Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

You don’t have to delve too deep into the crypto market before you stumble upon evidence of a battle that has been intensifying – Bitcoin vs. Bitcoin Cash.

Considerable effort has been put forth by both parties involved in this conflict. Bitcoin (BTC) supporters have accused Bitcoin Cash (BCH) of attempting to hijack Satoshi’s original vision of a truly decentralized currency. In turn, Bitcoin Cash supporters accused Bitcoin developers of allowing BTC to become unusable as a digital currency. Let’s take a moment to examine how this conflict originated and how it has developed over the last year.

The BTC vs. BCH Backstory

Bitcoin Cash was introduced to the cryptomarket via a hard fork on August 1st, 2017. While this is an important date in the feud, you must return to the beginning of BTC’s scalability issues to really understand how this debate became so heated. You also need to know a few key players.

Players in the Game

- Roger Ver – Owner of Bitcoin.com, angel investor for many BTC startups including Blockchain.info

- Jihan Wu – Co-founder of Bitmain, supporter of Bitcoin Unlimited

- Calvin Ayre – Owner of the online gambling platform Bodog, Calvinayre.com

- Dr. Adam Back – Inventor of Hashcash Proof-of-Work system

- Dr. Pieter Wuill – CEO of Blockstream, BTC lead Developer

A Rift Forms

Bitcoin began to experience scalability issues in early 2017, when cryptocurrency adoption started to take off. During this time, congestion on the blockchain was causing huge delays and unprecedented fees. By July of the same year, the crypto community was split on how to correct these issues. A large group of people felt that BTC had lost its ability to be used as a digital currency due to rising transaction costs and delays.

Increase Block Size

Of these individuals, some believed that it was paramount that BTC’s 1MB block size be increased. This side of the argument felt that BTC was no longer able to function as electronic cash due to the fees and congestion. In Satoshi’s white paper, he clearly states

“A purely peer-to-peer version of electronic cash.“

This group included Roger Ver and Jihan Wu. Wu felt that the increased block size would be beneficial to miners. Both of these gentlemen hold enormous sway in the crypto community. Roger Ver had even earned the nickname “BTC Jesus” for his past efforts supporting crypto startups such as Blockchain.info. Wu controls a huge portion of BTC’s network hash power. His firm, Bitmain, dominates the mining hardware sector.

Original Block Size

On the other side of the battle, you have Bitcoin’s development team. This side of the debate argued that increasing the block size was completely altering Satoshi’s vision. They felt that 1MB block size was integral to BTC because miners must download the entire blockchain. Any increase to the block size could potentially reduce the ability for new miners to participate.

On this side of the scalability debate, is Dr. Pieter Wuill. He is the brains behind the SegWit and BIP 32 implementations. He has also been BTC’s lead developer since May 2011. You also have Dr. Adam Back. Back’s Hashcash was cited in Satoshi’s White Paper.

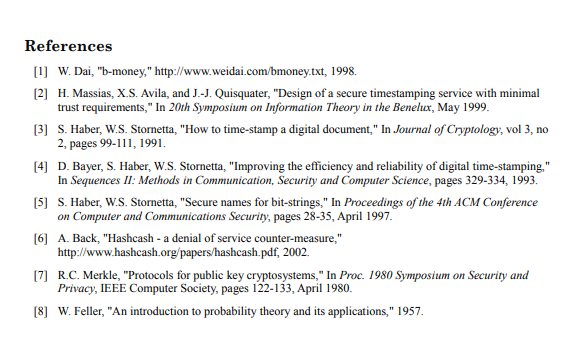

Satoshi’s White Paper References

New York Agreement

The New York Agreement (also known as the Silbert Accord) was published on May 23, 2017. This agreement was introduced as one of the options for ending BTC’s scalability issues. The agreement proposed integrating Segwit with a 2MB block size increase.

The agreement was signed by 50 different BTC-related companies. BTC’s development team, however, did not support this solution.

Neither side achieved the necessary 50 percent support from miners, despite their compelling arguments. Eventually, a compromise was conceived in which SegWit would be activated in August, and BTC’s block size would be doubled in November. This new plan received 80 percent approval from the mining community and for a brief moment, everything was calm.

The Calm before the Storm

As you already know, BTC block size was never increased. Bitwala and F2Pool dropped their support for the protocol, citing the lack of support from the Bitcoin’s developers. This led us to the now infamous BCH hard fork.

The Twist – BTC vs. BCH

Now the story gets interesting. On February 13, 2018, Roger Ver’s website, Bitcoin.com, published an article in which they announced the release of their new BCH wallet. The wallet featured an integrated ShapeShift feature that allowed users to trade their BTC for BCH or vice versa.

Bitcoin Core

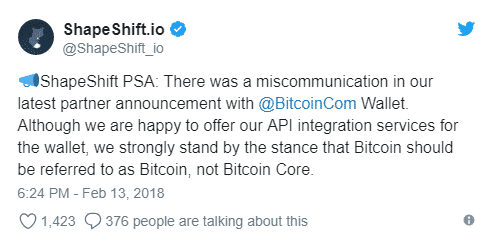

What made this story particularly interesting was, that, for the first time, the crypto BTC was referred to as Bitcoin Core. This led to a firestorm of social media responses and the official start of the BTC vs. BCH public debate. Even ShapeShift posted a Tweet in which they distanced themselves from the actions of Bitcoin.com.

Shapeshift PSA

Eventually, ShapeShift got onboard with the BCH project. This became apparent when users began complaining about emails which referenced BTC as Bitcoin Core.

At this point, the debate began to encompass all of the major figureheads in the crypto community. Litecoin’s founder Charlie Lee posted a scathing Tweet in which he accused Bitcoin.com of using their influence to confuse new users into believing they were investing in BTC.

Charlie Lee Tweets Roger Ver

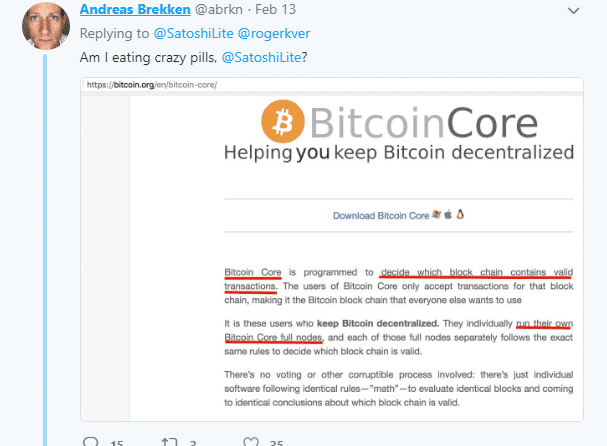

Bitcoin.com advisor Andreas Brekken defended the decision by posting Bitcoin Core references found on Bitcoin.org, Bitcoin’s development site. He even Tweeted a response at Lee that showed that the Bitcoin Core title was directly taken from the Bitcoin.org website.

Andreas Brekken Tweets Charlie Lee

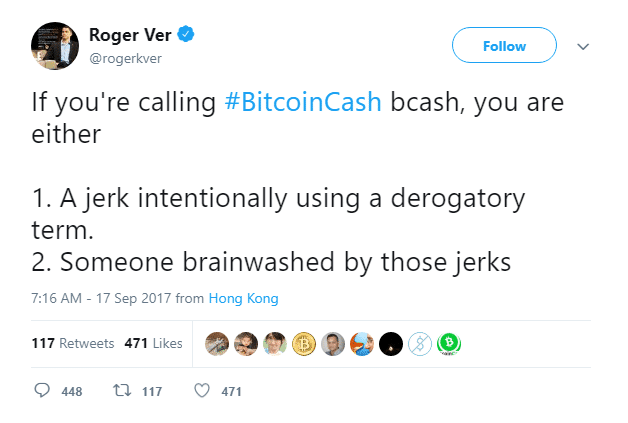

BCash

BTC supporters adopted their own slang in response, calling Bitcoin Cash, BCash. While you may not see this as a big deal, it was seen by many BCH supporters as a huge insult. Bitcoin Cash supporters believe they are carrying out the true purpose of BTC. Therefore, the removal of the term Bitcoin was seen as derogative by many. Roger Ver even took to Twitter to express his disdain for the term.

Roger Ver on the Term BCash

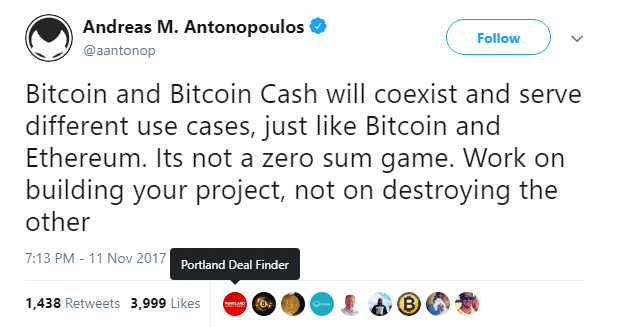

Not everyone has lost their cool in the BTC vs. BCH debate. The well-known crypto author Andreas M. Antonopoulos tweeted out a call for peace in the middle of all of this action. In the Tweet, he explains that both cryptos can coexist in harmony.

Andreas Antonopoulos Speaks for Peace

The Feud Continues – BTC vs. BCH

Fast forward to today and the debate is still raging. Bitcoin Cash has managed to carve out a niche in the crypto market and is currently the number three crypto in terms of market capitalization. BTC is quickly approaching the implementation of the Lightning Network. Many believe this off-chain protocol to be the solution to BTC’s scalability issues, but it has created controversy of its own.

Lightning Network

The Lightning Network is a second layer protocol which allows users to open direct payment channels. These channels reduce the amount of congestion experienced on the BTC blockchain. The Lightning Network is currently in its beta testing stages. This optional protocol has seen substantial adoption despite security and centralization concerns.

Lightning Network users can send BTC payments for less than a $0.01. Lightning Network App developers have already put forth multiple platforms to showcase off the microtransaction capabilities the protocol provides. Many of these platforms have become part of the raging BTC vs. BCH debate, with both sides hurling a barrage of insults.

The platform Satoshisplace allows users to experience the Lightning Network’s microtransaction capabilities first hand. It features a one million pixel whiteboard that users can mark at the cost of one Satoshi per pixel. The following time-lapse video illustrates just how quickly the board turned into a BTC vs. BCH battleground.

BTC vs. BCH – The Battle Shall Continue

Unfortunately, there is no indication that either side will let up their attacks at this point. To the contrary, it appears that the attacks are becoming more belligerent. For the time being, BCH is looking to fulfill BTC’s digital currency promise with a centralized twist, whereas, BTC’s developers want to keep the original cryptocurrency decentralized. Both currencies are looking to off-chain solutions to solve their problems.

Who’s right? That’s your call. As it stands now, you should sit back and watch the fireworks.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.