Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

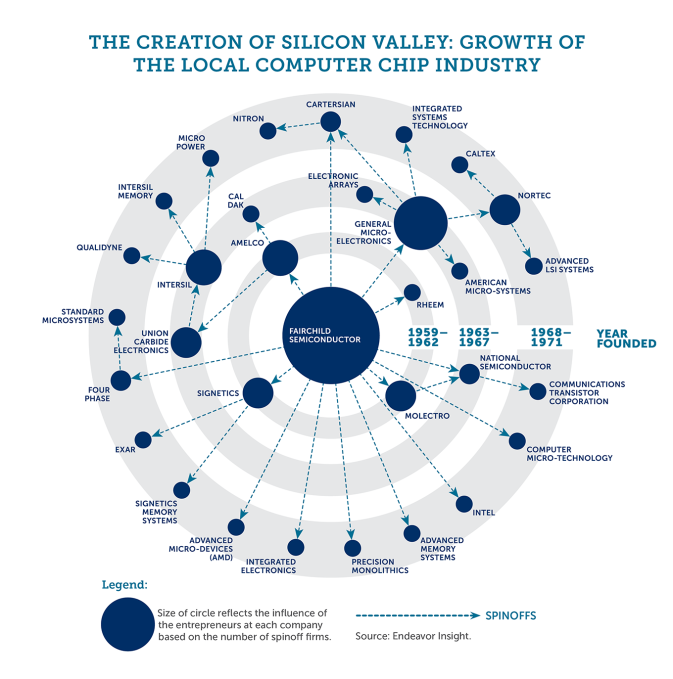

The story of Silicon Valley is one of regular cycles. A company is founded, scales rapidly, it’s employees start their own companies, and the cycle repeats.

The first cycle began in 1965 with Shockley Semiconductor, the first silicon-based high tech company in the bay area. In less than two years the company had made numerous breakthroughs and eight employees, nicknamed the Traitorous Eight, left to form their own company, Fairchild Semiconductor. In just three years Fairchild experienced explosive growth, generating over $20mm annually, an amount equivalent to over ten times that today. As its employees participated in this massive wealth creation they started spinning out on their own, growing both the number of companies and value created exponentially.

The “Fairchildren”. Graphic courtesy of Techcrunch

The “Fairchildren”. Graphic courtesy of Techcrunch

With momentum quickly outpacing it’s east-coast counterparts, the Silicon Valley cycle started to repeat. A few of the Fairchild spinouts (lovingly termed “Fairchildren”) were able to repeat the success of the company from which they came, leading to their employees doing as their founders did and spinout from the spinout.

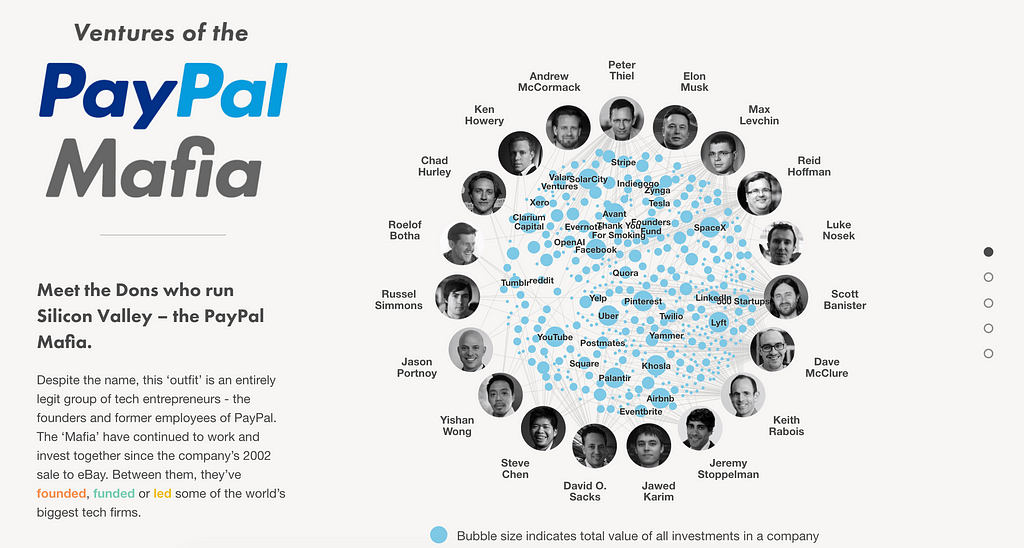

This is how Silicon Valley continued to grow and innovate. Employees left to create companies, some of these companies did extremely well, then their employees cashed out and created companies of their own. The most talked about example in modern times is Paypal (those that have left are collectively called the “Paypal Mafia”), but it’s also happened with Facebook and Twitter among others.

Image courtesy of Fleximize

Image courtesy of Fleximize

And so the cycle has repeated… until now. The recent rise of mega-funds like SoftBank’s $100bn Vision Fund means that companies are staying private longer. The employees whom previously would have taken their earned equity and broke off to launch their own ventures have instead — as TechCrunch vividly describes—been handcuffed:

“If you had the ability to sell a portion of your shares to pay the tax on them, that would be one thing,” says one longtime Uber employee. “But you can’t. So unless you’ve already made a lot of money or want to walk away from very valuable equity, you stay.”

Some employees are even at risk of losing their equity outright! As Alfred Lee over at The Information reports, most types of equity compensation that startups use have expiration dates. This made sense when the average time to IPO was 5–7 years, you don’t want open ended liabilities on your balance sheet so you’d slap on a 10-year expiry date confident that by then the company would either be public or dead. But with SoftBank and other late-stage mega-funds supplying amounts of capital previously only available in the public markets, that’s just not the case anymore — AirBnb turns 10 next month, Uber will be celebrating it’s 10th birthday in March, while Palantir is 15 and may never go public.

If companies had planned this from the start, communicated to employees their intention of staying private longer, perhaps indefinitely, and adjusted their equity compensation structures appropriately, that would be one thing. But they didn’t, and you can’t really blame them for that. Back when these companies started they had every intention of going public just like all the companies before them, the late-stage mega-funds didn’t exist yet. Now however the cycle has been broken, we’ve entered the land of the unicorns, and no one knows where it will take us.

So while we can’t blame companies for not anticipating staying private this long, we can most definitely blame them for not doing nearly enough to ameliorate its effect on employees.

So unicorns, it’s time to do right by your employees and the startup ecosystem upon which you built your success. Make it easy for your employees to cash out their equity and wish them well as they venture out on their own. Hell, go one step further and invest in them! You thought they were making good money for you as employees, watch what they do for you out on their own. Just look at Kleiner Perkins, one of the most successful investors ever, which began with a founder investing in the employees spinning out of his company.

SoftBank is Stifling Entrepreneurship was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.