Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Security Tokens 2.0: Some Thoughts Off-Chain vs. On-Chain Governance

Last week I moderated a panel at the Security Token Academy Launch Conference in New York with some of the top thought leaders in the security token space. One of the topics that was the subject of passionate debates was the different models for governing security token architectures. Most of the panelists believe that security token governance is merely a matter of using the current regulatory mechanisms for security token transfers while a couple of voices believe that security token governance will partially move on-chain. The core of the debate centers around one of the foundational aspects of the next generation of security token platforms: off-chain vs. on-chain governance.

Today, there is minimum regulation associated with security tokens beyond basic know-your-customer(KYC) and anti-money-laundering(AML) checkpoints. Most of the more complex regulatory aspects related to security tokens are addressed using human-based, off-chain mechanisms. In order to be truly transformative, I believe in the next wave of security token platforms should start incorporating more on-chain governance models. However, the paths towards on-chain governance in security tokens is far from trivial and its value proposition is also questionable.

Defining Security Token Governance

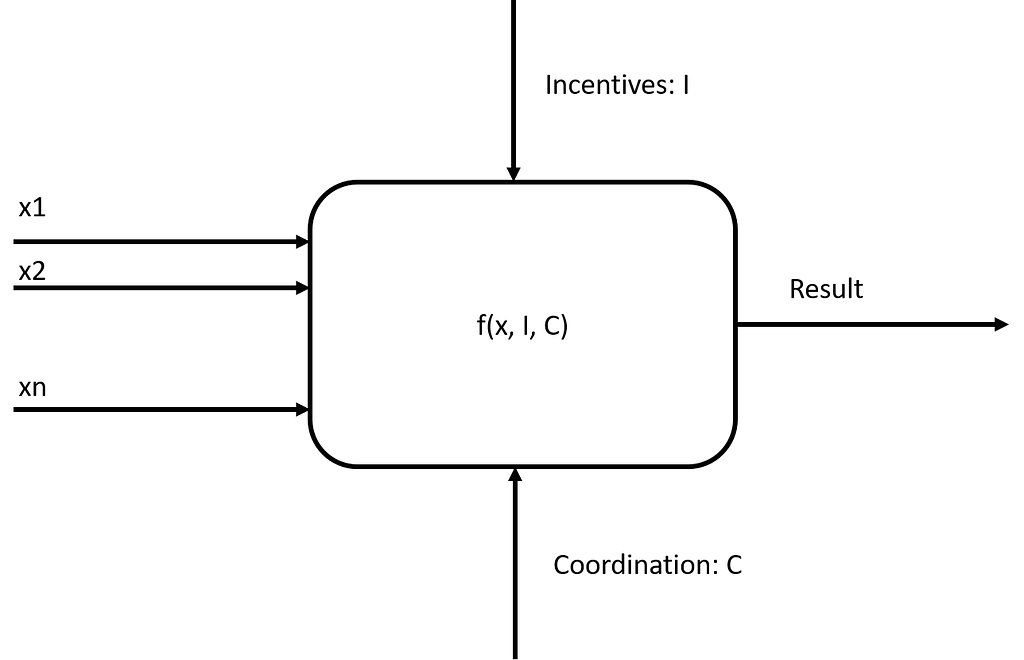

Mathematically, governance can be expressed as a function f({x1,x2,x3…xn}, I, C) → D where the inputs represents the votes of specific token holders, the incentive and coordination mechanisms of the vote respectively.

As expressed in the figure above, any blockchain governance function can be expressed using three main constructs:

· Votes: This element represents the wishes of relevant token holders in respect to a specific transaction.

· Incentive Mechanism: Each governance function should factor in the incentive model of the underlying network as it impacts the votes of the specific token holders.

· Coordination Mechanism: In a governance model, a coordination mechanism combines the decisions of all participants in the vote in a coordinated action.

How is this mathematical model relevant to security tokens? Well, if we look at the current generation of security token platforms, we can clearly see that we are missing both the incentive and coordination models for implementing any sophisticated governance function. Until those foundational mechanisms are in-place somehow, discussing on-chain governance will remain a theoretical exercise.

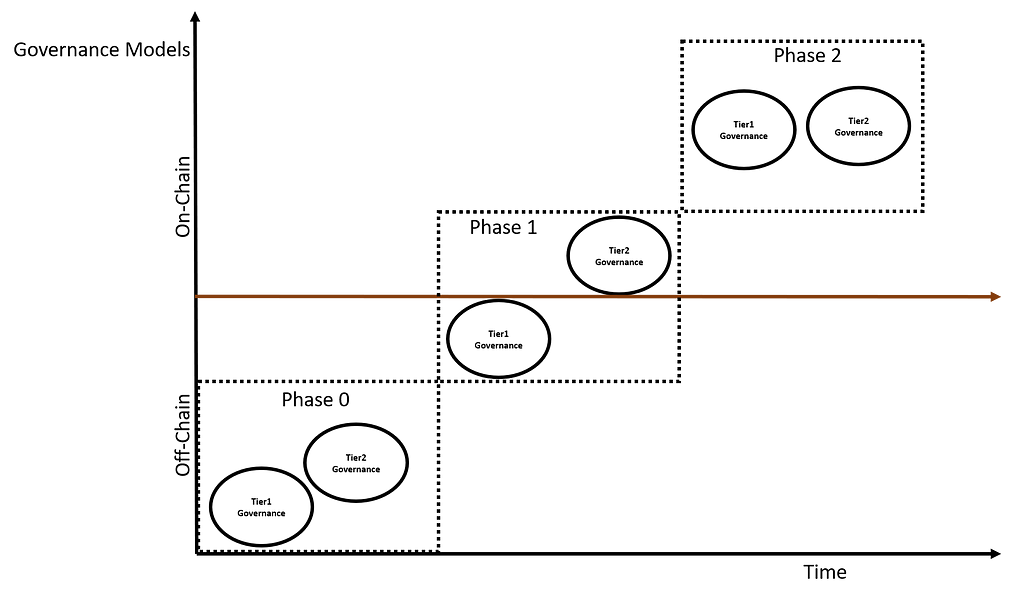

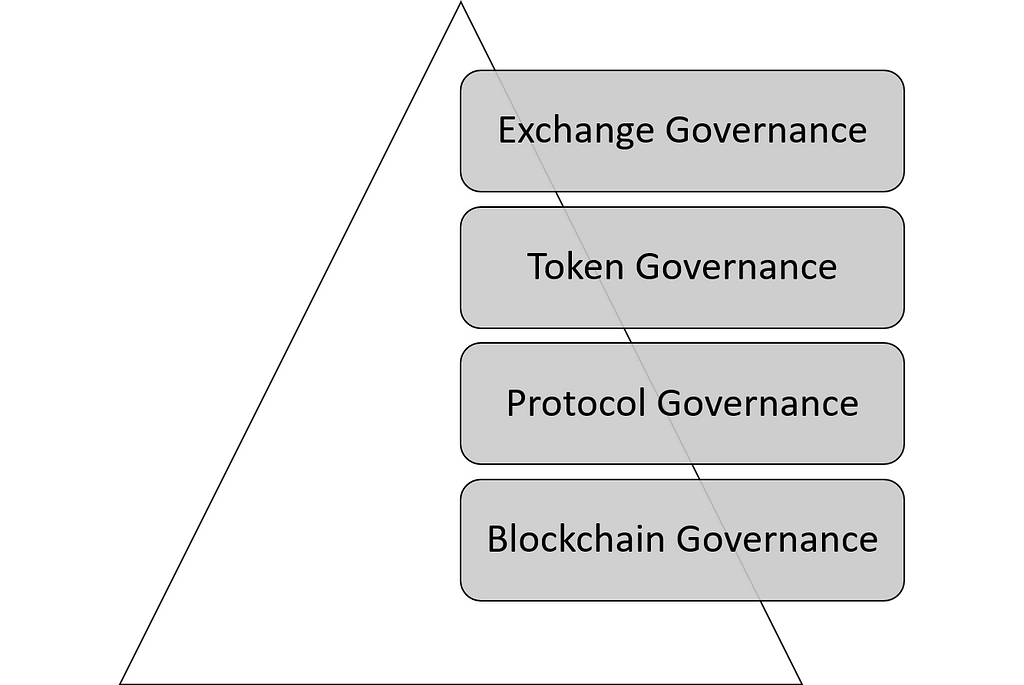

Another important aspect of security token governance is that it sits at a different level of traditional blockchain governance. In that sense, security token governance is orthogonal to governance problems such as forking or changes in the consensus mechanism. Conceptually, we can think about security token governance in two different levels:

· Tier 1 Governance: Responsible for governance decisions relevant to the topology of the network. Adding a new compliance node(ex: law firm, broker dealer) to a network or incorporating a new type of compliance are examples of Tier 1 Governance.

· Tier 2 Governance: Responsible for voting decisions relevant to a security token transfer. KYC/AML validation, capital control checks are examples of Tier 2 Governance models.

The two-level model is helpful to think about governance decisions in security tokens. Today, there is really no governance models related to security tokens. In the near future, we should expect to see tier1 and tier2 governance models implemented off-chain with on-chain ramifications. From there, we can evolve to a model in which tier2 decisions are implemented on-chain while tier1 remains off-chain. In my opinion, the only way to truly implement tier1 governance on-chain is to have a specific blockchain for security tokens and that will make for a very long post 😉. In any case, the subject of off-chain vs. on-chain governance is likely to be one of the most important decisions for the next generation of security token platforms.

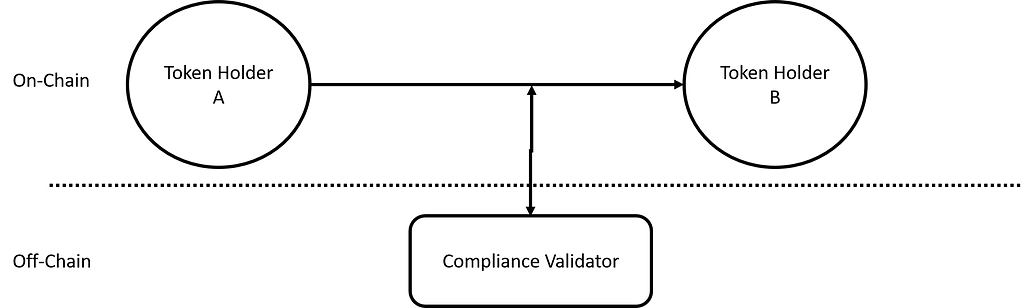

Off-Chain Governance in Security Tokens

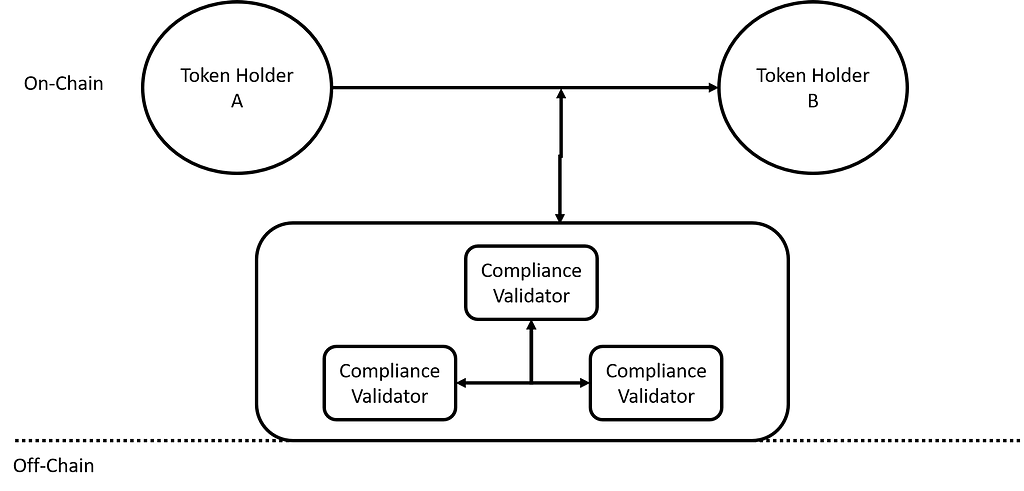

In the context of security tokens, off-chain governance refers to processes that regulate a network or security token exchanges without having a programmable representation. Off-chain governance leverages existing regulatory and compliance mechanisms outside a blockchain and incorporate their results into on-chain actions. Think about a security token exchange between two parties in which one of the parties need to be compliant with certain capital controls. An off-chain governance model for this scenario will have a broker-dealer agency which will manually validate the requirements of the transfer and issue a vote which will be factored in by the on-chain protocol.

Off-Chain Governance Challenges

Off-Chain Governance Challenges

When comes to security tokens, the main challenges with off-chain governance is that it’s not much of a governance model at all. Most of the decisions are issued by single entities and coordinating voting dynamics off-chain is nothing short of a nightmare. Additionally, off-chain governance models are hard to scale and can impose limitations in the evolution of security tokens.

On-Chain Governance in Security Tokens

An alternative to off-chain governance models is to transition many of the voting/governance decision to programmable interfaces on the blockchain. While tier1 governance models are difficult to move on-chain, tier2 governance mechanisms are a great candidate for on-chain governance. Most regulatory-compliance mechanisms in security token transfers are relatively easy to model using smart contracts. Going back to the scenario in the previous section, an on-chain governance model will automate the capital requirements validation using a vote from a group of validator nodes in the blockchain.

Programmable, on-chain governance can be expressed at different levels in security token architectures. Today, most of the compliance checkpoints take place at the token level but there are many scenarios in which this model results insufficient. An on-chain governance for security tokens should enforce governance mechanics at different levels of the network.

I plan to deep dive in this subject in a future post.

On-Chain Governance Challenges

On-chain governance sounds great in principle, but it doesn’t come without its challenges. For starters, the small number of participants in the governance process makes many of the models can be vulnerable to game theoretic attacks and manipulations. Additionally, there is a natural friction point to recreate governance models that have been around for decades onto on-chain dynamics.

Towards a Hybrid Governance Model for Security Tokens

The subject of governance in security token architectures is incredibly sensitive and complex. Thinking that the entire security token ecosystem is going to operate based on off-chain governance models seems incredibly limiting from my perspective. Thinking exclusively about on-chain governance models seems radical and likely to start off battles that derail the evolution of the space. In my opinion, security token governance will evolve as a hybrid combination of off-chain and on-chain models. One thing is clear, security tokens deserve a better governance foundation.

Security Token 2.0: Some Thoughts Off-Chain vs. On-Chain Governance was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.