Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin and Altcoins trading is like a raging river. It is a non-stop, rapidly changing process, more often than not accompanied by significant consequential events. If you swim against the current, you might disappear completely. In order to improve trading skills and market understanding, it is best to learn from other’s mistakes. The following article was written based on major experience in the crypto field and after having thousands of crypto trade positions over the past years. And of course, mistakes were made along the way. Shall we begin?

The order book — How to place commands properly

Let’s discuss the correct way of using the order book. A coin’s value is determined by the last executed transaction, at the junction between buyers and sellers, or according to the supply and demand forces. Those supply and demand commands are arranged in a table, better known as the order book. In crypto, it’s all about volatility. Thus, and following the previous tips given in our crypto trading article, when you enter a position it is recommended that you set the sell level to take profits. Alternatively, while aspiring to make it simultaneously, set a stop loss to minimize losses. But how will we know exactly where to place these commands? To identify both resistance and support areas, we start by analyzing the graph at the most basic level. A beginner’s technical analysis article will assist with this task. We identify points where we want to take profit (resistance levels) and simultaneously identify support levels. By referring to the order book we will find the optimal levels at which we will actually place these commands. Note that if support levels break down it is time to cut the losses.

Identifying sell levels to take profit: Using the order book we identify the areas of resistance that we previously analyzed. It is likely that being resistant, massive supply (a “wall” of sell commands) is present around these spots. The trick is to place our sell commands precisely one step ahead, at a slightly lower price, so in case the demands start to eat away the supply wall — our command has already been placed and sold to profit.

Identifying stop loss levels to minimize losses: In the order book we identify the points of support that we also analyzed before. It is likely that being supportive, massive demand (a “wall” of buyers) is present around those spots. This is the best zone to place the stop loss command, although it should be placed a little lower than the high demand zone. They will only get to our command if the sellers manage to lower the price and the “wall” of buyers breaks. The “wall” of buyers works as a sort of protection level for our command.

Is it possible to place a ‘take profit’ and a ‘stop loss’ command simultaneously? As of the time of writing, excluding some leveraged trading exchanges, such as Bitmex, current trading exchanges do not support the placement of the two commands simultaneously. In a perfect world, we could have set both stop loss for trade and levels of profit taking, lowering the chance of substantially loss. Until that happens, we will settle for what we have — I usually set take profit levels for some part of the position, while setting a stop loss level for the other ones.

Graph analysis — Altcoins vs Bitcoin and vs Dollar

Major Altcoins have the most volume traded again the USD. Thus, analyzing graphs of those Altcoins should be done whilst comparing them to their Bitcoin graph and their dollar value graph. Here on CryptoPotato we make sure we do that for our weekly market reports. If we were solely analyzing the Bitcoin value chart, we would surely miss the accumulation period of Ethereum by roughly $300 (recall $300 of Bitcoin accumulation back in 2015?). At the time of writing Ethereum is trading a month later, for more than $1000 for one Ether.

Ethereum is accumulated around 300$ (yellow area of the graph) until sky rocketing.

I’m targeting your emotions

An unbreakable rule in trading says that you should never involve your emotions in trading. This is a basic rule for anyone who trades over any term, but especially for the ones who trade for the short term. Imagine buying Bitcoin according to the DCA strategy: Let’s say the Bitcoin price had crashed by 40% in three days. Now what? Obviously it is the time to buy a second portion of the coin (according to DCA) and average the initial trading entry price. But instead, almost everyone I know got “cold feet” exactly at the “terrifying” moment of decrease and had not completed the purchase of the second share. Why does it happen to us? One word — emotion. Emotions, in this case — fear of loss, affects us and completely disturbs our plan of action. If you are one of those (yes, the majority) who won’t buy the second share in the example above — you should consider your future as a trader, a crypto trader in particular. Getting over your emotions is also important after an unsuccessful trade or after you have sold a coin which is sky rocketing just after you sold it (FOMO). To sum up, don’t regret profit you’ve missed and don’t feel guilty about lost trades. Set yourselves a plan of action together with a set of goals, and act accordingly — as if you were a pre-programmed computer. Human beings are not rational creatures.

Recommendation for such a plan: After placing target sell commands, and given the coin has reached its first goal, you need to close out half your position. Meanwhile, increase the stop loss to the initial entry level (so you won’t lose at all). At the second target level you should close out an additional quarter of the position. Now, it is likely you will stay in the position with a quarter of it, although with the profits alone — once you got the fund’s money back “home”. At this point the profit game becomes unlimited. Coins that pump up 2,000% in two weeks are not a rare sight in the crypto world. When you are only playing your profits — you are on the safe side and it becomes a lot easier.

What goes down — does not necessarily go up again

An additional common mistake is searching for crashed coins, in accordance to their value against the Bitcoin, hoping they will return to their glory prices. So newsflash — there are coins which are light years away from their peak levels. Take Aurora for example; in March 2014 an all-time high price of 0.14 Bitcoin for one Aurora was recorded. As of the time of writing, Aurora trades at a 99.9% discount — 0.00014 Bitcoins. Could the (damned) Aurora make a move upwards 1000x? You’ll never know. You surely can’t assume a coin being lower than its peak price is an opportunity rather than a falling knife. There are also coins which disappeared and slowly got out of continuous trading — a scenario defiantly worth considering (especially with the low-cap and volume altcoins).

Time is money

A week in the crypto market is equivalent to three months in the traditional capital stock exchange, in terms of events and occurrences. One who wants to jump right into the deep water of crypto trading has to follow it not just on a daily basis, but on an hourly basis. It’s not everyone that can play this game. Nevertheless you need to consider the amount of time invested in the process. Sometimes it pays off to be a long-term investor, rather than a daily trader. By the way, as a daily trader it does not necessarily mean you are bound to buy and sell and trade every single day. Trades can reach their destination within minutes, as well as within months. Think about the time you are willing to invest in studying and tracking the market. Remember your time has marginal cost, or in other words — your time has a price tag. If you have decided to put your time and effort into trading on a daily basis, it is better to start with small doses and examine the performance prior to increasing invested amounts. This is yet an additional benefit of crypto — the possibility of trading on micro-transactions. Unlike the capital market, where if you put an eye on Apple stock, you would need to buy a minimum share equivalent to a couple thousand bucks, in crypto you can perform transactions of a few cents.

First mistake: I buy Ripple as its price is relatively cheap compared to Ethereum’s

A common beginners’ mistake is to look at the coin’s price rather than the market cap. Just as you asses a company by its market cap performance, which is calculated by multiplying the number of shares times a single share’s price, the same is done for Altcoins. The number of existing coins in circulation times the coin’s price. For a low price coin, such as Ripple, there is solely a psychological influence on the buyers. There is no difference whether one Ripple equals one dollar, and there are a billion Ripples out, or if one Ripple equals a thousand dollars and there are million units of Ripple. Therefore, from now on, when examining coins for investment on CoinMarketCap, look mainly at the more substantial figure, which is the market cap, and focus less on the price for one coin.

Second mistake: Don’t put all of your eggs in one basket

Crypto is really unpredictable. While reaping profits of hundreds of percent, the section withstands now and will continue getting dozens of billions of dollars erased flat out in the future. When Bitcoin loses its value against the US dollar Altcoins usually go through the same process. Simple math shows that even holding a part of the portfolio in Altcoins, such as Ethereum and Litecoin, is usually not enough to avoid getting a big chunk of the portfolio’s USD worth wiped out following a Bitcoin dump.

In 2015 and the beginning of 2016, when Bitcoin held solid — as solid as Bitcoin can be — shuffling around $300 per one BTC, the game was trading Altcoins in order to gain more Bitcoin. It was expected that Bitcoin would grow higher in the future (the Pygmalion effect). Having a rather volatile base asset, such as Bitcoin, raises our need to compare our portfolio performance both in terms of its Bitcoin’s value and its dollar’s value. Many traders decreased the number of Bitcoin they are holding during the past year (hey, and it wasn’t hard when Ethereum got cut 70% from its Bitcoin all-time high…) although it had a nice dollar yield. Bitcoin’s growth made a lot of money for the crypto market, causing its total market cap to increase 30 times during the last year! As traders, it is important to keep Bitcoin as your base asset, but also not to forget the dollar value, and to take profit sometimes. You should always see the bigger picture — crypto is only one tier of your investment options. There are also the stock markets, real estate, bonds and many more investment opportunities. It is important to spread the risks among the crypto portfolio, as well as in the whole household investment portfolio.

Third mistake: Bitcoin has increased a lot, so I’ll buy Litecoin

As was mentioned above, there are two ways to examine investment in Altcoins — vs Bitcoin and vs the US dollar. This is a common mistake amongst those who missed the Bitcoin train, and are looking to cash in on the other altcoins. Those investors have to examine the investment dollar-wise, since they exchange US dollars or out FIAT in order to buy crypto (instead of buying with the Bitcoins they already have).

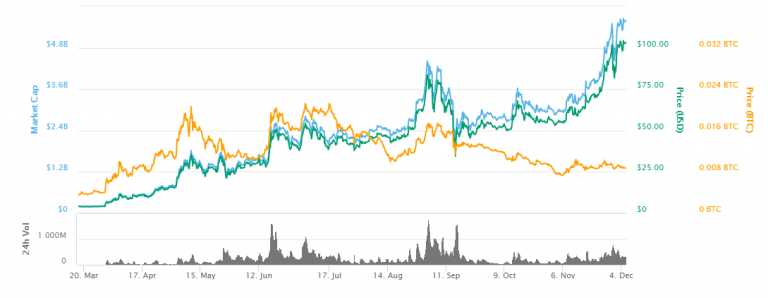

What’s the catch here? Take a look at the following Litecoin chart, showing its performance from March to December 2017:

The yellow line represents Litecoin’s price in Bitcoin’s value, green represent US dollar price of Litecoin, blue line represents total market cap of LTC in USD.

Bitcoin-wise, the first assumption that Altcoins’ value decrease when Bitcoin value increases is correct. A side note: it’s not true all of the time; When China outlawed the crypto exchanges, money flew out from all of the cryptos — Bitcoin declined and Altcoins declined even more.

Dollar-wise, as you can see — Litecoin’s price has increased along with Bitcoin (but less). A reminder about the majority of those quoting “Bitcoin has increased greatly, I’ll buy Litecoin”, buy Litecoin with FIAT (or by converting to Bitcoin, then to Litecoin right after — which is the same). Therefore, learning from the graph yet maintaining the same behavior, when Bitcoin’s value drops, Altcoins’ USD value will drop as well (although as a percentage it will probably be less, but it will still go down).

In conclusion

Good traders acknowledge their mistakes, and more importantly — analyze and learn from them, thus improving their skills for understanding the market. So which kind of trader are you? Did you find yourself somewhere in the article? We would love to hear on the comments section below, and you are welcome to share this article with whoever you see as relevant.

You are also welcome to continue reading the previous article — 8 must read tips for trading Bitcoin and Altcoins.

Originally published at cryptopotato.com on January 9, 2018.

7 Crypto trading tips and common mistakes was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.