining these two concepts to address Japan’s labor shortfalls. Skycatch’s drones provide autonomous robots real-time feedback on the construction environment, dramatically improving the accuracy and efficiency of the robots’ work while reducing the need for supervisory human labor. These hybrid teams of drones and robots require just one or two non-skilled human workers to be on-site.

Hundreds of hours in labor are being saved through the combination use of drones and autonomous robots. (From Pixabay user Powie under CC0 1.0)

Also available for on-site use, 3-D printing utilizes large robotic printers that spit cement ink to build houses with minimal human oversight. SF-based Apis Cor, one of the earliest startups in this space, can build a 400-square-foot house for just $10,000. Apis’ first build, which took place in early 2017, impressively required only 24 hours of work and can be replicated in a number of different climates. The company hopes to expand beyond its test site in Russia to Europe, the U.S., and even the Antarctic and Mars.

Apis Cor prints a house using cement ink for $10k. (From Wikimedia Commons user Fizpaket under a CC-by-SA 4.0 license)

Owning and financing differently.

Traditional financing models require a 10% to 25% return to investors. To meet these margins, developers must either increase rents or sale prices. But several ownership and financing structures better balance profit and social impact, reducing costs while recognizing that housing is a critical social good. Community land trusts (CLTs) are one such example.

Organized as nonprofits, CLTs own and then affordably lease the underlying land for 99-years, so that homeowners only have to pay for the housing structure itself. As a result, CLTs drastically lower the barrier to homeownership.

In a rapidly-gentrifying part of Austin, CLTs run by the Guadalupe Neighborhood Development Corporation enable minority residents to buy homes for 50% of the average cost. In exchange for affordable and long-term leases, homeowners are limited in their abilities to sell and profit off gentrification.

Long-time Austin residents are now able to become homeowners for 50% of the cost thanks to a local CLT. (From the Guadalupe Neighborhood Development Corporation)

Eliminating third party developers entirely, another example, baugruppen, is one of Germany’s most successful tools for creating affordable housing. Individuals pool their resources to become developers themselves, and government facilitators help them navigate legal and technical problems. While traditional developers require 10 to 25 percent returns on their capital, citizen-developers, since they simply care about living in the units, do not require such high returns. Housing costs, as a result, drop.

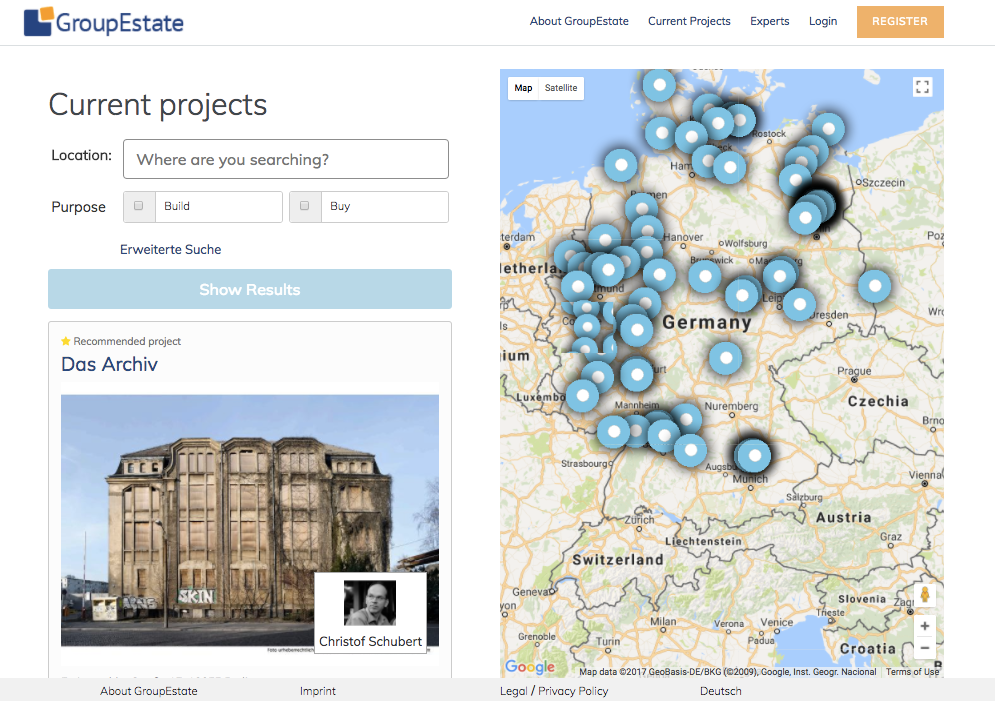

As attractive as this outcome is, finding like-minded citizen-developers is not always easy. GroupEstate, a startup based in Germany, targets this pain point through an online platform that facilitates this process. The startup also allows people to buy into already completed projects and provides other products, like loans and free sample contracts. By simplifying the process behind baugruppen, GroupEstate hopes to further popularize this resident-first approach to affordable housing. The concept is gaining interest in the U.S. as well, and a few examples of baugruppen-like resource pooling, like Durham Central Park Cohousing Community, already exist stateside.

GroupEstate currently has over 60 active projects. (From GroupEstate)

While both models are increasingly embraced as tools for long-term affordable housing, their scalability remains an open question, with only about 250 CLTs in existence today. In contrast, private investment efforts may be better suited to scalability. Real estate investors focused on social impact, such as Turner Impact Capital, have discovered that buying “naturally affordable” older properties and keeping them affordable can be good business. Since demand for lower rent increases during recessions, such units act like bonds in economic downturns. As of 2015, Turner and 15 other leading investors, such as Avanath Capital Management, invested in 60,000 affordable housing units to keep them permanently affordable.

Turner Impact Capital invests in naturally affordable housing units and provides free educational and health classes to improve quality of life. (From flickr user Iman Shad under a CC-by-2.0 license)

In conclusion, let’s build better cities together

The interventions above are promising in their abilities to reduce costs and can even be combined to accelerate housing affordability. But to be truly effective in the fight for affordable housing, private companies should study and implement these innovations in consultation with each other and the various players in the housing field.

Facebook’s Catalyst Housing Fund, which focuses on “scalable ways to increase … affordable housing”, has done a particularly admirable job of coalition-building. The Fund now involves a civic movement, local government efforts, and established nonprofits. Its efforts will inform the development of a new campus, which will house 1,500 below-market rental units open to both Facebook employees and the general public.

This type of collaboration is particularly important in the context of new technologies and processes. Innovative concepts can help us resolve the affordable housing crisis but in all likelihood, will also pose steep learning curves. Those challenges are best mastered together, not alone.

Note:

- A much more detailed mapping of housing innovations is available here.

- A related map of the affordable housing field is available in another article in The Multifamily Executive.

Startups and the Future of Affordable Housing was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.