Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

For those that were fortunate enough to read the exclusive news release attesting to the fact that Coinbase has officially added $ZRX into its API, you’ll probably be anticipating a price analysis on what’s going on.

Is it going to pump from here?

Are the gains already price in for $ZRX at this point?

What is the maximum R/R for this trade if I enter into a long position from where I am currently?

These are all great questions that will be answered in this article, so sit tight.

$ZRX Price Analysis

We’re going to start with the daily chart resolution here:

As one can see on the chart above, there was a precipitous backslide in the price that started around July 16th, 2018, before eventually being broken toward the end of September (23rd of the month to be precise).

The price has been on a mini-uptrend ever since, nothing major.

In fact, this most recent bounce is what allowed us to draw the uptrend line that you can currently see on the chart above.

Now, since the price data is so ‘fresh’, we’ll go ahead and move in to a smaller time frame, in order to get a better idea of impending price action.

Before We Move On, Keep This in Mind

We are currently looking at the $ZRX / BTC price pairing.

Now, since the price of Bitcoin has been relatively stable over the last month or so, we can look at the Bitcoin and USD charts in an interchangeable fashion on the markets for the most part (**Fun fact: The price of Bitcoin 30 days ago was $6,528 at open, which is less than $60 away from where it is trading currently at the time of writing).

However, traders should be aware that the price of Bitcoin could change drastically at some point in the near future. Therefore, traders would be wise to consider strategies that will account for the potential increased volatility of Bitcoin in the near/distant future if they are only looking at the Bitcoin-paired charts like we are today.

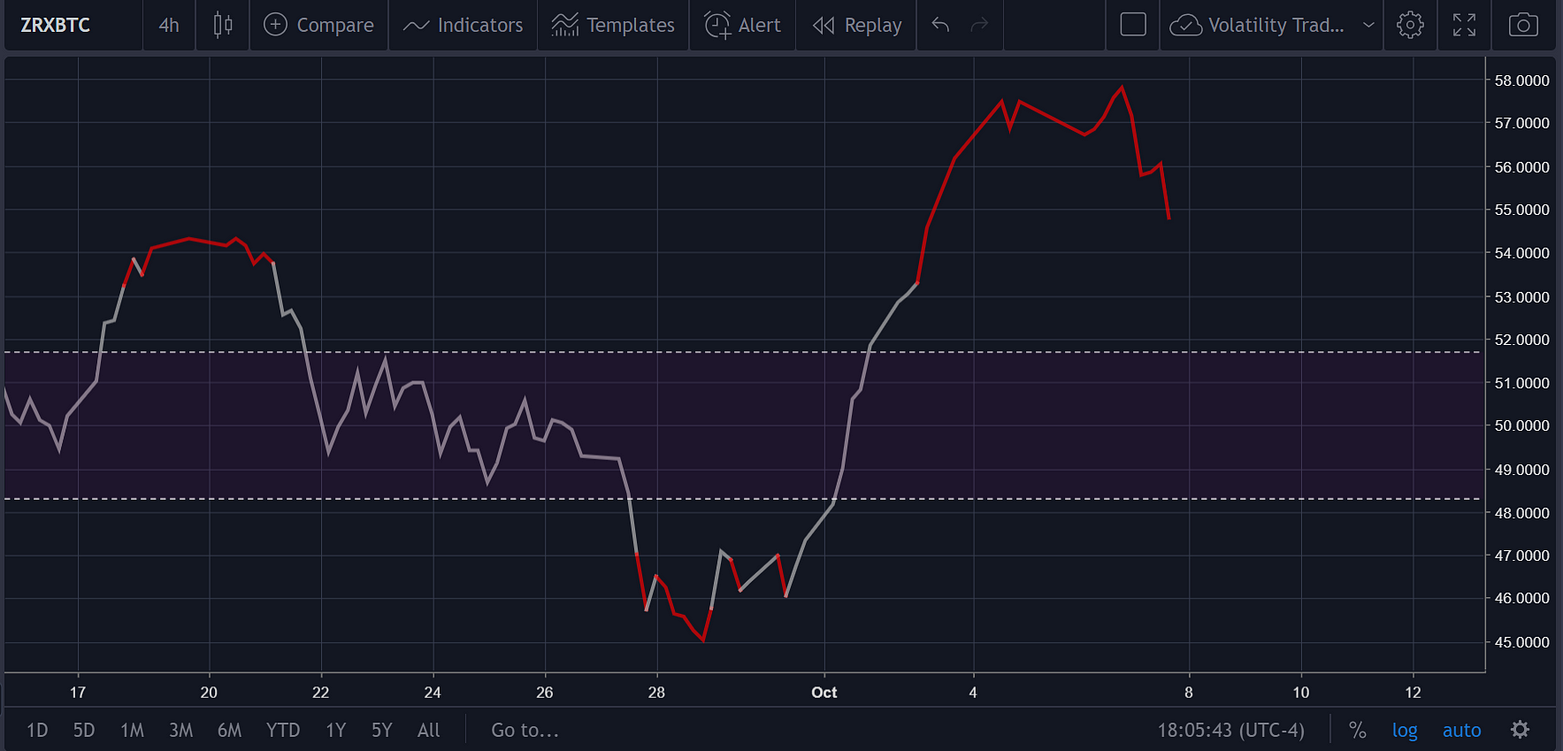

H4 Time Frame for $ZRX

Now, if you’re looking at the chart above and getting a bit confused by the diagonal and horizontal lines, don’t worry.

We’re going to simplify this for you.

Let’s just look at the horizontal lines for now:

In the picture above, the blue boxes represent the points of resistance/support that were visually identified on the chart (we just look at points where the price appears to have consistently failed to break above/below a certain price and draw a horizontal line there to mark these areas).

Currently (no surprise), the price of $ZRX is struggling to get above heavy resistance at the 11k sat zone.

This has resulted in a slight draw down of the price.

Now, on the above chart, the Heikin Ashi bar design is used (to ensure easier viewing of price movement), but in order to get a better idea of price movement, we’re going to switch over to the ‘normal candle’ view.

Why did we just do this?

We did this because the above picture now shows us that the price is back on its way down.

What does this mean?

Great question. For now, it means that we should/can anticipate a potential re-testing of the resistance point that $ZRX had broken in order to reach the highest overhead resistance that at 11k sats that it failed to break.

Re-testing of the Supports/Resistances

This is a phenomenon that happens very frequently in trading.

You’ll see a price break through a resistance and then the price will stagnate on its run up and then eventually return to that resistance to test it as a point of support.

Conversely, a price may break below a support point, and after a period of heavy selling, will gravitate back toward that support point to test it as a resistance before continuing further.

Above we can see the most likely price action for $ZRX on the H4 if it is to adhere to this principle.

We’re switching back to the Heikin Ashi now

Next Point of Resistance

Okay, so let’s assume there is a re-test of that lower support point (10k sats), and then the price is able to successfully bounce from there and continue upward to the 11k sat point that its struggling to break now…

Where would be the next point of resistance?

The chart above is telling us 12.6k sats (based on analyzing the chart data itself; not via indicators).

Thus, the following stream of graphs that you see below could represent the impending price movement.

- The price could decline up to 8.22% as it re-tests the former resistance point as a support.

- This could then be followed by a +14.41% increase.

From there, there may be another 6.51% nod, totaling a 21.29% bounce (assuming that the price does touch all the way down to that lower support).

RSI(14) for $ZRX

The RSI(14) on the H4 for $ZRX corroborates our assumptions as well. While the RSI(14) is a relatively sensitive instrument (more so than people realize or account for), it still can give us fairly accurate readings when it comes to analyzing future price movement.

In the chart above, the downward point of the RSI(14) is not necessarily factored into our considerations (just yet), because the period is not currently over; thus, the price information could change and render an entirely different reading in a couple of hours.

However, what we can confirm is the fact that the RSI(14) is reading that the crypto is grossly overbought at this point. And all of that momentum did not come solely from the Coinbase news.

$0X was already outperforming several coins in the market before the advent of said news.

RSI BoP Indicator for $ZRX (Custom Indicator)

This indicator (which is custom) is showing that the buy pressure on $ZRX has reached an extreme over the last few periods, which amount to 32 hours when you do the math (8 periods of the indicator tracking ‘extreme’; denoted by the red coloration of the line).

It now appears that the incidence of selling has finally picked up.

Brief Look at the 10 Min Chart for $ZRX

Now, take the readings here with a grain of salt, because, by the time you’re reading this portion of the article it is more than likely that the price of $ZRX may be wholly different from that point or reflect alternative information…

But it appears from can be seen now that the 11k region specifically is holding itself as a solid point of support.

Now, of course, exuberance could hit investors once the news of the likely Coinbase addition becomes really widespread, which would result in that 6% increase first before a drawdown back to 11k and perhaps even further to the lower 10k sat range.

Conclusion for the $ZRX Price Analysis

On a fundamental level, a potential Coinbase addition is huge (if this is something that does happen).

And, regardless of whether it does or not, the more important thing to analyze here in terms of market movement is whether or not the market believes that it is going to happen.

If the market does believe that it is going to happen, then it is as good as done.

However, if the market does not believe that it is going to happen, then the price action for $ZRX will more than likely bottom out sooner or later and continue downward precipitously.

But we do not anticipate this to be the case.

Coinbase noted before that they were strongly considering adding ERC20 token support to their platform and signaled as much with the addition of $ETC (Ethereum Classic) before moving on to post that they will be advocating the support of other ERC20 tokens as well.

We have no R/R on this trade, because we feel that it would be best if traders waited until the downturn of this move finishes out before moving back upward.

However, we do feel that 12.5k sats is a safe bet for the price in the near term.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.