Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

While cryptocurrencies have generated the lion’s share of investment and attention to date, I’m more excited about the potential for another blockchain-based digital asset: security tokens.

Security tokens are defined as “any blockchain-based representation of value that is subject to regulation under security laws.” In other words, they represent ownership in a real-world asset, whether that is equity, debt or even real estate. (They also encompass certain pre-launch utility tokens.)

With $256 trillion of real-world assets in the world, the opportunity for crypto-securities is truly massive, especially with regards to asset classes like real estate and fine art that have historically suffered from limited commerce and liquidity. As I’ve written previously, imagine if real estate was tokenized into security tokens that you could trade as safely and easily as you do stocks. That’s where we’re headed.

There’s a lot of forward momentum around tokenized securities, so much so that based on their current trajectory, I believe security tokens are going to become a common part of Wall Street parlance in the near future. Investors won’t just be able to buy and sell tokens on mainstream exchanges, however; “crypto-native” companies are also throwing their hats into this ring.

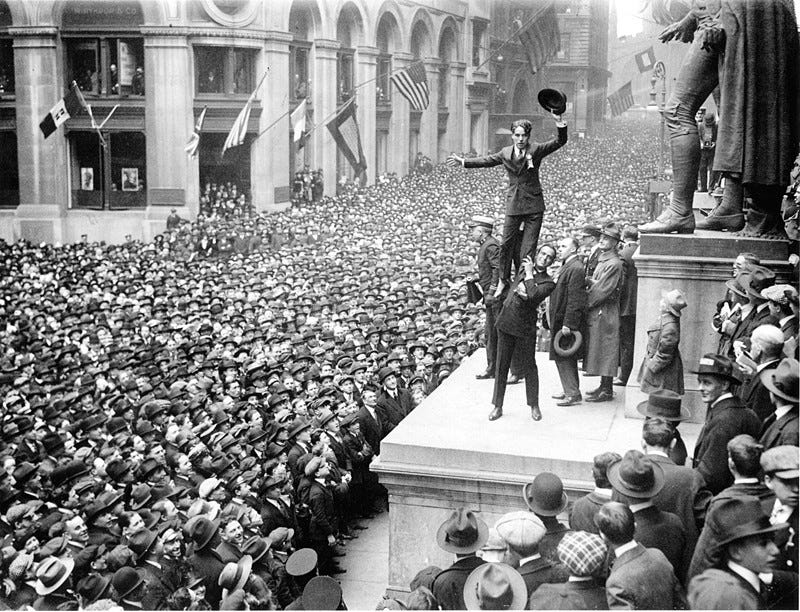

The starter pistol has been fired

The race is on to bring security tokens to the masses

The race is on to bring security tokens to the masses

Because Bitcoin and other cryptocurrencies are not classified as securities, it’s been much easier to facilitate trading on a large scale. Security tokens are more complex, requiring not just capabilities around trading, but also issuance and, critically, compliance. (See more of my thoughts on compliance here.) It’s a major undertaking, which is why we haven’t seen the Coinbase or Circle of security token trading emerge yet (or seen these companies expand their platforms to address this — more on that later).

Meanwhile, regular exchanges are blazing the trail and moving into providing tokens trading. The founder and chairman of the company that owns the NYSE announced a new venture, Bakkt, that would provide an on-ramp for institutional investors interested in purchasing cryptocurrencies. Last month, the SIX Swiss Exchange — Switzerland’s principal stock trading exchange — announced plans to build a regulated exchange for tokenized securities. The trading and issuing platform, SIX Digital Exchange, will adhere to the same regulatory standards as the non-digital exchanges and be overseen by Swiss financial regulators.

This announcement confirms a few things:

- Most assets (stocks, bonds, real estate, etc.) will be tokenized and supported on regulated trading platforms.

- Incumbents like SIX have a head start due to their size, regulatory licensing and built-in user base. They are likely to use this advantage to defend their position of power.

- Most investors will never know they are using distributed ledger technology, let alone trading tokenized assets. They will simply buy and sell assets as they always have.

I expect other major financial exchanges to follow SIX’s lead and onboard crypto trading before long. I can imagine them salivating over the trading fees now, Homer Simpson-style.

Live shot of financial exchanges drooling over crypto trading fees

Live shot of financial exchanges drooling over crypto trading fees

Crypto companies are revving their engines

The big crypto companies are preparing to enter the security token arena

The big crypto companies are preparing to enter the security token arena

Stock exchanges won’t have the space to themselves, however. Crypto companies like Polymath and tZERO have already debuted dedicated platforms for security tokens, and all signs indicate announcements from Circle and Coinbase unveiling their own tokenized asset exchanges are not far behind.

Coinbase is much closer to offering security token products after acquiring a FINRA-registered broker-dealer in June, effectively backward-somersaulting its way into a state of regulatory compliance. President and COO Asiff Hirji all but confirmed crypto-securities are in the company’s roadmap, saying that Coinbase “can envision a world where we may even work with regulators to tokenize existing types of securities.”

Circle is also laser-focused on security tokens. Circle CEO and co-founder Jeremy Allaire explained the company’s acquisition of crypto exchange Poloniex and launch of app Circle Invest in terms of the “tokenization of everything.” In addition, it is pursuing registration as a broker-dealer with the SEC to facilitate token trading — it could also attempt to take the same backdoor acquisition approach as Coinbase.

If there’s a reason Circle and Coinbase haven’t moved into security token services even more rapidly, it’s that there simply aren’t that many security tokens yet. Much of this is due to the lack of compliance and issuance platforms, keeping high-quality securities on legacy systems with which issuers feel more comfortable. As projects like Harbor ramp up more, this comfort gap will grow smaller and smaller, driving the big crypto players deeper into security token services.

The old guard versus the new wave

Expect a battle between traditional and crypto exchanges

Expect a battle between traditional and crypto exchanges

This showdown between traditional finance incumbents and crypto giants will be worth watching. One is incentivized to preserve the status quo, while the other is looking to create a new, more global financial system.

The Swiss SIX Exchanges of the world enjoy some distinct advantages over the likes of Coinbase — they have decades of traditional financial operating experience, deep relationships throughout the industry and a head start on regulatory compliance. Those advantages probably mean that such incumbents will probably be the first to make infrastructural and logistical upgrades to their systems using security tokens. The first time you interact with a security token, it is likely to be through the Nasdaq.

Having said that, incumbents’ greatest disadvantage will be transporting an old-finance-world mentality to these innovations. Coinbase, Circle, Polymath, Robinhood and other newer players are better suited to harnessing the stepchange elements of security tokens — particularly asset interoperability and imaginative security design.

University of Oregon professor Stephen McKeon, an authority on security tokens, told me that “the potential for programmable securities to enable the expression of new investment types is the most exciting feature.” Harbor CEO Josh Stein explained why private securities in particular will be transformed: “by automating compliance, issuers can allow their investors to trade to the limit of their liquidity across multiple exchanges. Now imagine a world where buyers and sellers around the world can trade 24/7/365 with near instantaneous settlement and no counterparty risk — that is something only possible through blockchain.”

Those hypergrowth startups are going to experiment with these new paradigms in ways that older firms won’t think of. You can see evidence of this forward thinking in Circle’s efforts to build a payment network that allows Venmo users to send value to Alipay users — exactly embracing interoperability, if not in an asset sense.

The race is on

As Polymath’s Trevor Koverko and Anthony “Pomp” Pompliano have been saying for the past year, the financial services world is moving toward security tokens. As the crypto economy matures, we’re inching closer to a new era of real-world assets being securitized on the blockchain in a regulatory compliant manner.

The challenge for both traditional and crypto exchanges will be to educate investors about this new way to buy and sell investments while powering these securities transactions via a smooth, seamless experience. Ultimately, security tokens lay the groundwork for granting investors their biggest wish — the ability to trade equity, debt, real estate and digital assets all on the same platform.

Originally published in Techcrunch.

Sunny Dhillon is a founding partner at Signia Ventures, a $85m seed and series A venture capital firm based in the San Francisco Bay Area. He invests in consumer and enterprise startups. He leads the fund’s investment strategy in distributed ledger tech.

If you enjoyed this post, please “clap” 50X in the bottom left corner so it will be shared with more people. You can also tweet me your thoughts, find me on LinkedIn, or learn more at my personal website.

Security Tokens Will Be Coming Soon To An Exchange Near You was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.