Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Cryptocurrency prices have been quite stable over the last few weeks as volatility throughout many markets has been non-existent. After patiently waiting, traders and investors are now curious to see if something transpires after a long spell of tranquil digital asset markets.

Also read: New Qart Wallet Gives Bitcoin Cash QR Codes a Personal Touch

Do Calm Crypto-Market Seas Suggest Something Big Is on the Horizon?

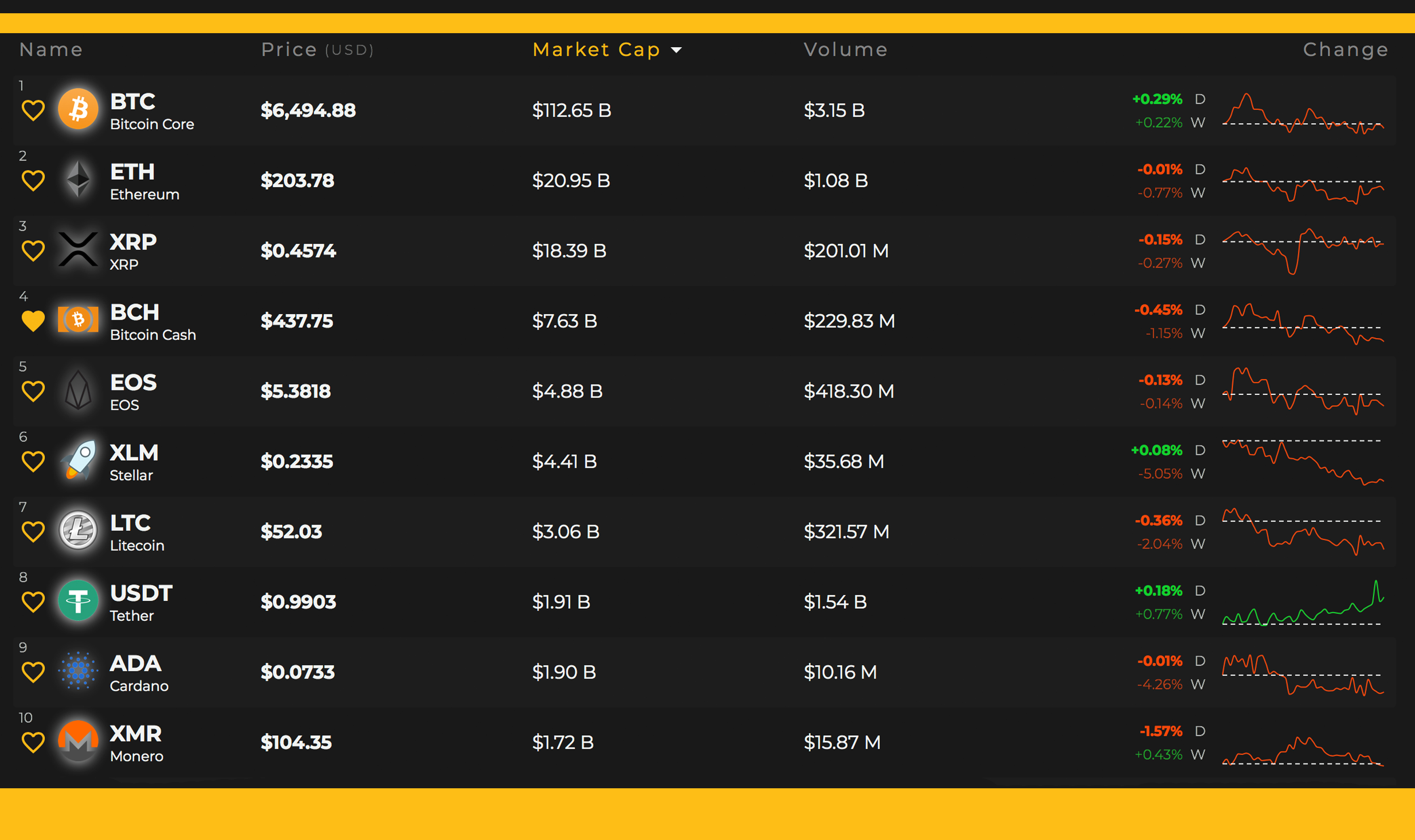

Throughout the flurry of new stablecoins, the original pack of digital currencies has been very stable these days with low volatility. This Saturday, Oct. 27, the entire cryptocurrency economy is valued at $212.5 billion with around $8.6 billion worth of 24-hour global trade volume. The top exchanged coin today with the most trade volume is bitcoin core (BTC) with a daily volume of around $3.7 billion. At the moment, BTC is trading at a global weighted average of around $6,494 per coin, with an overall market valuation of about $112 billion. Following behind BTC is ethereum (ETH), which is trading for $203 per coin. The third highest cryptocurrency capitalization is held by ripple (XRP) and each token is being swapped for $0.45. Lastly, this weekend eos (EOS) tokens are being traded for $5.37, with a capitalization of about $4.8 billion today.

The top ten cryptocurrency markets. Oct. 27, 2018.

The top ten cryptocurrency markets. Oct. 27, 2018.

Bitcoin Cash (BCH) Market Action

The fourth largest market valuation among all 2000+ digital assets belongs to bitcoin cash (BCH) this weekend. Bitcoin cash is down 0.63% this Saturday and 1.2% over the last seven days. At the time of publication, one BCH is being swapped for $439 per coin and has around $229 million in global trade volume. The top five exchanges swapping the most BCH include Lbank, Hitbtc, Bithumb, Okex, and Digifinex. BTC is the leading pair swapped with BCH as the currency captures 38.4%. This is followed by USDT (25.4%), KRW (18.4%), ETH (10.9%), and ZB (2.2%) pairs. Bitcoin cash holds the sixth largest global trade volume throughout the entire crypto-economy.

BCH/USD Technical Indicators

The BCH/USD 4-hour and daily charts show very little action and less volatility than we’ve seen in weeks. RSI and stochastic levels are meandering in the middle (between 46-50) and it’s been hard to find an indication of any big market moves coming soon. The Macd shows a similar outlook even though at the moment it’s heading southbound. A trend change may be imminent as the two Simple Moving Average (SMA) trendlines are about to cross.

BCH/USD 4-hour, Bitfinex. Oct. 27, 2018.

BCH/USD 4-hour, Bitfinex. Oct. 27, 2018.

The longer-term 200 SMA is just about to dip below the short term 100 SMA indicating the path towards the least resistance could change toward the upside. Order books show some tough resistance at the $475 range and another hump above the $515 territory. Looking at the backside, BCH bears will see some pitstops at $410 and a much large wall in the $380 zone.

BCH/USD 1-hour, Bitstamp. Oct. 27, 2018.

BCH/USD 1-hour, Bitstamp. Oct. 27, 2018.

The Verdict: Apprehensive Traders Among Calmness and Stability Within the Cryptocurrency Economy

A great majority of 2018’s market update verdicts have been filled with skepticism and this week’s outlook is no different. The last ten months of bearish markets, fakeouts, and extremely flaccid trade volumes have led to uncertainty among many cryptocurrency traders. However, most digital assets have seemingly found their bottoms (the lowest the price will go), or at least some people hope the crypto-price bottoms have been found. The truth is no one truly knows what prices will look like by the year’s end. As stated above, the eerily serene markets are likely making traders and enthusiasts more anxious for an unexpected breakout in both directions to occur.

What do you think about the tranquility of cryptocurrency markets these days? Let us know what you think about this subject in the comments section below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.