Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Wallets have always fascinated me. But crypto wallets have always particularly fascinated me since i got into crypto because they are the starting and the end point of any trip in that new territory: there is no banks in the middle. One thing that has always kept me curious was their business model because most of them are free to download. So i started to learn about them and understand how they are (or not) making money.

Before we start: crypto wallets are generally free software or mobile apps that enable you to manage your crypto funds: host, send, receive and public/private key management. If you ask me, they all look like fax machine but some are very popular and even making serious money. So how is that possible?

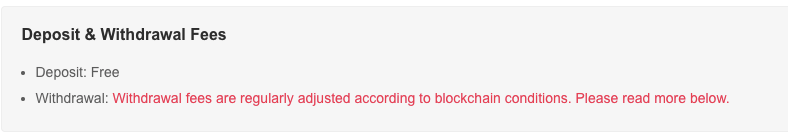

Wallets do not make money from transactions

There is a misconception that crypto wallets make money by cutting a fee when you make a transaction. This has been falsely installed because of the practices of some exchanges (often and wrongly considered as wallets) who charge users hefty fees for moving funds out (and sometimes funds in) and because, educated as we are in the fiat world, we believe any middle man involved in a transaction of money takes a fee.

The fees a wallet will charge you are actually networks fees aimed at rewarding miners involved in securing the transaction being operated and registered on the ledger. Wallets are not the one mining your transaction (although they could also operate an independant full node involved in the transaction)

In general, Coinbase does not charge a fee to use our Hosted Digital Currency Wallet service. Transfers of virtual currency to an address off the Coinbase platform may incur network transaction fees, such as bitcoin miner’s fees, which Coinbase may pass through to you. Any such transfer fees will be disclosed to you at the time of the transaction. From Binance

From Binance

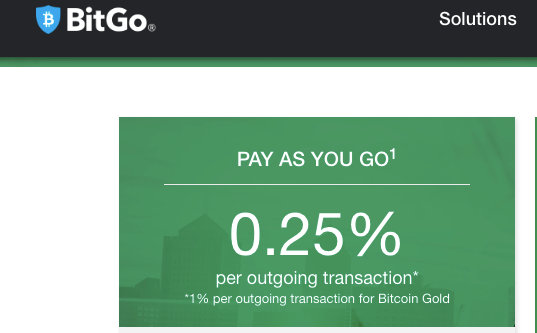

There is an exception to that: Bitgo a multi-sig wallet that will charge something like 0.2% on any incoming or outgoing transaction in exchange of the secure custody of your funds on behalf of your company. Bitgo is not aimed at consumers but at corporation in need of a third party custodian.

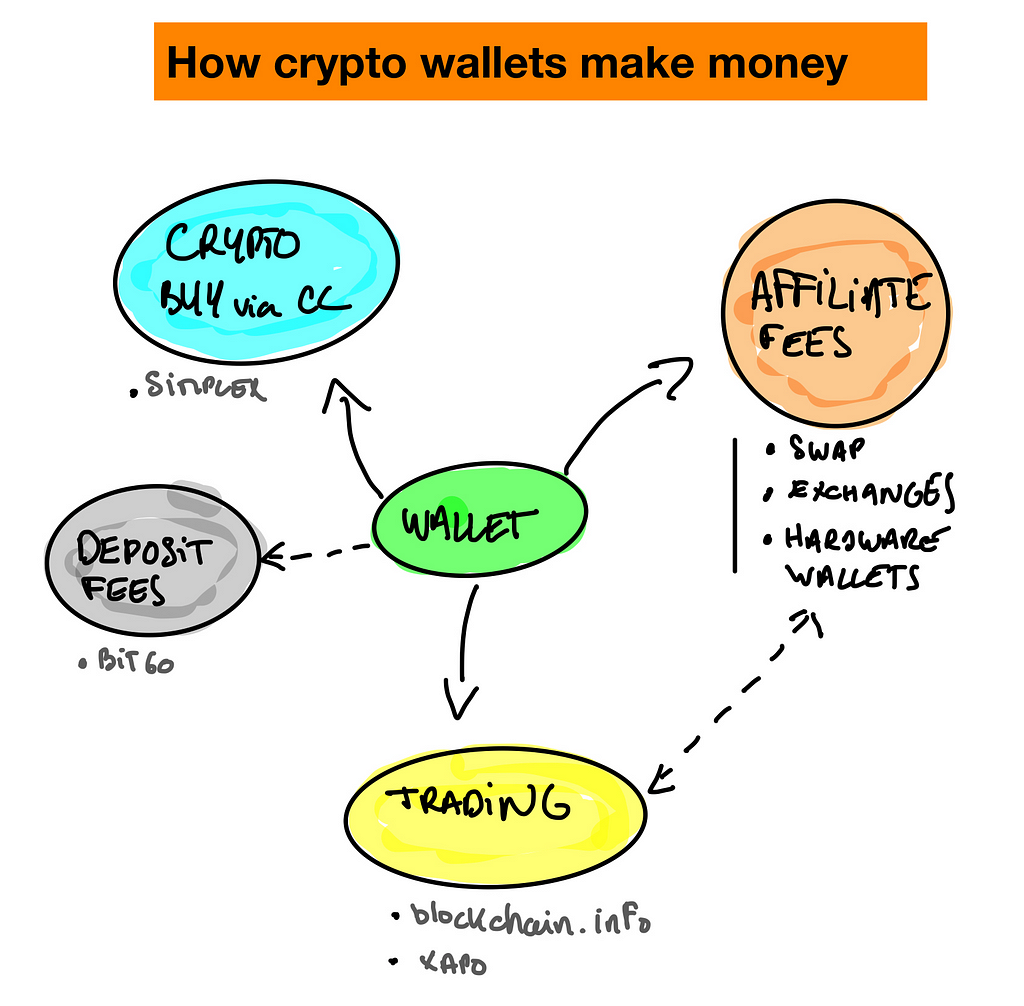

Most Wallets leave on affiliate fees

Yes. That the model. at least today. Wallets, because they attract a lot of users and usage, are able to squeeze in all sorts of goodies and apparently native features which are nothing more than a way to generate an affiliate commission from third party services

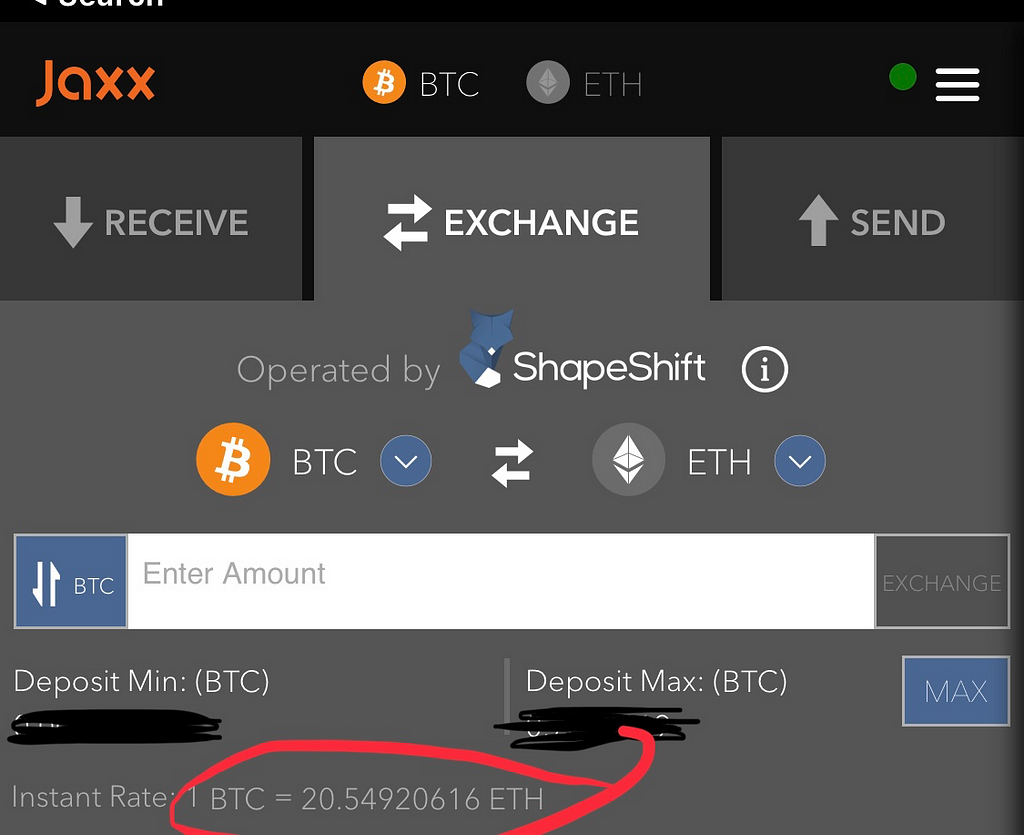

The most popular one would be the ability to swap instantly a coin with another via Shapeshift or Changelly who have very generous partner program because their rate is usually way higher than the average market price. You pay for simplicity and wallets get rewarded for it by the service provider.

Jaxx allowing you to swap coins at a hefty rate with Shapeshift

Jaxx allowing you to swap coins at a hefty rate with Shapeshift

Finally you will find in a few wallets a service to buy crypto assets directly with your credit card. Those services are not operated by the wallet but in partnership with companies like Simplex who will pay back wallets a fee on their transaction. Again users pay for simplicity and wallets get rewarded for it by the service provider

You can buy crypto from you wallet with Changelly or Simplex

You can buy crypto from you wallet with Changelly or Simplex

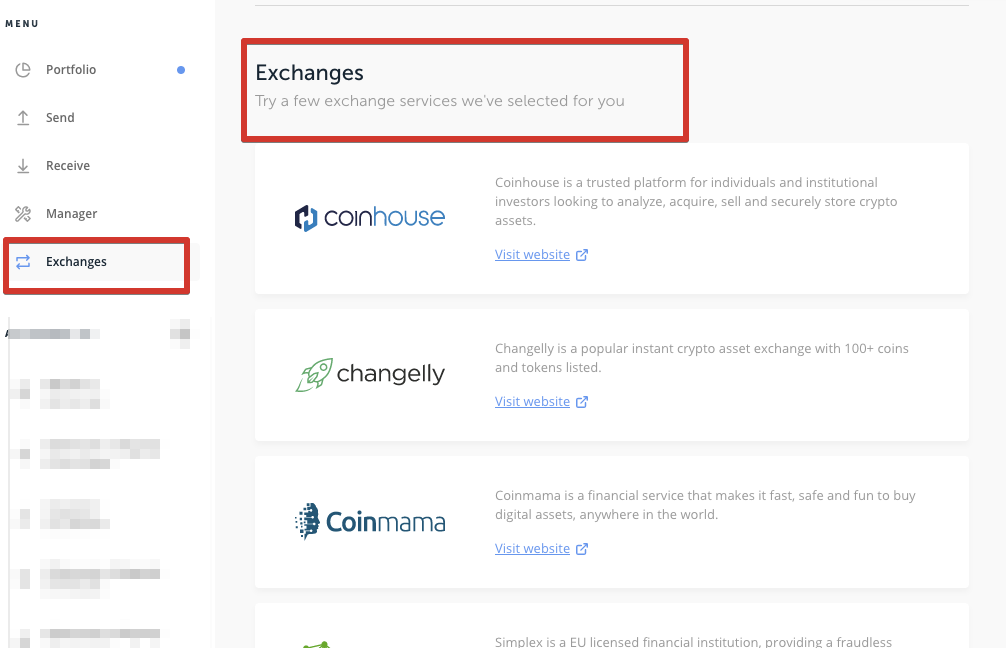

Another way wallets make money is by generating traffic to exchanges which are ready to pay hefty fees for new customers. They all have an affiliate program. Even hardware wallets (who are not free wallets) showcase them

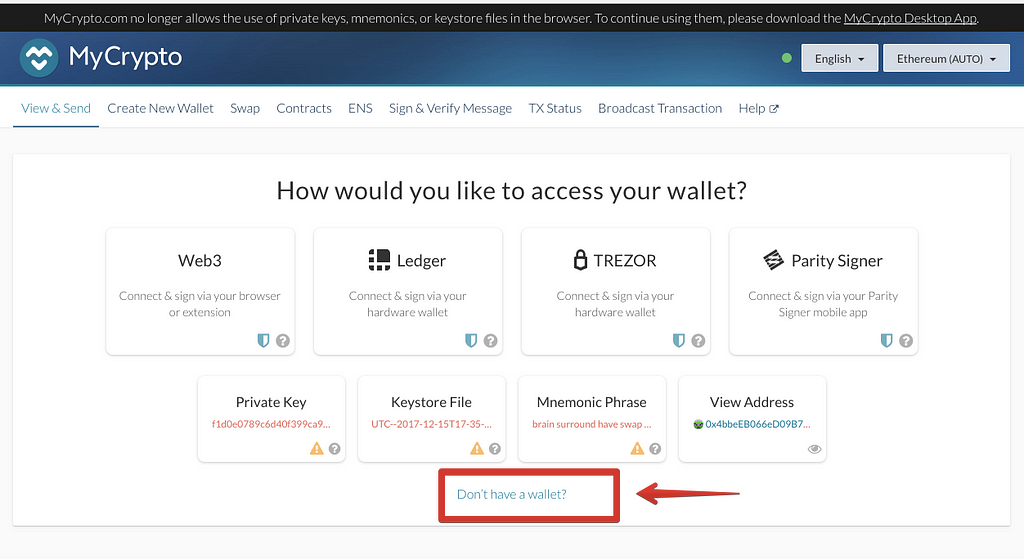

Finally some of those software wallets like mycrypto make money by enabling you to buy hardware wallets (see more on that below)

Buying a 3rd party hardware wallet generate revenues for Mycrypto

Buying a 3rd party hardware wallet generate revenues for Mycrypto

I don’t have internal data of those wallet companies but i would be ready to be that 90%+ of their revenues are based on one or more of those revenue lines.

Hardware wallets have revenues but a problem

Hardware wallets (also called cold wallets vs hot wallets for software) have usually a simpler revenue model. They are paid for. The price ranges between $50 to $300 USD. Their hardware is probably much cheaper to build (sub 20 USD) and their margins are ginormous which enable them to offer a generous affiliate program in return [10% cashback for Trezor for example]

There is only one problem with that model: the lifetime value of the average customer is very limited. You have no compelling reason (unlike a phone) to buy a new hardware wallet every year. You buy one (maybe two for back ups) and that is it. Those companies have nothing more to sell you in theory.

They know it and that is why they are beefing up their software with affiliate links or expending into promising new territories (the famous “institutional custody”)

Ledger hardware wallet inviting you to the affiliate program of some exchanges

Ledger hardware wallet inviting you to the affiliate program of some exchanges

The hybrid wallet/exchanges

Some wallets allow you to buy crypto-currency but unlike an integration with a third party they operate the exchange directly. Xapo or Blockchain.info for example, arguably the largest crypto wallet out there (and one of the oldest) allows you to buy BTC and ETH. They will charge trading fees but sometimes will also make money on the forex conversion

Some wallets don’t need to make any money

Many of the crypto wallets are just open-source projects with no intention to make any money. But you quickly feel the limit as a user…free has a price.

Some other projects (Ethos for example) don’t need to make money because they raised so much from their ICO that revenues are absolutely on the list of urgent items in their schedule

Finally some wallets won’t even need to make money because they are owned by an entity that makes money on other line of products and the wallet is just an operational cost to them. This is the case of Trust Wallet, a product that was making no revenues before it was acquired by Binance, a situation that is unlikely to change.

The new frontiers

So in summary wallets either live on revenues they do not control, or revenues with short live time value. Affiliate fees are never a great sustainable revenue: you never know when the pipe will dry up or shut down.

So is there a sustainable path forward for crypto-wallets? hard to say at this stage.

Eventually, years from now, everyone will own a crypto wallet, the same way everyone has a phone and a camera. Crypto wallets are going to capture a massive part of the value cake in the industry. They are the new browsers or emails clients of the web if you prefer. And affiliate revenues or even trading are unlikely to become the way forward to sustain their operational costs (which are not cheap).

I anticipate that new native revenues will come forward and will support this category. It is too early to see them showing up but they will be tightly link to the way the consensus protocols operate and incentive their stakeholders.

I also expect the raise of additional revenues for which users will be ready to pay directly (or indirectly). Because, breaking news: people also pay for software and services. A huge chunk of the multi-billion non-gaming mobile app store revenues are here to show that this is the case. New bank models like N26 or Revolut prove that people will pay for services that are worth. People will pay for services related to their wallet. There is absolutely no doubt about it. People for good stuff. They don’t pay for bad stuff. Which brings me to disagree with the debate below

Right now if feels like the whole industry is affiliating each other in wait of better times. Hardware wallet affiliates exchanges which partner with software wallets who refers exchanges and hardware wallets. What a merry-go-round. Of course the industry needs to expand and that will only happen once new fresh money will come in, new regulations will clear out and a new native crypto economy will develop. Wallets are still in young age. But they are a fundamental part of this crypto-economy

ps: this addresses non institutional wallets. The market for institutions (which right now is experimental and confidential) is really different and will charge customers in a very different format.

The Business Model of Crypto-wallets was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.