Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

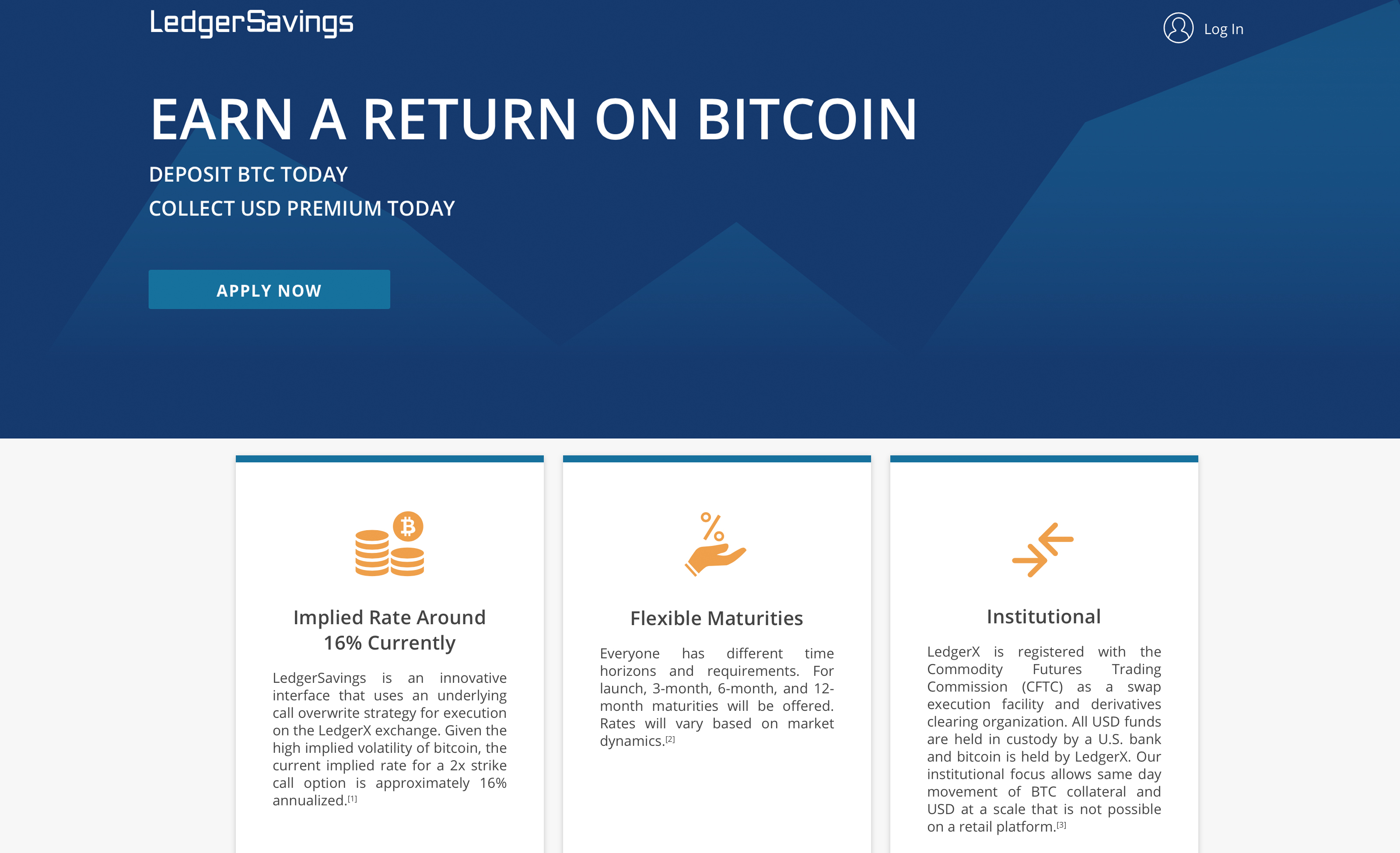

This week the firm Ledgerx announced the soft launch of its ‘Ledgersavings’ platform, a new service that allows users to deposit bitcoin core (BTC) and accrue interest on the deposit over a variety of maturation periods. The CFTC-regulated company explains the new savings program will allow clients to gain an annualized return of roughly 16 percent, even when crypto-markets are not appreciating.

Also read: Robinhood Reaches Iowa and Georgia, Coinbase Returns to Wyoming

Ledgerx Launches Ledgersavings

Last May, the US Commodity Futures Trading Commission (CFTC) regulated digital currency clearinghouse and options exchange, Ledgerx, announced the company had plans to launch a savings program for BTC. The firm has been trading a lot of BTC derivatives over the past few months and Paul Chou, the CEO at Ledgerx, announced the official soft launch of Ledgerx savings on August 3. Chou says it is the first major service launch since the company started the digital currency options business.

Last May, the US Commodity Futures Trading Commission (CFTC) regulated digital currency clearinghouse and options exchange, Ledgerx, announced the company had plans to launch a savings program for BTC. The firm has been trading a lot of BTC derivatives over the past few months and Paul Chou, the CEO at Ledgerx, announced the official soft launch of Ledgerx savings on August 3. Chou says it is the first major service launch since the company started the digital currency options business.

“I’m excited to announce the soft launch of Ledgersavings, the first major new service since we launched Ledgerx late last year,” Chou details. “The first transaction was completed a few weeks ago and yielded the client a 15% per annum return on their Bitcoin for the next 6 months, even if Bitcoin depreciates or stays at current levels. This is a powerful use case in market conditions where Bitcoin is not appreciating.”

The First CFTC-Regulated Digital Currency Savings Options Allow Ledgerx Clients to Collect Interest on Idle Funds

Because BTC prices are volatile, the rate for a 2x strike call option for Ledgersavings is 16 percent annualized. Investors can opt for 3-month, 6-month, and 12-month maturities with interest paid out in USD. According to Ledgerx, the company holds the digital assets and a US bank holds the gained USD.

“Ledgersavings takes one of the most popular trades on the Ledgerx platform, call over-writing, and puts it in terms that are more intuitive to investors who are not as familiar with the minutiae of options theory.

We list contracts that have a defined maturity, an interest percentage in USD that you receive up front, and the terms of when you might exit the underlying Bitcoin. It provides an intuitively simple way to monetize an innate quality of Bitcoin — high volatility. You deposit Bitcoin, choose an interest rate, and you can get the cash today.

A lot of people hold their digital currencies for a while and a savings account allows people to earn interest on idle funds. Ledgersavings is the only CFTC-regulated interest-bearing account that works with virtual currencies but there are a few global trading platforms offering savings programs. For example, the trading platform Magnr not only offers digital currency trading but also a savings program that earns interest. Magnr Savings provides regular interest for deposited funds held with the company as well. In addition to the BTC savings options, the Ledgerx CEO details that the firm will also be supporting ethereum (ETH) in the future.

What do you think about the Ledgersavings platform Ledgerx launched this week? Let us know in the comment section below.

Images via Shutterstock, and Ledgersavings.

Now live, Satoshi Pulse. A comprehensive, real-time listing of the cryptocurrency market. View prices, charts, transaction volumes, and more for the top 500 cryptocurrencies trading today.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.