Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Source

Source

At some point of time we all want to retire early and live the best of life with free mind.

Sounds too amazing right, but yes, this is possible.

People often think about retirement when they surpass a specific age and then it is late to reach your goals.

I believe it takes a generation to uplift financial status of a family. But if you start early you can watch your money run for you.

So yeah the best way to get rich is start investing. Investing in some growing asset will grow your investment.

Say you invest 20% in new poultry farm opened in your area which has just 10 chickens and you get 20 bucks every month as profit.Now imagine this farm grows to 1000 chickens in an year, you will roughly get 2000 bucks a month.Profit: your small 20% is getting you 100X returns and guess what you still own 20% of the company.That is the power of investing in the right asset at the right time.

So what can you do as a new invester

Try to cut short the liabilities. Liabilities are like owning a home instead of renting, big car etc. Don’t worry better days are coming, till then have patience. Instead try to build assets. Assets are like above poultry farm investment, stocks, mutual funds, real estate investment etc.

Liabilities undergo depreciation with time.

- Your 10k car will be 6k the next year. Your home can get you gains but imagine how much you have to pay as EMIs.

- Is the total amount you paid any lesser than the appreciation?Also owning a home restricts you to move outside city for a good job offer or any opportunity. Again buying a home at a developing place is a better choice but do your maths for the final gains before investing. You can start with small investments in your home town which are not costlier than the cities. They can get you Good returns and that too in lesser amount that you put into and peaceful manageable EMIs.

- Start investing in the market. I won’t recommend investing in stocks at first as it needs great market knowledge and your compete time. Stocks are like deals, you miss it and its gone. You have to buy/sell stocks at the particular time to get great returns and therefore it needs your eye balls on the market for the entire day.Those interested can definitely try this as it can get you good market knowledge and great returns, however you need to give your time a run and manage your boss.

- Start with mutual funds. These are the financial houses which actually invest the money in several stocks. Its like you hire a broker to find home and they get you great home with good deal but they charge their bit as a brokerage amount.

- Similarly, you give the money you have, to these fund houses and they invest for you.Since you do not have time to invest and track various stocks and their results, this task is handled by mutual fund houses and the returns generated are yours.These houses generally charge 1% to invest on your behalf if you are investing directly into the fund house.

Do invest in direct mutual funds as they save you 1% of the commisson charged by fund houses.

- Why mutual funds?Since you are planning your retirement that infers that you have at least 15 years before retirement. Your money grows with time in market. Longer you stay invested in market, longer are the returns. Mutual funds give you YoY returns which are dependent on the market. If your economy is doing great you will have great returns and vice-versa. But in the longer time duration, mutual funds actually averages out the ups and downs and you get good returns as compared to the fixed return plans like recurring deposits, Fixed deposits, Provident funds etc.My advice: Do not ever keep your money in bank accounts or nominal return plans as they do not cop up with the inflation rates.The money you will gain in next 5 years will be lesser than your normal expenditure today.

- Provident funds, Fixed depositsif you do not want to take the market risk, you can invest in public provident fund. If you have a lump sum amount that you do not need in near future you can put it in fixed deposit. However since you are salaried chances that you have a useless lump sum amount are very less.PPF give you somewhere around 7.5% compound interest.

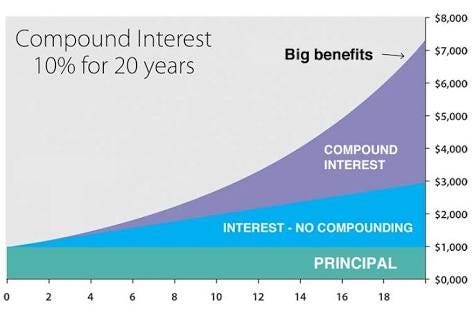

Einstein once said, Compounding is the 8th wonder of the world.

When invested (1.5 Lakhs per annum) for 15 odd years, PPF can get you roughly 50 Lakhs rupees.However same investment with a great portfolio can get you more than 1.25 crores.

For lesser risk options you can also try bonds or debt funds which are of less risks and guaranteed returns.

I will create another post explaining mutual funds, choosing right portfolio, planning the long term goal etc.

And yeah one last point do not consider bitcoin as investment option :-P

Stay tuned for the same.

Hit the 👏 (claps) button to make it reachable for more audience.Follow me and Better World for more such stuff!

Start now to Retire Young, Retire Rich. was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.