Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

There are many ICOs. The phenomenon, that started three years ago, has become very accessible due to Ethereum based ERC-20 tokens. After you’ve learned how to identify a good ICO, in the following list you will find 10 red-lights for bad ICO investments.

1 — Team is inexperienced in the crypto field: No well-known crypto advisers, no famous venture capitalists investing. Watching interviews with the team’s key members can help answer if you trust them or not.

2 — “This is an existing company, with 3 years’ experience and 20 workers”: Is the company only here for the money? If the pivot is not necessary, then yes. If the company is already profitable in their field, why is the ICO needed, besides the “easy money?”

3 — Bonuses for everyone: The more funds are raised with a bonus — the more likely the price will be traded close to that discount level. The more serious case is when there is no vesting for the pre-sale investors.

4 — Hard cap is huge: other than a very few cases, an unlimited cap or a very-high cap means huge demand is needed to make up a secondary market (or exchanges). No one will be waiting to buy the tokens on the exchanges.

5 — No real need for the token: The whole ecosystem is built around the project’s token. If you can replace the token with Ethereum or Bitcoin and it still works, there is no real need for a token, hence no real need for an ICO.

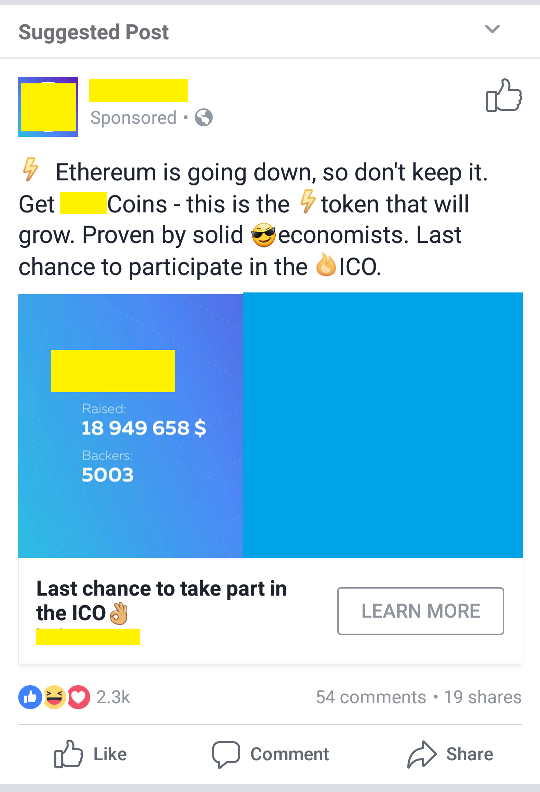

6 — Aggressive marketing: when you see too many Facebook and Google Remarketing banners and ads, especially when they promise nice profits. That’s a red light.

7 — Community’s discussions are of low quality: Join the Telegram, ask questions, see how the developers respond to these questions. Same can be said about the ICO’s BitcoinTalk Announcement thread. A strong community creates high-value discussions.

8 — The public sale lasts too long: either the cap is too high, or the demand is too low, or both. Better for the project to raise 100% of 20M than 50% of 40M.

9 — No signs of a major exchange looking to list the ICO’s tokens: It won’t be said clearly because the legal team doesn’t let the ICO teams speak about exchanges, but this is a major part of the game. In 2016 Poloniex was the hottest exchange, 2017 was Bittrex’s year. Is Binance the exchange of 2018? Might be. What we do know, is that each new coin added there — benefits its initial ICO investors.

10 — Market cap is already huge: Assuming the company is selling only 10% of the circulating tokens for 100 Million USD, the token initial market cap is starting from 1 Billion, without making any 3x or 5x that will explode the market cap value before trading even started. This depends on the circulating supply. Be suspicious of the following: If there is no finite number of tokens, a small percentage is distributed to the public, no lock up on the tokens reserved for the team.

How do you find good ICOs to invest? Visit our ICO List section.

Originally published at cryptopotato.com on February 26, 2018.

10 Signs you are investing in a bad ICO was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.