Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Poland is a country with one of the best-promising opportunities for FinTech industry, considering legislation, education, infrastructure and innovation culture.

The FinTech industry continues to mature, and it comes to grow in milliards of dollars each year. This rapid growth of interest makes FinTech startups flock in Boston, Silicon Valley or New York, that are among world’s biggest tech hubs. In Europe, the same role is automatically assigned to London, Dublin or Berlin, which also gather startup owners, innovators, and business investors. Poland, with Cracow as its “CEE Silicon Valley,”is another emerging star, that holds the potential of becoming the next FinTech El Dorado for a number of reasons.

Legislation

The dynamic development of FinTech sector is obviously influenced by law regulations. In case of Poland, this includes both local law and European Union directives. And those are fairly promising.

The Polish government is currently working on “Sandbox regulations,” that are to soften the way of implementing FinTech solutions to market. In other words, they are going to improve user safety and smooth out the restrictions for FinTech startups.

The Innovation Hub Program, recently set off by Financial Supervisory Commission, brings promises even further: According to the Program, The commission members are to open the dialogue with FinTech entrepreneurs to work out legislative solutions for the entire FinTech industry. Given all that, chances are big to see Poland literally flooded with FinTech startups in a matter of months.

Considering the legislation, we also need to keep in mind Revised Directive on Payment Services (PSD2), administered by the European Commission. The directive will let non-banking institutions the access to information about customers (just these, who gave their agreement) from banking databases. From the perspective of FinTech startups, this law will bring significant improvement and speed up the delivery of market-fit products.

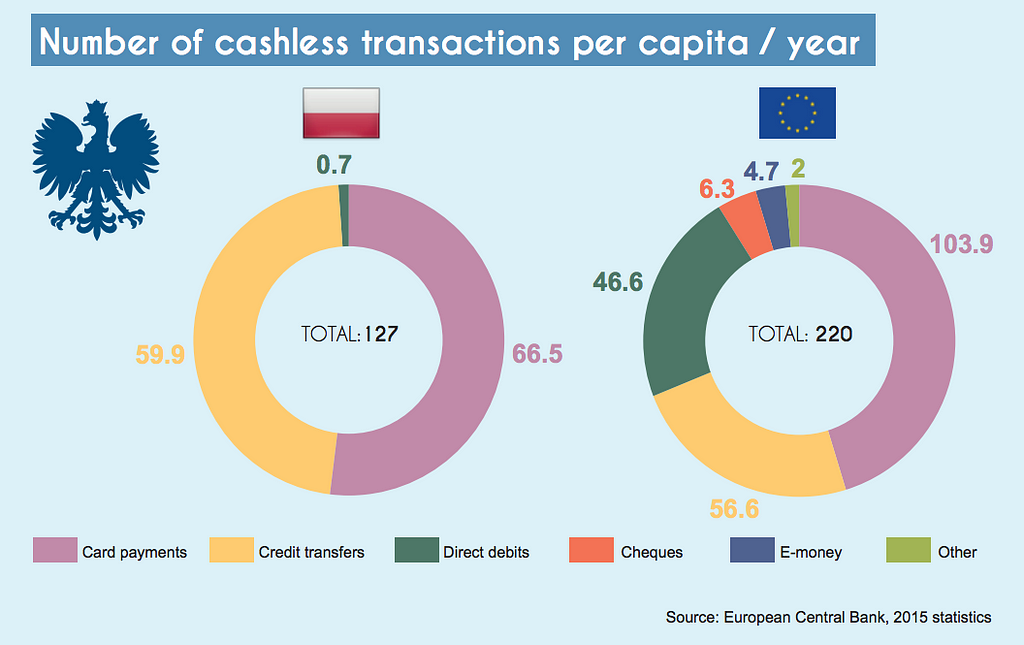

FinTech infrastructure

Poland is a real FinTech experimental polygon and the so-called ”launchpad” for testing FinTech solutions. Let’s consider the example of PayPass.

According to MasterCard report, 25% of Poles declare they use their PayPass every day. This means we’re using contactless payments 20 times more often than e.g. Germans and 3 times more often than the European average. Besides all this, 85% of Polish respondents declare their payment card has a PayPass function.

When we look back to the history, we saw Polish WBK Bank implementing Maestro paypass cards as the first institution in Central Europe (2007). The dynamic development of paypass payments in Poland is a success on a European scale.

Or Blik.

Blik innovatory solution invented in Poland lets millions of Poles safely use their smartphones to withdraw cash from ATMs, pay in traditional stores and transfer money immediately to other users phone number, without knowing their bank account. The system is a national, universal payment standard and the fastest method of making a purchase. The balance of 2 years of Blik existence is 10 million transactions and 3,5 million users. According to estimates, 70% of Polish society uses the solution.

The system is appreciated in a number of European countries, that look up to the level of Polish FinTech and the intensity of its market absorption. The solution is probably also the favorite of Apple that wants to introduce Apple Pay to Polish market in the second half of this year. And, yes, this will supposedly happen with the help of Blik.

The absorption of FinTech solutions in Poland gives us a huge advantage while developing and testing FinTech apps, for foreign and native companies.

At Untitled Kingdom, for instance, we come up with our ideas and suggest optimal solutions. If we couldn’t test these solutions in real life, we obviously wouldn’t go beyond the guess-stage. But with the FinTech ICT infrastructure around, we can propose validated options that take off, although they weren’t even previously taken into consideration by our clients.

Poland’s potential is becoming noticed by prominent FinTech companies from overseas (like Revolut, that based one of their offices in Cracow). As Polish society absorbs FinTech like a sponge, the number of native financial startups is also skyrocketing. While developing their products, the startups simply test their solution on the local ground, gather feedback, implement user-validated improvements and scale their business globally.

Polish FinTech scene via FinTech Poland report

Polish FinTech scene via FinTech Poland report

Our leading status in FinTech across Europe is confirmed by one of the best known and renowned research and consulting companies in the world — The Forrester Research, and underlined by foreign industry media, including American Banker. Our FinTech solutions are ahead of trends and are an inspiration for foreign banking institutions.

The Potential of Polish Programmers

Poland is the Mecca of top-talent software experts, that makes us stand out among other counties. We rank 4th in the world in the Top Coder ranking, and land in the top 3 for multiple categories in Hackerrank list).

Rankings don’t lie — Polish progammers are leading experts in Europe. If we utilise this potential in FinTech , the sector can soon peak higher than ever before.

Even now, Polish IT specialists are admired worldwide for their ingenuity, reliability and professional expertise. They are encouraged to travel abroad and join foreign FinTech companies’ teams, or support them remotely.

Also at Untitled Kingdom, we’re quality-focused, so we’re gathering the savvy team of top-talent experts, that makes us stand out among our competitors. We’re explorers, who always jump into to challenge and continuously pursue for improvement and innovation.And we believe in utilising this power in Fin-Tech.

Innovation culture

Poland loves testing. We also cherish new ideas, and praise innovation. This gives businesses a fertile ground to validate their inventions and scale globally, repeating the sucess of Azimo , Atsora and dozens of other FinTech startups born in Poland and flourishing worldwide. We’re not afraid of business risk — Polish entrepreneurs create startups reknowned and appreciated globally. All of this combined makes Poland a great place to invest and develop word-class FinTech solutions that take off, scale and bring a real impact.

Read more from Untitled Kingdom:

- How to choose a company for app development?

- Lean product development is possible, also in corporate environment

- 4 types of Machine Learning that can enrich your digital product

- Why you don’t want freelancers for your product

And remember to VISIT OUR WEBPAGE!

Why to develop your FinTech solution in Poland was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.