Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Dan Held, co-founder of Interchange, published a summary on Thursday about the perceived fairness of Satoshi Nakamoto’s initial distribution of bitcoins. The director of the institutional-grade cryptocurrency portfolio management service argues that the Bitcoin protocol’s earliest cryptocurrency distribution processes remain the most honest and equitable to date, particularly in comparison with the methods favored by many of the premined altcoins that exist today.

Also read: Bitpay Phases Out Crypto-Debit Cards for European Cardholders

Constant Stream of Crypto Complaints

People are always loudly complaining about Satoshi’s early cryptocurrency distribution processes, with many individuals claiming that other blockchains can offer better methods. But this week Held published a paper firmly asserting that “Bitcoin’s distribution was fair.”

Held says that the Bitcoin network “continues to challenge mainstream thought” as it soars in popularity. Yet he also acknowledges that the protocol is still struggling to shake off gripes about specific aspects of its existence. As the Interchange co-founder explains:

One of those is that the distribution of Bitcoin wasn’t ‘fair,’ particularly in the earlier stages of network development… (but) Satoshi set out to design the fairest system possible.

Satoshi’s Hashrate Reduction

Held dives into the earliest days of the Bitcoin protocol, before the concepts of ‘premining’ or ‘insta-mining’ even existed. Premining is the practice of mining lots of coins privately; usually in such cases, the developers end up keeping the largest stash of the currency. But Held claims that the message in the genesis block about the chancellor bailing out the banks is an argument in itself against the wisdom of premining.

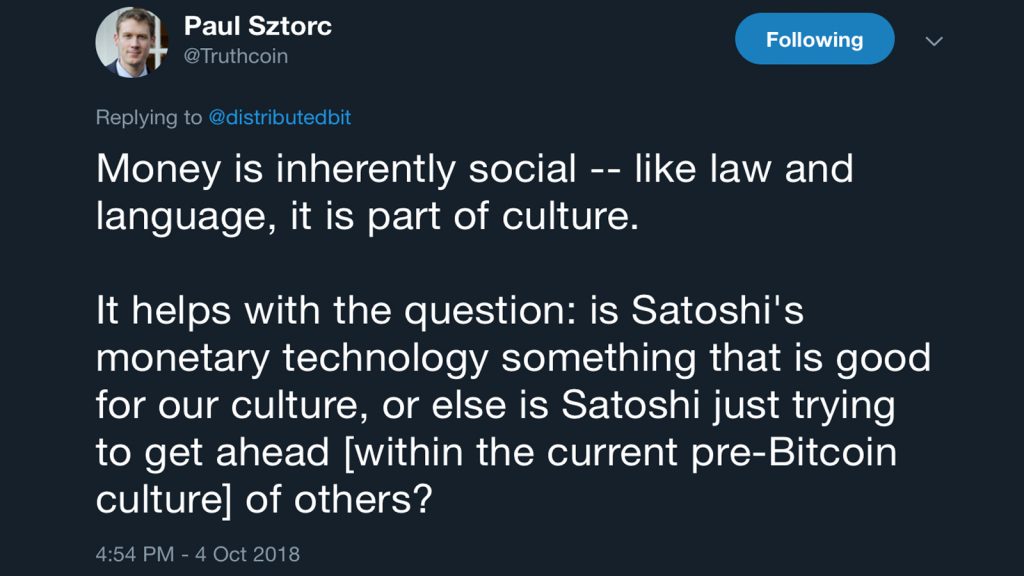

Paul Sztorc sounds off on Dan Held’s editorial and the fairness of Bitcoin.

Paul Sztorc sounds off on Dan Held’s editorial and the fairness of Bitcoin.

Held also explains that Satoshi gave the public a two-month lead time before mining the first block. People such as Hal Finney and others listened to Satoshi right away and began mining the currency. But as Held claims, it really was up to Satoshi and a small handful of miners to keep the nascent network running in those early days. Yet it is widely known that this small group of miners also left the mining scene just a few short years after Bitcoin was firmly up and running.

“For the first year of Bitcoin’s existence, Satoshi and other miners couldn’t muster enough hashrate to mine more than 144 blocks/day and trigger an upwards difficulty adjustment,” Held says. He claims that Satoshi only mined because the network needed people to do so. And Held notes that Satoshi left the scene once the network had stabilized to the point where it no longer required his own mining output.

The study continues:

He reduced his percentage of the hashrate in a slow and steady manner. The Satoshi-fingerprinted mining carefully balanced the hashrate of the cluster, with the goal of historically viewable well-meaning intentions — Satoshi initially followed a plan of reducing the hashrate by 1.7 Mhps every five months, but a month after the second such drop abandoned this method in favor of a continuously decreasing hashrate.

Dan Held’s paper argues that Satoshi reduced his hashrate significantly over time. Chart Source.

Dan Held’s paper argues that Satoshi reduced his hashrate significantly over time. Chart Source.

The Faucets: A Flood of Free Coins to

Encourage Early Adoption

Some people have claimed Satoshi mined around 1 million bitcoins. But Held points to recent research done by Bitmex, which claims it is more likely that Nakamoto only mined 700,000 coins. Furthermore, a large portion of the early coins have not even been moved since the day they were created.

Some people have claimed Satoshi mined around 1 million bitcoins. But Held points to recent research done by Bitmex, which claims it is more likely that Nakamoto only mined 700,000 coins. Furthermore, a large portion of the early coins have not even been moved since the day they were created.

Held details how the cryptocurrency was pretty much worthless at the time; for many years, early adopters gave tons of bitcoins away. He points to the faucets that were set up during the early days that gave away lots of bitcoins, such as “the 10k BTC faucet set up by Gavin and other Bitcoiners who donated funds.” Another example of these large giveaways took place this week when Bitcoin developer, Jeff Garzik, explained on Twitter how he gave over $103 million dollars worth of BTC in bounties. Garzik states:

In 2010-2011, I gave away 15,678 BTC in developer bounties.

Satoshi’s Signal

Held acknowledges that Satoshi wasn’t perfect, but he concludes that Bitcoin’s release was the most even-handed distribution process one could build, “given what he was building/timing/audience.”

Satoshi was trying to “signal to everyone” that Bitcoin was not simply a “scam,” Held says.

The conservative deescalation of his mining contributions, his departure from the community, never spending any of his coins, nor using his influence for any purpose, shows that he wanted the world to make up their own mind about

his project and judge it on its own terms.

Held’s conclusions about the fairness of Bitcoin’s distribution processes stand in stark contrast to the chaotic nature of the current token craze. Many initial coin offerings (ICOs) and other altcoins in the past have had significant premines, some of which have been so blatant that everyone knows the developer and close friends recruited to help pump the coins are simply setting themselves up to be rich for life. Some of these individuals have even lied and pretended to not premine at all, while many others have openly admitted to premining anywhere from 1-20 percent of the currency’s total supply.

In contrast, Satoshi and the early developers and adopters dealt with an electronic peer-to-peer cash system that was essentially worthless at the time. But they attempted to get others to see how bright the future could be. And eventually, people started to listen.

What do you think about Held’s claim about Bitcoin being a fair distribution process? Let us know how you feel about this in the comments section below.

Images via Shutterstock, Picks & Shovels, Twitter, and Pixabay.

Need to calculate your bitcoin holdings? Check our tools section.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.