Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Hey SEC: Don’t Rain on My Parade

The market went marching in a parade of green this week, and prices looked a few bucks shy of a clear trend reversal. Then the SEC gave the run-up a rain check.

Indeed, prices were up and climbing and Bitcoin broke above $8k for the first time since April, but then the SEC announced that it had denied the Winklevosses latest attempt to list a Bitcoin ETF. Crypto’s total market cap swiftly responded by dropping from $302 bln to $288 bln, giving it a lackluster 1.3% increase on the week.

Many have heralded an inevitable Bitcoin ETF, Winklevoss-filed or otherwise, as a trigger for the market’s next bull run. This week’s events no doubt put a damper on those hopes in the short run, but the SEC still has a slew of Bitcoin ETFs consider before these hopes die.

All of that said, be sure to keep an eye on how Bitcoin reacts to this news in the coming week. If it climbs back above and holds $8k, then the market may show signs of bullish sentiment divorced from the SEC’s decision. But if it continues to fall–and if it falls as low and breaks $7k–this rally may have been as fleeting and feeble as those that came in February and April.

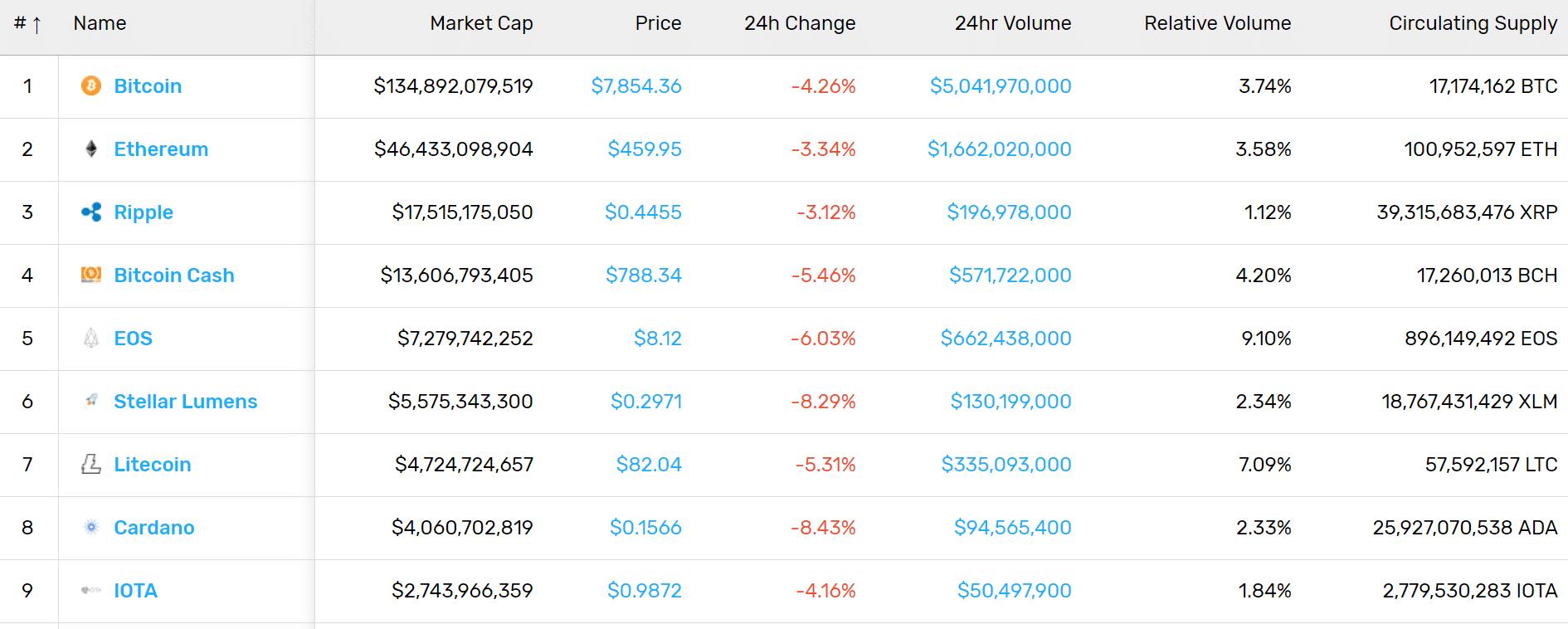

Bitcoin: At $7,880, Bitcoin gained 5% over the course of the week.

Ethereum: Crypto’s number two lost 1% this week, currently trading at $460.

XRP: In the same vein as Ethereum, XRP is also down this week, losing 2% at $0.44.

Domestic News

Delaware DOJ Reaches Out to Poloniex Users, Offer Help for Potential “Issues”: The Delaware Department of Justice is keeping its eye on Poloniex. A recent email by the department’s Chief Special Investigator Craig Weldon to select Poloniex customers indicates that the DOJ has heard their complaints. “If you have any issues with your Poloniex account please contact me at your convenience,” Weldon writes in the succinct message, acknowledging the issues that Poloniex users have experience recently and offering a degree of protection and assistance from such obstacles in the future. So far this year, Poloniex users have taken to Reddit to lament frozen funds, account deactivations, and verification issues, and one user has even proposed filing a class action against the company to seek recompense for damages.

Internal Investigations Claims No Foul Play With Coinbase’s Bitcoin Cash Listing: In the days leading up to Coinbase’s unannounced listing of Bitcoin Cash, the currency made an impressive run-up, increasing in price roughly 25% in two days. Critics swiftly accused Coinbase’s employees of insider trading, and the company launched an internal investigation. The results of the investigation, which was conducted over the past few months by two undisclosed law firms, were announced this week, and the investigators found no evidence of insider training. “We would not hesitate to terminate an employee or contractor and/or take appropriate legal action if evidence showed our policies were violated. We can report that the voluntary, independent internal investigation has come to a close, and we have determined to take no disciplinary action,” Coinbase said in a statement to Fortune.

Bitwise Files for Cryptocurrency Index ETF: Everyone’s scrambling to launch the world’s first Bitcoin Exchange Trade Fund (ETF), and the SEC is inundated with filings. But Bitwise Asset Management wants to offer more than just Bitcoin; it wants to launch an ETF off the back of its Bitwise HOLD 10 Index Fund. “The new ETF will be called the Bitwise HOLD 10 Cryptocurrency Index Fund. It aims to track the returns of Bitwise’s HOLD 10 Index, a market-cap-weighted index of the 10 largest cryptocurrencies, rebalanced monthly. The HOLD 10 Index captures approximately 80% of the total market capitalization of the cryptocurrency market. It uses a 5-year-diluted market cap and other eligibility criteria meant to address challenges of the crypto space such as continuously changing supply, liquidity, trade volume concentration, and custody limitations,” the press release reads.

Very impressed with the team assembled @BitwiseInvest. A crypto index fund ETF would be a game changer. https://t.co/f1BfIpL0n1

— Adam Nash (@adamnash) July 26, 2018

Speaking of ETFs: SEC Puts Off Approval for Direxion’s Suite of ETFs Until September: The US SEC is holding off on the handful of filings for Bitcoin ETFs. Filed in January, the ETFs were submitted by the fund management company Direxion, and they include the Direxion Daily Bitcoin Bear 1X Shares, Direxion Daily Bitcoin 1.25X Bull Shares, Direxion Daily Bitcoin 1.5X Bull Shares, Direxion Daily Bitcoin 2X Bull Shares, and Direxion Daily Bitcoin 2X Bear Shares. “The Commission finds it appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider this proposed rule change. Accordingly, the Commission, pursuant to Section 19(b)(2) of the Act,\10\ designates September 21, 2018, as the date by which the Commission shall either approve or disapprove the proposed rule change,” the official order reads.

Coinbase Acquires $20 bln Hedge Fund, Experts Urge Caution: Coinbase just added a monster of an acquisition, buying out an undisclosed $20 bln hedge fund to integrate into its custody services, Coinbase Custody. According to sources who tipped Business Insider, the deal has been brokered and Coinbase is looking to acquire other hedge funds to offer margin financing for institutional investors. Cornell University Law Professor Robert Hockett indicated to Business Insider that this acquisition and subsequent ones could put Coinbase on the SEC’s radar for conflicts of interest: “This raises conflict concerns, given Coinbase’s also running a coin exchange, reminiscent of those that the Commission has found when securities firms have attempted to combine these two roles.”

Wisconsin Governor Candidate Accepts Bitcoin for Campaign In Spite of Unclear Regulations: This Spring, the Wisconsin Libertarian Party asked its state’s Ethics Commission if it could accept cryptocurrencies as campaign contributions. The question was handed to Wisconsin’s Legislature as it posed “a serious challenge to the commission’s ability to ensure compliance with state law.” Regardless, Phil Anderson, the party’s chair and candidate for Wisconsin’s governorship, is pressing forth with his plans to accept crypto contributions for the upcoming election. “We will not allow the lack of appropriate interpretation of the current statute [to] affect the First Amendment rights of those who want to show support and contribute. I have no faith in the Assembly to handle this fairly nor expeditiously,” he said in a statement.

What’s New at CoinCentral?

Why a Bitcoin ATM Business May Be Perfect for You: Bitcoin ATMs are a great way to make crypto accessible, and their presence is growing.

Nvidia Chip Maker Lowers Prediction Figures Amidst Changing Crypto Mining Trends: As the market has slumped, so too have graphics cards sales.

What Is Siglo? | A Blockchain Protocol to Exchange Your Data for Mobile Connectivity: Siglo is a blockchain protocol in which you exchange personal information and your attention for mobile Internet access.

A Brief History of the BTC vs. BCH Feud: Grab your popcorn, kiddos–it’s story time.

What Is ION (ION)? | Beginner’s Guide: ION is the cryptocurrency of the Economy gaming community. Their goal is to establish a “thriving ecosystem” that is centered on gaming and digital goods paid for with ION.

How Online Bitcoin Casinos Are Raising the Bar in Developing Software Algorithms: As software developers continue to develop new algorithms that test the fairness of games, we are seeing new opportunities that benefit the creation of new casino businesses all while attracting new players from around the globe.

An Analysis of Bytecoin Mining: Is it Still Profitable?: Bytecoin, the allegedly shady blockchain that Monero forked from, might still be a solid option for investing your hash power. However, like any pre-mining considerations you may make, Bytecoin mining comes down to the numbers.

The Swiss Cryptocurrency Market Faces Banking Sector Challenges: It has become increasingly clear for cryptocurrency and blockchain related companies looking to set up a base in the country that the banking sector is not warming up to them just yet.

Blockchain and Its Video Rendering Industry Takeover. Feat. Leonardo Render: Out of the multitude of various industries blockchain technology has the potential to significantly impact, the world of graphical rendering is right at the forefront.

The Best Cryptocurrency News Sources | Stay on Top of the Latest Trends: Wanna stay on top of the news? These are the sites you oughta frequent.

How to Find the Best ICO to Invest In: You don’t need to have a crystal ball to pick out a good investment (but it would help).

How to Increase Your Crypto Portfolio Like a Pro: Learning how to increase your crypto portfolio like a pro can help to buffer your losses in times of market downswings.

Interview with Andy Levine on Steem Today and Tomorrow: This is Part 1 in a 3 Part Series on Steem and the Blockchain World, a conversation with Steemit Content Director Andrew Levine.

Celsius Network CEO Alex Mashinsky Is Moving from VoIP to MoIP: You may not recognize the name, but Alex Mashinsky has most likely affected your life in some way, shape, or form without you knowing it.

Is Huobi Token (HT) Worth It? An In-Depth Guide: Exchange tokens have become increasingly popular. Check out our guide to see if Huobi’s own is a worthwhile investment.

What is BitTube?: Yep, a decentralized Youtube.

Ethereum vs Cardano | A Comparison of Two Dominant Dapp Platforms: See how two of the market’s top Dapp platforms stack up against each other.

Why Is Popular Bartering Platform Listia Getting into Blockchain Tech?: In classic “disrupt yourself before the disruptors” style, Listia has been using its own cryptocurrency for a while now.

All You Need to Know About Blockchain-Based P2P Energy Trading: Imagine a world where you could swap power directly with your neighbor. Well, blockchain may soon make this future a reality.

Blockchain in HR Will Make Employing People Easier for Businesses: HR is one of the many areas in business that blockchain will streamline.

Blockchain Connect June 26th, 2018 Conference Recap: We had the pleasure of being a media sponsor at the Silicon Valley Blockchain Connect–here’s what went down at the conference.

Economists’ Take on Why It Is (Or Isn’t) Worth Investing After the Bitcoin Dip: A balanced look at both sides of the coin for post-dip investing.

Have You Ever Wondered What Really Goes into KYC/AML?: What really goes into KYC/AML? What’s the point of it and–more importantly–how many cryptocurrency exchanges are actually playing by the rules?

Digital Currencies: An Iran, Venezuela Saviour Amid Sanctions and Inflation?: International governments are turning to crypto to shore up failing economies and dodge U.S. sanctions, but will cryptocurrencies provide the way out these governments want?

Blockchain Smartphones: An Exploration of Several Market Offers: In this article, we take a closer look at some of the blockchain smartphone offers being advertised on the market.

Cryptocurrency News From Around the World

Coinbase Rolls Out Crypto E-Gift Cards in EU and Australia: In a partnership with WeGift, Coinbase now offers its European and Australian customers direct withdrawals into e-gift cards. These “customers can now spend their crypto with all their favourite retailers, like Nike, Tesco, Uber, Google Play, Ticketmaster, Zalando, and many more. Customers purchasing an e-gift card will enjoy zero Coinbase withdrawal fees and bonuses on select e-gifts. From converting bitcoin into Uber credits or ether into a Nike shopping spree, customers will have greater flexibility and control over how they use their crypto,” an announcement via blog post reads. Outside of Australia, the option is available in the UK, Spain, France, Italy, the Netherlands, and the company hopes to onboard more companies and expand the option to other countries within the coming months.

Bitmain Revamps Transparency Policies for Mining and Shipping: In a campaign to galvanize community trust, ASIC manufacturer and mining giant Bitmain has released a blog post that gives a clear breakdown for a handful of the company’s operational policies. The four tenets of their new transparency policy include a “[disclosure] policy on self-mining,” a [zero] tolerance policy against ‘secret mining’,” a commitment to “never seek to mine ‘empty blocks’,” and a “promise provide shipping and volume information of new miners to the public.” These measures will build on previous ones the company has undertaken recently to increase transparency, including ” restricting order quantities, ensuring a first-paid-first-ship order of fulfillment, blocking IPs that we suspect to be hoarding, and publishing detailed shipping updates openly,” the post reads.

TRON Confirms Acquisition of BitTorrent: It’s official: TRON has bought out BitTorrent. Justin Sun, TRON’s CEO, took to the cryptocurrency’s Medium blog to herald and confirm the acquisition. “Through this acquisition, BitTorrent and TRON will combine forces, with the TRON US team merging with the BitTorrent team. BitTorrent possesses world-class technical talent and solid experience in decentralized protocol technology. Combining the robust capabilities of the two teams will take the technology behind the TRON ecosystem to a whole new level,” Sun writes in the release.

Fortune Releases a Crypto 40 Under 40: The crypto industry now has its very own version of Fortune’s 40 Under 40. Presenting a bit of overlap with the magazine’s main list, The Ledger 40 Under 40 “has assembled a supplementary honor roll of the most impressive, young superstars transforming business at the leading edge of finance and technology,” the magazine claims. Brian Armstrong (Coinbase), Vitalik Buterin (Ethereum), and Jihan Wu (Bitmain) secured the top three spots, respectively.

Who made The @FortuneLedger 40 Under 40? The brightest stars in fintech and crypto—that’s who. https://t.co/UXtQBwBkyA pic.twitter.com/MBZMo8w7Vd

— The Ledger (@FortuneLedger) July 23, 2018

Venezuela to Launch New National Currency Backed by the Petro, Its National Coin: Plenty of governments have toyed with the idea of backing a national cryptocurrency with their existing fiat currencies, but Venezuela is the first country to turn this on its head and try to back a national currency with a cryptocurrency. The petro, Venezuela’s national cryptocurrency which is itself backed by commodity reserves like oil and gold, will back the Bolívar Soberano (sovereign bolivar), according to the Venezuelan government. The initiative is the latest attempt by the Maduro administration to salvage an economy ravished by hyperinflation, as the sovereign bolivar will replace the bolivar fuerte, the country’s current currency.

More on National Coins: Iran Preps Its Own: Iranian officials confirmed their plans to issue a state-backed cryptocurrency to domestic media outlets this week. “We are trying to prepare the grounds to use a domestic digital currency in the country,” public official Alireza Daliri told ISNA news.“This currency would facilitate the transfer of money (to and from) anywhere in the world. Besides, it can help us at the time of sanctions.” Iran has been weighing its own national coin for some months as the Trump administration continues to threaten to reintroduce US sanctions on the Middle Eastern country. If Iran carries on with its plans, it’ll be in the company of Venezuela, whose petro was launched, even if implicitly, for a similar purpose earlier this year.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.