Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Dawid Zawiła | Unsplash

Dawid Zawiła | Unsplash

For many large cryptocurrency investors, the existing exchanges very often do not provide the necessary liquidity or logistical operation required for their preferred trading habits. The TABB Group recently disclosed the OTC markets eclipsing exchange volume by 2–3x. The lack of liquidity on many exchanges is at the forefront of what could be several issues when processing substantially large quantities of trades for high profile investors. Liquidating hundreds of millions of dollars of cryptocurrency on existing public exchanges in a short time-frame could crash the market. This can especially ring true if there are not enough buy orders to help convert the sell orders. But through careful trading using Huobi OTC, I was able to provide a solid foundation encouraged at helping maximize my crypto investments.

What is OTC Trading?

OTC trading occurs via a decentralized network of dealers- specialists whose job it is to ‘making a market’ in these securities and coins while simplifying trades for clients. Over-the-counter trading is a service available to high-volume traders; as such it will only be available to select individuals and groups. Favored by many of the larger scale traders, OTC trades are often desired by institutional investors or high-net-worth individuals.

OTC trades can be facilitated via:

➲Brokers

These platforms provide a custom service by allowing high-volume traders to execute large block trades while avoiding any problems with slippage by having access to funds via liquidity providers in ownership of large quantities of cryptocurrency.

➲Chat Rooms

This method of OTC trading is hosted on numerous IRC channels and allows for P2P transactions between traders.

➲ATM’s

More frequently, Bitcoin ATM’s are being installed in places allowing customers to convert fiat into cryptocurrency coins without the need to go through online exchanges. However, this process is often very slow and cumbersome.

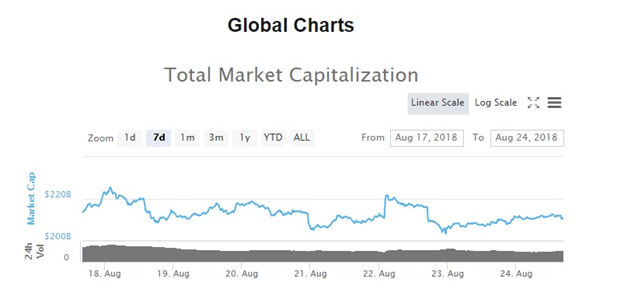

Recent Market Movements 📉

Following on from the markets bloodbath on August 10–15th, the markets have managed to stabilize slightly. There has been a consistent sideways movement in Bitcoin price, while alt coins are having mixed fortunes. Ether continued its high volatility and is now settled around the $280 mark. Bitcoin has been consistently finding rallies towards $6900 mark, only to have the gains wiped out and corrected to intraday lows near $6260. However, Bitcoin has now bounced back slowly towards the $6400-$6600 area, continuing the consolidation sentiment into the range it was thought to have escaped.

With the recent news of the US Securities and Exchange Commission (SEC) disapproving eight Bitcoin-related ETF’s yesterday, the BTC price reacted by dropping from $6550 to $6280. However, there was a quick market rebound in the past 24 hours, jumping from $6280 to $6550. Given that the future-backed ETF’s had a very low approval chance from the SEC, their subsequent rejection shouldn’t have had too major an impact on the price of BTC, which explains the quick recovery.

🚀How OTC Provided Higher Investment Returns

After having been fortunate enough to witness and be extensively involved in the infamous late-2017 bull run, I liquidated many of my altcoin positions into fiat and held a total position of approximately $55,000. I continued to keep hold of the funds throughout the whole year, waiting patiently for the right opportunity to present itself. That arrived earlier this month on August 14th, as the price of BTC dropped below $6000 to $5971 for the first time this year. The decision was made to invest the whole amount into BTC and hold patiently. Following thorough research, I decided to use OTC as my preferred method of trading, more specifically Huobi OTC. The main reason bring for selecting this route- slippage.

In volatile markets such as crypto, slippage is frequent. Slippage refers to the difference between the price a trader is expecting on a trade, and the price actually received. This can translate to a higher price when purchasing cryptocurrency, or a lower price when selling; slippage occurs as a result of exchange sellers wanting different prices for their coins. Following the placement of an order, the order book is from the cheapest price to the most expensive.

If I was purchasing a small amount of Bitcoin, this wouldn’t be an issue, however as I was purchasing a very large amount, slippage will increase with the increasing quantity purchased, as I would have to go further down the order book. But by using Huobi OTC, slippage was avoided completely due to there being single purchase rate for the order. Huobi OTC was able to find a seller who individually held large amounts of Bitcoin and paired with me for the sale while allowing the seller to receive payment via their chosen method. There was also the possibility that if I was unhappy for any reason with the seller paired, I could request to go to the next seller if not satisfied. This is in contrast to centralized exchanges where, if I was unhappy with the price or fees, there may not be any suitable alternatives.

Huobi OTC Use Cases

The following video is a great representation of not only the services provided by Huobi OTC but also a good overview of how OTC Trading works in general.

To be able to quickly and very smoothly start trading OTC, readers can either download the Huobi app via Play Store/Google Play or visit https://otc.huobi.com. Following, which is then a simple sign up process. Once completed readers are required to login and execute the following steps:

➲Step 1: Select the digital asset you want to trade (taking “Buy BTC” as an example), choose the price and the payment method as your wish, and click “Buy BTC”

➲Step 2: Enter the total/amount you wish and click “Confirm”.

➲Step 3: On the order page, confirm the amount (total) and payment method of the order.

➲Step 4: In the “Confirm Payment” pop-up window, click “Confirm”.

➲Step 5: Wait for the seller to release the digital assets.

➲Step 6: After the seller releases the digital asset, the transaction is completed.

Note, that is by 5 or 10 minutes, the order has still not been completed following payment; readers have the option of contacting the seller via the ‘call’ icon.

Posting Advertisements On The Platform

As well as a buying option, there is, of course, a selling option for OTC users looking to liquidate their cryptocurrency holdings. For this to take place users are required to do the following:

➲Step 1: Ordinary users must complete the “ID verification” before posting of advertisement is allowed.

➲Step 2: The maximum amount of each advertisement is capped at 2BTC/20EHT/20000USDT/2000EOS/5000HT. (For higher advertisement amount, you need to apply to be a Verified Merchant)

➲Step 3: The OTC account of the Ordinary User must maintain a minimum total asset equivalent to 0.01 BTC or otherwise, the advertisement shall be posted offline or hidden.

➲Step 4: This only applies to Non-China region users.

➲Step 1: A verified merchant shall subject to our strict background check on his/her personal information and is required to pay a security deposit.

➲Step 2: A verified merchant can post higher purchase/sale advertisement.

➲Step 3: A verified merchant can utilize the unique V logo.

➲Step 4: A verified merchant can enjoy the one-to-one exclusive customer service and merchant training program.

Disclaimer: Please only take this information as my OWN opinion and should not be regarded as financial advise in any situation. Please remember to DYOR before making any decisions 🤓

How OTC Trading Helped Maximize My Crypto Investment was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.