Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Source: WFP

Source: WFPToday’s Agenda

- VISA — B2B Connect

- World Food Program — Building Blocks

- DeBeers — Tracr

1. VISA B2B Connect

Source: Visa1.1 Problem To Be Solved

Source: Visa1.1 Problem To Be Solved

- Address challenges with traditional cross-border and cross-currency non-card payments

1.2 Promise

- Predictable and Transparent: Participating banks and their corporate clients receive near real-time transaction notification and finality of payment

- Secure: Signed and cryptographically linked transactions designed to ensure an immutable system of record

- Trusted: All parties in the network are known participants on a permissioned private blockchain

1.3 How It Works

- Blockchain Type: Permissioned private blockchain

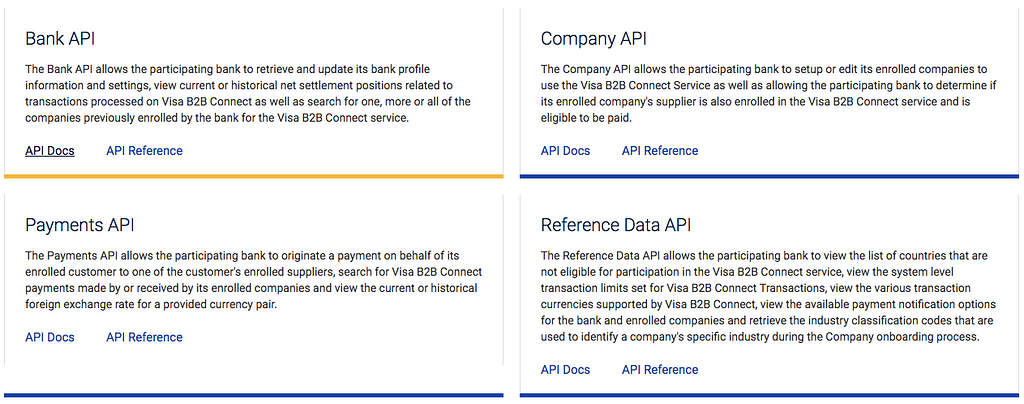

- Interaction Interface: Participating banks can choose to integrate to the suite of Visa B2B Connect APIs to enable development of an end-to-end B2B payments solution that allows them to on-board their customers, setup their suppliers, check Visa B2B Connect foreign exchange rates and submit payments. Alternatively, they can choose to integrate to a subset of the APIs to address more specific needs, such as checking on the status of a payment

Source: VISA1.4 Pilot Partners

Source: VISA1.4 Pilot Partners

- Key Technologies: Chain (ledger-as-a-service)

- Issuer Banks: Commerce Bank (US), Shinhan Bank (South Korea), the Union Bank (Philippines) and the United Overseas Bank (Singapore)

1.5 How To Get In

- Sandbox: The Visa B2B Connect APIs can be used by any developer in the sandbox with registration and acceptance of terms and conditions

- Approval: However, only participating pilot banks and their technology partners will be able to use these APIs in production. Bank participation in the pilot is subject to Visa approval and execution of the pilot participation agreement

1.6 Roadmap

- Early 2018: Testing starts.

- Mid 2018: Commercial Launch

1.7 Results

- “Remember, blockchain actually is not very good about facilitating low-value high-volume scale transactions, which is the core of what we do. So, you’re not going to see us make any announcements that blockchain — we’re moving a blockchain to in any way, shape or form to drive our core business.” — VISA CEO Alfred Kelly in July 2018

2. World Food Programme — Building Blocks

Source: WFP2.1 Problem To Be Solved

Source: WFP2.1 Problem To Be Solved

- Background: Every year, WFP assists over 80 million people in 80 countries, making it the largest humanitarian organisation in the world.

- Now: When refugees would purchase food from their local grocery stores, the bank would validate these transactions and then settle with the retailers at the end of every month. After taking their fees, the banks would then provide a summary of account balances to WFP

- Silver Lining: It will tackle a central problem in any humanitarian crisis: how do you get people without government identity documents or a bank account into a financial and legal system where those things are prerequisites to getting a job and living a secure life?

2.2 Promise

- A wallet, filled with camp transaction history, government ID, and access to financial accounts, all linked through a blockchain-based identity system. With such a wallet, you can more easily enter the world economy

2.3 How It Works

- Blockchain Type: Permissioned Ethereum-based payments run by Parity Technologies

- Interaction Interface: The new system provides accounts to every beneficiary on the WFP’s blockchain. Transactions are instantly verified and continuously monitored without the need for a bank to summarise and report in end-of-month batches, allowing Building Blocks to monitor funds without waiting a second. At the end of every month, the WFP directly settles with every merchant, saving on transaction fees and assuring the security of the refugees’ data

- Other Technologies: Since many refugees may not have smartphones or stable internet connections, they are given identification services via iris scans which in turn provided them with a convenient way to buy the food they need. Another verification option includes an SMS-based service that allows beneficiaries to verify transactions with a 2-factor authentication PIN code

- Key Technologies: Parity Technologies

- Key Partners: Jordanian Government, UN

2.5 How To Get In

- PoA does not depend on nodes solving arbitrarily difficult mathematical problems, but instead uses a set of “authorities” — nodes that are explicitly allowed to create new blocks and secure the blockchain. The chain has to be signed off by the majority of authorities, in which case it becomes a part of the permanent record

- This makes it easier to maintain a private chain and keep the block issuers accountable. It also means that WFP has the sole right to appoint “authorities”

2.6 Roadmap

- Jan 2017: The World Food Program initiated a Proof of Concept using blockchain for authenticating & registering transactions in Pakistan. Next, a more robust pilot was launched in Jordan

- Jan 2018: Pilot expands to include over 100,000 people

- Next stage: Expansion to all 500,000 Syrian refugees in Jordan (estimated end of year)

2.7 Results

- Cost-savings: Reduce the number of cash transactions from 10,000 upfront payments to the banks to 200 settlement transactions to local retailers per month. This saved the WFP significant money in upfront costs, as well as 1.5% to 3% per transaction

- Fighting Corruption: The pilot in Jordan alone is said to save the agency $150,000 a month while eliminating a staggering 98% of bank-related transfer fees. That’s a big deal, since upwards of 30 percent of UN assistance is lost to corruption

- Challenge 1: Ultimately, the question with Building Blocks or any similar system is whether it will put ownership of digital IDs in the hands of the people being represented or simply become an easier way for corporations and states to control people’s digital existence

- Challenge 2: The real promise of using blockchains may not be realised until organisations like the WFP and the UN have the courage to open at least parts of the system to other agencies, and then to take the bravest step of all and turn over ownership of the data beneficiaries, who currently have little say in the matter — you have to be in the system if you want to eat

3. DeBeers — Tracr

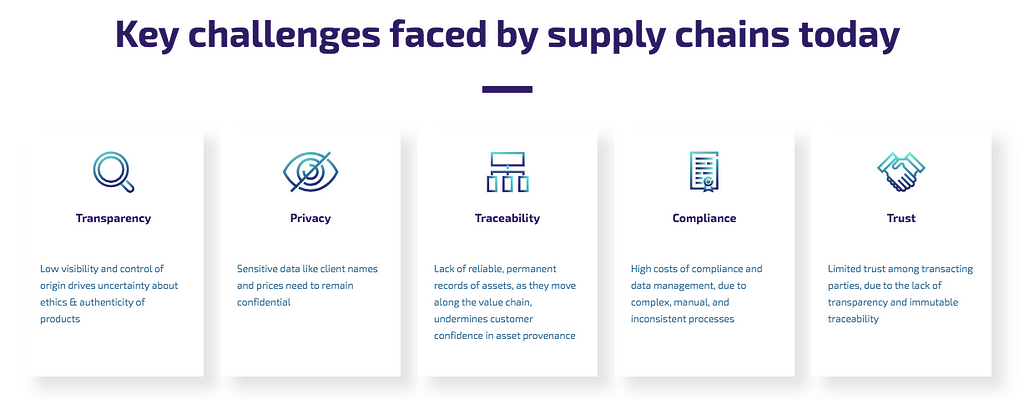

3.1 Problem To Be Solved

- Clear the supply chain of imposters and conflict minerals

- Tracr is the first collaborative, industry-focused digital platform that securely tracks a diamond across the full value chain, providing consumers with confidence, the trade with increased efficiency and lower costs, and lenders to the industry with greater visibility

3.3 How It Works

- Blockchain Type: Ethereum

- Interaction Interface: Privacy controls restrict access to sensitive data, while maintaining traceability. Personal and organisational identities and KYC (Know Your Customer) are digitally managed to ensure accountability. Uploaded data is protected by asymmetric cryptography. Data science and physical ID techniques allow for tracking of diamonds from rough to polished with confidence

- Other Technologies 1: Tracr is compatible with existing ERP (record-keeping) and stock tracing systems like AX and Fantasy, among others. Although the teams aims continue to integrate with a broader spectrum of systems, some simple file upload-based methods that should make it easy for anyone in the industry to participate. The team is working on an integration layer allowing for more direct and real-time data updates

- Other Technologies 2: In addition to a simple barcode-based unique ID, Tracr incorporates complex data science models to create a unique signature for rough and polished diamonds alike. Once this signature is created, a diamond can forever be verified against it to prevent fraud of any kind

Source: Tracr3.4 Pilot Partners

Source: Tracr3.4 Pilot Partners

- Key Technologies: Co-developed by BCG Digital Ventures

- Key Partners: Producers, Banks, Sightholders, Diamond Offices, Traders, Logistics, Graders, Retailers (DeBeers, Diacore, Diarough, KGK Group, Rosy Blue NV and Venus Jewel, Signet Jewelers)

3.5 How To Get In

- Entry upon KYC completion. Governance mechanism undecided

- Uploaded data will help create an immutable and tamper-proof trail of a diamond’s journey along the value chain providing benefits for all participants, but at no point in time will it be visible to anyone outside the organisation which owns it (unless the data owner chooses to share it).

3.6 Roadmap

- Jan 2018: De Beers looks into blockchain to improve transparency of the diamond value chain.

3.7 Results

- Asset-traceability: In early May, De Beers announced that it had successfully tracked 100 high-value diamonds along the value chain on Tracr, marking the first time a diamond’s journey has been digitally tracked from mine to retail

- Challenge : Potentially problematic to employ a yet-to-be-decided governance mechanism considering the large number of pilot participants. Statement Tracr: Tracr is designed to be an inclusive and open platform for the diamond industry, which will be reflected in its governance structure

4. Observations

- Most corporate-led pilots have a high degree of centralisation, using PoA consensus mechanisms (WFP), permissioned private blockchains (VISA) or KYC (DeBeers). Since the WFP has control over who joins its network, it also has the power to rewrite transaction histories. Instead of cutting banks out of the equation, it has essentially become one

- Centralisation & Decentralisation sit on two ends of a spectrum. A slight shift towards the decentralisation camp is already yielding results. Taking Tracr as an example, securely tracking a diamond across the full value chain is impossible without industry-wide collaboration

- Appetite for coalitions, to learn, but also to share risk. DeBeers and VISA both work with a broad coalition to accelerate learning (the more data touch-points, the more well-rounded learnings are likely to be), but also to lend legitimacy to initiatives

- The friendlier the blockchain implementation to legacy processes, the higher the likelihood of adoption. Centralised organisations won’t become decentralised overnight

- The cost of blockchain projects isn’t just blockchain related. Blockchain is useless if the wrong data is recorded. To store data you’ve never stored, you need to use tools you’ve never used. In addition to a simple barcode-based unique ID, Tracr incorporates complex data science models to create a unique signature for rough and polished diamonds alike. Once this signature is created, a diamond can forever be verified against it to prevent fraud of any kind

- Experimenting with blockchain is palatable to corporations. Crypto-assets, less so. The prevailing sentiment is that blockchain can benefit compliance, whereas tokens complicate it

- That being said, the first Fortune 500 company to crack tokenisation will have a significant first mover advantage. Think Blue Ocean strategy

- In the next year(s) Fortune 500 companies will apply start-up learnings at scale. May 2015: Leanne Wood founded Everledger, a global digital registry to tackle “blood diamonds”. Jan 2018: De Beers looks into blockchain to improve transparency of the diamond value chain

- Business goals go beyond new revenue streams, ranging from a more traditional fee-based service (VISA) to saving costs (WFP saves $150,000 a month while eliminating a staggering 98% of bank-related transfer fees), to boosting consumer confidence to increase the overall target market (DeBeers)

- There are benefits and downsides to using an external development team. To get a pilot going large corporations often use an external development teams, e.g. Tracr was developed in cooporation with BCG Digital Ventures. The upside: developers with exposure to multiple projects. The downside: blockchain talent is in short supply. The take-away: bringing a blockchain pilot internally takes longer than you think, potentially delaying the roadmap

—

What do you think of these pilots, and which pilots do you want us to cover next? Any information missing that should be there? Tell us in the comments!

Arwen Smit (@arwensmit) is CEO at MintBit (www.mintbit.io). Follow us for the blockchain insights on Twitter at @mintbit_.

Learning from Blockchain Pilots was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.