Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Whether you’re new to crypto or an experienced investor, you might still wonder, “What is a crypto card?” In this article, we answer all your questions about them. We also look at some of the benefits and challenges for consumers and merchants using crypto cards. Finally, we highlight some of the top crypto cards on the market today to help you better understand the current options for 2018 and beyond.

What Is a Crypto Card?

The answer to this question is actually quite simple. A crypto card is any debit or credit card that allows you to pay using at least one type of cryptocurrency. Crypto cards typically provide you with the option to pay using fiat currency as well.

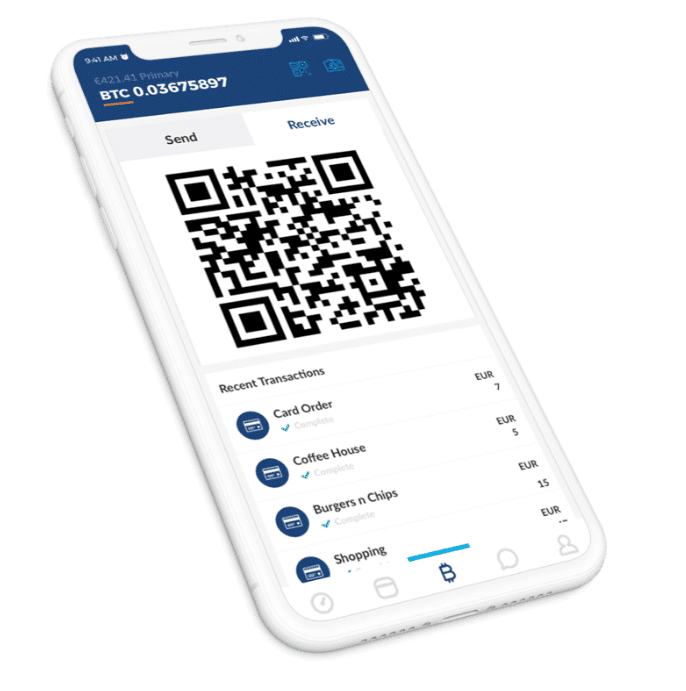

While you may prefer paying with newer payment technologies (i.e. QR code scans with a mobile device), many people like having the option to use a card instead. Most, if not all, crypto cards offer the flexibility to pay using either plastic cards or mobile applications. Both parties win.

Benefits for Consumers

For consumers, there are a few benefits of using a crypto card vs. an ordinary wallet-to-wallet transfer.

While some users might be accustomed to sending P2P crypto payments, many newer users might not be. By allowing crypto payments to occur in ways that are similar to the fiat world, crypto cards bring added convenience and familiarity. These attributes are key components to help crypto reach mainstream adoption.

Additionally, crypto cards don’t require the meticulous process of making sure that a recipient’s address is correct. In many cases, sending to the wrong address means that the sender loses funds altogether or has to pay a recovery fee. By using a QR code or swiping a card, users are able to more easily verify transaction details before sending payments.

Could crypto cards facilitate the widespread adoption of cryptocurrencies?

Challenges for Merchants

Crypto cards aren’t all sunshine and rainbows, though. Merchants have to consider volatile cryptocurrency prices. For example, if a merchant accepted BTC (or most other cryptos) in December 2017, that merchant would probably be a bit frustrated by declining price values throughout 2018. Price fluctuation sparks the infamous sell vs. HODL debate. For merchants who depend on consistency, accepting crypto payments can add risk.

Additionally, merchants simply might not want to take the time to accept new forms of payment that haven’t reached mass adoption. Many stores may choose to wait until user demand reaches a certain level.

Even though there are significant barriers to adoption, merchants should also consider the benefits.

Benefits for Merchants

Merchants should consider the fact that crypto cards have proven the potential to drastically reduce third-party payment processing fees. Cryptos are at least bringing beneficial competition to commerce and could very well become the future of electronic cash systems. This is due in large part to their mission to cut down on transaction fees and processing times.

Additionally, unlike many cryptocurrency exchanges which charge high trading fees, many crypto cards have lower exchange fees. They also simplify the overall crypto-to-fiat exchange process.

Popular Crypto Cards

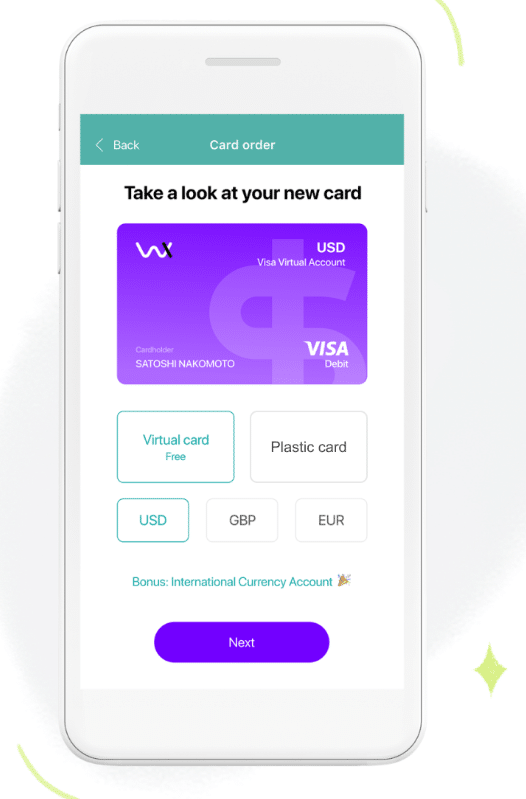

All of the cards listed below offer both virtual cards and plastic cards.

Note that this list doesn’t include all crypto cards on the market and that the policies for these cards (i.e. geographic restrictions and fees) could change in the time after this guide is published.

Wirex

Wirex, previously known as E-coin, is one of the most popular crypto cards on the market. One of the coolest features about this card is that it offers 0.5% crypto cashback for in-store purchases.

Wirex features several key currency integrations. For example, you can store Bitcoin, Litecoin, and Dash in maximum security blockchain wallets. You can also use Wirex to exchange over 50 different altcoins. Most importantly, the app has integrations with several of the most popular fiat payment processors like PayPal, Alipay, and more. This makes it simple for users to buy and sell crypto on the go.

For US investors, however, Wirex is not currently available as of August 2018.

Wirex boasts several important fiat and cryptocurrency payment integrations.

Monaco

Whilst this project did go through two years of delays, it now appears to be on a solid track to user adoption. Monaco is now working to serve a waiting list of approximately 70,000 orders. In summer 2018, Monaco was introduced in Europe and Singapore. In Q4 2018, it’s expected to be available in the US.

Unlike other crypto cards on this list, Monaco has its own native cryptocurrency (MCO) that has consistently ranked relatively high in the market cap rankings. Another interesting tidbit to mention is that Monaco bought the crypto.com domain in 2018 for an undisclosed sum of money.

Details on fees, card options, and more can be found in our Monaco Card beginner’s guide article.

In 2018, the Monaco project team was able to purchase the crypto.com domain name.

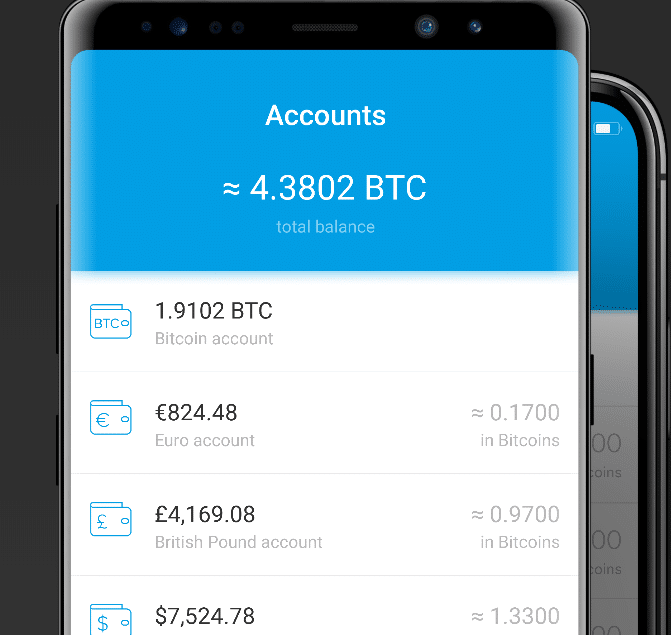

Cryptopay

Founded in 2013, Cryptopay is one of the most established crypto card companies in the market. The project regularly updates user stats that show exactly how popular this card is. As of mid-August 2018, Cryptopay boasts greater than 121,00 prepaid cards issued. It also has over 921,000 active users.

While these numbers are impressive when it comes to crypto cards, it’s also important to consider that average transactions per month are still quite low. For example, there were less than 32,000 Cryptopay transactions in total throughout July 2018. However, this statistic is probably indicative of crypto card adoption usage in general. It”s refreshing to see that Cryptopay makes these stats public as it adds greater transparency between the company and potential users.

Cryptopay frequently releases stats regarding user adoption of its crypto card.

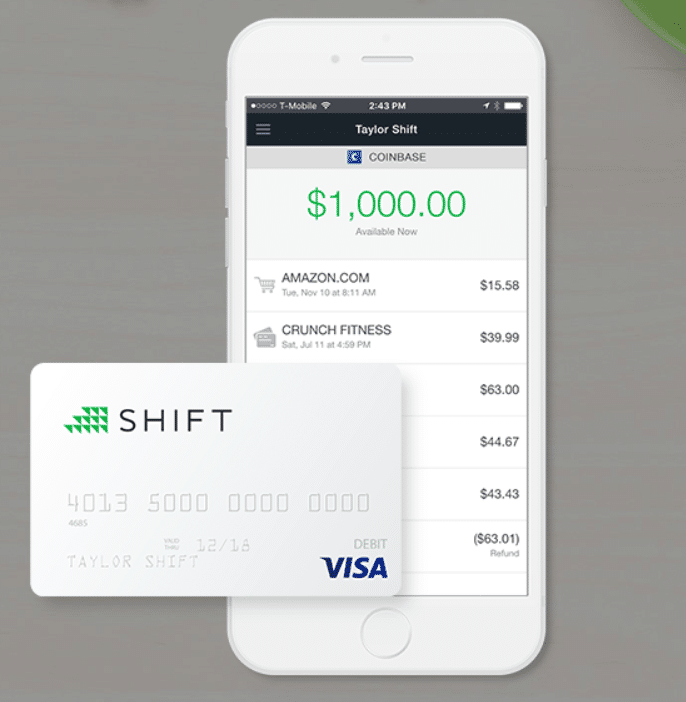

Coinbase Shift Card

As the name suggests, this crypto card is directly associated with Coinbase. Users are able to link their existing Coinbase wallets to the Coinbase Shift Card. Unfortunately, this card is only available in the United States as of August 2018.

The good news is that you have the ability to use this card with 99% (38 million) of the world’s merchants. It also features no monthly fee or POS charges. However, daily spending is limited to $1,000. Also, the daily maximum ATM withdrawal is only $200.

Yes, this card’s possibilities for real-world adoption are limited for now; however, its connection with Coinbase certainly gives it the potential to become a more viable option in the future. This is especially true if Coinbase decides to open up Shift Card registration to users throughout the globe.

While Shift Card limits signups to US users, it can be used to spend online and offline at over 38 million merchants globally. It also allows users to directly link their Coinbase accounts.

Bitwala

When it comes to currency integrations, Bitwala is on a similar (if not higher) level to Wirex. Available fiat currencies include USD, EUR, GBP, JPY, KRW, VND, AUD, and a few South American currencies. In addition, Bitwala has partnered with ShapeShift, a popular cryptocurrency exchange. This means that users can send and receive a variety of cryptocurrencies, including several emerging altcoins.

One of the biggest upsides is that Level 3 users can spend up to €50,000 per month with one account. This only requires a quick Skype session with a company representative. It’s also possible for you to raise this limit to €100,000. As a Level 4 business user, you can spend up to €500,000 per month. This is significantly higher than most other crypto cards on the market today. One downside, however, is that Bitwala isn’t available in the US as of August 2018.

Bitwala has some of the highest monthly spending limits of any crypto card on the market.

Conclusion

In 2018, there are still a number of fees to consider when using crypto cards. For example, many do charge a 3% fee for international transactions. There are also geographic limitations to consider. While you can pay in fiat in many locations, crypto payments still rely upon merchant adoption.

For now, crypto cards don’t quite make borderless commerce a reality. Despite these issues, crypto cards are still important because they offer a link between the fiat and cryptocurrency-based economies. As a result, this link makes it possible to create a better foundation for a variety of cryptocurrencies to gain mainstream adoption as forms of P2P payments.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.