Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In today’s edition of The Daily, we focus on an Israeli crypto security startup that has raised $30 million in funding from a number of notable companies. We also look at how tokens are being used to clean up the environment, as well as efforts by major auditing firms to service clients in the cryptocurrency field.

Also Read: Survey: 60% of US Voters Want Crypto Political Donations to Be Legal

Israel Grows as Crypto Development Hub

Starkware, an Israel-based startup developing zero-knowledge proof technology to improve the scalability and privacy of blockchains, has revealed that it recently closed a $30 million equity funding round. Paradigm led the round, which included new investments from Intel Capital, Sequoia, Atomico, DCVC, Wing, Consensys, Coinbase Ventures, Multicoin Capital, Collaborative Fund, Scalar Capital and Semantic Ventures. Previous investors in Starkware also participated in the funding round, including Pantera, Floodgate and Naval Ravikant.

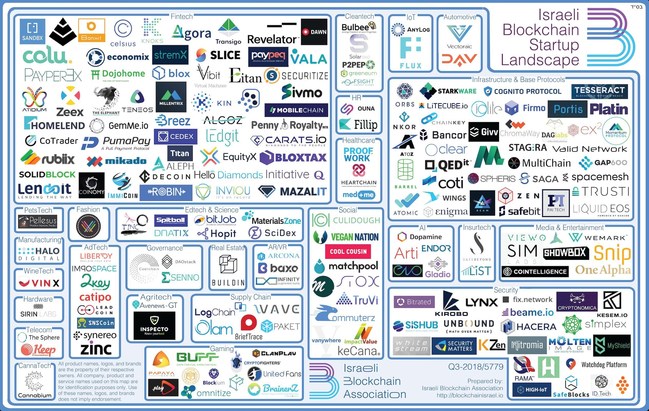

The investment underscores the emergence of Israel as a crypto development hub. Earlier this month, the Israeli Blockchain Association released its third Startup Map, which covers more than 200 young companies operating in the larger crypto industry. In addition to Starkware — whose co-founders include Prof. Eli Ben-Sasson of the Technion Israel Institute of Technology and Alessandro Chiesa, an assistant professor at the University of California, Berkeley — there are now 37 startups developing protocols or infrastructure in the country, with 23 operating in the security sector.

Getting Paid to Recycle

While the mainstream media continues to spread the misconception that cryptocurrencies are bad for the environment, in the real world creative visionaries are actually using them to help with conservation efforts. SC Johnson, the U.S. multinational behind household products such as Raid, Windex, Mr. Muscle and Toilet Duck, has unveiled a plan to fight pollution from plastic with cryptocurrency.

In collaboration with Plastic Bank, the Wisconsin-based company plans to open eight recycling centers in Indonesia, where people will be able to exchange plastic waste for digital tokens. The first facility officially opened in Bali on Oct. 28, with all of the centers to be operational by May 2019. Each of the eight recycling centers will be able to process a minimum of 100 metric tons of plastic per year.

“(This program) will help create more opportunities for people living in poverty and will offer waste collectors an important sense of pride,” said David Katz, founder and CEO of Plastic Bank. “(It will also) benefit a wide range of socio-economic demographics including local residents living below the poverty level.”

Plastic Bank CEO David Katz and Fisk Johnson, chairman and CEO of SC Johnson, show off a mobile collection center.

Plastic Bank CEO David Katz and Fisk Johnson, chairman and CEO of SC Johnson, show off a mobile collection center.

“We want to help recover plastic equal to the amount we put into the world, through innovative recycling and recovery programs,” said Fisk Johnson, chairman and CEO of SC Johnson. “In this way we can neutralize our environmental impact and, at the same time, do some good in communities that have excessive plastic pollution.”

Big Accounting Firms Start Crypto Hiring Spree

According to a report by the Financial Times, major auditing firms such as EY, PwC and KPMG have been hiring hundreds of crypto experts to help with accounting startups and investors in the cryptocurrency segment. The companies are also said to be creating in-house technologies tailored to specific processes that will be used to audit cryptocurrency ventures.

According to a report by the Financial Times, major auditing firms such as EY, PwC and KPMG have been hiring hundreds of crypto experts to help with accounting startups and investors in the cryptocurrency segment. The companies are also said to be creating in-house technologies tailored to specific processes that will be used to audit cryptocurrency ventures.

“We have no choice than to address this because some of our clients have invested in that space,” explained Jeanne Boillet, global assurance innovation leader at EY, which is said to have more than 150 clients with crypto assets around the world, including traders, exchanges and mining companies.

PwC claims it currently has about 400 “blockchain experts” on its payroll in multiple divisions around the world. “We are in the midst of a rather significant effort,” said Ralph Weinberger, leader of PwC’s global network assurance methodology group. “We are devoting significant resources to how we might provide audit services in not just cryptocurrency, but blockchain.”

What do you think about today’s news tidbits? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at Satoshi’s Pulse, another original and free service from Bitcoin.com.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.