Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

There’s a lot of talk revolving around Bitcoin’s transition from digital money to a store-of-value. The crypto market is dominated by speculators and money-making interests, which up to now has been the primary driver for many in our industry. But for those of us trying to build the future of finance, the focus has to shift from a store-of-value mindset to one thinking in terms of source-of-value.

The future of the crypto industry will rely on two kinds of projects: the ones focused on creating simple on-ramps into the ecosystem and the ones providing more value than products that already exist. People aren’t going to adopt something simply because it uses Blockchain. It has to be better. This idea, while broad, is the most significant roadblock for the growth of the crypto ecosystem.

Framing the Past

To date, the crypto ecosystem has gone through roughly two main stages. The first started with the base-level protocols — mainly Bitcoin and Ethereum. This “infrastructure age” (think pre-2013) was where we as a community focussed on the basic tenets of blockchain tech: accessibility, speed, and affordability. From this sprouted projects like Coinbase, making crypto more accessible for those seeking to participate in the growing blockchain movement. For the first time ever, anyone in the world could send money to anyone else in the world in the most affordable way available. That was a huge advancement and many of us quickly rallied behind it.

Next came the the “Application Age,” which spanned 2013 to mid-2018. Here we saw the first big application for Ethereum — the Initial Coin Offering (ICO). As a result, we saw things like dApp ecosystem begin to thrive. As Ethereum development grew, so did speculation as the popularity of ICOs skyrocketed. The key focus for many ICO projects at the time was not on developing a product, but on growing massive online communities of followers to act as a network of marketers, all contributing to spread the word about their favorite projects. Many of these companies raised tens of millions of dollars as a result.

The vast majority of these tools are far too technical for the average consumer to understand. Can you explain how to use a hardwallet to a random person the street in two short sentences? Why should that person care about the technical advancements of your protocol solution?

@CryptoShillNye recently put it aptly — builders in the crypto space need to focus more on the user, otherwise the tech means nothing.

body[data-twttr-rendered="true"] {background-color: transparent;}.twitter-tweet {margin: auto !important;}

If we don't have $crypto companies that have actual users, crypto will die. Exposure was the last wave. Usability is the next one. 💯

function notifyResize(height) {height = height ? height : document.documentElement.offsetHeight; var resized = false; if (window.donkey && donkey.resize) {donkey.resize(height); resized = true;}if (parent && parent._resizeIframe) {var obj = {iframe: window.frameElement, height: height}; parent._resizeIframe(obj); resized = true;}if (window.location && window.location.hash === "#amp=1" && window.parent && window.parent.postMessage) {window.parent.postMessage({sentinel: "amp", type: "embed-size", height: height}, "*");}if (window.webkit && window.webkit.messageHandlers && window.webkit.messageHandlers.resize) {window.webkit.messageHandlers.resize.postMessage(height); resized = true;}return resized;}twttr.events.bind('rendered', function (event) {notifyResize();}); twttr.events.bind('resize', function (event) {notifyResize();});if (parent && parent._resizeIframe) {var maxWidth = parseInt(window.frameElement.getAttribute("width")); if ( 500 < maxWidth) {window.frameElement.setAttribute("width", "500");}}

Usability & Information as Drivers of Value

With the bear market in full swing, it’s more important than ever to remind people that critical mass is required for a technology to gain mainstream adoption. The average person won’t adopt something simply because it uses Blockchain technology. For them, it needs to be easy, it needs to look good, and most of all — it needs to work.

Coinbase plays a significant role in our industry as not only a market leader, but as the go-to exchange for first-time U.S.-based crypto investors. They were the first exchange on the market with a user-friendly on-boarding process that used a visual design consumers were already familiar with. That simplicity provides value that feedbacks throughout the crypto industry. Once people buy their Bitcoin or Ether, they can move on to trade alt-coins, use dApps, participate in ICOs, or even take out cryptoasset-backed loans. But — they need to be on-boarded into the ecosystem first.

Coinbase‘s ability to simplify their products through design is a huge driver of value.

Coinbase‘s ability to simplify their products through design is a huge driver of value.

There’s something to say for providing outstanding consumer value. Despite the high fees, Coinbase has been able to maintain their position as the most user-friendly exchange in the U.S. Why is that? Because their platform looks nice, it’s easy to use, and it works.

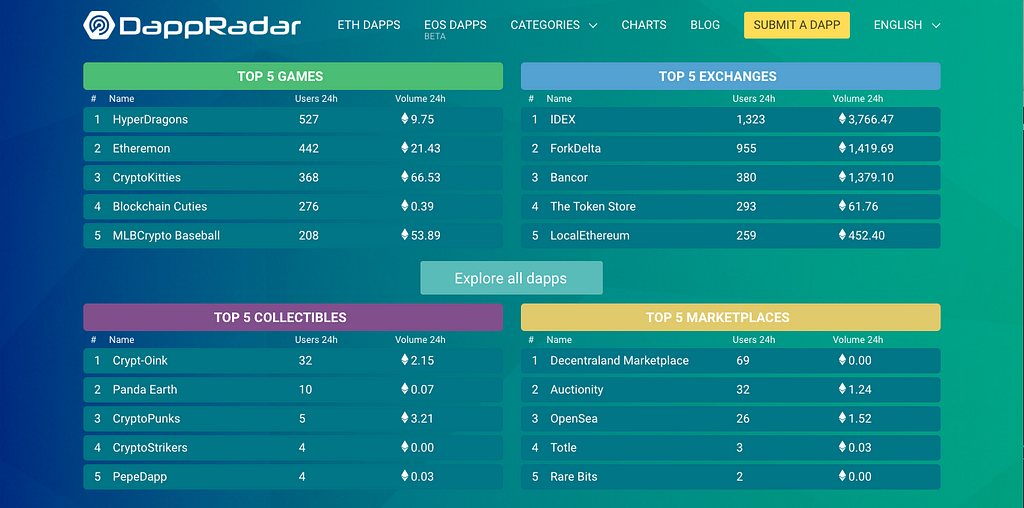

Drivers of value don’t necessarily have to be huge money-makers. Projects like CoinMarketCap, Etherscan, and DappRadar are on the pulse of the industry, providing essential information that drives the life-blood of the ecosystem. They are the Wikipedia and Google Search of the crypto world and provide priceless value to everyone from traders to educators.

DappRadar provides volume and user data on Ethereum and EOS dApps.

DappRadar provides volume and user data on Ethereum and EOS dApps.

Even companies like BlockFi, a crypto-to-USD lender, drive value to consumers by converting an existing traditional financial products for crypto investors. Increasing the available liquidity in the crypto ecosystem in the form of debt and credit is especially important when considering the value this provides for individuals across the world. This means that they can connect low-cost credit options and dollar denominated borrowing to emerging retail markets where it has never been available in the past. This has the effect of making crypto assets inherently more valuable and increases utility in the long term.

The future of the cryptocurrency industry is bright, but the path to mass adoption is unclear. What is clear is that founders, developers, and marketers need to start considering the power of simplicity and familiarity among consumers. For the future of the ecosystem, the only way to fully take advantage of blockchain technologies is by transitioning our priorities from a store-of-value to source-of-value mindset.

The Next Stage of Crypto: Source of Value was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.