Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Shrimpy is becoming the default portfolio management application for the crypto space. Allocating a diverse portfolio across multiple exchanges has never been so easy. Continuing our vision requires more features that target additional aspects of portfolio management.

Today, we are introducing the Shrimpy Index Tool. This free indexing feature will provide the most powerful way to index the cryptocurrency market. The index will automatically buy and sell assets on your favorite exchanges in order to construct the index of your choice.

Why Use Shrimpy To Index?

In Shrimpy, we don’t restrict you to a few select indexes. You get infinite options to configure the index that works for you.

- Select any number of assets for your index.

- Allocate based on market cap or an even distribution.

- Set a maximum percent allocation per asset.

- Fix a minimum percent allocation per asset.

- Exclude assets your index should ignore.

- Pick a rebalance period that works for your strategy.

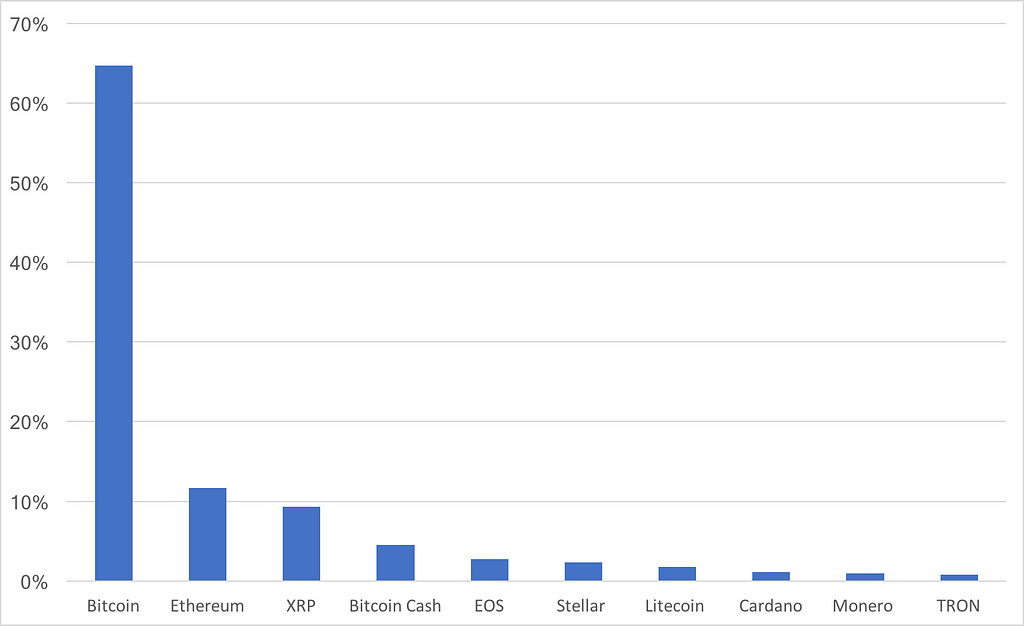

In order to better understand how each of these configurations work, let’s walk through a few examples of indexes that can be built in the Shrimpy application. First, we should look at the most traditional style of index fund. An index which allocates the top ten cryptocurrencies weighted by market cap.

This is an index of the top ten cryptocurrencies, weighted by market cap. USDT was excluded because it is tethered to a fiat currency.

This is an index of the top ten cryptocurrencies, weighted by market cap. USDT was excluded because it is tethered to a fiat currency.

Looking at this index, it is clear that the overall performance of this fund will heavily rely on the performance of Bitcoin. As a result, you may decide that you want to reduce the reliance on Bitcoin by putting a cap on the percent allocation allowed for any one asset. For the sake of this example, let’s say we want a maximum percent allocation of 20%.

Shrimpy allows you to easily solve this problem by entering a minimum and maximum percent allocations. This will prevent any asset from maintaining a target allocation greater than the maximum percent allocation and from achieving a target allocation less than the minimum percent allocation.

The max and min percentages that you chose are completely up to you.

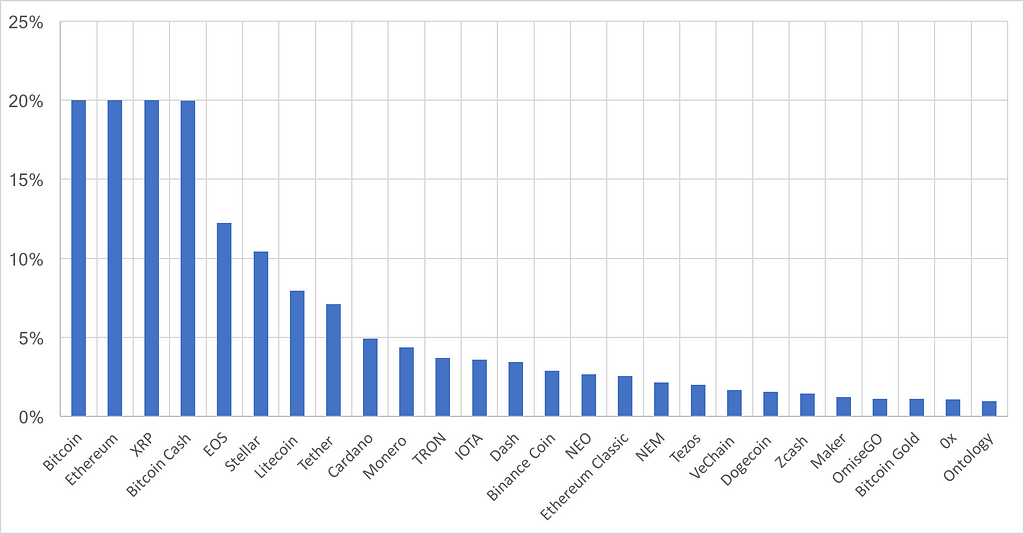

In addition to setting a minimum and maximum percentage, let’s pretend you read our article on diversity, and this led you to wanting a more diverse portfolio.

Crypto Users who Diversify Perform Better [New Research]

Once again, you can do this with Shrimpy. All you need to do is input the number of assets you would like to hold in your index. If you wanted 26 assets, simply input 26.

The result so far is an index which has 26 assets that are weighted by market cap and has a maximum allocation percent of 20%. This index would look something like the following:

This is an index of the top 26 cryptocurrencies, weighted by market cap. The maximum allocation for any asset is capped at 20%.We can quickly see this is becoming a powerful tool for numerous use cases.

This is an index of the top 26 cryptocurrencies, weighted by market cap. The maximum allocation for any asset is capped at 20%.We can quickly see this is becoming a powerful tool for numerous use cases.

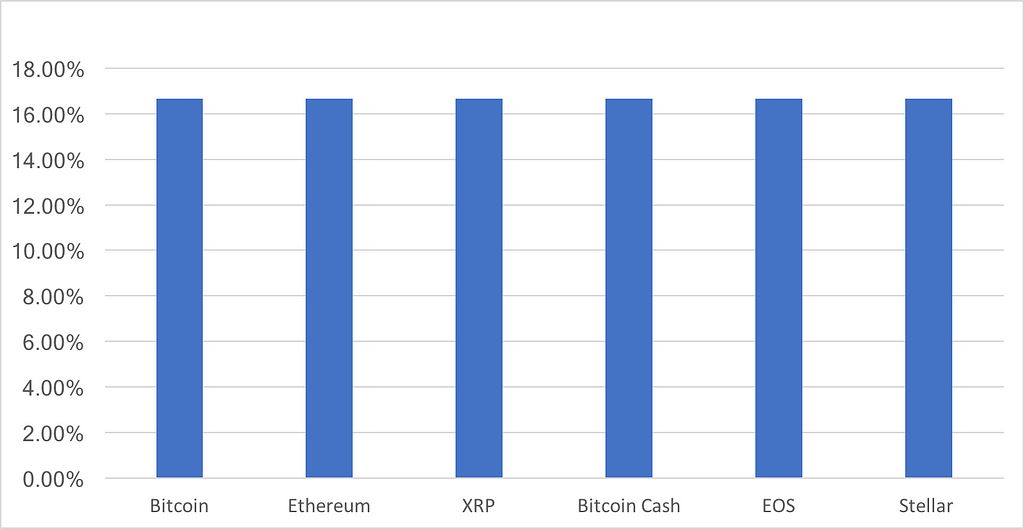

After allocating such a beautiful portfolio of 26 assets, let’s say you changed your mind. You decided you only want to index the top 6 cryptocurrencies. Additionally, maybe you read our article about optimizing asset distribution and determined that an evenly allocated portfolio would be a better strategy.

Optimizing Asset Distribution For Cryptocurrency Rebalancing

Shrimpy allows you to instantly change your strategy and implement this new index within seconds. It’s the easiest thing you will do in the crypto space. Let’s take a look at what the resulting allocations would be in Shrimpy.

Now that your portfolio has been allocated, you may be wondering how much maintenance is required.

Well, none.

Shrimpy automatically adds and removes the assets from your allocations as they come in and out of the rank you designated. If you selected to hold the top 5 assets by market cap, then you will always have the top 5, even when the market moves and the rankings change.

Rebalance period

Everyone knows us for our rebalancing, so you might be asking yourself “Ok, but does it rebalance”.

Don’t be silly!

Of course it rebalances. Select any rebalance period. Anywhere from every 1 hour to every million years. You have the freedom to select your rebalance period. You can also rebalance instantly at any time by clicking the “Rebalance Now” button on the dashboard.

If you aren’t familiar with rebalancing, you can learn more here:

Portfolio Rebalancing for Cryptocurrency

Get Started Today

There is no application in the market that compares to Shrimpy. Gain the flexibility and freedom of a premium application for the price of nothing. While other applications charge an arm and a leg, we make the world your playground and don’t charge you a dime. Enjoy everything Shrimpy has to offer by signing up today.

The Future of Indexing

Shrimpy is pioneering the way for crypto indexing. Without buying an index fund, you can get exposure to the most powerful indexes by maintaining the underlying assets on Shrimpy and indexing through the Shrimpy Index Tool.

We aren’t done with indexing though. There are more features and capabilities that will be coming to our users on the Shrimpy application. As we explore indexing options, we will continue rolling out new ways to manage your portfolio.

Shrimpy for Institutions

If you are an institution who is manually indexing the market. It’s time to automate your process. Sign up for a free trial of the Shrimpy Institution platform and get the most powerful tools to manage your crypto fund.

Institutional Investors Are Now Using Shrimpy to Rebalance Their Crypto Funds

Disclaimer: Assets and strategies mentioned throughout this article are for example purposes only. It is not intended to be investment advice.

Don’t forget to check out the Shrimpy website, follow us on Twitter and Facebook for updates, and ask any questions to our amazing, active communities on Telegram & Discord.

The Shrimpy Team

Index the Crypto Market With Shrimpy [Feature Release] was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.