Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bytecoin mining quick stats

Bytecoin, the allegedly shady blockchain that Monero forked from, might still be a solid option for investing your hash power. However, like any pre-mining considerations you may make, Bytecoin mining comes down to the numbers.

A Quick Recap

Bytecoin was the first blockchain on the scene to natively launch with Cryptonote, a pillar to Bytecoin’s anonymizing technology. Launched in 2012, Bytecoin leverages ring signatures to create unlinkable transactions between stealth addresses, fostering an ecosystem of anonymity within their blockchain. The majority of Bytecoin use cases overlap with Bitcoin and other payment processing cryptocurrencies. However, Bytecoin’s differentiating factor is shared between its full anonymizing blockchain and its first-to-market presence.

For the full story on Bytecoin, pop over to our more detailed explainer, which covers how Bytecoin works and where to buy and sell.

Can Bytecoin Mining be profitable?

Before jumping into the world of mining, some essential planning is necessary to give yourself a path and define your goals. The profitability of Bytecoin mining, like most other mineable coins, can be reduced to a few key factors with your hashing power paramount to all other elements. Simply put, the more your rig can hash per second and the less it costs per day to run that rig, the more profit you can make.

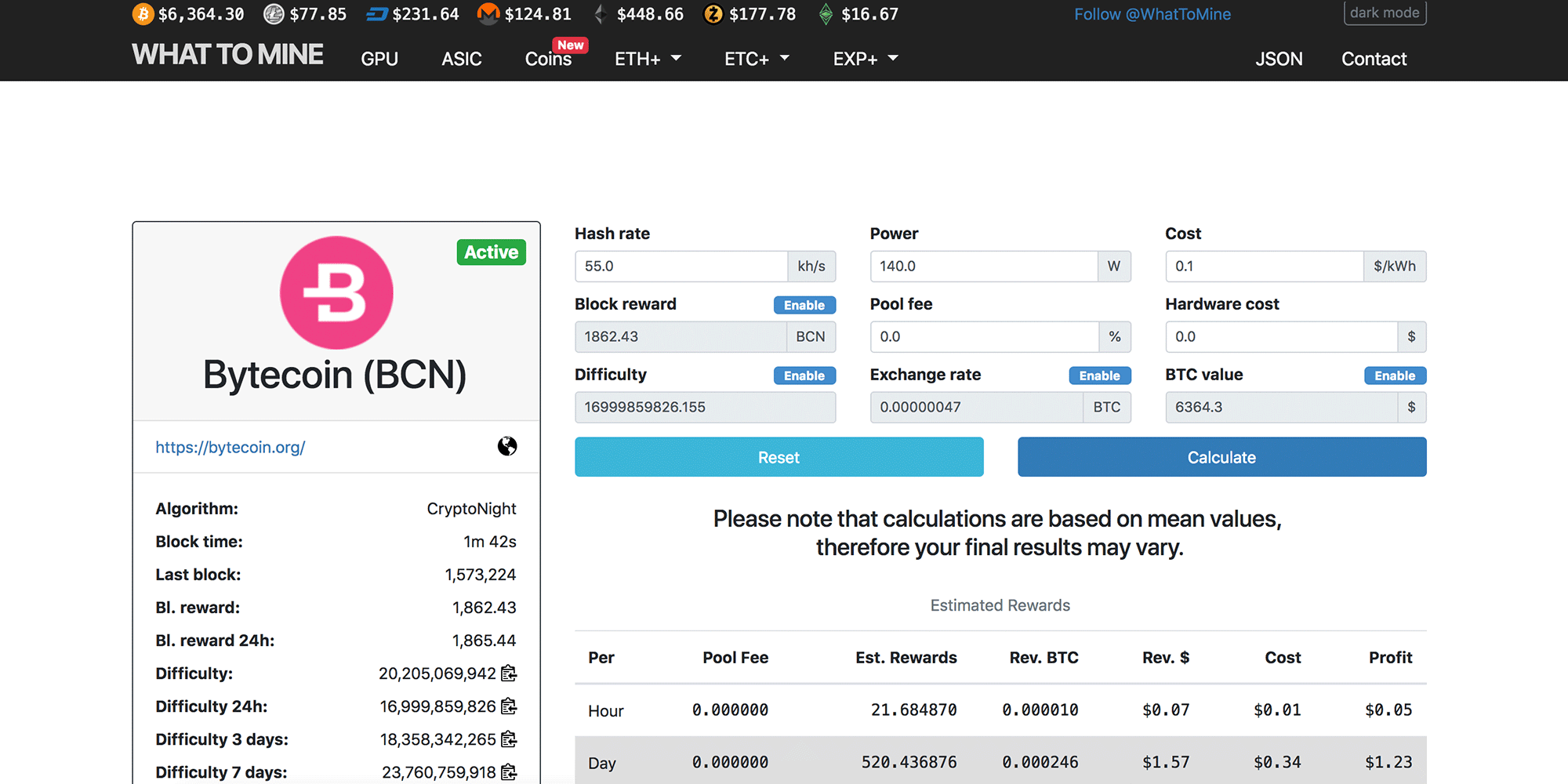

Bytecoin mining profitability calculator

Thankfully these figures are relatively easy to forecast and plunk into a handy profitability calculator. With a bit of insight into your initial costs and operating costs, you can get a feel for how much mining you can expect, and when you might see a break-even point on your hardware costs.

By trying out a few different scenarios with hashing power of various CPU, GPU, or ASIC hardware options, you can begin to get a picture that the more hashing power you can throw at your operation, the faster you will reach your breakeven and create room for new investment or profit taking.

Deciding whether Bytecoin mining is profitable covers a lot of the same questions that surround the profitability of any minable coin. These questions begin with your hashing power and expand into other areas of consideration, which can shrink or widen the margins of your mining rig. Some factors, like the per kilowatt cost of your energy or the wattage your rig will require, are easily reflected in a profitability calculator but do not give the entire picture of potential challenges to your bottom line. Political shifts or economic winds can change the cost of energy or your access to good power sources. Software and hardware can fail, leading to unexpected down times that cut into your profit projections. Furthermore, and this should be pretty obvious, crypto prices fluctuate widely.

Hedge your risk against these less controllable factors that can affect your profitability by creating some high and low scenarios. For example, what is the break-even of your operation if Bytecoin halves in price? What is your break-even if it doubles in price? Take things a step further and explore alternative options in energy sources. Diversifying your power source will protect your mining endeavor if the economic forces-that-be change over the lifespan of your operation.

In summary, is mining Bytecoin profitable? Probably, but there’s risk. Do the research, use the available resources, and build within your budget. Small rigs will rarely mine more value than the cost of electricity, but who knows, crypto prices fluctuate widely.

Speaking of Fluctuations

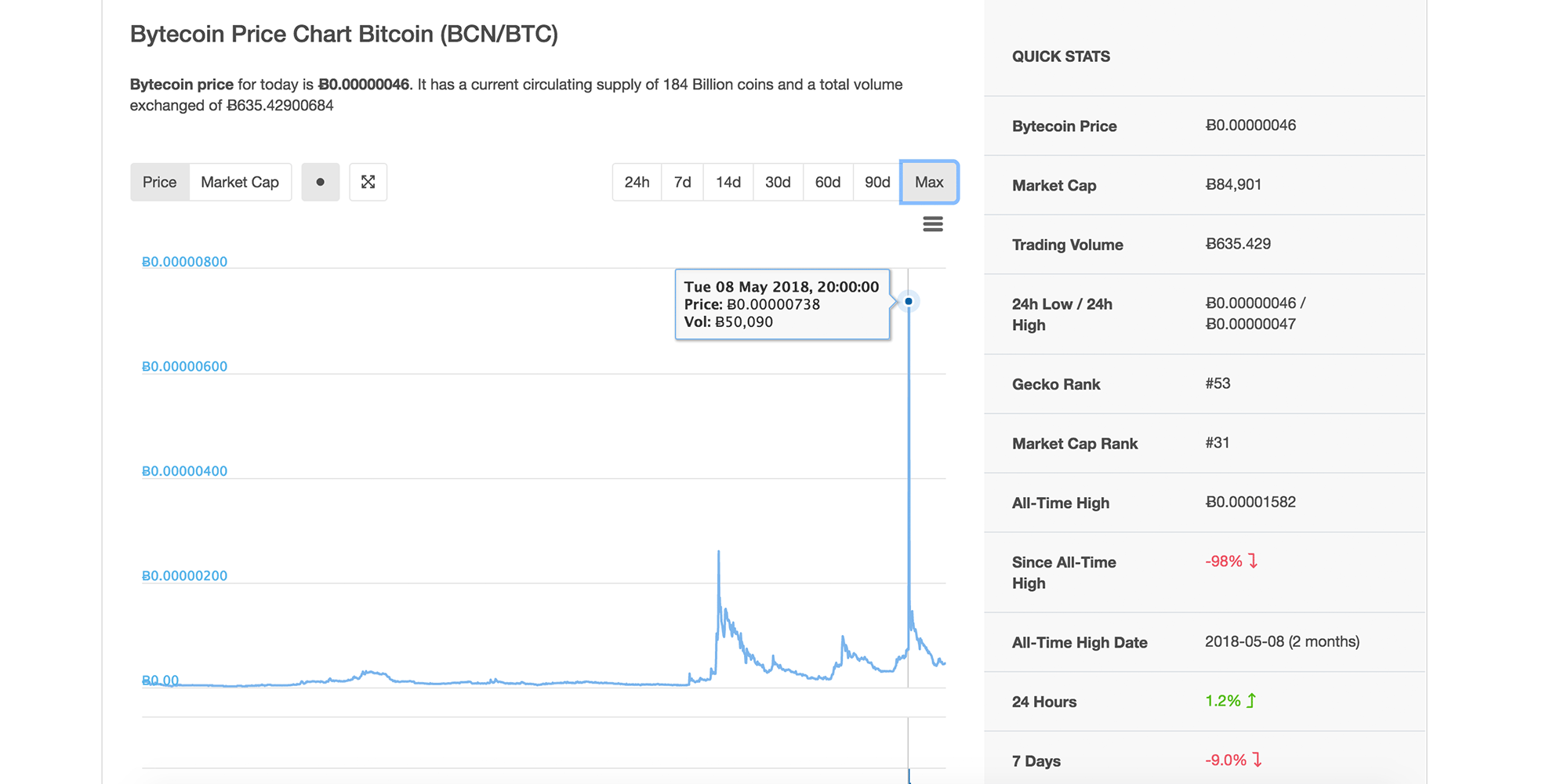

Cryptocurrencies are volatile, not a shocker, and Bytecoin isn’t exempt. Check out price charts dating back to 2014 for Bytecoin.

Bytecoin price spikes after Binance adoption

Bytecoin has had a few sizable spikes in the course of its price history. The most recent spike was attributed to the news and subsequent adoption of BCN on the world’s largest crypto exchange, Binance, on May 8th, 2018. However, the overall trend of Bytecoin’s price has been largely been tied to the movements of the crypto market at large and of course the market dominant Bitcoin.

User adoption and use-case growth will presumably help fuel growth of the Bytecoin network and speculatively the market price. However, mining profitability will be dependent on whether Bytecoin can experience long-term price growth despite short-term price spikes, or at least produce higher price valuations than your overall mining operational costs.

What’s in Store

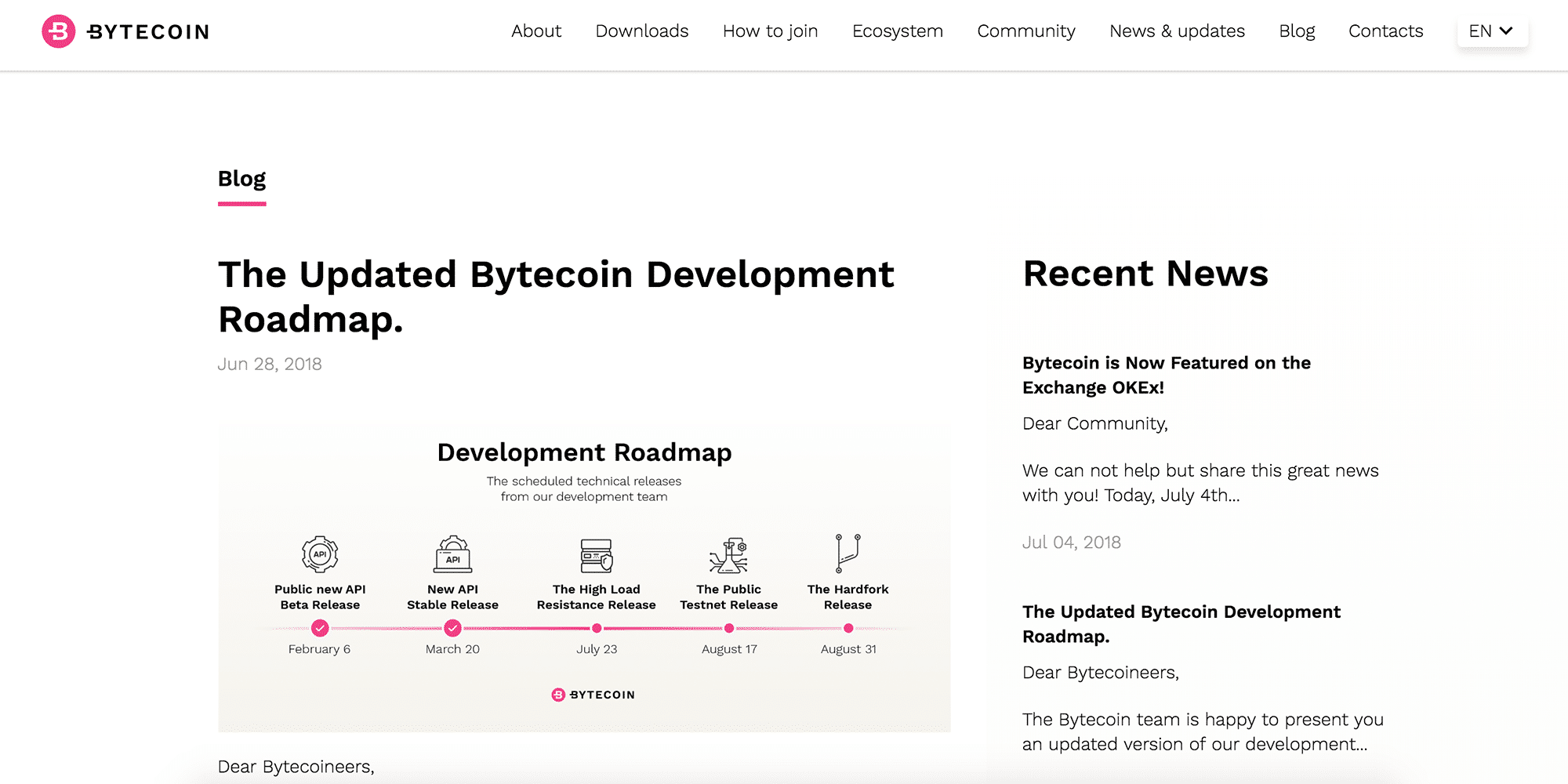

In the pipeline for Bytecoin, on their recently updated roadmap as of June 28th, 2018, some specific dates have been named in the near future. This includes a planned hard fork on August 31st. Ideally, these longer-term goals, including expanding into the African Market in Q3 2018, could lead to building a better price base within Bytecoin.

Bytecoin roadmap – next step into new markets and upcoming hard fork

Wrap It Up

Bytecoin mining profitability is certainly possible in the short term. But the big gains remain to be seen as the future unfolds and the open-source team delivers on their plans. The mining community is strong and Bytecoin seems to be ASIC friendly, at least until the end of 2018, leaving the ecosystem open for large-scale mining from Cryptonote friendly ASIC chipsets.

Overall, profitability will be the direct outcome of an operations’ access to hash rate, cheap and predictable power, and the stable growth of Bytecoin price.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.