Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Whatever brought you here, your last click was your first as a CryptoLawyer.

Welcome aboard! We’re glad you’re here. We need all the help we can get. Let’s get started.

What is CryptoLaw?

CryptoLaw is a big deal. Here’s one way to define CryptoLaw:

CryptoLaw: a cloud of legal norms, processes, institutions, and vocabularies for governing inter-crypto (Ethereum Foundation vis-a-vis OmiseGO, etc.), intra-crypto (ETC v. ETH), and all other legal relations concerning crypto instruments, institutions, and markets (public legislative/regulatory oversight of crypto; enterprise-crypto integration; intersection of private contract law with private so-called “smart contract” #CodeIsLaw; etc.)

This is just the tip of the iceberg in our conception of CryptoLaw. But it’s a good start.

CryptoLaw structures our imaginations of what’s possible in the crypto-economy. It gives us certain operational logics and vocabularies for resolving crypto-legal disputes. It defines what’s possible and impossible and the costs of blurring the line between the two.

CryptoLaw Strategies

CryptoLaw doesn’t just exist. It’s not just a thing that sits there and governs. It’s an experimental system of governing human relations. And it’s got a LOT of problems. If you want proof, here’s our list of Crypto’s Biggest Legal Problems.

A CryptoLaw strategy could mean anything from coalition or cartel-building (such as Stanford & E+5), direct regulatory engagement (IOTA), impact litigation, or something else.

Over at Crypto Law Review, we are continuing work on an analytical piece called CryptoLaw that maps out the crypto legal landscape, from theoretical all the way down to the most seemingly mundane and “technical” things like … oh, you know, jurisdiction: who can do what, and where.

In order to do this well, we need to open up a bigger runway so we can spread our wings a bit further.

For instance, we’re learning things in our research that expose the “personal factor” — individuals’ ideological leanings that might have steered a particular project in this direction or that direction.

As relative outsiders to the crypto development space, we have no particular need or desire to make our analysis “personal.” Nor do we technically have a need to talk about particular projects, like Bitcoin, or Ethereum, or Ethereum Classic. We can generalize and make the arguments abstract.

But as arguments get more abstract, they become less compelling and less immediately relevant.

So, in order to strike the right balance and develop the broader CryptoLaw arguments that we need to develop, we offer these contextual notes — basic explainers on why we’re doing what we’re doing with CryptoLaw — in the off-chance that these notes might be useful to you in formulating your own CryptoLaw strategies.

Our Bona Fides

Before we get further into CryptoLaw arguments, we need to introduce ourselves and build a little trust.

We do this so you see that (a) we have no conflicts; that (b) we genuinely respect crypto developers’ efforts; (c) we appreciate divergence of views within crypto; and, that (d) instead of FUD, this is constructive critique intended to put crypto on much stronger footing.

For some time now, we’ve been exploring these themes in different forums and from various perspectives, including (a) Against “Smart Contracts,” (b) #CodeIsLaw … Maybe, (c) Crypto Needs Better Lawyers ASAP, (d) Crypto Scaling is a Legal Problem, and so on — analysis that is being continuously refined and expanded at Crypto Law Review, which we also started.

Suffice it to say, we’ve sunk a lot of resources and time into developing these arguments because we think they are of existential importance to crypto.

It’s important to lay this groundwork so that we — (we+you) — resist the urge to generalize “CryptoLaw” as this or that, good or bad.

CryptoLaw arguments can’t be reduced to a meme or a blurb, just like inner workings of Bitcoin can’t be reduced to a gif.

In order to reach you, we’ve written in different genres, registers, and tones (from abstract and theoretical to concrete and practice-oriented).

“CryptoLaw” is our most eclectic analysis of the true costs of misunderstanding how Law structures social order and economic exchange — in both material and so-called “cyber” realms.

CryptoLaw — mapping the Crypto Legal Matrix — is a complex analytical project that defies easy categorization. If you prefer bite-sized nuggets instead, the list of ingredients that went into this stew is up above.

If this approach speaks to you, great. If not, please tell us how you would sharpen this analysis.

One way or another, if you care about “crypto,” you’ll need to work through the themes raised here — the issues are just too foundational to ignore. In our view, the sooner this is done, the better.

Time is of the essence.

Your Bona Fides & Alliances

While some of the themes thus far may seem theoretical and abstract, we must be clear that CryptoLaw is war — with real-life consequences for billions of people.

We’re all combatants in a major fight for control over the conceptual architecture of the 21st century. Control over CryptoLaw = control over the 21st century economy.

We’ll illustrate this with concrete examples and illustrations. But bigger picture, here’s our position in this war:

(1) Crypto never should have positioned Law as its enemy.(2) By now, the “CryptoLaw Bar” should be should be smart enough to realize the futility and real costs of that approach.(3) It’s not too late to adopt different CryptoLaw strategies with much higher probabilities of better outcomes than the current adversarial model of engagement with Law.

Phrased differently: If you cling to the Crypto v. Law framework like you cling to your Ledger Nano, then you don’t understand law and you don’t appreciate crypto’s potential. You may think you’re winning big battles, but you’re actually losing the war.

If these sound like fighting words, please remember, we are in the midst of a war. If you need proof, search for “crypto” and “law” in your favorite news engine. Scan the results. Exactly.

You, Esquire

By “CryptoLaw Bar” and “CryptoLawyers,” we don’t just mean “lawyers” in the traditional sense of the word.

Instead, the growing CryptoLaw Bar includes CryptoCats like Gavin Wood, Vitalik Buterin & everyone who has ever used Legalese (such as the term “smart contract”) — including YOU — irrespective of educational or professional background.

If you’re a crypto dev, you might never have seen yourself as a CryptoLawyer. You might mistrust or even despise lawyers.

You might have thought that Law and Lawyers were part of “the problem” for which Crypto was “the solution.”

If you thought that, you were wrong. Not trying to be mean; just stating the truth.

Don’t Take Our Word For It, Read Yellowpaper.io

Please understand that it’s not little ol’ CleanApp that’s calling you out, saying you’re wrong to fight quixotic legal windmills, and tagging you into the CryptoLaw Bar.

It’s the law firm of Nakamoto, Wood, Szabo, Buterin, Hoskinson & Associates, PLLC (founders of Bitcoin, Ethereum, Ethereum Classic & CryptoLaw) who opened the CryptoLaw Bar, threw you in it, and then locked the door on their way out.

Here’s Gavin Wood at the end of 2015, telling us we were all crypto-lawyers who were now finally free to play with our magical crypto-legal “building blocks” to construct whatever shady legal things we wanted to construct:

While contracts that provide pure services concerning each one of these pillars [(1) Identity; (2) Assets; (3) Data] will be extremely useful, these should be considered merely building blocks from which a crypto-lawyer (or crypto-lawmaker?) may construct appropriate shades.

It was all fun and metaphor when we were imagining what it’d be like to be “crypto-lawyers” and “crypto-lawmakers.”

But now that we’ve started being called to account, now that the “shitcoins” are ricocheting off the SEC’s long-arm fanblades, people should realize that not everyone’s a “crypto-lawmaker” in Cryptopia.

Everyone Wins v. Winners & Losers

There are winners and losers under any set of rules. Winners understand the rules better … because they write them.

CryptoLaw’s (and crypto’s?) biggest failure thus far is the self-delusion that everyone’s a winner because everyone is free to write the rules of their own game, and, crucially, everyone is free to either play a given crypto game or not.

The dominant crypto paradigm today is: everyone wins. If you HODL, you win. If you sell and profit, you win.

Heck, even if you sell and lose, you win.

How so? Even though you’ve lost big today, you’re really winning because you’re learning how to win even bigger … tomorrow.

It’s gambler “logic.” Returning from Vegas after losing everything, you brag about how much fun you had, how many buffets and show tickets you were “comped,” and how you’ll “get” the Circus Circus next time. Gamblers know better than anyone that, statistically, “the house always wins” & “the rules are rigged.”Yet despite this knowledge, gamblers, by and large, follow the rules. Why? Because (a) everyone does it; (b) there are a lot of those damn rules, with lots of different costs for transgression; (c) there never seems to be enough time to learn “all the rules;” (d) [ “X” ].So, better be safe than sorry. Better luck next time.

In today’s Circus Crypto, the logic is the same. Even if you lose your fortune, you’re a winner in “experience points,” “dignity points” and “Liberty tokens.” Your Liberty & Dignity are preserved because you had the crypto-legal right to “inspect the code,” to familiarize yourself with “the rules,” and so on.

This applies beyond just “trading,” to encompass virtually every aspect of today’s crypto economy: (a) investor v. ICO disputes; (b) trader v. exchange disputes (easy to put money into Gox, Coinbase, etc., not as easy to take it out); (c) CryptoDev v. CryptoDev disputes (ex: ETC v. ETH); (d) crypto mining disputes (ex: intra-pool disputes; Bitmain v. Obelisk; algo v. ASIC; etc.); (e) “smart contract” disputes; (f) and so on.

However you may be losing your coin, don’t question the rules of the game. If you do, you’re sowing FUD, which is penalized with the ultimate legal sanction — banishment.

Instead, even if you’re losing, you’re getting “rich” in experience points, which “feels” valuable because next time, you’ll know the rules better — greatly boosting your chances of winning. Never mind the fact that next time’s rules are already different (the “X” in the list of ‘Gambler Logics’ above).

Again, we’re not talking about just cryptocurrency trading markets and rules, or the governing rules of this or that crypto instrument. The lessons above apply more broadly.

Crypto-Casino-Capitalism Law

Already, everyone should see remarkable ideological and functional parallels between Capitalist, Casino, and Crypto approaches to rules:

(1) Transparency/Open Law: everyone can inspect & learn “the rules,” even though few do (due to, say, information overload from open access to so many rules);(2) Equality of Opportunity: rules are “set” so that everyone can win, even though few do;(3) Clarity: ambiguity is bad; clarity is good. Who decides? The “rules” — ! And if the rules are ambiguous? See #5.(4) Immutability: rules are rules; contracts must be enforced; pacta sunt servanda;(5) Expertise: if changes to #1 — #4 need to be made, trust the “experts” and “rule technicians” to do their thing — you just do you, stay focused on winning.

In this regime, it’s clear that you don’t become a winner by following the rules; you become a real winner by understanding the rules.

Do you want to know why next time’s crypto rules are already different, even though the “game” is being played on “immutable” code?

We thought so. Let’s go on.

Don’t Trust Us: Question Everything, Assume Nothing

We don’t know what your institutional alliances or ideological beliefs are, but we promise this: the payoff of working through this argument is a much more solid conceptual and institutional framework for crypto — not just CryptoLaw.

Don’t “trust” us. Instead, assume nothing; question everything.

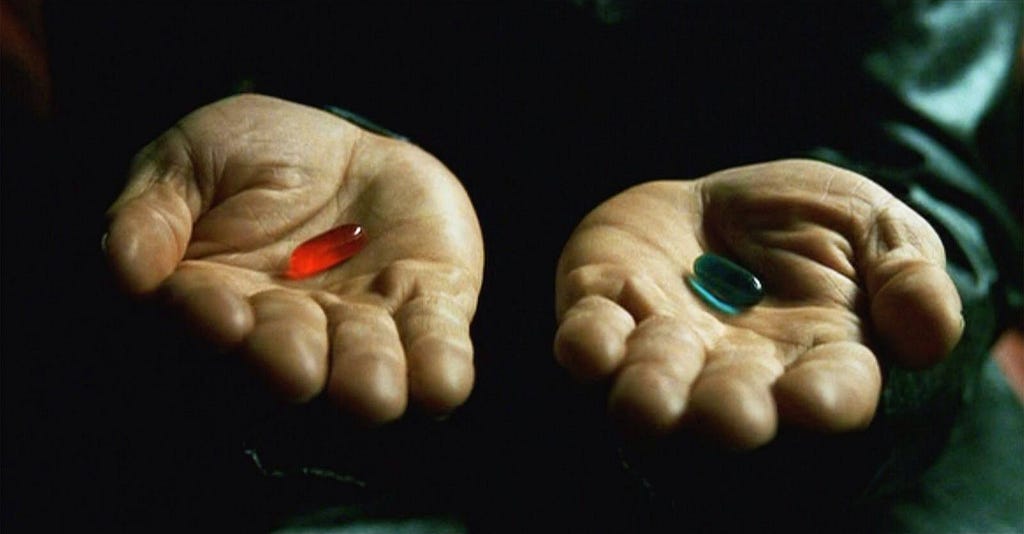

The most important takeaway thus far is to start questioning the Crypto Legal Matrix.

Start with the basics: the who, what, when, where, how.

Unwillingness to work through this argument and these questions because of Law FUD, or a short attention span — tl;dr — means continuing to labor under irrational and misplaced fear of the legal atmosphere.

That means remaining stuck in a Crypto Legal Matrix that continues to refine ways to control you, without your consent.

“Law ghosts” pose as much threat to crypto as oxygen — but it’s up to crypto to understand why that’s so. We are making this as clear as we can, including literary parallels to The Matrix, which we hope serves as a common metaphorical point of reference.

You are the one who must want a better understanding of the Crypto Legal Matrix. From there, everything becomes progressively easier.

It’s Time to Decide

So, do you want to stress test your understanding of the world (and crypto’s place in it)? Do you have the intellectual courage to even ask this question — or are you so deeply bound by your “anarcho-crypto-libertarian” or “crypto-liberal” or “crypto-radical” (or whatever other ideology) beliefs that your very mind has become … immutable?

We know you’re a free thinker at heart.

So let’s enter the Crypto Legal Matrix.

Building a CryptoLaw Strategy was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.