Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

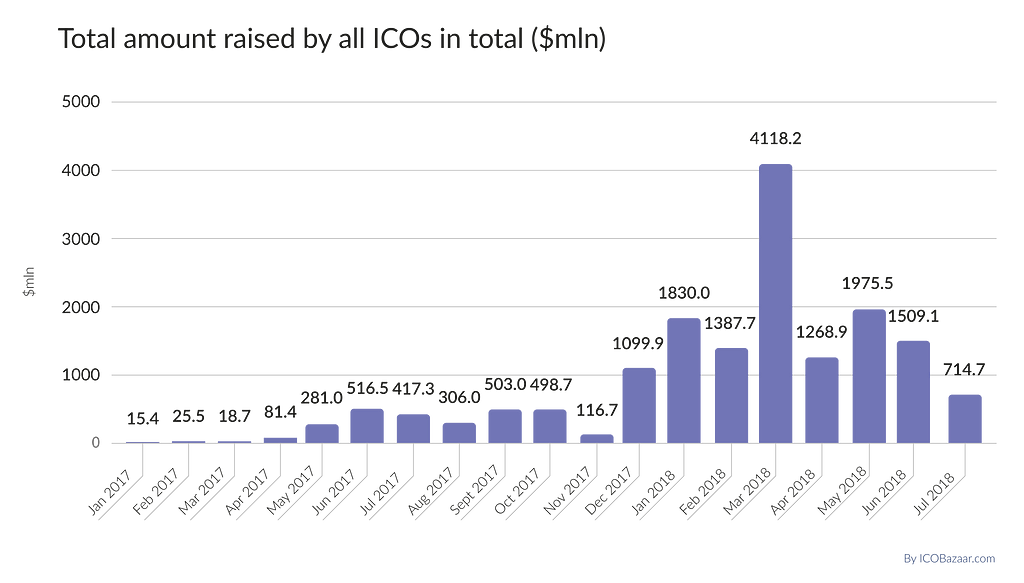

$715 mln raised total, 51% closed sale report rate

Market overview

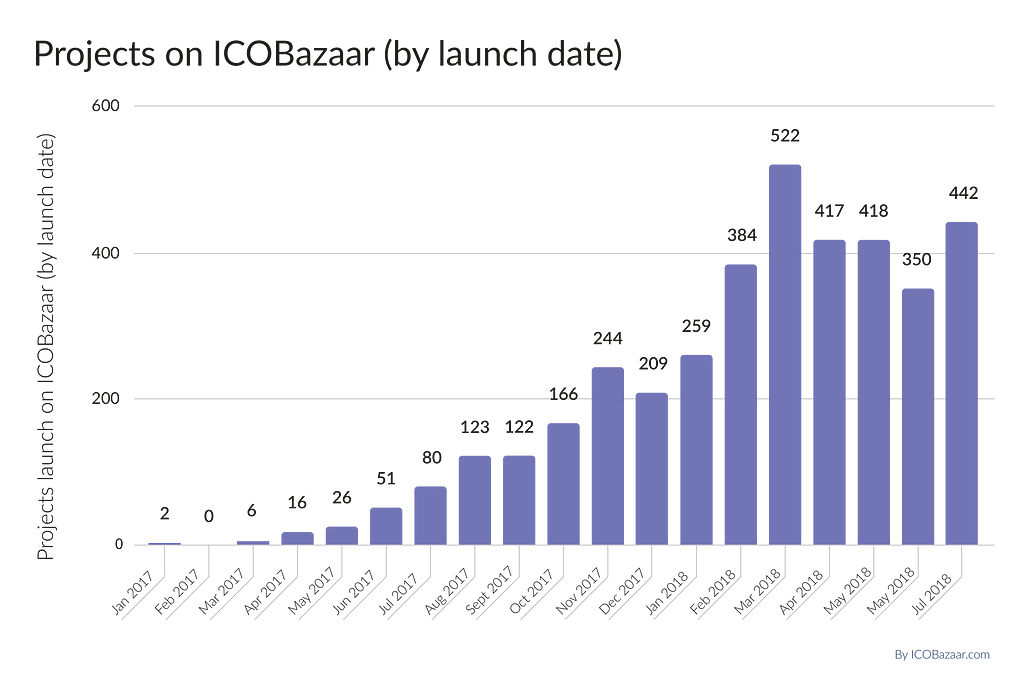

400+ ICO data analyzed by one of top listing platforms ICO Bazaar. $714 mln raised in July, twice less than in June. A clear delayed effect of the summer decrease in investors’ activity due to vacation season.

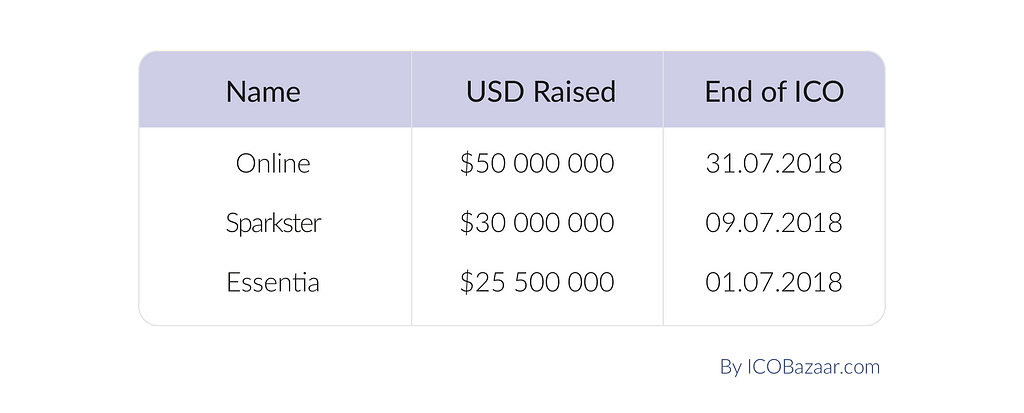

Most successful projects of the month are Online with $50 mln raised, Sparkster with $30 mln raised, Essentia with $24,5 mln raised.

In July we didn’t have any of those extremely successful ICO projects with billions of funds raised (comparing with El Petro ICO in February, Telegram ICO in May and EOS finally closed at the beginning of June).

Top ICO by funds raised in June

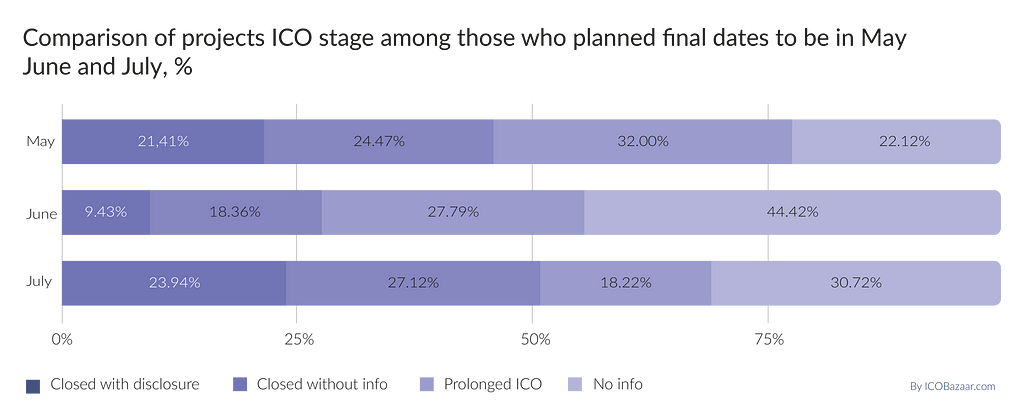

ICO token sale disclosure rate

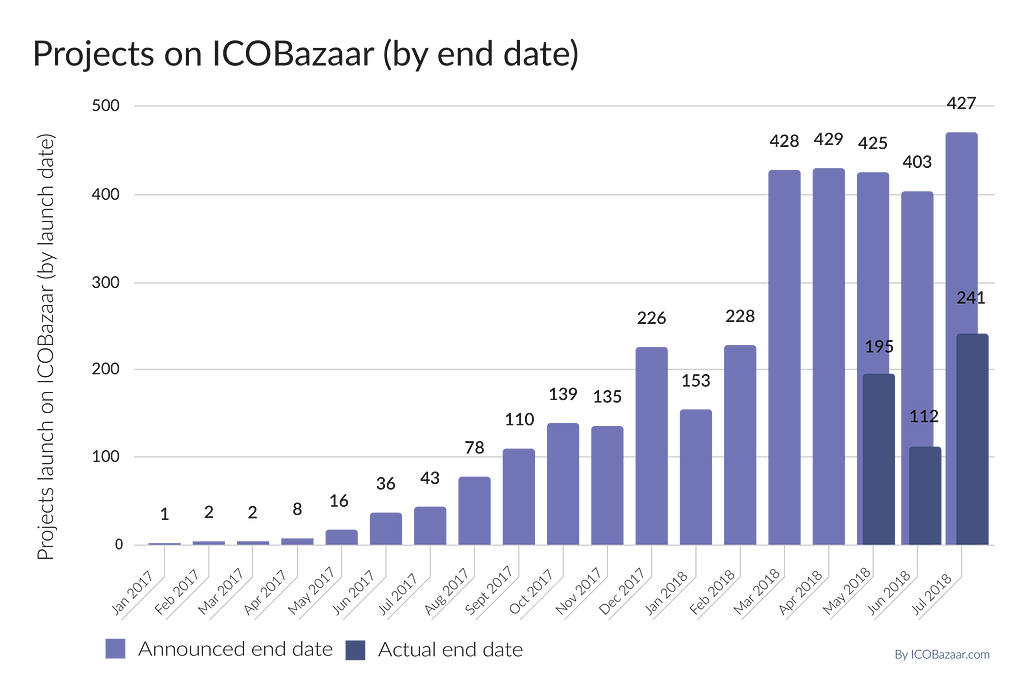

In July 51% of projects officially closed their ICO as they planned (241 out of 472). This result differs from June (30%) and May (46%).

24% — closed with disclosure

27% — closed without info

18% — prolonged ICO

31% — no report

June so far was a month with the least amount of open information, more than 44% of ICO did not publish information about their plans and did not appear in the calculations. Despite the significant reduction in the accumulated token sale results, the number of launching projects remains quite high (26% higher than in June). Comparing the number of announced token sale endings, the difference would be 17% higher in July. Actual token sale end rate in July is twice higher than in June — 241 vs 112.

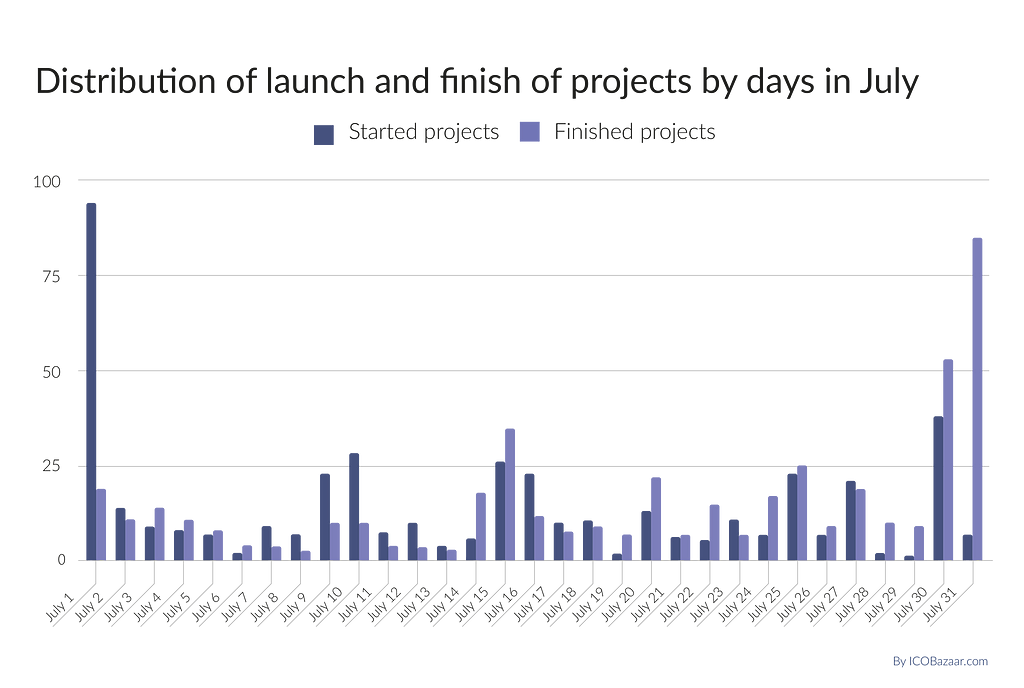

Only half of ICO planned for summer actually did start and end token sales. 50% of both start and end dates were postponed. The chart below shows that the beginning of the month is usually an attractive start date. The same works for the last date of a month and the end date (and also similar to June market insights).

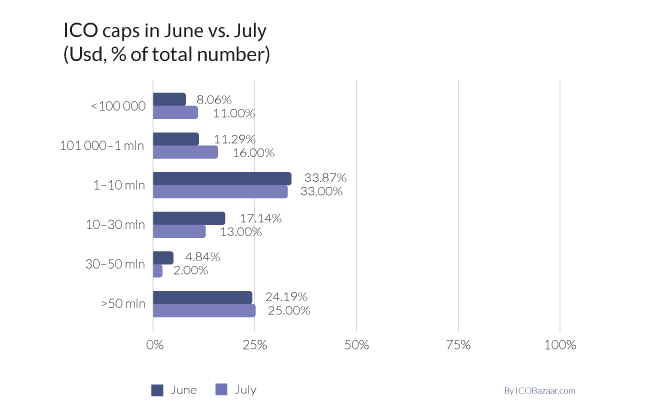

Hardcaps the projects that ended in July did not differ much from the June projects. Still, there is a trend for more ambitious hardcaps. For example, the average ICO goal in May was about $1.2 mln, $3.9 mln in June and $4.2 mln in July.

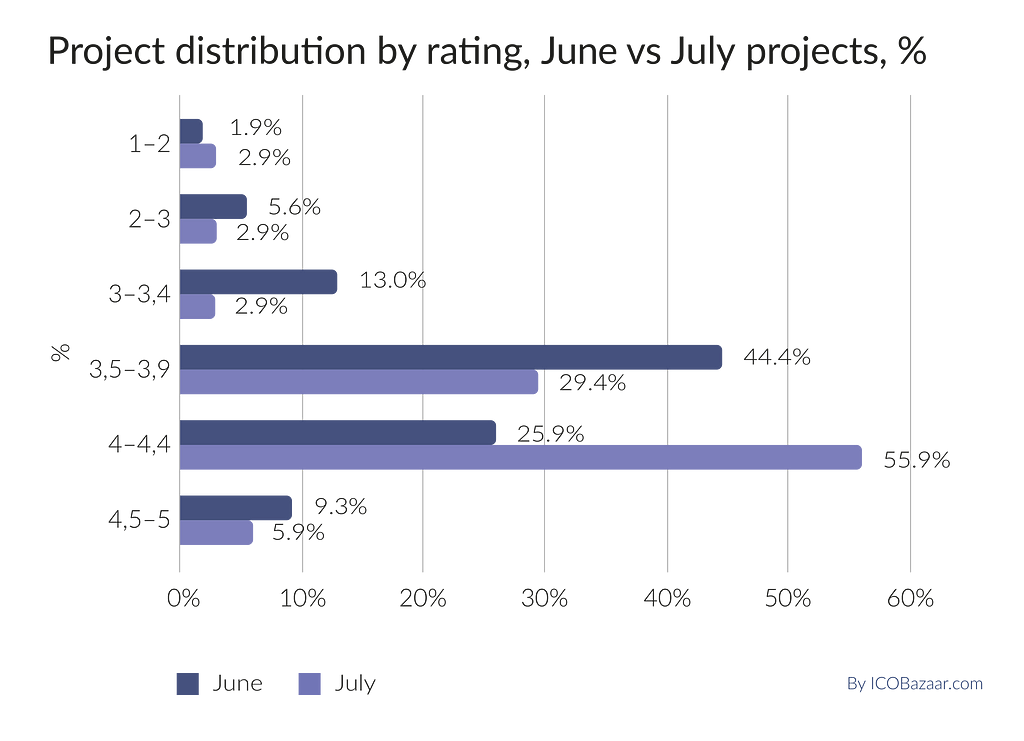

ICObazaar rating — higher results in July

In July the number of projects with a rating score below 3 points decreased by 22%, while the number of strong medium projects with a score below 4 points increased by 76%. The number of top-rated ICO also decreased by 30%.

Source: ICOBazaar.com

What is behind the rating?

In general, the growth of ICO number rated from 4 to 4,4 points was due stronger technological side of the project. The weakest point for many projects during the last 3 months is media. Often the result of the initial idea evaluation is below the final average rating.

Top-5 projects rated in July

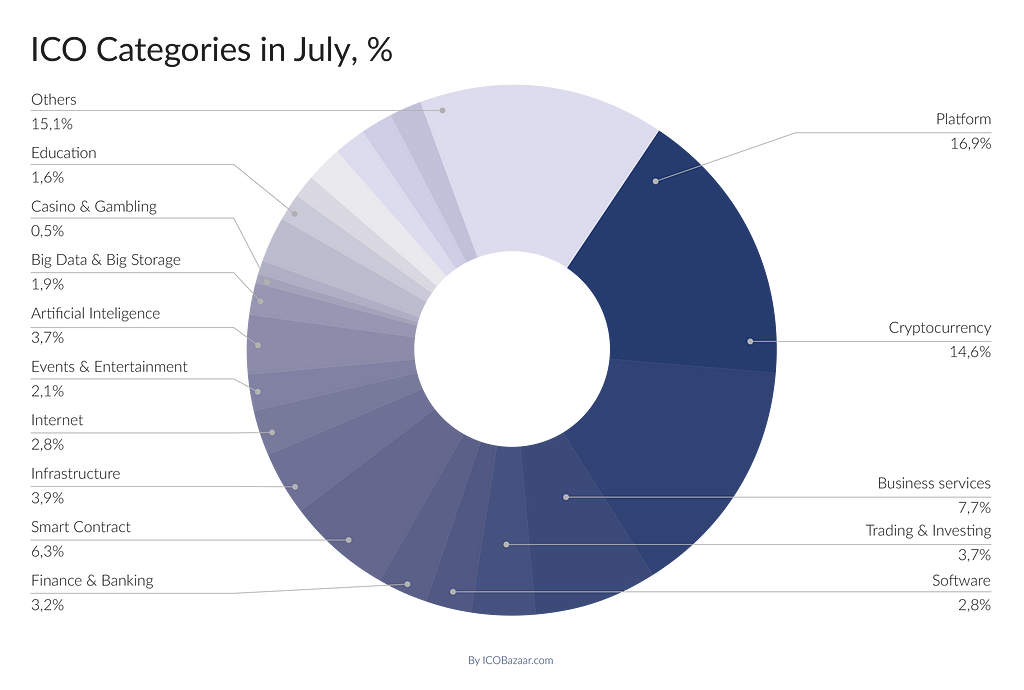

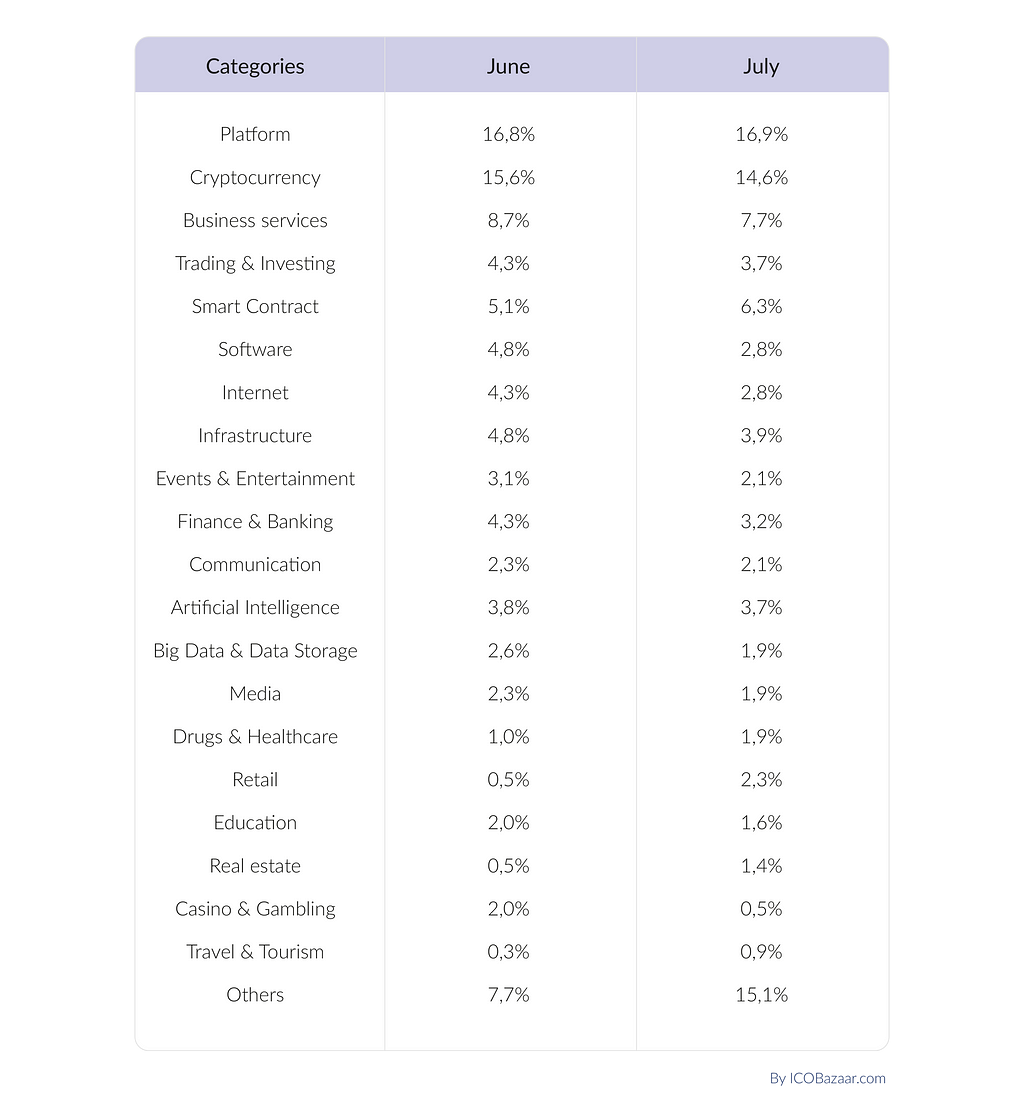

Top ICO categories

Most popular ICO categories in July (the same as in June) were Platform, Cryptocurrency and Business services — 39% of all projects. Then goes Smart Contract, Infrastructure and “Trading & Investing with 13,9%. Smart contract category gained +23% increase comparing to June. Other growing categories: Retail (+355%), Real estate (+173%), Travel & Tourism (+264%)

All most popular categories showed slight decrease: “Cryptocurrency”, “Business services”, “Trading & Investing”, “Software”, “Internet”, “Infrastructure”, “Events & Entertainment” together lost 17% from the June result.

ICO by categories July vs. June

What to expect

We see that in July the amount of launched projects slightly raised but the number of funds raised decreased drastically. This can be explained by the fact that not all projects have yet reported on the conducted IСO, and in the next cycle, these results will be updated. In August, we expect an increase in the number of projects, but the funds will remain at a low level. A significant increase in fees can be expected in the autumn when investors return to active work.

Top-20 public ICOs ended in June 2018 by amount raised

Check out ICObazaar Telegram channel for more updates on ICO market.

July ICO Market Report was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.