Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

This year’s election in Italy was shocking. The populist, anti-establishment Five Star Movement party emerged from obscurity to become the largest party in government. Its central campaign plank was to pay a Universal Basic Income (UBI) to every citizen of Italy. Italy has long suffered from mass unemployment. The new government is fulfilling its campaign promise: it has introduced a UBI of €780 per person, every month, in its draft 2019 budget.

Technology is Destroying Jobs

Economists have often wrongly predicted that technology will destroy jobs. Today, a widely held view is that technological advances will make up for the jobs they destroy by creating new ones, as they have in the past. But this time could be different.

AI could optimize workflows to the extent that minimal human contribution is required, thereby destroying more jobs than it creates. Take the example of taxi drivers. Uber and Lyft have reduced their wages, but increased the demand for their services. When cars become fully self-driving, these drivers will have to seek work elsewhere. A similar example is truck drivers. They will first transition into the passenger seat, supervising self-driving trucks. In the next phase, they will no longer be necessary.

In a couple of decades, the interaction of AI, robotics and hive robotics, digital automation and the Internet of Things could make most jobs unnecessary — just as the population of the world hits an all-time high.

Unemployment, Underemployment and Wage Stagnation are Rampant

Source: Wikimedia Commons

Source: Wikimedia Commons

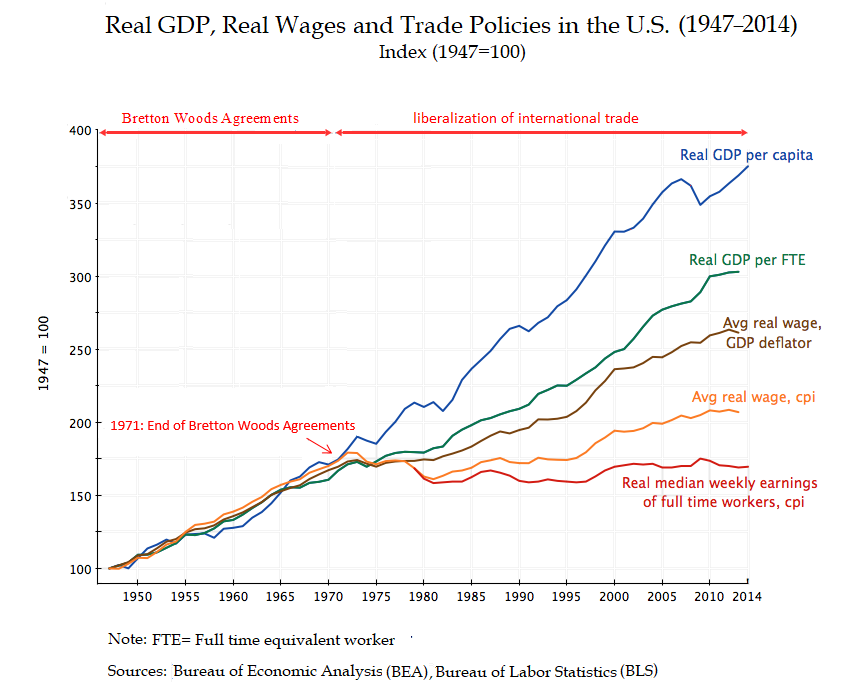

Unemployment is already a major issue. Despite the booming US economy and high employment figures, wages are stagnating, a large percentage of people are underemployed and there has been a long decline in the labor participation rate (more people have been staying home and not looking for work).

Even when the global economy is healthy, unemployment is a major problem in much of the world. After the next economic downturn, the world will witness mass unemployment and an even more volatile social environment.

To address unemployment, underemployment and wage stagnation, populist politicians in Italy and elsewhere have turned to UBI as a campaign plank.

What is UBI?

Universal Basic Income (UBI), sometimes referred to as a ‘Basic Income Guarantee’ or ‘Universal Demogrant’, is a proposed welfare program in which every citizen of a country receives an unconditional, regular, and livable sum of money from the government.

Since UBI is unconditional, it is received by the employed and the unemployed alike, and the rich and the poor alike.

UBI’s critics sometimes liken it to socialism or even communism. This is wrongheaded. History has shown communism to be a failed ideology that has led to colossal economic mismanagement and waste, violent unrest, and even genocide and mass starvation. Communist and socialist regimes have often consolidated power in a dangerous manner, enabling government officials to create state-sponsored economic fiefdoms at the expense of the citizens they purport to govern. UBI is an economic program that can co-exist with our tried and tested, modern, capitalist economic system. UBI’s aims are limited and simple: to support the basic needs of every citizen and to eradicate extreme poverty.

Policy Makers should Grapple with Technology’s Effects

Policy makers are presiding over a political and economic system designed over 70 years ago and tweaked a few times since then. It has given us a period of economic growth, technological innovation, and increased personal freedom.

It will have to be tweaked again to head off technology-sponsored mass unemployment.

Already, we are experiencing a backlash against big tech companies in the United States and around the world. Companies that were benign startups in the 1990s have emerged as market-leading conglomerates, and can deploy massive capital, data, and algorithms, not to mention the best tech developers and thinkers that money can buy. The power they have aggregated has increasingly engendered fear and suspicion.

The Office of Science and Technology Policy.

The Office of Science and Technology Policy.

These feelings will only become stronger if technology continues to destroy jobs. The process is far along in many industries, such as agriculture and advanced manufacturing. It is likely that the labor participation rate will continue to drop, with short bursts of job creation masking the overall downward trend.

However, elected officials around the world increasingly find their terms plagued with gridlock, political jockeying, and preparing for the next election. This is hardly the ideal environment for grappling with complex, long-term problems like the threat of mass unemployment in the future. Even the lucky few political leaders who are able to pursue their agendas often attract investment with the hope of creating jobs. Ironically, the sector that attracts the most investment is technology — the same sector which is poised to destroy our jobs in the long term.

This is not to say that policy makers should oppose the march of technology. This approach would be akin to trying to patch a crack in the hull of an oil tanker with a bandage. A more pragmatic approach is to recognize the issue of technology-created unemployment and address the consequences it may have.

The Economic Perspective

Economists often argue that despite UBI’s noble aims, it is too expensive. The amount paid to every citizen must come from somewhere. They are also often concerned by UBI’s effects on incentives to work and be productive.Running perpetual government deficits could be disastrous for the national debt, the money supply is controlled by independent, technocratic, and risk-averse institutions, and all of this exists within a complex, interconnected global economic system. The shockwaves of a poorly-implemented UBI program in one country may be felt by economies across the world. So, how can a government fund a monthly stipend for each of its citizens?

A recent model developed at Wharton (at the University of Pennsylvania) suggested three potential ways to pay for UBI in the United States: by running deficits, by increasing the payroll tax, or by external financing (similar to oil revenues from Alaska providing stipends for all of its citizens).

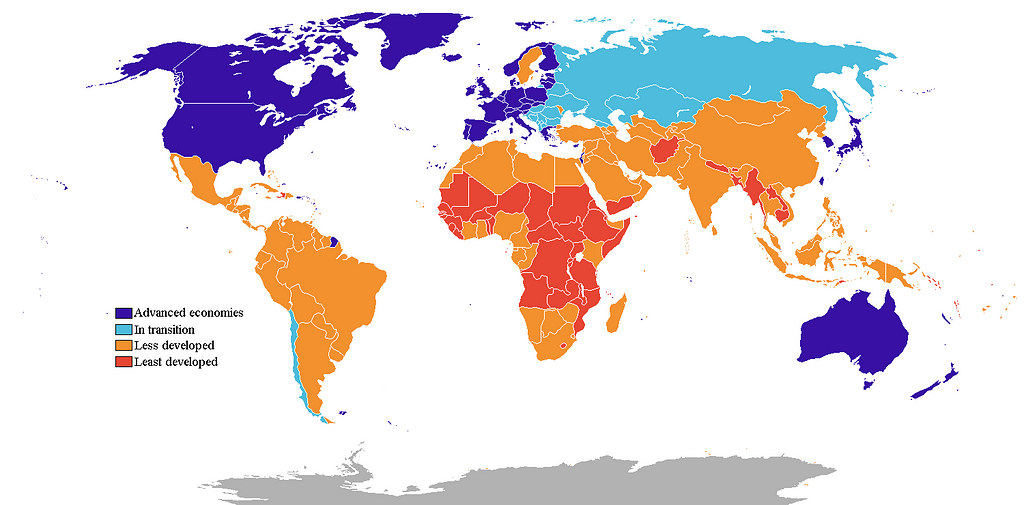

The model found that UBI would reduce the hours people worked and would reduce the GDP. If UBI is not viable in the United States, it follows that it is even less viable in emerging economies. This explains why most economists oppose UBI.

Developed and developing countries. Source: Wikimedia Commons.

Developed and developing countries. Source: Wikimedia Commons.

Power rests with Politicians, not Economists

However, in democracies, economists do not dictate policy — the political process does. In the next economic recession, populist leaders will seize upon unemployment, underemployment, and economic anxiety to promise UBI.

What has happened in Italy could happen elsewhere. Therefore, it is important to think about how UBI and similar programs could be implemented effectively, before a politician promising the moon comes along and clumsily enacts a thoughtless or counterproductive policy.

There have already been many UBI studies and pilots in various parts of the world. Recipients often continued to spend money, were less likely to slip into alcohol or drug abuse, and strived to better their situations. The challenge is to retain these benefits while minimizing unintended costs.

A ‘Economic Stack’ of Proposed Solutions

Cryptocurrencies and digital currencies enable programmable money.

Cryptocurrencies and digital currencies enable programmable money.

The ideas below are my contribution to the UBI debate. These ideas should be tested, tweaked, and iterated, with the aim of better modeling a UBI that can enhance the quality of people’s lives without harming the global economic system. Software developers are familiar with the idea of a ‘stack’, which contains a group of technologies that work together, but in which any element can be replaced. I think of the three ideas below as elements of an ‘Economic Stack’: they can be mixed and matched, and they can be tested on top of our current economic system.

Proposal 1: Expiring Money

Blockchain technology and cryptocurrencies have introduced money that can be programmed with conditions and variables. I propose adapting this idea to UBI by issuing fiat currency tokens (that represent regular money), which can be programmed to expire at a specific time or when certain conditions are met. A whole array of strategies can be created with this technology. For example, imagine a UBI token (representing $200) which vanishes if not used by the end of this month. This ‘use it or lose it’ feature would ensure that people would spend their UBI income (thereby stimulating the economy), since this would make the UBI generated money impossible to save.

Proposal 2: Money Programmed for Certain Goods and Services

Rather than providing money, governments could provide tokens that represent a basket of critical goods and services which each person is entitled to every month. Each person would be free to claim the goods and services each month, or not to. This already exists in many forms (for example, like food stamps in the United States).

Categories of programmable tokens would be innovative because: 1) the funds would be fully digital and could be spent by cell phone (no need for cash or bank transfers, credit cards, or physical stamps that could be lost or destroyed), and 2) the basket would be divided into categories of goods and services (those in each category would be redeemable by corresponding tokens). For example, imagine three categories of coins. The first category is green coins, which can only be spent on rent and associated living expenses. The second category is red coins, which can only be spent on food and beverages. The third category is yellow coins, which can only be spent on medical and other health-related expenses. A government could then decide how many units of each category to dispense to each person each month.

Proposal 3: Tax Benefits for Merchants Accepting Programmed Money

Governments and people have incentives to experiment with new markets, tools, and contracts to help achieve a functional UBI. However, we also need to get providers of goods and services on board: if not properly implemented, either of the above proposals could create black markets for unused currency. It is thus important to ensure that colored money is only spent directly at trusted vendors or at authorized locations (and cannot be transferred to other parties).

Trusted businesses providing these basic goods and services and accepting programmable and/or colored money in return should be given incentives to participate in UBI experiments and pilot programs. These incentives could come in the form of a tax break in a magnitude proportional to how many colored coins are received.

Programmable money can be used by designated cards or even mobile devices.

Programmable money can be used by designated cards or even mobile devices.

These are my initial thoughts. I encourage readers to build on these, experiment with them, mix and match, combine them with other ideas, or come up with better, novel ideas.

Conclusion

Populist politicians around the world will soon follow Italy’s lead in promising UBI. Public confidence in financial institutions, media companies, governments, healthcare companies, and the judicial system is very low worldwide. The next economic crisis could create a perfect storm for populism.

The populists are tapping into a legitimate grievance. In many ways, the world has never been better:

- New technology is steadily making clean energy production and distribution possible

- Scalable water purification technologies exist

- Precision farming technologies and advances in biotechnology are bolstering food security, even as we have already achieved an annual massive surplus of produce

- Advances in genetics are creating tailored, personalized medicine

- Human and algorithm-assisted intelligence is abundant

- Vast computing power exists, and quantum computing is on the horizon

- The internet has dispersed information broadly and democratized learning

- Many parts of the world have liquid capital markets

- Scientific research grants are available in almost every country

Given these achievements and positive trends, it is reasonable to ask why so many people in the world live in economic anxiety, and worry about meeting their basic needs.

It is time to proactively explore the impact of a possible UBI on economic incentives and poverty.

I love technology. I am passionate about the infinite possibilities it will help us unlock. But it is a double-edged sword. It could destroy hundreds of millions of jobs in the next few decades. We need to take a proactive approach to plan for this contingency.

I encourage people to take any of the ideas presented in this essay, play around with them, build upon them and work to better understand the UBI puzzle.

Universal Basic Income is Here, Like it or Not. was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.