Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

By Pavel Cherkashin and Julia Demkina

The initial coin offering (ICO) market is overheated now and investing at current prices might be not the best choice. So what is a reasonable ICO investment strategy, sellable to cautious institutional investors?

Our recommended strategy is based on the following assumptions:

· There is long-term fundamental value in blockchain technologies and cryptocurrencies and they will have a substantial impact on the global economy within the next 10–20 years, although the number of practical, proven use cases is limited at the moment (as was the case with the internet in the late 90s).

· The current crypto market cap and valuations are mainly based on expectations rather than real implementation of the technologies. Due to the low barrier of entry for non-qualified investors, the valuations are overinflated.

· Any moment now, investors will become disappointed in the market and start selling. Our estimates for when this will happen range from the end of 2018 to the middle of 2019.

· When the capitalization of the market falls below a certain level, a panic sale will begin, because non-qualified investors will lose confidence and will want to extract as much value as they can before their currency is worth nothing.

If these assumptions play out, it will not be good news for small investors who spray their limited capital among hundreds of crypto tokens, since limited liquidity will push prices even further down.

However, for large institutional investors, this scenario represents a great long-term opportunity to participate in projects that will create the foundation of the new global economy. To seize the opportunity, investors will need to answer two main questions:

· Which projects will survive through the crisis and would be worth supporting?

This question can be answered through standard venture assessment of the teams, deliverables, traction and current valuations, since there are projects that are too big to fail. Here are some of our tips on how to do that.

· At what price level should investors start buying?

This question is much trickier. Investing too early may eat up the entire internal rate of return (IRR), since it will take too long for the projects to return their valuation to the purchase level. Investing too late is not worth the effort, because other investors will realize all the upside.

To help find the ideal moment to invest if there is a panic sale, we came up with the following hypothesis:

What if a panic sale doesn’t follow economic logic, but is purely a psychological phenomenon? In other words, when investors are desperate to sell, the price drops to a certain psychological minimum.

If this is true, every panic sale should have a similar pattern, and therefore we should be able to estimate the psychological minimum based on similar market conditions in the past.

The closest event is the dot-com bubble burst in 2000–2002. (There are many great articles on this topic; we recommend reading Popping The Bubble: Cryptocurrency vs. Dot Com.) The dot-com crisis washed away most companies with hyper inflated expectations and empty promises. But investors who were brave enough to buy stock in the most prominent companies enjoyed very favorable valuations and gained significant returns over the next decade.

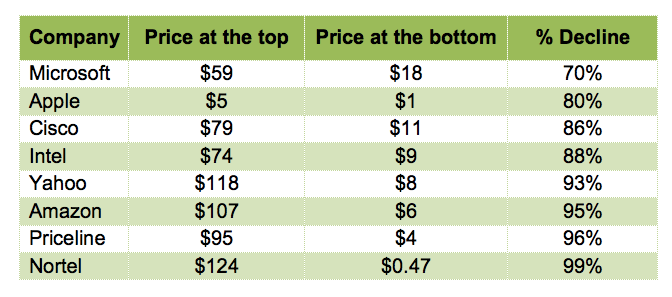

We dug into what happened with the stocks of technology companies in particular. The NASDAQ index fell by 79% in just over a year and a half, from 5,048.62 on March 10, 2000 to 1,114 on October 09, 2002. Even companies that survived the crisis fell to critical levels. Different sources show different numbers, but overall the picture is clear:

We see the following psychological levels here:

● Companies with stable cash flows and predictable economic models that were not fully dependent on the internet, such as Microsoft and Apple, fell not more than 80%, because investors could see how those companies could survive and grow even through the hard times.

● Companies with business models that were fully dependent on the internet fell more than 90%, because their ability to adapt to the new economic environment was not clear to investors. If the internet were rejected by the mass market and remained an expensive toy of the IT crowd, whom would Amazon, Yahoo, Cisco, Nortel and Priceline be selling their products and services to?

There are very few Microsofts and Apples in the blockchain world yet, in terms of revenue and diversity of a product portfolio. Companies like Bitmain or Bitfury that develop mining equipment tend to rely on more traditional instruments, such as IPOs, than on ICOs. Bitcoin, Ethereum and Ripple could potentially fall into this category, because they function as reserve currencies and might play the role of a “safe harbor” for investors in panic mode who still want to stay in crypto.

Based on this data, to prepare for the coming panic sale and take advantage of it, investors might want to follow the following strategy:

1. Build a list of the cryptocurrencies they believe will survive the crash.2. Raise funds while the market is still up. When the panic sale begins, psychology will outweigh any mathematical calculations and economic research, and it will be almost impossible to convince investors to take the risk.3. More conservative investors will prefer to focus on the core (reserve) currencies and start buying them when they fall by 60–70% and keep buying if they fall further.4. More aggressive investors may want to watch the other currencies that they believe to have real economic potential and wait until they fall even further, by 80–90%, before they buy, and then build their portfolios hoping for longer-term market adoption and growth.

Of course, it is essential to remember that the crypto market is much more dynamic than the stock market and is more accessible to millions of smaller investors from around the world. This creates higher volatility and therefore possibly deeper dips to catch.

***

Pavel Cherkashin is a venture capital executive and entrepreneur with a successful track record of building billion-dollar companies as a founder, investor and board member. As a co-founder and managing partner at Mindrock Capital and GVA Capital, Pavel invests in artificial intelligence, blockchain and self-driving tech.

Julia Demkina had a summer internship as an investment opportunities analyst at Mindrock Capital. She studies innovation management and technological entrepreneurship at Moscow Institute of Physics and Technology (MIPT) and works on her startup in logistics.

How to take advantage of the coming panic sale in the ICO market was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.