Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Security Tokens 2.0: About On-Chain Governance [Part II]

This is the second part of an essay that explores off-chain and on-chain governance models for security tokens. In the first part, we discussed a potential evolutionary path for governance architectures in security tokens going from completely off-chain, to hybrid to on-chain protocols. In this section, I would like to deep dive into on-chain governance models that can be relevant to security tokens.

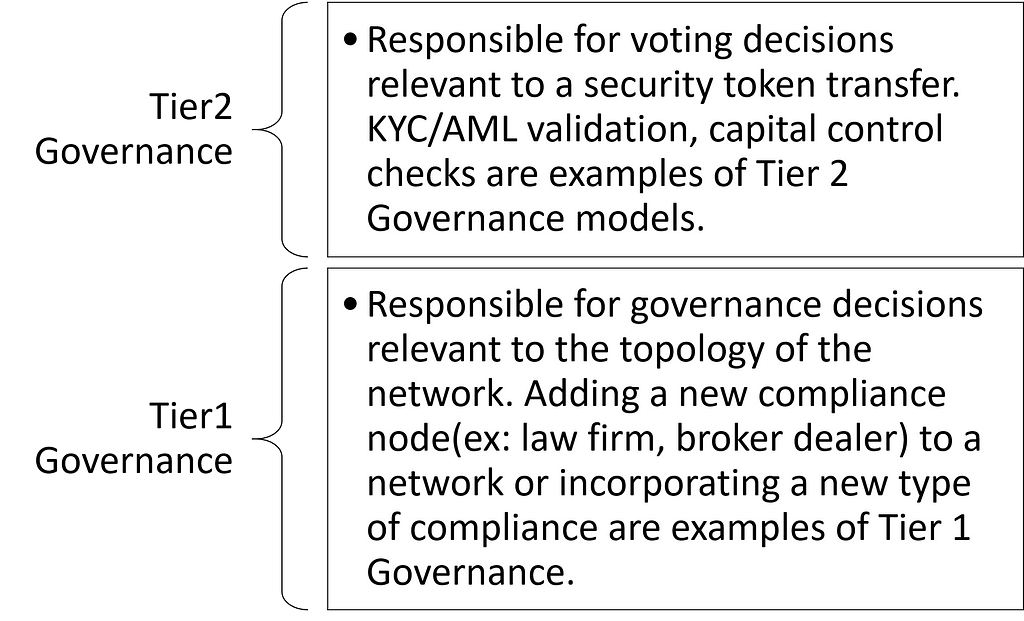

An interesting, and somewhat controversial, way to think about security tokens is as an amplifier of regulation. Essentially, security tokens offer a foundation to enable regulatory and compliance processes to move on-chain in the form of smart contracts. If we follow the ideas expressed in the first part of this article and think about security token governance in two tiers, we should assume that a lot of the tier2 governance models will become more programmable. I wrote about the notion of programmable regulation and security tokens in this article.

Towards On-Chain Governance in Security Tokens

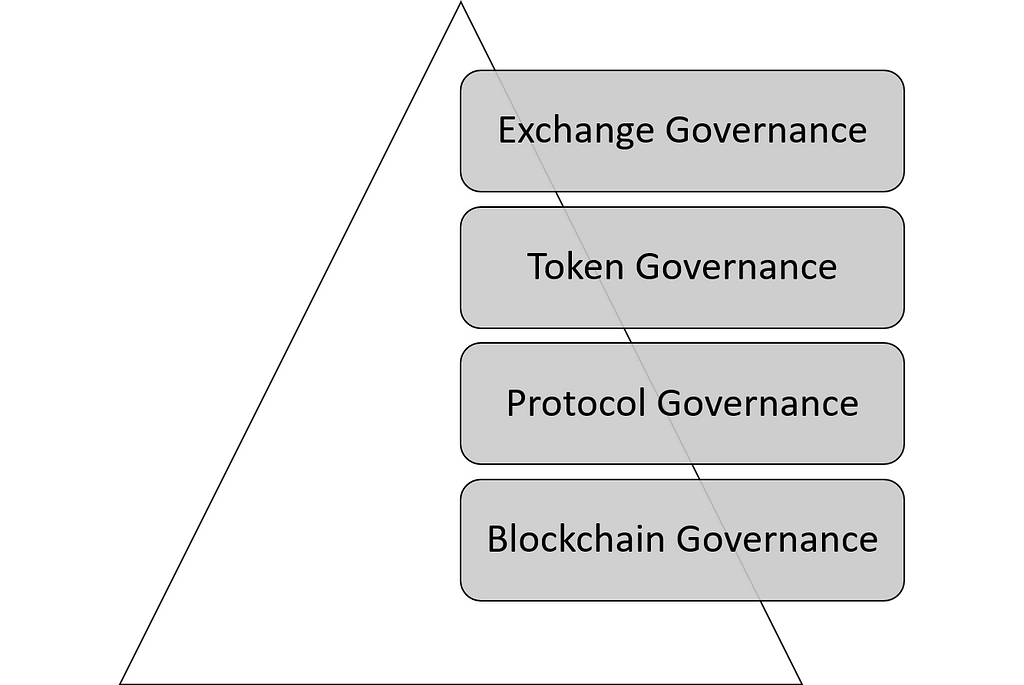

If we agree that on-chain governance is going be relevant to crypto-securities, then the next logical step is to figure out what governance structures are needed in this new world. Today, security token governance is almost non-existent or encoded at the token level. In the future, I think there are four fundamental levels of on-chain governance that should be considered in security token architectures.

Blockchain-Based Governance

When comes to security tokens, blockchain-based governance is the hardest to understand. This is partially due to the fact that blockchain-based governance only makes sense in a world in which we have specialized blockchains for security tokens instead of relying on general-purpose blockchains like Ethereum. In security token blockchain runtimes become a trend, they will have to enforce different on-chain governance decisions:

· Addition and removal of validator/regulator nodes

· Fork decisions

· Protocol modifications and roadmap voting

· Addition and removal of security token infrastructure nodes(ex: escrow accounts, clearing house nodes…)

There are not many well-documented examples of blockchain governance processes in the current ecosystem. From the operational blockchains in the market, the governance models of Tezos and DFINITY offer very valuable lessons that can be extrapolated to the universe of security tokens.

Protocol-Based Governance

Crypto-financial protocols in areas such as debt, derivatives, swaps, decentralized transfers and many others are going to become relevant in security token platforms. We can imagine the next generation of a security token platform to incorporate versions of protocols such as Dharma(debt), Airswap(decentralized transfers), dYdX(derivatives) and many others. Those protocols can enforce different levels of on-chain governance that are independent of the specific crypto-securities they operate. For instance, we can imagine a debt protocol that automatically adjust the dividend payment to token-holders based on the performance of a specific asset. Like that example, there are several on-chain governance decisions that can be addressed at the protocol level:

· Enforce privacy of specific information in security token transfers.

· Voting on protocol modifications.

· Compliance rules that involve both buyers and sellers (ex: both buyer and seller need to be residing in the same country).

· Cross-blockchain security token transfers (if this ever happens 😉 )

Token-Based Governance

Token-based governance is the closest on-chain governance models to the current version of security token platforms. Enforcing regulatory and governance rules at the token level seems like the right place to start given than its easier to build tokens than protocols or blockchains. However, thinking that all regulation and governance is going to be enforced at the token level seems limiting in my opinion. In any case, there are plenty of on-chain governance scenarios that can be enabled at the token level:

· Identity verification

· Token distribution and lifecycle management

· Financial policies

· Exchange integration

Exchange-Based Governance

Finally, security token exchanges will also have some on-chain responsibilities. Clearly, exchange-based governance should be constrained to aspects relevant to a specific exchange itself but that doesn’t mean they are less important. There are several interesting on-chain governance models that can be enabled at the exchange level:

· Addition or removal of crypto-securities

· Audits and disclosures

· Custody rules

· Trade halting and monitoring

Risks of On-Chain Governance Models in Security Tokens

On-chain governance seems like a great idea and an inevitable step in the evolution of security tokens. However, on-chain governance models also introduce very tangible risks that are not acceptable in the context of security laws. Programmable governance opens the door to all sort of interesting game theoretic attacks in security tokens:

· Collusion Attacks: This type of attack represents scenarios in which a group of validators come together to manipulate the voting process

· Voting Disincentive Attacks: This type of attacks rely on removing for validators to vote in a crypto-security transfer making the outcome of the vote more predictable and vulnerable.

· Insider and Price Manipulation Attacks: This type of attacks rely on non-public, non-material information to manipulate the prices of a specific crypto-security.

There are plenty of other attack vectors that can be enabled by on-chain governance models in security tokens. Despite the risks, I believe on-chain governance is going to be an essential component of the next generation of security token architectures. Ignoring on-chain, programmable governance and regulation in security tokens is ignoring one of the biggest benefits that blockchain brings to crypto-securities. At that point, we might be better off ignoring blockchains altogether.

Security Tokens 2.0: About On-Chain Governance: Part II was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.