Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Disclaimer: Points shared in this article are based on my own personal understanding of the Cryptocurrency space. They are not meant to be financial advice nor should it be viewed as concrete evidence to current market circumstances. As always, please do your own research.

BEHAVIORAL PORTFOLIO MANAGEMENT

by C. Thomas Howard

Ever since the 2008 financial crisis, there has been a focus on Behavioural Finance and Economics. In an attempt to keep up with the ever-evolving world of Finance, Thomas Howard developed a transitory approach to the traditional Modern Portfolio Theory in portfolio management.

The book teaches how to develop a portfolio that revolves around behaviour and emotions.

Three Principles discussed in the book:

- Emotional Crowds Dominate Pricing and Volatility

- Behavioural Data Investors Earn Superior Returns

- Investment Risk is the Chance of Underperformance

The book focuses on the entire traditional market and do not mention the Cryptocurrency market however, the principles discussed can be applied when managing your crypto portfolio.

The main topic revolves around emotions in investing. The cryptocurrency market is the epitome of emotional investors which makes the book a perfect guideline to formulate an investing strategy.

Implementing Behavioural Portfolio Management

Three key things:

- Redirecting Your Emotions

- Harnessing Market Emotions

- Mitigating the Damage of YourEmotions on Portfolios

Volatility is the measure of emotions and the book discusses how to tackle the issue with volatility in your portfolios. The contrarian approach is perhaps the best approach when it comes to the Cryptocurrency market — Sell when exuberance is present, buy when there is despair and anger. Going against the masses can be quite a daunting experience but in an emotionally-driven market, it could be your saving grace. Patience is an important trait to counter volatility.

Personal Opinion

The book perfectly describe what goes on in the Cryptocurrency market where just a promise from a whitepaper can determine life-changing amounts to be gained. There are instances where the book goes against the traditional investing philosophies like going 100% in stock markets is a better move than diversifying into other asset classes. The book also goes against the idea of diversification. I believe this can be quite dangerous to the uneducated and irrational investor.

Upon further consideration, his ideas are fully justified. Should an investor wish to maximise his returns, he should go with the most volatile asset class but be educated enough to enter and/or exit the market at the right moment — emotional contrarian. Diversifying is just seen as a buffer to prevent any emotional tendencies. Over-diversification can absolutely hurt performance.

I highly recommend all crypto investor to have a look at this book. It provides a very interesting perspective that has changed the way I manage my own Crypto portfolio.

Let me know your thoughts on the book or in the cryptocurrency market in general!

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Follow me on Medium to receive instant updates on my upcoming articles where I discuss topics revolving Cryptocurrencies, Investing in general and Technical Analysis.

Cryptocurrencies: What Retail Investors Should Know (Part 1)

Do also follow me on other social media platforms: TwitterYoutube

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

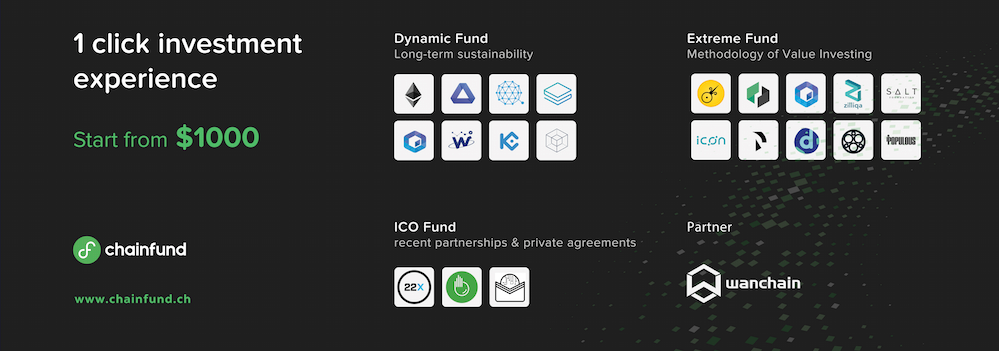

Iliya Zaki is the Community Manager of Chainfund.

Exciting news: Our private sale for MNODE Fund Starts NOW ! Find out here

Founded in 2017, Chainfund offers a 1-Click investment experiencedesigned to be open and accessible to everyone. Chainfund substantiates their highly ambitious nature with their philosophy — investing in high potential Crypto-assets with long-term values and growth.

- Read more on our seamless platform which currently includes Dynamic, Extreme and ICO portfolios on Medium @ https://goo.gl/rArrRp

- Register @ htttp://chainfund.ch to receive exclusively reports and experience 1-Click investment. Investment starts at $1000.

- Join our Telegram Global group — https://t.me/chainfund

The Book That Changed How I Manage My Crypto Portfolio was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.