Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Let’s Face It

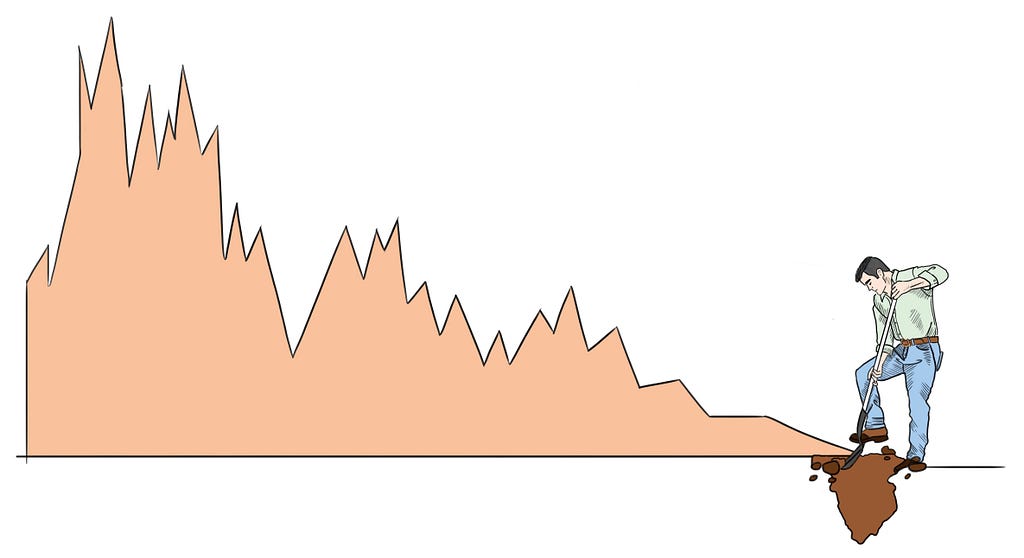

The crypto markets are currently f*cked. Between the consistent manipulation they face, as well as specific issues per individual major exchanges like Coinbase Pro, Binance, and Bittrex, there is a lot to be concerned about when making even the simplest of token swaps and transfers. There are bots to beat, whales to wade through, advisors to avoid, and ICO’s to ignore. But adorable wordplay aside, the numerous obstacles in crypto markets today have jaded many investors and traders, and the hinderances have cost both annoyingly small to devastatingly large fortunes to many.

Regulating cryptocurrency would not necessarily unf*ck the markets by any means. In fact, it may just end up f*cking it even more. Here is a short list of cons associated with making crypto more regulated:

- People have invested their money into crypto as a way to break free from centralized governments. If the biggest advantage to cryptocurrency (decentralization) was taken away, it would defeat the purpose of using it as an investment vehicle, and values would plummet as more and more limitations are imposed on what investors and exchanges can and can’t do. The ideological objective of cryptocurrency would ultimately be lost.

- Regulatory practices can lead to abuse of power, and with decentralized assets in the hands of a centralized power, there would be major concern over how those in power are using cryptocurrency for their own agenda.

- Unless regulations are entirely unflawed and seamless, those savvy enough to find loopholes in them would greatly be able to manipulate the new system in place.

As for the pros of centralization and regulation of cryptocurrency:

- Regulation would strongly encourage the reduction of ICO scams, manipulative tactics, and complete exchange implosions. There would also be more price stability due to the strong decrease in pump and dump groups and manipulative tactics like wash trading.

- Intentions of regulatory practices would be to build a safer space to invest in cryptocurrency. Ensuring the safety of exchanges would not necessarily end the deregulatory nature of cryptoassets themselves.

- There would be an increase in awareness, and central authorities would be able to inform the masses of what crypto is and how to invest in it.

The irony of it all is that the unregulated nature of crypto brokers and exchanges is something cryptocurrency and its traders would like to maintain at all costs (even if many don’t realize it) in order to break away from the lack of freedom and flexibility typically synonymous with traditional brokerages. Michael Maisch from Handelsblatt Global explains,

“Regulators and policymakers should, of course, ensure that trading takes place in a regulated manner, and they should try to immunize the market as much as possible against attempts at manipulation. But beyond that, there is currently no reason to regulate the cryptocurrency just because overzealous politicians believe that cybercoins are as harmful to uninhibited investors as smoking or hard drugs.”

The pain, manipulation, and corruption involved in the markets can incur steep side effects. Staying unregulated is a double edged sword in the sense that there are so many obstacles intended to take your money, yet you have the power to be the shark of these markets yourself and use the lack of established rules to your advantage. Manipulation, the disadvantages that low-capital traders face, the amount of shoddy advice that pose as professional knowledge, and the minefield that are ICO’s are all legitimate concerns that we all keep our heads on a swivel for. Even the most experienced traders can fall prey to these, and the successful ones have simply found a fortunate way to work around them.

The foregone conclusion revolving around crypto is that the markets are not going to be unf*cked any time soon, and the best way to survive trading in them is to simply be knowledgeable of the problems they face. That is not to say there aren’t bright spots on the horizon — the new algorithmic trading platform, Samsa.ai, is looking at ways to help traders move away from all of the landmines they face in these highly volatile markets. But, until the following market environment conditions outlined below are improved, crypto traders currently are, to be blunt, f*cked.

Disadvantaged Trading

When it comes to trading cryptocurrency, there is a pretty pronounced and glaring disadvantage to being a small fish in a big pond full of whales. And yes, it’s a lot more glaring than the discrepancy in traditional markets. Making good decisions based on market news and research to accurately assess coin values can be very helpful in being a profitable trader. But what if you’re one of the fortunate ones to have the capital to at least temporarily sway the market in the direction you’d like it to go whenever you please? Do rational, research-based decisions even matter?

“We’re going lower, folks!” warned nobody who actually had control over the price of Bitcoin, ever.

“We’re going lower, folks!” warned nobody who actually had control over the price of Bitcoin, ever.

According to a fascinating article by Hackernoon author Bitfinex’ed, there is a bot he has discovered, which he dubs “Spoofy”, that is able to pull and manipulate the price of Bitcoin on the Bitfinex exchange just as he pleases. He states,

“Spoofy makes the price go up when he wants it to go up, and Spoofy makes the price go down when he wants it to go down, and he’s got the coin… both USD, and Bitcoin of course to pull it off, and with impunity on Bitfinex.”

To assume Spoofy is an isolated instance of this kind of trader, one that manipulates the market as it pleases using its overwhelmingly large capital (from God knows what source), would be incredibly optimistic. The reality is that there are numerous Bitcoin and other altcoin whales that skew the markets in their favor on a daily basis. If you are not someone who can singlehandedly push prices up and down as you please, then you are effectively at a disadvantage and at the mercy of accounts like Spoofy, who can essentially dictate the direction markets go.

The fact of the matter is that most of us are not Spoofy, nor do most of us own millions in cryptoassets that can effectively sway the markets in our favor just from using sheer capital. We are small players in a giant room full of millions of other small players and a handful of big players, who more or less tell us when it’s time for us to enjoy crypto growth or alternatively bury our heads and panic.

Bad Advising Sources

As much as we like to joke about fake news in politics and various topics that pour all over our Facebook feeds, these bogus sources are a legitimate problem for crypto traders. It is disheartening that we have the sheer number of contradictory, biased, and ulterior motive-laced stories telling traders exactly what they should do next, but it should be expected in such a young and booming asset class. Unless you really know what news stories are significant, let alone real, it can be easy to get caught up in following the market’s lead in the wrong direction.

Sources may tell you a certain coin is going to change the world, only to pull the rug out from underneath you as soon as they’ve completed their agendas.

Sources may tell you a certain coin is going to change the world, only to pull the rug out from underneath you as soon as they’ve completed their agendas.

Take the news in late 2017 about IOTA partnering with Microsoft and Cisco, for example. Initially announced in late November 2017, IOTA’s market cap quickly soared from $3 billion to $17 billion. The excitement of a coin adopting real world use in tandem with two technological leaders was enough to cause mass hysteria across the crypto community. However, just two weeks later IOTA cooled off the rumor by claiming that they had no formal partnership, and they were simply “…working together with more than 30 of the largest companies in the world on the marketplace as a co-innovation exercise.” As you may guess, the value of IOTA plummeted right back to where it began, and many traders who had jumped on board the bullish news ended up becoming very light bag-holders.

Here are a few tips for avoiding fake news and incorrectly reacting to news and falsified/exaggerated stories:

- Take social media crypto news with a grain of salt — There are plenty of reliable Facebook and Twitter posters out there who provide great source-based content with cited and fact-based information. They usually have a high number of followers and active, insightful comment sections. However, literally anyone can post on social networks about Bitcoin’s impending demise or a new sh*tcoin’s path to reaching the top 5 on Coinmarketcap by next week (despite it currently being ranked 1,064th). Don’t assume they know what they’re talking about. For all you know, they are making their predictions as a tongue in cheek comment to get laughs, or to follow through on a cruel social experiment to see how many sheep they can convince of nonsense. If half of their posts are rehashed memes from a year ago and their comment sections are full of people putting each other down and inciting internet fights, it may be an indicator that you’re paying attention to the wrong people.

- Follow experts who have been through the ups and downs — Long-time crypto traders who have been through the Mt. Gox debacle, numerous country bans and unbans, and ridiculous hoaxes such as the fake death of the founder of Ethereum tend to press the panic button only when needed. Having people in your newsfeed that are reliable voices of reason is a great way to avoid overreacting yourself.

- Look for sources within your sources — If a major news story is being reported on a non-credible site or one you’re unfamiliar with, see what types of citations/links they have for their story. Are there similar reports of this story literally anywhere else on the web besides this Reddit post you’re viewing with 6 upvotes? Maybe wait for it to show up elsewhere before assuming it as truth.

Initial Offering Hype — The Real Bubble Indicator

For starters, one thing notable during the peak of the dot-com bubble was how companies raised funding simply through the notion that it had potential to grow into something big. Initial public offerings, better known as IPO’s, were commonly used as vehicles for these companies to gain traction and go public despite many of them having no history of public use or generation of any profit or revenue. Does this sound familiar? Well cryptocurrencies use similar methods for new crypto tokens looking to fundraise, known as initial coin offerings (ICO’s).

“Yes, peasants. My ICO will indeed cure cancer, fly us to Neptune, and provide the ability to time travel to meet Marty and Doc in their DeLorean. It’s the latest new Bitcoin of Bitcoins! Just trust me on this one.”

“Yes, peasants. My ICO will indeed cure cancer, fly us to Neptune, and provide the ability to time travel to meet Marty and Doc in their DeLorean. It’s the latest new Bitcoin of Bitcoins! Just trust me on this one.”

These ICO’s are based on attracting investors to buy into coins with potential use cases and they essentially function as a “crowdfund” in the cryptocurrency world. They are opportunities for individuals with interest in a coin to “get in on the ground floor” in hopes that the coin and team running the respective coin will turn it into something successful, thus generating significant profit for investors. ICO’s are certainly helpful for getting deserving coins to emerge, and there are several success stories, such as Ethereum’s 2014 ICO, which raised over $18 million for $0.40 per coin (now currently sitting at $281 as of August 15, 2018). However, there are more than a handful of unsuccessful ICO’s as well. According to the article from Kai Sedgwick, a crypto analyst at news.bitcoin.com,

“Many of the 531 ICOs that have failed or are failing from last year looked sketchy from the very start. In most cases, investors were able to spot the signs and steer clear. Not everyone escaped unscathed though: these projects still raised $233 million between them… Thanks to diminished returns, increased competition, and a never-ending stream of opportunistic ICOs, crypto investing in 2018 is riskier than ever.”

Just as we saw during the internet bubble, ICO’s with very little promise received tremendous backing, particularly during the latter part of 2017 when cryptocurrency went on its massive historic bull run. Investors enjoy making gambles on small projects in sectors that are thriving. But their own choices can often lead them astray.

ICO and S-Token Scams

Initial coin offerings (ICO’s) can often be very appealing to investors for the massive return potential of a coin and huge risk/reward payoff if it breaks through to market. But the success rate of ICO’s have historically been dreadfully low, hence the risk. In fact, the list of coins that funded through ICO’s and made it to market is alarmingly small compared to the massive list of total ICO’s that have historically been offered to investors. However, the tokens that have succeeded have rewarded their investors beyond handsomely, with lists revealing that ICO’s like NEO have returned a 294,000% ROI since becoming publicly traded.

Investing in an initial coin offering can be a major risk, and it’s really the ultimate gamble in investing. Nearly every ICO token these days claims to be world changing, yet very few live up to their promises. Many don’t even have any intention of ever going public. Raw data suggests that the majority of the time, investors simply shouldn’t believe the hype of even the most well put together white papers. Keep in mind that looking at a coin’s initial plans on these feature documents can vary drastically from what their actual publicly listed product will end up being. Many modifications, tweaks, additions, and subtractions can be made to their initial plans before things are actually made official. This is why white papers are best used as a guide for investors to understand what big points a particular coin’s ICO is addressing on the blockchain. Not as the end all be all basis for deciding whether they are worth your time to invest in.

Rob May, the CEO of Talla.com, voices his opinion, stating:

“I think it is much better to evaluate a blockchain the way you evaluate a startup — you assume the starting point is a starting point, not an end point. Crypto buyers, it seems to me, evaluate a white paper like a final product, and that is where they go wrong.”

In 2016, $95 million was raised by 43 different initial coin offerings. In 2017, the number ballooned roughly 39 times that value to $3.7 billion, spread across 209 separate ICO’s. As of the first half of this year, 2018 ICO’s raised $12 billion, and there is no sign of a slow down with the price and volume of Bitcoin picking up significantly in recent weeks (mid-July). If the year continues at this overall rate, $30 billion in ICO funds raised is certainly within reach.

Beating the Markets — David vs Goliath Mentality

Beating the cryptocurrency markets can seem daunting and impossible at times, but the best thing to do is focus on long-term goals and investments. Spend the time to really do research on some of the coins out there with recent attention, particularly the ones that currently have top rankings on CoinMarketCap. These popular coins may not necessarily be the ones you want to invest in, but it will generally be significantly easier to do solid research on those with already established followings. Understand the use cases that so many of these coins are aiming to have. Some projects, such as Bitcoin, are much further along than others and are already being used for transactions in the real world. But there are a handful of others that have either already been publicly listed or are still in the ICO phase that have potentially groundbreaking ideas and impressive white papers.

With large price swings happening in cryptocurrency on a literal hourly basis, it can be easy to get caught up in trading fluctuations that would normally be massive in the crypto market. But don’t get caught up in this. Focus on rebalancing your portfolio when the opportunity strikes. Sell the profits of your winning coins to add on to the losing positions you may have. Sites out there, such as Samsa.ai, will even automate this process for you so you can minimize your attention to charts and go enjoy your day while making profitable trades. Dollar cost averaging your buys and sells is another way to ensure you are removing emotions such as greed and fear from the equation of your deals.

Knowing your role as a trader in a deregulated market full of predators may seem absolutely terrifying, and to an extent, it is. But being self aware of your position and knowledgeable of the fact that others likely can’t be trusted should only incentivize you to do your own research about tokens you are considering. Those who make rational and emotionless decisions are the ones who find ways to maximize their returns while minimizing their risk in spite of how f*cked things currently are in the good ol’ land of crypto.

I write in depth cryptocurrency analysis at Samsa, the passive investing tool for crypto. See what we’re doing at Samsa.ai and see our other analysis at our magazine. If you love what you see, give this article 50 claps! If you hate it, show your displeasure with 49.

This article and related content is for informational purposes only. It should not be considered investment advice, and you should consult a financial advisor and do your own research and due diligence prior to making any investments. Where securities or commodities are referenced, it is only for illustrative purposes only, and does not imply any position on securities or commodities classification. To the extent that Samsa services are offered or discussed, those services are available only for Samsa whitelisted assets only.

Unf*ck the Crypto Markets was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.