Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Rewind back to the 1990’s when the times were much simpler. Your digital legacy in this age would include just your email accounts (and maybe your IRC password). But in today’s digital era, it includes photo archives, encrypted device backups, personal information held by search engines, and of course, cryptocurrencies.

Cryptocurrency is digital money that is secured by unbreakable cryptography. It is stored in virtual wallets and each wallet has a public key that can be shared with anyone. And then there are private keys that are held by the owners of the wallets. And, of course, you cannot access the funds stored in the wallet without its private key.

If the cryptocurrency owner passes away and their private key is not known to anyone, the money they’ve held in crypto will never make it to their rightful heirs.

A Crypto miner died in a plane crash

Michael Moody, a 26-year old man, died in a tragic plane crash. His father knew that Michael used to mine Bitcoin, but he had no information how much money he had or how to get it back. After struggling for years, he came to know that he cannot access his son’s assets as they were all in crypto form.

Bitcoin is unregulated and decentralized, which makes it secure. But it also means that it’s so secure that your legal heirs cannot access it without the right information or private keys.

Coinbase solves the case of a Colorado investor

A Colorado-based Bitcoin investor died and left his estate unsorted. When the family checked his bank records, they discovered that he had invested in Bitcoin. With debits made to Coinbase, a popular crypto exchange and wallet, they got to know about his crypto ventures.

The family approached Coinbase with legal documents related to the investor’s death and the crypto company agreed to transfer the contents of the wallet. But, unlike the first case, this time the funds were stored and controlled by an exchange.

Solutions to the crypto inheritance “problem”

If planned carefully, crypto inheritance can be pretty easy to handle.

The old-school approach

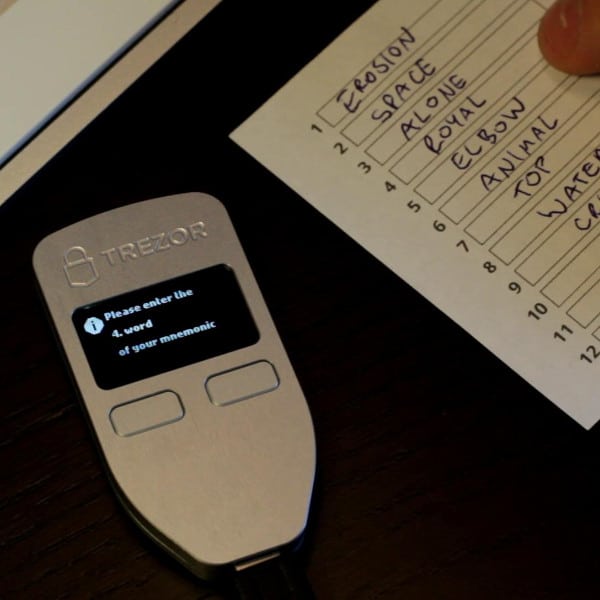

It’s simple – write it down. Just take a small notebook and write down the details of your crypto assets and where you’ve invested and stored them. You can write the private key in it and keep it in an airtight, fireproof location that’s disclosed only to a trusted person. Read those must-have security tips.

There are some pitfalls in this approach – the notebook can be found by a third person. Or the paper might degenerate over the years. However, this is a very safe method and is more secure than handing over your data to third parties.

If your family members are not crypto-savvy or don’t have an idea of how to access crypto wallets, you can write down a step-by-step walk through for them on how to recover the funds in case anything unexpected happens.

The new tech approach

To make things a bit easier, there are now some software solutions to the crypto inheritance dilemma. These software tools are still in their nascent stage and cannot be completely trusted.

One such app is called Dead Man’s Switch. This app won the Tokyo Hackathon last year. It’s a digital will keeper that can open up the crypto details and keys to beneficiaries when triggered. If the owner of the wallet doesn’t check into the app for long, it will send an alert to confirm if they’re alive.

If they still don’t check in, the app will need three validators to confirm if the owner has passed away. Next, the app will require further validation by two public notaries. Once the validation processes are complete, the will details will be revealed to the beneficiaries.

Some exchanges offer beneficiary service

There are companies who are waking up to the inheritance issue and have started to make provisions. For example, Coinbase offers a beneficiary service that will let a deceased investor’s family gain access to their assets. The heirs of the wallet owner would have to provide documents such as death certificate and testament proofs to claim the assets.

The Legal Connection

Unfortunately, the legality of crypto lies in a dense gray area. When you write your will, make sure you include all your crypto assets in it. Many jurisdictions can claim your assets if they are not mentioned in your will. If you invest in crypto currencies, you must keep the future possibilities in mind and inform your family about your assets.

Thinking about death can be a morbid experience, but it’s best to be prepared. No matter which storage medium you choose – a digital ledger or a handwritten note, if you want your heirs to have the fruits of your labor, you need to will your assets to them. If you don’t plan it right now, your crypto wealth might become useless tomorrow.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.