Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The World’s First Tokenized Garage

A short overview of the recent pilot, where 19 investors from 4 different continents invested in a single tokenized real estate asset.

When we posted news in Blocksquare’s Telegram group that the pilot tokenization project would involve a garage parking in Tech Park Ljubljana, one of our active community members inventively commented: ”Well, many successful companies started their business in a garage, why should Blocksquare be any different,” with the below picture following shortly after.

Small garage projects turning into international success stories are rare, but stories we’ve all heard of. They show us that e strong idea is not worth much without focus, determination, and perseverance. At Blocksquare we aspire to these garage stories and strive to deliver the best blockchain-based tools for real estate businesses.

Blocksquare’s vision is simple — to make real estate investing accessible, digital and global — and the recently concluded pilot proves our team is on the right track!

While the full pilot report can be found here, this short review will focus mainly on the execution part, how it applies on BST token holders and how established real estate businesses can benefit from our technology.

About Blocksquare

For those who are not familiar, Blocksquare is a startup developing the world’s leading blockchain-based tokenization system for commercial real estate properties. With a team of dedicated professionals and digital currency enthusiasts based in Ljubljana, Slovenia (EU), Blocksquare is on a mission to bring real estate investments to anyone with an internet connection.

The project

At Blocksquare we’re creating an out-of-the-box solution for more or less established businesses like real estate crowdfunding platforms, asset management companies, real estate developers and other similar players. Each of these businesses is by itself already a working platform — they source real estate investment deals in their region to a pool of investors. What these businesses don’t have is the tools to offer a new emerging asset class — tokenized real estate investments.

And that is where Blocksquare comes in!

A local asset management company NDP successfully tokenized a small real estate property in Slovenia — an underground garage parking space located in Technology Park Ljubljana. This Minimum Viable Property (MVP) attracted small investors from all around the world that participated through a 16 days long crowdfunding cycle.

Our primary goal was to test the beta version of the PropToken system in the everyday environment. The small size of the property, a single garage parking space in Technology Park Ljubljana gave the opportunity to our team to mainly focus on execution, rather than investor relations.

Digital Shares

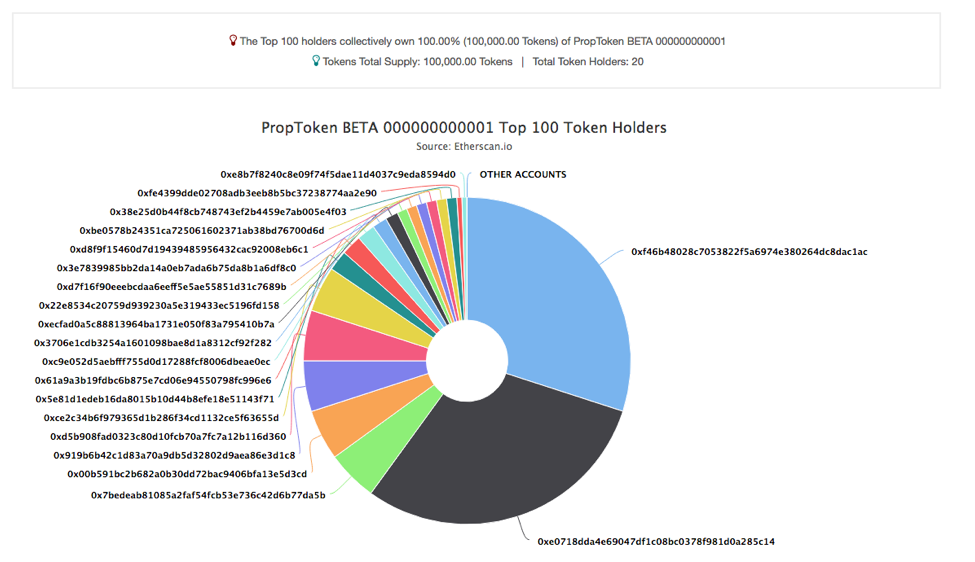

Digital shares — or PropTokens (BSPT), how we call them at Blocksquare — were distributed to 19 investors from 8 different countries. BSPT stands for Blocksquare Property Tokens, and they are distinguishable to 100,000 digital shares that represent a 100% stake in a given property. Each set of digital shares is managed by a separate smart contract deployed on the Ethereum blockchain, meaning 100s or even 1000s of users can now become invested in a single property without the downsides of other co-investment models that bound investors to the decisions of others.

Source: Etherscan

Source: Etherscan

The maximum purchase in the garage was limited to 30,000 BSPT or 30% of the tokenized property, resulting in a fair distribution of stakeholders. The PropToken system automatically tracks and records stakeholders even on the secondary market. The fact that every transaction is recorded on the Ethereum blockchain gives investors ultimate transparency and insight.

Rent distribution

Every property has its own unique smart contract address used by the certified partner when specifying a deposit made to the PropTokenRENT contract. Looking at this contract address on a blockchain indexing platform like Etherscan, anyone can verify the total amount of BST bought from generated rent, as well as the amount of BST already claimed by stakeholders.

Source: Etherscan

Source: Etherscan

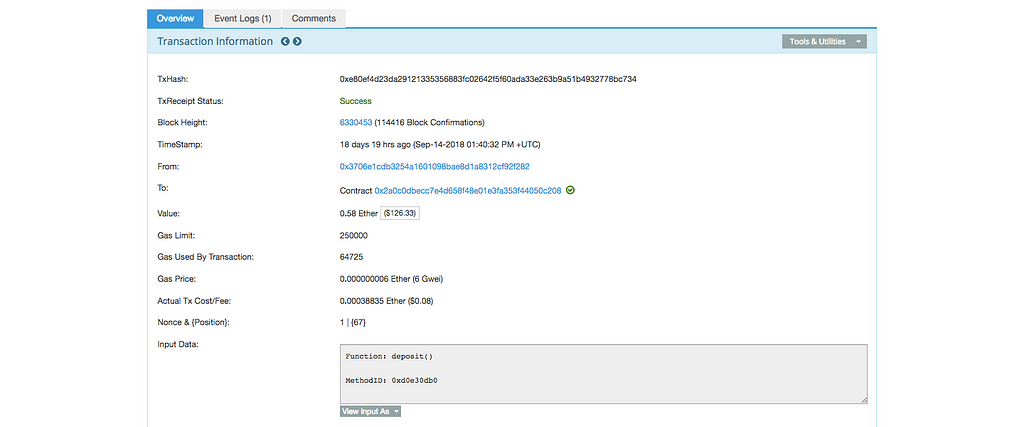

As all addresses are public, we also know the certified partner’s main address that is used by NDP Asset Management to tokenize new properties and make rental yield deposits. Taking a closer look at the address, we see that NDP sent 0.58 ETH (or approximately 100€) on the 14th of September to IDEX — an exchange where BST trading is currently available.

Source: Etherscan

Source: Etherscan

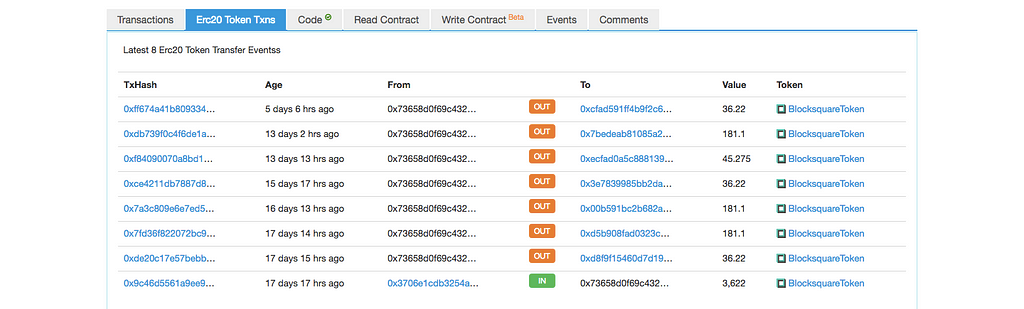

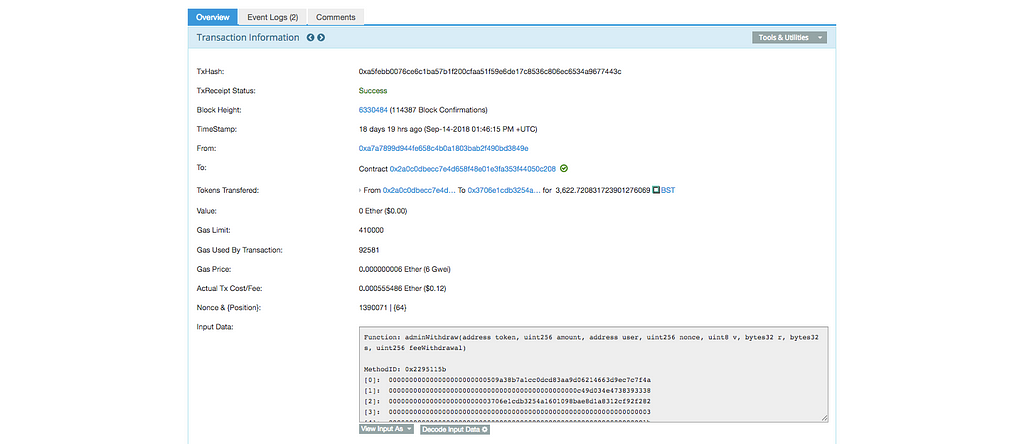

A subsequent incoming transaction of 3,622 BST from IDEX to NDP’s Ethereum address clearly shows that BST was bought by NDP and later deposited to the PropTokenRENT smart contract. Everything is TRANSPARENT and publicly auditable!

Source: Etherscan

Source: Etherscan

NDP will continue to make these distributions on a monthly basis, usually around the 15th of each month. Other Certified Partners and tokenized properties may need a different distribution schedule, and Blocksquare is built to allow any distribution schedule.

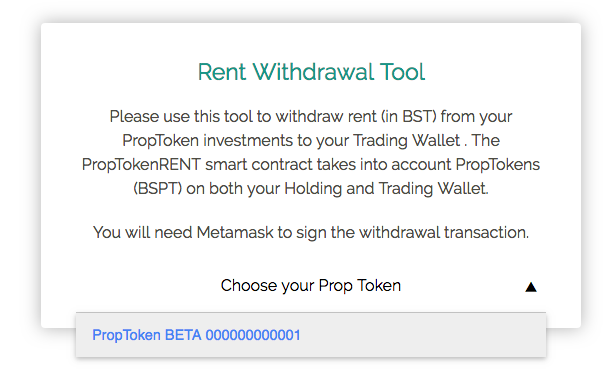

On the investor’s side, stakeholders need to withdraw their rent appropriations either using one’s Blocksquare account or directly by interacting with the PropTokenRENT contract. Stakeholders can do so more or less regularly, resting assured they are the sole beneficiaries, and their total unclaimed share is cryptographically secured and always available for withdrawal.

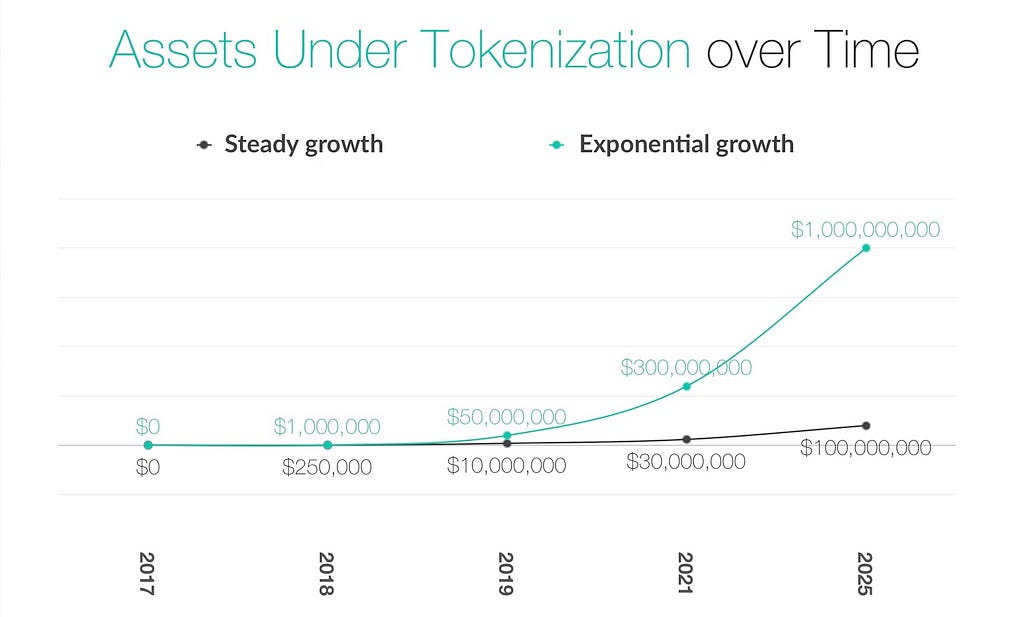

This first tokenized real estate property sets a clear example of how a rent-generating property increases liquidity of BST. The garage parking adds demand for BST of about 1200€ on an annual basis. Not much, but the fact that this liquidity is provided by fresh capital and not artificial market making is a very important consideration — with new Certified Partners the number of properties under tokenization will increase, subsequently influencing BST liquidity levels.

First Buyers are investors who participate in a PropToken Generation Event to purchase PropTokens (BSPT) directly from a Certified Partner and not later on when digital shares are trading on the secondary market.

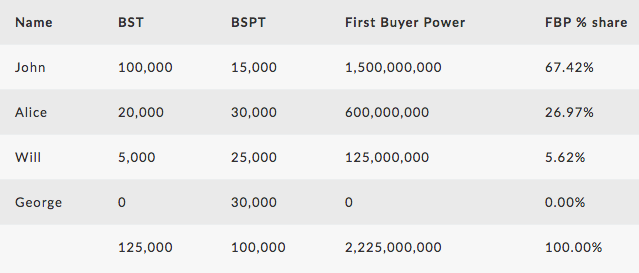

First Buyers of a specific PropToken are permanently recorded on the blockchain and will split 0.3% transaction fee each time the specific digital shares change hands. An investor’s First Buyer share of the transaction fee is calculated based on:

(a) the amount of BSPT the investor purchased, and(b) the amount of BST the investor holds at time of purchase.

The higher an investor’s First Buyer Power (FBP), the more significant the transaction fee share. The below table displays a simplified example of FBP calculation with only 4 participants in a PropToken Generation Event:

Simplified FBP % share calculation example

Simplified FBP % share calculation example

Grow with us

Tokenization of commercial real estate properties enables asset management companies, real estate crowdfunding platforms, multi-family offices, real estate developers and similar real estate business, to increase the number of deals, expedite deal flow, expand operations into new markets and exponentially grow their business.

We offer a global solution to a local problem.

We understand that it is not about who your consumers and employees are today… but who your consumers and employees are tomorrow!

Any established real estate business should embrace and understand the business model offered by tokenization of real estate properties. Engaging with Blocksquare will allow you to experiment and learn as NDP Asset Management did by working with us on the garage parking pilot.

We love creating win-win situations — collaborating with us will enhance your company’s capabilities and value propositions, encouraging innovation both internally and externally, preparing your today’s employees for your future customers!

Get in touch:

join our telegram group • follow us on twitter • like our facebook page

…or simply email us at future@blocksquare.io ;)

Fusion accelerator program in Geneva, Switzerland

The pilot proved to be even more important for Blocksquare — we got accepted into Fusion PropTech! Our hard work placed us amongst the top from 100s of startups world-wide, and we are looking forward to starting the fellowship, learn from the best and shape our product to best fit today’s market.

The World’s First Tokenized Real Estate Property is a Garage was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.