Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

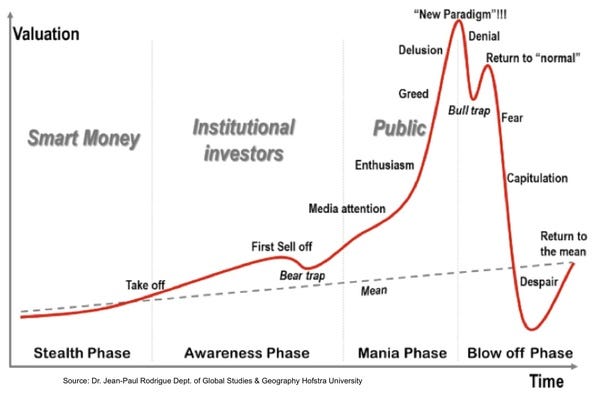

The cryptocurrency market has gone through many phases since the birth of Bitcoin and the ride has been rocky the whole way.

What we are experiencing right now has already happened before. We can look at Bitcoin as an example of how the cryptocurrency market works.

Stealth Phase — Smart Money/Original Believers

2007 — Bitcoin is created by “Satoshi Nakamoto”, there are many rumours as to who he or they may be or whether they/he are still alive, however this story is for another time.

November 2008 — The Bitcoin Whitepaper is published

2009 — The first ever Bitcoin transaction between Satoshi Nakamoto and Hal Finney is completed. Bitcoin is born.

Bitcoin was barely worth anything at this point and it took until March 2010 for Bitcoins price to even reach $0.003, which is less than a cent.

Awareness Phase — Institutional Investors

2011 — People start to hear about Bitcoin, since Bitcoin is open source, new cryptocurrencies begin to emerge and the first ever altcoins are created.

Wikileaks starts asking for Bitcoin donations and a few other organisations start to accept Bitcoin.

Silk Road marketplace is launched.

Vitalik Buterin (the founder of Ethereum) co-founds Bitcoin Magazine.

The largest ever “Bitcoin Bubble” takes place in this period, seeing Bitcoin grow from $0.30 to one dollar in February and then skyrocketing to $10 in June. Next Bitcoin tripled in less than week, taking it to $30.

Bitcoins price grew over 100 times during this period.

Mania & Blow Off Phases — The Public Gets Involved

2011 — The first manic phase saw Bitcoin grow from 30 cents to $30, then dropping to $5 and rebounding to $20 then finally falling down to $5.

2013 — Bitcoin starts off at $15 and grows to $50 by mid-March, about 2 weeks later one Bitcoin is worth $100. In less than 2 weeks Bitcoin grows again to $230.

The next day Bitcoin falls to $160, then $70 a week later before rebounding to $100.

2013 (Part 2) — Bitcoin grows to $250 in November and the price quadruples in a month, reaching $1,100. Bitcoin later settles down to $70.

2017–2018 — Bitcoin grows from $900 to $2700 by June. Bitcoin then grows again to $4300 by mid-August and continues to grow onto $20,000 with a few falls along the way.

Bitcoin starts to fall in early 2018, falling down to $15,000, then $11,000, $8,000 and now $6,200.

Final Thoughts

It is very clear we are experiencing another blow off phase,we already had a rebound from $8,000 to $11,000 in February and another one from $6,800 to $9,200 in April.

There is definitely a chance for recovery in the cryptocurrency market, if you look at the historical price charts for most cryptocurrencies you can see a sharp upwards trend after major pull backs.

Everyone loves to buy in when the prices are rising but those are not always the best times, you could of profited more by buying in during a downturn.

Traditional investors call this a bear market but opportunistic investors see this as a discount season.

Finally, I will leave you with this quote by legendary American stock market investor, Peter Lynch.

“You get recessions, you have market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.” — Peter LynchI hope you enjoyed my story, feel free to check out these useful resources below:

You can buy Bitcoin, Ethereum, Ripple, Bitcoin Cash, Dash, Bitcoin Gold, Stellar Lumens and more from anywhere in the world using CEX

You can buy Bitcoin, Ethereum, IOTA, OmiseGo, EOS, Bitcoin Cash, Litecoin and more from anywhere in Europe using BitPanda.

You can keep up with me on Twitter and Medium.

Will Cryptocurrency Prices Recover? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.