Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

“Blockchain but not bitcoin”. A sentence that appears to be making the rounds of late. The meteoric rise of Bitcoin has caused Wall Street and big business to sit up and take notice of the underdog asset class. High-flying bankers like Jamie Dimon (JP Morgan Chase) and Lloyd Blankfein (Goldman Sachs) seem to change their minds on bitcoin, blockchain, and cryptocurrencies just about every other day. Climbing aboard the blockchain bandwagon may not be desirable but it sure can’t be ignored anymore.

In the world of business, perception is everything. Consequently, companies are rushing to integrate “blockchain” into their business model, even if ain’t necessary. Some company stocks skyrocket on the mere mention of the word. But can private blockchains really take on the public darlings of cryptocurrency? The showdown is unfolding and the players are set. Let’s get ready to rumble!

In the Red Corner

In may of this year (2018) former president of Goldman Sachs and former advisor to US President Donald Trump, Gary Cohn explained in a CNBC interview:

“I’m not a big believer in bitcoin. I am a believer in blockchain technology. I do think we will have a global cryptocurrency at some point where the world understands it and it’s not based on mining costs or cost of electricity or things like that. It will be a more easily understood cryptocurrency.”

The red camp contends that the benefits of distributed ledger technology (DLT) can be used in a more controlled fashion. Several well-known companies are focusing their efforts on building enterprise-ready blockchain solutions.

In the red corner we introduce you to Hedera Hashgraph and IBM Hyperledger Fabric:

Hedera Hashgraph

Thanks to their concentrated marketing efforts, Hashgraph has been getting a lot of media attention. Dr. Leemon Baird conceived of the Hashgraph framework in 2016 and patented it for Swirlds, a company that he co-founded with Mance Harmon. Swirlds develops software for private distributed applications.

Hedera is their latest project. While Swirlds focuses on the private sector, Hedera is gunning for the lucrative opportunities that public blockchains have to offer.

Governance

The platform is built on top of a closed governance model which means that up to 39 organizations from various industries and locations around the globe will manage decisions on how the code is developed and how the platforms native cryptocurrency is managed and distributed throughout the system. A sort of decentralization only for organizations, if you will.

“The Hedera Hashgraph Council will provide governance for an open, fast and fair decentralized public ledger built on the hashgraph consensus algorithm.”

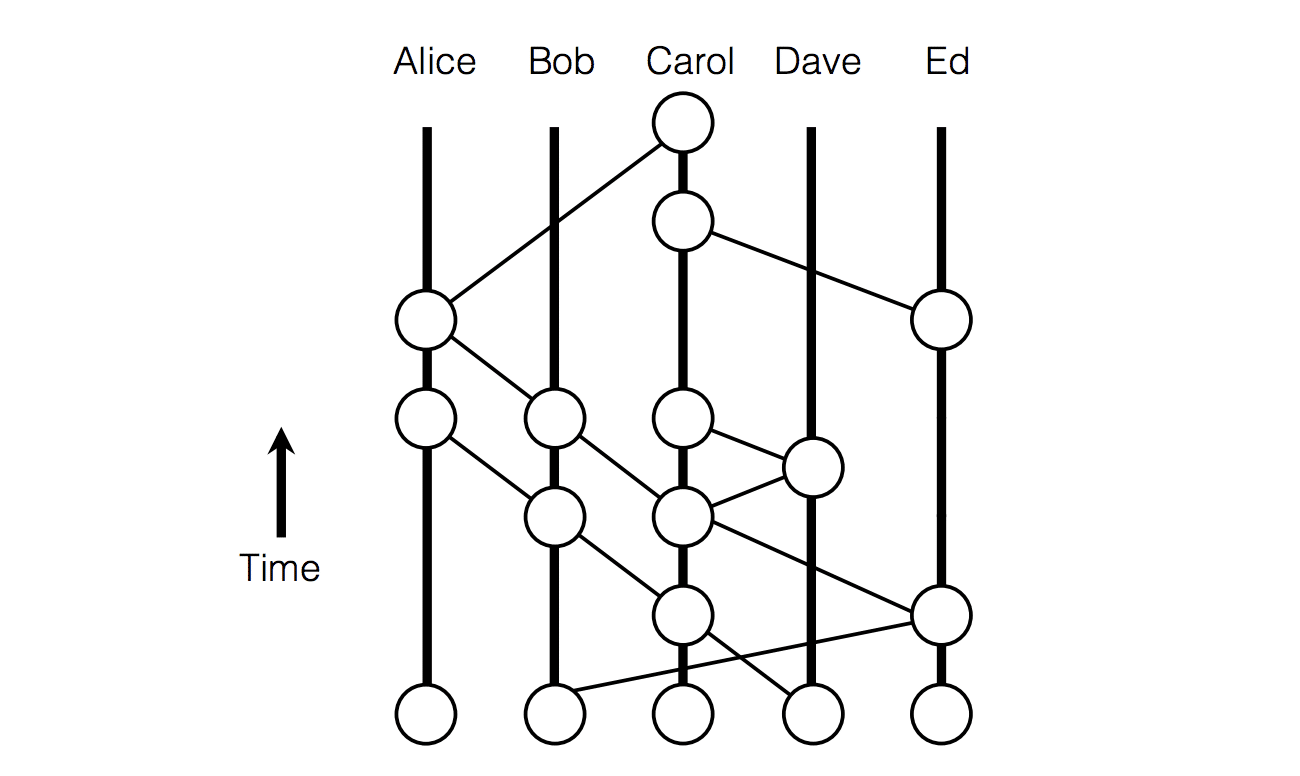

Hashgraph does not actually use your typical blockchain implementation but, in fact, uses something similar to a directed acyclical graph (DAG) which is applied both in IOTA and Nano. It uses what is known as a gossip protocol.

By the Crypto Watercooler

In gossip systems, nodes on the network communicate with each other randomly. As they ‘gossip’ each node will give another node all the information it currently has on the network, say for example a history of transactions. After receiving this info, this node will in turn gossip to other nodes, and so on and so on. As a result, all nodes will achieve consensus as the correct information spreads across the network.

The power of the gossip protocol in Hashgraph

Hedera will be raising funds for their public blockchain token until the 16th August 2018. Unfortunately, this only applies to accredited investors at this time. Their token sale is following the SAFT (Simple Agreement for Future Tokens) process which falls in line with SEC regulations.

Hyperledger Fabric

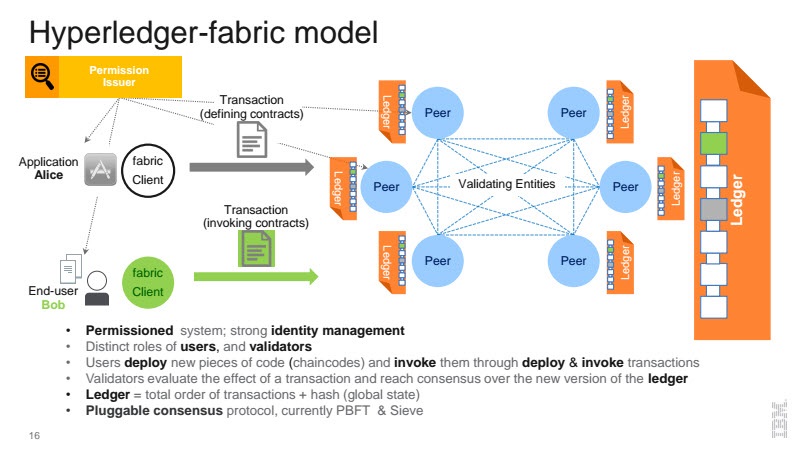

Hyperledger is an open-source collaboration of blockchain tech by several prominent companies in industries from finance, banking, supply chain, manufacturing and so on. Fabric was created from one of the first hackathons of this initiative and most of the code was contributed by IBM who are promoting their project as “building open-source blockchain for business”.

The IBM Hyperledger approach has taken a somewhat different view by creating plug-n-play blockchain components. Need a specific consensus method? Just plug it in. Does your company already have an identity management system in place? Just plug it in. Well, that’s the theory.

A Hyperledger blockchain in action

Some additional key Fabric concepts include:

- Private transactions

- Confidential contracts / chaincode

- Data on a need to know basis

- Modular consensus

- Scalability

- Auditability and identity

Perhaps the most important difference, however, is that Fabric has no native cryptocurrency included as part of its development and doesn’t require one to function. Hyperledger Fabric sits firmly in the “blockchain but not bitcoin” camp!

In the Blue Corner

They are champions of the cryptocurrency revolution and defenders of decentralization. The blue camp believes that peer-to-peer networks are the future. Blockchains which allow anyone to transact with each other without the need for a third-party.

In the blue corner we introduce you to Bitcoin and Ethereum:

Bitcoin

Bitcoin was born out of the 2008/9 financial crisis. Satoshi Nakamoto had had enough of suspect banking practices. Throughout history governments and central authorities have destroyed economies through unpayable debts and unlimited money printing. What’s worse they then turned on citizens to fit the bill. He/She/They saw a way to finally change all of that – Bitcoin:

1. It’s a Question of Trust

Conventional money systems require us to put all our trust in a third party:

- Can we trust central banks to manage our countries money supply responsibly?

- Do we trust banks to give us access to our hard-earned wealth?

- Will governments allow us to transact with anyone we please?

Unfortunately, highly trusted systems don’t work in the best interests of society. For example, in the years following the European financial crisis of 2010/1, the Greek government imposed capital controls (several times) cutting off large amounts of cash from its citizens. Imagine working your whole life building wealth only to be told you could withdraw a maximum of €60 ($69) per day.

Bitcoin changes all of that. It acts a bit like cash in your wallet, you own it and you can do with it as you please. Since the global bitcoin blockchain validates your transactions, you don’t need permission to access or transfer it.

2. Robust Decentralization

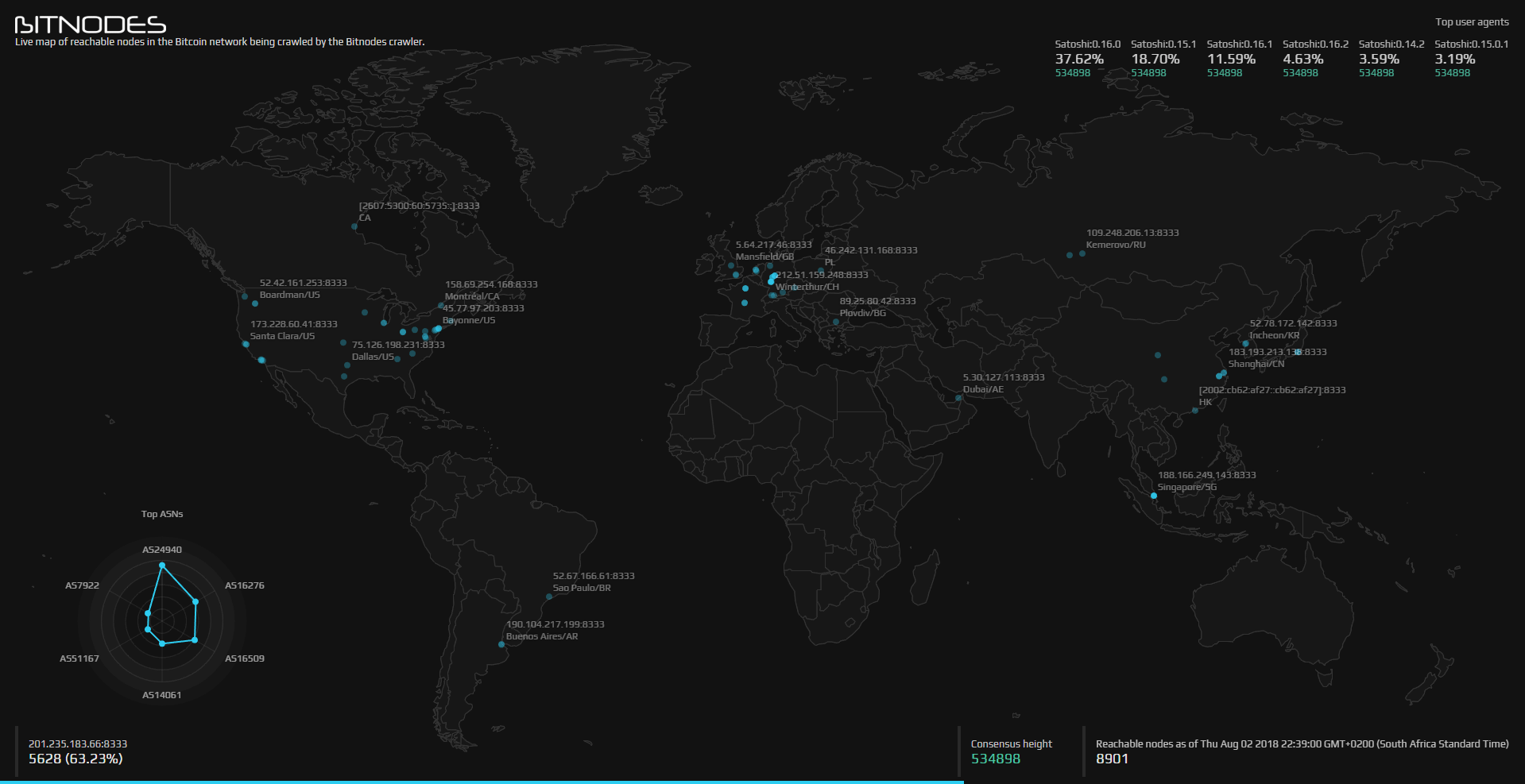

The real power of the bitcoin ledger lies in its decentralized nature. Authority is delegated to anyone who wishes to take up the challenge of validating transactions. No single authority can reverse transactions and/or change the rules if and when they feel like it. Bitcoin is the first currency which allows value to be exchanged across borders without having to worry about big brother!

Here’s an interesting live view of bitcoin nodes around the world.

A live view of global bitcoin nodes

3. One Node Can’t Rule Them All

And now we come to the meat of what makes a cryptocurrency… well a cryptocurrency. It takes work to validate transactions in a crypto network and workers (nodes) will rightfully want to be paid for doing so. By design, the bitcoin network rewards those who provide this service. It’s a win-win scenario, as players compete to secure the network no single authority can develop to rule the network.

Since bitcoin is the first pioneer of blockchain technology, it’s worth keeping these additional features of it in mind:

- Scarce supply – hold its value

- Open-source – anyone can audit, download and create alternatives

- Censorship resistant – transact without permission

- Immutable – transactions cannot be reversed

- Pseudonymous – no identification is required

For a more detailed discussion of bitcoin take a look at our in-depth guide.

Ethereum

Ethereum adds that extra dimension of flexibility to the cryptocurrency space through smart contract solutions. Its decentralized application platform is the reason we see the massive Initial Coin Offering boom going on right now.

It too is a highly decentralized network with a large number of nodes securing the network. In fact, according to Ethernodes, the Ethereum blockchain has roughly 3x as many nodes as bitcoin.

For a more detailed discussion on Ethereum take a look at our in-depth guide.

Blockchain But Not Bitcoin: The Final Score?

While companies like Hedera and IBM push forward with their blockchain ambitions, one major question remains unanswered. How do private blockchains actually differ from existing systems?

Your stock standard database has been around since the 1970’s and blockchains are nothing other than decentralized databases. The innovation lies in the decentralization of the network, in the distribution of power to many network players. Not just to those at the top of the pyramid. Therefore, anyone should be able to validate transactions on a network.

Bitcoin expert Andreas Antonopolous paints this picture quite clearly:

It would appear then that most companies don’t, in fact, actually need blockchains because true blockchains are at odds with a traditional organization’s goals.

Hedera claims to be building a public blockchain but Hashgraph technology is not open-source and is owned by a corporation. As a result, the code is not open to public scrutiny and we once again have to rely on trusting the team and their promises. Hyperledger Fabric, on the other hand, claims to not even need a cryptocurrency. This begs the question of how their blockchain can actually be independently audited.

You cannot separate a blockchain from it’s underlying currency. The token is essential for decentralization and driving the value of the network. Separating the tech from the underlying cryptocurrency is similar to copy-pasting a system we’ve had for nearly 50 years.

The game is young and perhaps there’s still time for corporate blockchains to prove themselves. But for now at least, “blockchain but not bitcoin” appears simply to be a marketing ploy.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.