Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Five ways to identify a Bitcoin Bull Run?

For those who’ve seen Bitcoin for over a year now knows what’s a bull run is, how it crushes alt-coins to dust and how they all regain their status once bitcoin stabilizes at every level. This is a pattern that we have observed in the past and been working as expected so far. But, are there any symptoms of identifying a bull run? Photo by Hans Eiskonen on Unsplash

Photo by Hans Eiskonen on Unsplash

Given the slump in the prices from the beginning of 2018, traders and investors who entered an year ago or at all time high has pretty slow and disappointing Q1 and Q2 of 2018. There is only one thing on everyone’s mind — When would be the next Bitcoin bull run?

Investors would like to see their assets regain past glory, traders would like to make some profitable trades in a bull market and make as much money as possible. But for all this to happen, a bull run is needed. When is that going to happen? Is there a way we can detect that a bull run is approaching?

Here are five ways to identify a Bitcoin bull run:

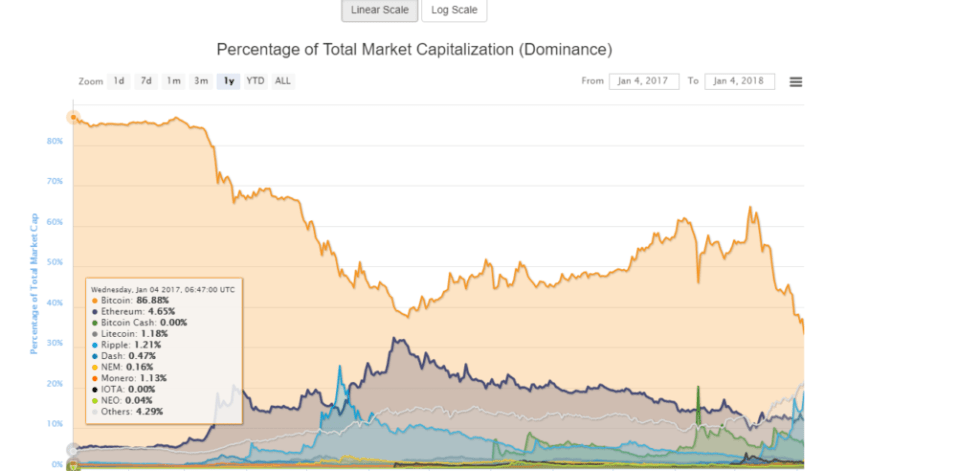

1. Correlation between BTC & Alts

Generally on slow days, Bitcoin and alt-coins go hand in hand. But, at that one moment when the bull run is imminent, Bitcoin relieves itself from other alt-coins and gears up for it’s own run. That’s when the correlation between BTC and alt-coins reverses resulting a growth in Bitcoin dominance in the entire cryptocurrency market.

So, when this correlation starts diluting, it’s one of the signs for Bitcoin bull run or the entire cryptocurrency market.

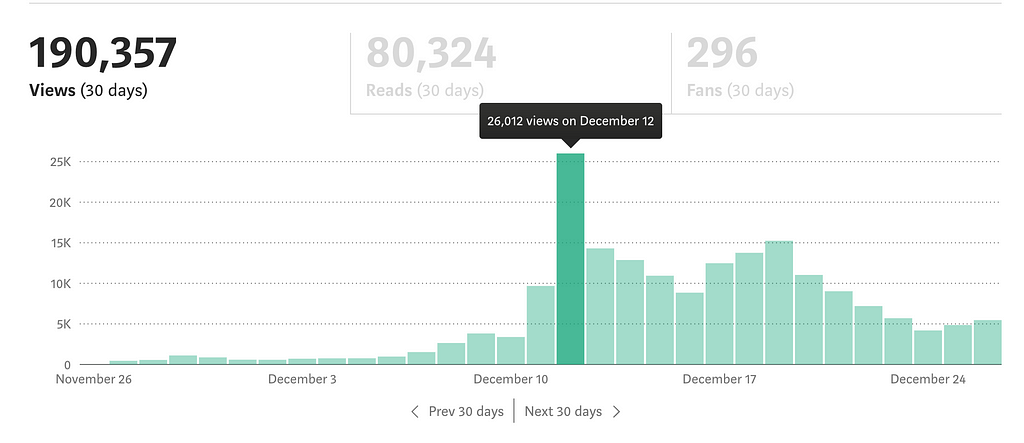

2. Keep an eye on Medium Statistics

This is an interesting factor for all those writers on medium. If you are a prominent writer on topics like cryptocurrency, Bitcoin, alt-coins and related stuff, your medium stats will be pretty flat since the beginning of 2018 — i.e. during the bear market. But, when there is a bull run upcoming, you see the stats start growing.

My medium stats for the month of December

My medium stats for the month of December

Since most of the traffic on medium is via google, this could mean that more retail users are looking for knowledge around cryptocurrency and Bitcoin, who are going to buy Bitcoin and increase the demand — thus resulting in spike in prices.

So, if your medium stats shoot up — it’s one of the signs for a bull run for Bitcoin or cryptocurrency market.

3. Spike in your Telegram Activity From Google — Not mine

From Google — Not mine

Telegram groups, which are like generic cryptocurrency discussion groups or analysis groups (I am not talking about pump and dump groups) — These groups must be calm and lifeless for past few months. Except for few forwarded articles or some breakthrough news links shared by couple of enthusiasts with the hopes of moving price in a positive direction.

But, when the bull run is imminent and approaching in few days, you would sense an increase in activity on various cryptocurrency related telegram groups you are part of. The only thing common would be the discussion of price, applications, adoption, mainstream media articles and all the good news along with some solid calls and puts — confidence levels geared up everywhere.

So, increase in the activity on telegram groups along with other signs would be a way to identify an incoming bull run.

4. Positive news & Reddit memes posts

Reddit — the front page of internet, is also a prominent place for discussions around cryptocurrency and it’s projects. I guess Reddit is the only place where people refer to these tokens and coins as projects instead of financial tools of exchange.

Memes, are an integral part of humanity to express their feelings — these memes are best used in crypto scene to express the bull runs, bear markets, anxiety, despair, aggression and many more feelings. There are tons of interesting, humorous and hilarious memes shared on Bitcoin/Ethereum/Ethtrader and many more subreddits regarding price and significant events.

Before the bull run, activity on reddit also increases. Normal days’ activity is mostly confined to development or marketing updates of projects and few beginner questions and more of customer service rants. But, yeah! before a bull run — everything is like a friday night party — very lively, everyone will be dancing around sharing creative memes or post the same old memes.

So, reddit activity is one of the signs for identifying a bull run.

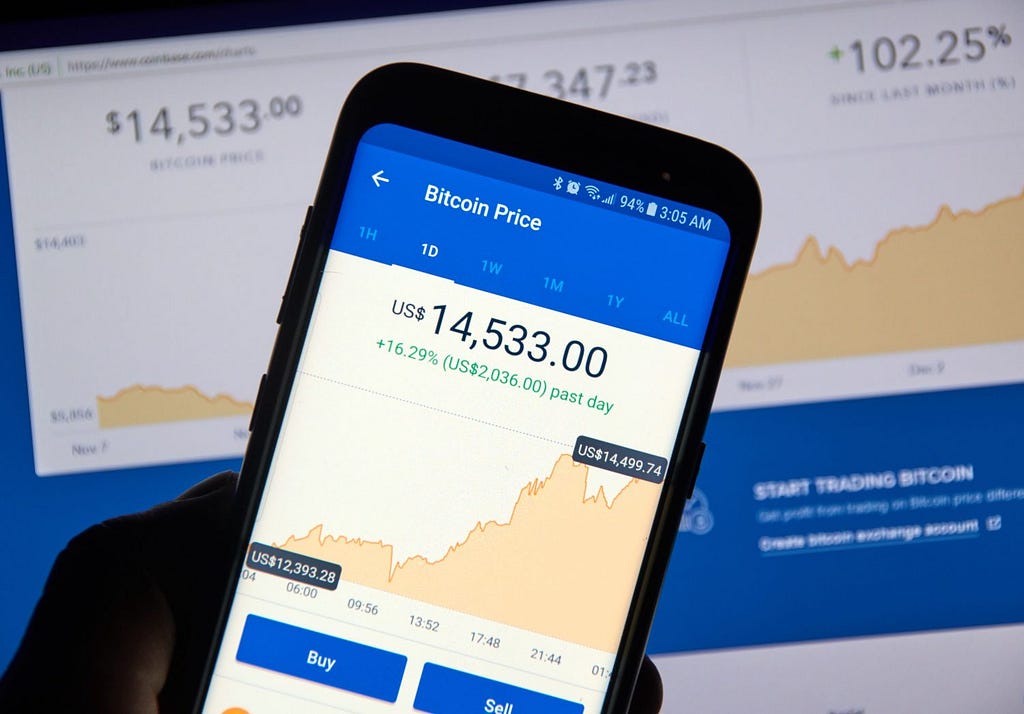

5. Actual BTC Ticker — if you monitor it closely, it keeps growing! believe me!!

Interestingly, price of Bitcoin also starts rising rapidly through out a bull run — this is the most important signal that it’s running. Forget about bubbles and bursts and bear markets. When you feel it’s a bull run, ride it as far as you can & sell off to make profits.

If you wait through the bull run & enter a bear market — you can bookmark this article to read again at that time!

So, that’s some interesting information, which can help you identify an incoming Bitcoin bull run as it’s approaching. If you feel this is helpful — clap for the article and share it across the social media.

Information provided is based on experience and has some humor elements added to it to make it interesting. This is not a suggestion or financial advice in any form and should not be considered as one. Cryptocurrency markets are very volatile and one could lose the entire investments. So, please use your own discretion for making any decisions and take them after thorough research.

If you’ve already made investments in cryptocurrency and need help with calculating taxes, use our service BearTax — which can connect to tonnes of exchanges seamlessly and provides you with gain loss calculation within minutes. Check out www.bear.tax

BearTax - Your Crypto Tax Assistant

Five ways to identify a Bitcoin Bull Run was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.