Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Photo by rawpixel on UnsplashTo Get Closer To “Yes”

Photo by rawpixel on UnsplashTo Get Closer To “Yes”

If you’ve demonstrated traction in the market, believe you’re in a position for capital infusion to optimize growth and built an investor lead list, then it’s time to design an investor commitment checklist. It’s imperative to follow a systematic process when raising funding for your startup. Developing a checklist can help make your fundraising more efficient especially if you’re pressed for time.

Upon receiving hard commitments from investors (i.e. wire in the bank) it’s even more vital to keep track of soft circles. A soft circle is a commitment, but not a legally binding one.

“Hard circle is a commitment to invest; soft circle is an indication of potential — often conditional — interest. The former can, theoretically, be relied upon in building up a round. The latter is typically somewhere between conceivable and aspirational.” — David S. Rose, Managing Partner, Rose Tech Ventures

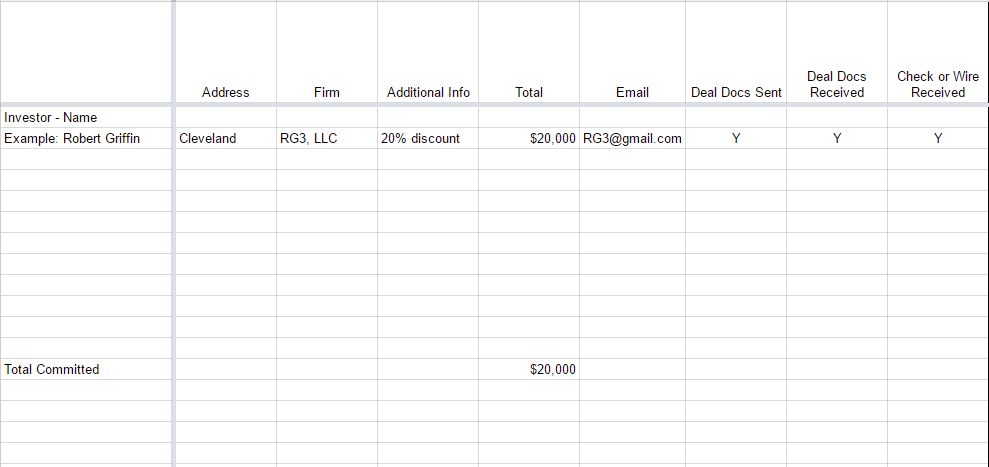

Much like an investors investment decision checklist, founders should develop a strategy worked out in advance by starting with a list of items and points to be considered in order to fill the round. The checklist includes:

- Name of investors/prospects

- Location/Address

- Firm/LLC/Angel Group

- Additional info/rights/discounts

- Amount of investment

- Contact info

- Deal docs sent/received

- Wire received

- Email wire confirmation to investor

- Upload signed docs to file hosting service (Dropbox, Google Drive)

- Add investor to CRM for investor updates

- Update investment name, address, amount on operating agreement

- Update tax prep/EIN

Tracking commitments in a Google Sheet is also helpful for inserting comments within cells detailing when you last spoke with them or why they haven’t wired funds yet. To further help startups stay on top of investor commitments, I recommend the following template which gives founders a better sense of how many soft circles are needed to convert.

Investor Commitment Template (Click File > Make A Copy to build your own)

Investor Commitment Template (Click File > Make A Copy to build your own)

As John Sechrest, Founder of Seattle Angel Conference, stated, “the distance from a “yes, I will invest” to a “check in the bank” is much much further than you think.” Remember to do your due diligence on finding investors or other sources of capital that best suit your startup’s needs. These commitments are qualified leads that you have already met with, pitched and discussed the terms of the deal.

Build An Investor Commitment Checklist was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.