Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

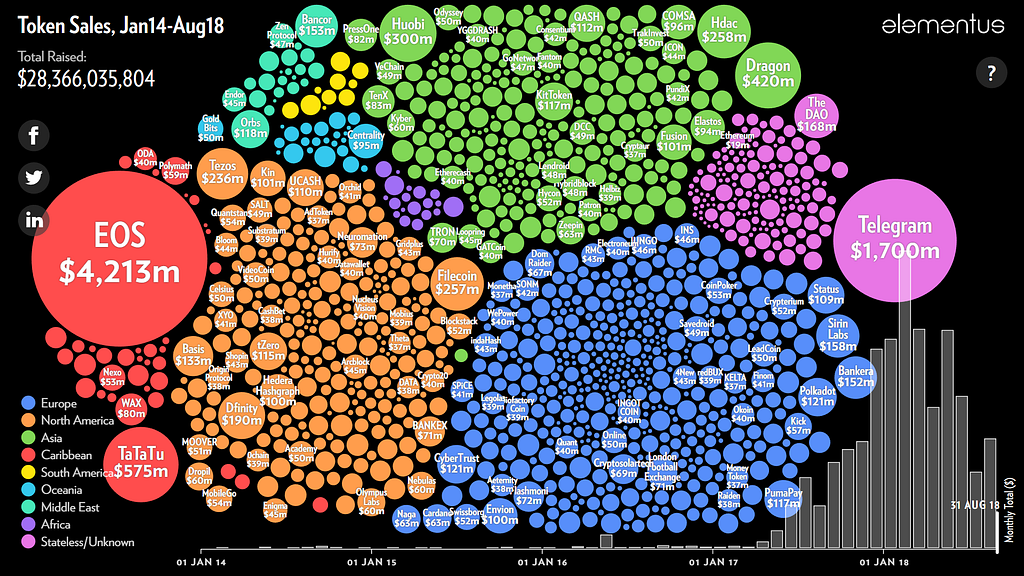

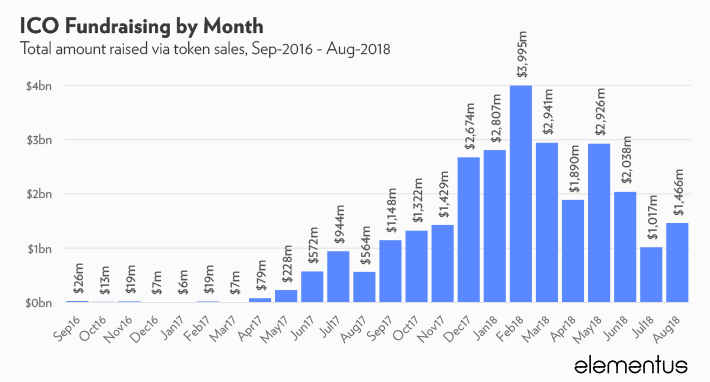

This visualization shows every token sale that successfully raised at least $100k from the beginning of 2014 through the end of last month, August 2018. The bar chart at the bottom of the graphic displays the total dollar amount raised in each month (details below).

Token Sales: August, 2018

The state of the token sale market as of 31-August-2018

Key takeaways:

- Despite a rash of claims to the contrary, the ICO market remains quite robust with $1.4 billion raised in August — an increase of 44% over the prior month

- All signs point to a maturing ICO market: fundraising grows more competitive, more established companies wade in, and security tokens show their first signs of life.

- For the first time, Singapore hosted more ICOs than the U.S.

How much has really been raised by ICOs so far?

Most token sale statistics available online rely strictly on third-party reported amounts, which may be outdated and in most cases will exclude projects that do not report their fundraising. There is no consensus among them as the numbers vary between $14 billion and $21 billion as of August 2018.

Paradoxically, accurate information about fundraising occurring on the most open, transparent database in the world remains stubbornly difficult to find.

A visual history of token sales

A visual history of token sales

Although blockchains are technically transparent, they are functionally opaque. Elementus collects, organizes and analyzes data directly from the blockchain. Our technology enables us to read the Ethereum transaction ledger like an open book. By identifying the various wallets controlled by ICO projects, we may then calculate their total fundraising amounts.

In total, we estimate ICOs have raised a combined $28.4 billion as of the end of August, 2018.

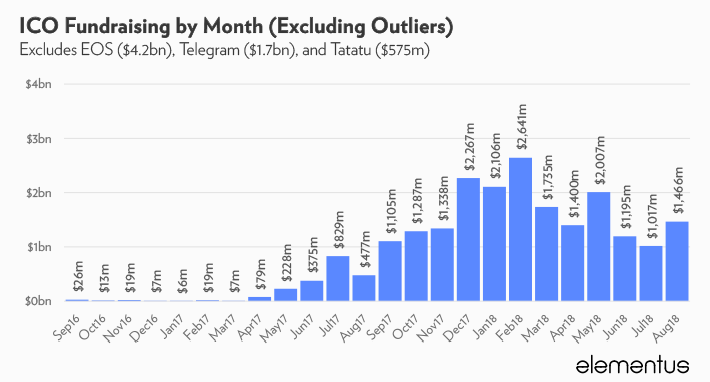

August fundraising volume matched that of last November

While investor appetite for tokens has fallen significantly from its peak last February, the picture is not nearly as bleak as the market collapse many are reporting.

In August, ICOs raised nearly $1.5 billion, on par with the amount raised during the bull markets of last November. In fact, the majority of historical ICO fundraising occurred during the current bear market. Of the total $28 billion raised to date, $15.9 billion occurred between February, 2018 and August, 2018.

Furthermore, much of the sharp rise-and-fall trend exhibited in the chart above can be attributed to just three ICOs — EOS ($4.2bn, Jun17-Jun18), Telegram ($1.7bn, Feb18-Mar18), and Tatatu ($575m, Jun18). With these outliers removed, the picture looks reasonably stable, particularly given the wild fluctuations seen in the crypto markets over the same period.

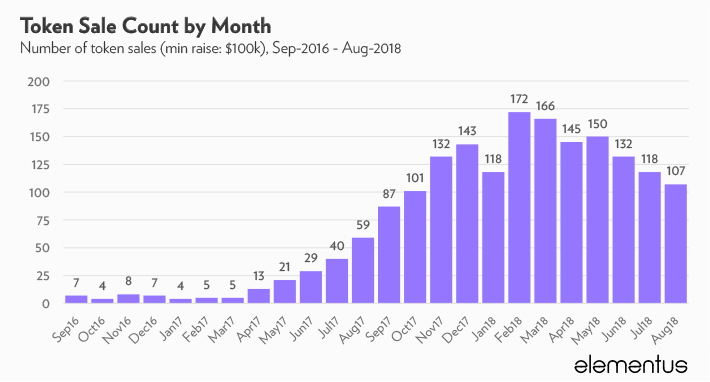

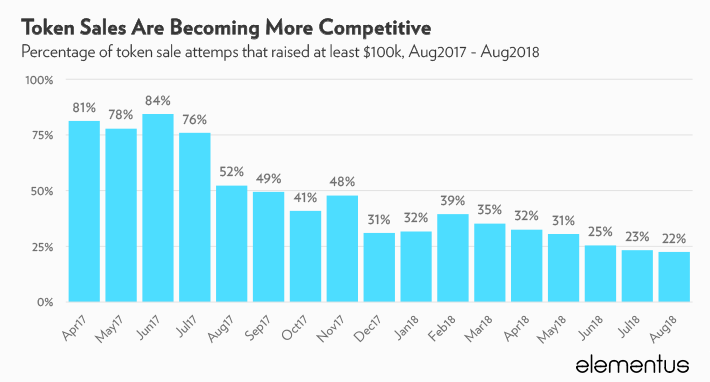

The chart below shows the number of token sales by month. As we have discussed before, we view this metric as a more accurate gauge of ICO market activity, as it is less susceptible to idiosyncratic fluctuations.

Consistent with the chart above, this measure also points to a more stable, healthy market.

One could argue that overall investor appetite for ICOs has remained strong during this bear market. Of course, once on exchanges, the tokens prices are still at the mercy of the traders.

The token sale market is showing signs of maturity

The rate of successful ICOs (above $100k raised) has dropped from one-half to one-fifth over the last 12 months. It seems that investors, whether retail or professional, are growing more selective when giving money to ICO teams.

Another sign of market maturity, it is becoming increasingly rare to see pre-product startups complete a $100m+ ICO based on a white paper. The biggest ICOs are increasingly conducted by established companies. Examples from August include London Football Exchange, tZero and Dfinity.

Of particular note, tZero’s token sale represents the first security token offering to raise over $100 million. Security tokens have long been hyped as the future of the token fundraising, but successful examples are few and far between. tZero is an important landmark that demonstrates security tokens are capable of garnering strong interest from investors.

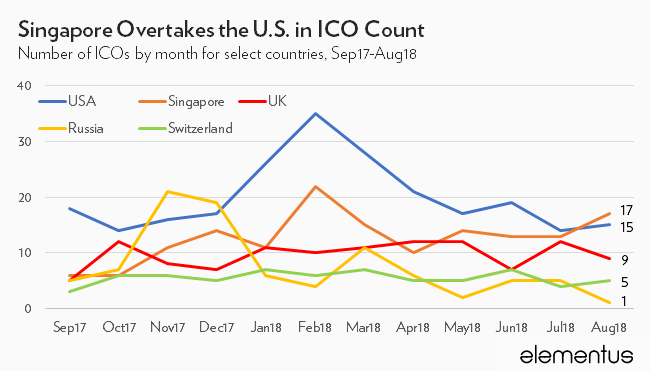

For the first time, Singapore hosted more ICOs than the USA in August 2018

In terms of location, ICOs are still a global phenomenon.

The most striking geographic trends in recent months are a shift away from the U.S., ostensibly due to increased regulatory scrutiny, and a shift toward Singapore. August was the first month in which Singapore hosted more ICOs than the U.S.

Click here to view the interactive bubble chartData and Methodology

Click here to view the interactive bubble chartData and Methodology

The figures above were sourced via the Elementus Protocol, an expert system that extracts and interprets transaction data directly from the blockchain.

Fundraising amounts were converted into USD at the prevailing cryptocurrency exchange rate at the time the sale closed. Contributions to the EOS ICO, which has been ongoing since June, 2017, were converted daily at the ETH-USD exchange rate.

Funds raised through token-convertible securities were sourced from SEC filings. Project location countries are self reported, compiled primarily from social media profiles.

Originally published at elementus.io on September 25, 2018.

The ICO market is not collapsing. It’s maturing. was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.