Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Jurisdictions with crypto-friendly legislation or comprehensive regulations in place are leading in terms of exchange-based cryptocurrency trading. According to a new study, however, over the counter and P2P exchange is much more popular in developing nations and countries where non-cash payments are still not widely spread.

Also read: Crypto Funds Number 466 Despite Trends, Uncertainty

Exchange Trade vs OTC Trading

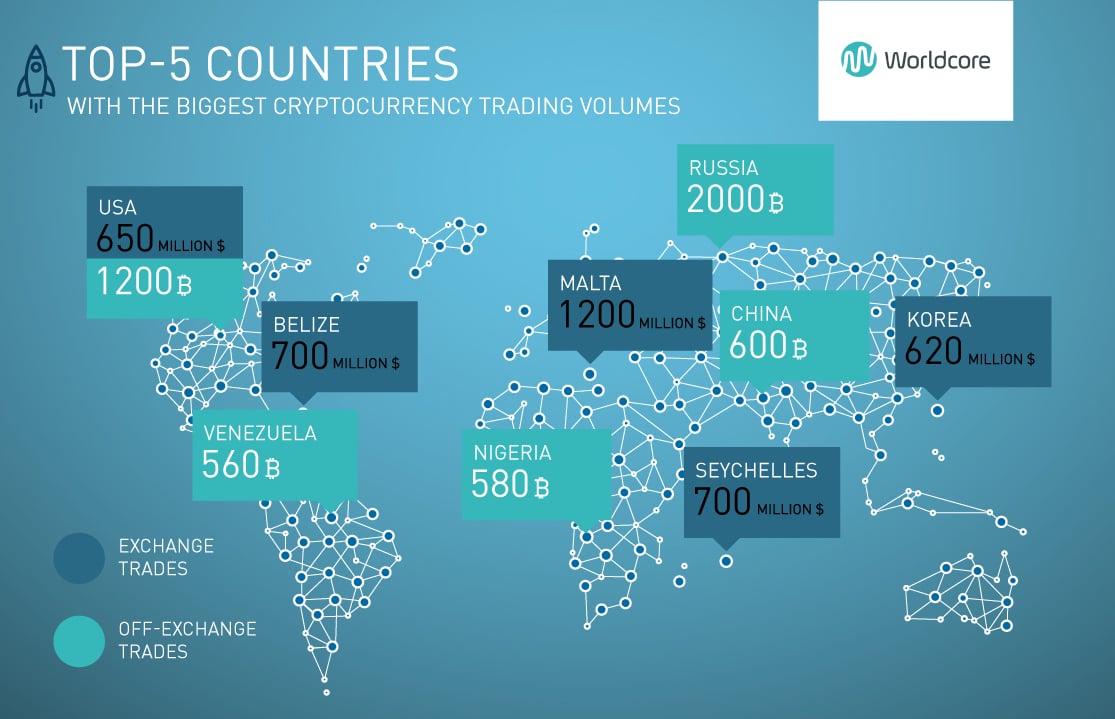

The report produced by financial services provider Worldcore covers data from the months of June and July and uses statistics from a Morgan Stanley study conducted earlier this year to compare two lists of countries – one with the top destinations by volume traded on cryptocurrency exchanges, and a second one with those that lead in terms of over the counter (OTC) and peer-to-peer (P2P) trading volumes.

The new study confirms that jurisdictions offering favorable business climate through crypto-friendly legislation as well as those with well-established regulatory frameworks account for a large portion of the exchange-based crypto trade. Malta ($1.2 billion), Belize and Seychelles ($700 million each) are topping the chart with over 2.6 Billion USD of daily trading volume.

Following are nations that have already adopted some comprehensive crypto regulations, including South Korea, the Untitled States, and Hong Kong. Russia is 13th in this group with a 24-hour volume of less than 50 million USD on trading platforms.

The researchers at Worldcore have specifically compared exchange and non-exchange volumes for the week of July 14 – July 21, 2018, using data from the popular P2P exchange Localbitcoins. The results turned out to be quite opposite to what the Morgan Stanley figures show, as Kommersant reports. This time, Russia is the pronounced leader, having registered a weekly trading volume of 2,000 BTC, while the US has 1,000 BTC. They are followed by China and Nigeria with 600 BTC traded by the residents of each country. Next are Venezuela, Great Britain, and the EU member states.

Reasons, Explanations, and Predictions

The authors of the study cite some good reasons for the notable divergence. “Crypto exchanges are most often registered in countries with preferential taxation, and many over-the-counter trades occur in nations with low financial culture or strict tax legislation,” commented Worldcore CEO, Alexei Nasonov, who is also leading the research team.

The analysts further explain that the popularity of direct exchange methods in Second and Third World countries like Russia, Nigeria, Colombia, and Kenya, is largely due to the relatively undeveloped system of non-cash exchange of crypto assets and fiat through payment systems and banks. Restrictive currency laws also play a role, as is the case with Russia for instance where crypto-specific regulations are yet to be adopted and the exchange services are currently unregulated.

The researchers believe that trading platforms will continue to migrate to destinations providing favorable conditions and preferential tax regimes. Malta is a good example – the island nation has already attracted companies like Binance, the largest trading platform by volume which is exploring opportunities to launch a decentralized bank there, Okex, another Chinese-run cryptocurrency exchange which announced in April it is setting foot on the island, and the Polish Bitbay which revealed its plans to move to Malta in May.

The team at Worldcore also expects the average volume of transactions to increase in the future. At the same time, the financial tech company predicts that the off-exchange market will shrink with growing crypto turnover through traditional payment systems and the spread of payment gateways supporting transactions with Visa and Mastercard credit cards.

What are your expectations for the future of crypto trading? Share your thoughts on the subject in the comments section below.

Images courtesy of Pixabay, Worldcore.

Make sure you do not miss any important Bitcoin-related news! Follow our news feed any which way you prefer; via Twitter, Facebook, Telegram, RSS or email (scroll down to the bottom of this page to subscribe). We’ve got daily, weekly and quarterly summaries in newsletter form. Bitcoin never sleeps. Neither do we.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.