Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Last year’s crypto hysteria has slowed down a bit.

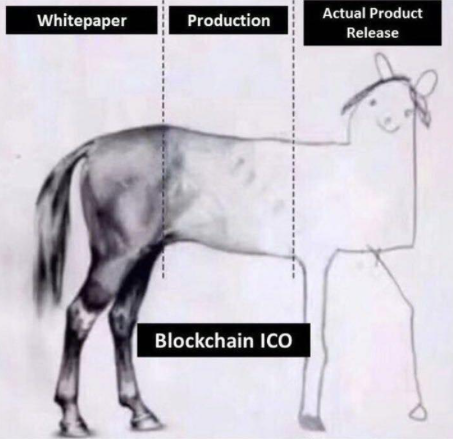

Bitcoin price has suffered a massive correction, going from $19,000 to $7000, while many ICO projects have gone radio-silent: 92% of ICOs failed or turned out to be a scam, and of the the remaining 8%, many will follow the lead.

What this means simply is that those who were in it only for the money have moved to other places to scam people.

The good news is that now these snake oil salesmen are gone. Hardcore developers continue to slowly build the decentralized world and bring the hyperbitcoinization closer to reality. So, today, I want to talk about decentralized applications (aka DApps).

First, let’s talk about some background on the topic.

What is the difference between DApps and a regular app?

For simplicity, let’s assume that a decentralized application consists of a frontend code (written in any programming language) and decentralized code running on a blockchain.

Currently, DApps require a browser (Toshi, Brave) or a browser extension (i.e. Metamask) to take care of storing private keys and identity management, thus removing an extra step in the registration process. According to the latest data, 95% of all decentralized applications work on the Ethereum blockchain. We can therefore assume that:

DApp = frontend code + Ether smart contract.

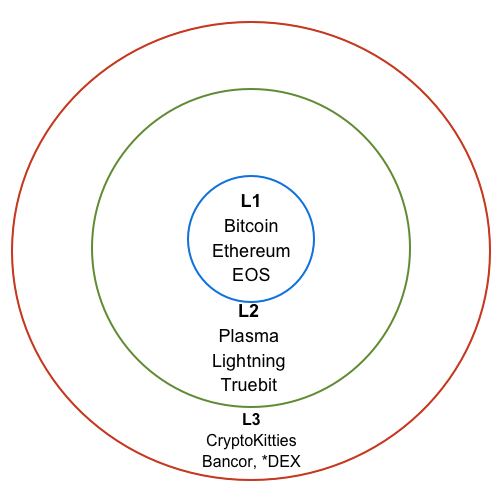

Let’s imagine that the entire ecosystem is divided into three layers:

- Layer 1 — Blockchains (Bitcoin, Ethereum, EOS etc).

- Layer 2 — Protocols built on top of L1 — (i.e. infrastructure protocols such as Plasma, sharding, Lightning, Truebit and so on).

- Layer 3 — Applications and services that use decentralized components in one way or another.

So, what’s the deal with DApps?

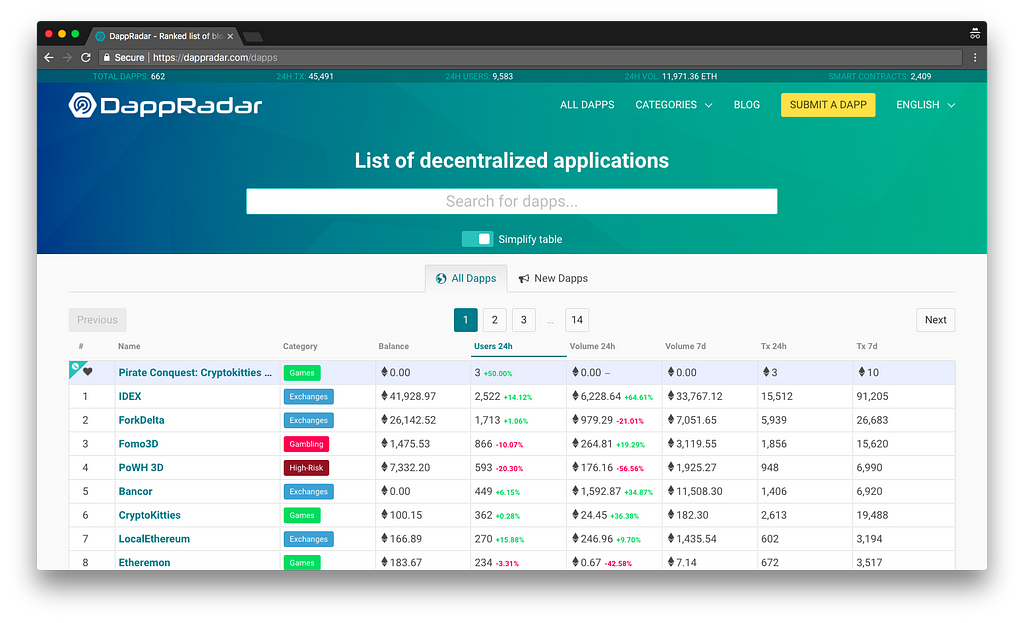

For data on DApps and their usage, we can to look at a few sources. DAppradar is one of the most popular DApp statistics websites. There are also many others such as app.co (backed by Blockstack) or StateOfTheDapps. I will be using DAppradar to analyze the top list of the DApps built on Ethereum (market cap ~$50B).

Most DApps fall into these categories:

- Games (Cryptokitties, Ethergoo)

- Exchanges (IDEX, Etheredelta)

- Marketplaces for non-fungible tokens (Rarebits, Decentraland Market)

- Gambling

There are also services that do not fall into any of the above categories (Peepeth is a decentralized version of the Twitter, PoWH3D is a pyramid, and so on), but games and exchanges take up the lion’s share of DApps in terms of transaction volume.

The State of Ethereum

Many agree that full-scale crypto adoption (100M+ users) is at least a few years ahead. Yes, current Ethereum throughput capabilities do not allow for building a really popular application. Some Chinese ICO which you may have never heard of or a massive airdrop can clog the network to the point of sheer dysfunction and raise gas prices to unacceptable levels.

As an outside observer, I do not have a clear understanding of the internal processes that happen within the Ethereum dev ecosystem (and I read the regular core dev meeting notes on GitHub), but it’s difficult to make any assumptions or forecast when Casper/sharding will be implemented and if the state channels will be widely adopted anytime soon (to my knowledge, they work in production only in Spankchain and Funfair); despite the fact that Vitalik said “Ethereum 2.0 upgrades are coming in 2019”, we have already heard it many times before.

The State of DApps

It must be understood that the popular idea to “decentralize everything” has no solid background. Most crypto projects are still “solutions looking for a problem” and are trying to apply hot technology to problems that were solved long ago, or are not even problems worth solving at all.

The key idea beneath the decentralized blockchain is censorship resistance (which comes with its drawbacks, e.g. slow speed, transaction costs), and ask yourself: do we really need a decentralized version of Twitter, where we need to pay for each tweet or set of tweets (could be $0.6 today or $3.2 tomorrow)? Do we need a crypto-based ride-sharing or a decentralized document editor?

When was the last time you’ve been censored when editing a document in Google Docs or calling a taxi ?

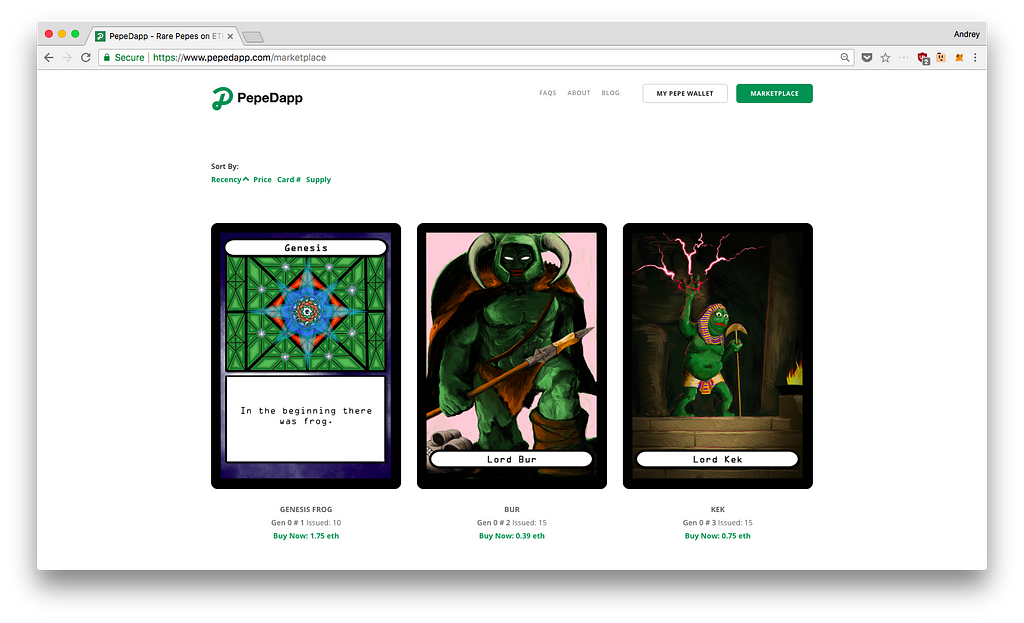

Virtually all of the currently available top DApps were created in order to redistribute the surplus of crypto and make more intelligent people somewhat richer, and vice-versa, hence the popularity of pyramids and pay-to-win-games. Numerous mediocre CryptoKitties clones and poorly drawn NFT-based “games” also confirm this theory.

In the majority of crypto-collectibles “games”, an ordinary person has zero chances to win or profit: this is the typical MLM scheme where the technically gifted author of the application always makes sure that the average Joe exchanges as much of his own crypto for a useless picture, even if it is somehow bound to a blockchain. And the underlying value of the picture disappears completely with the appearance of the new and shinier crypto-collectible game tied to yet another smart contract.

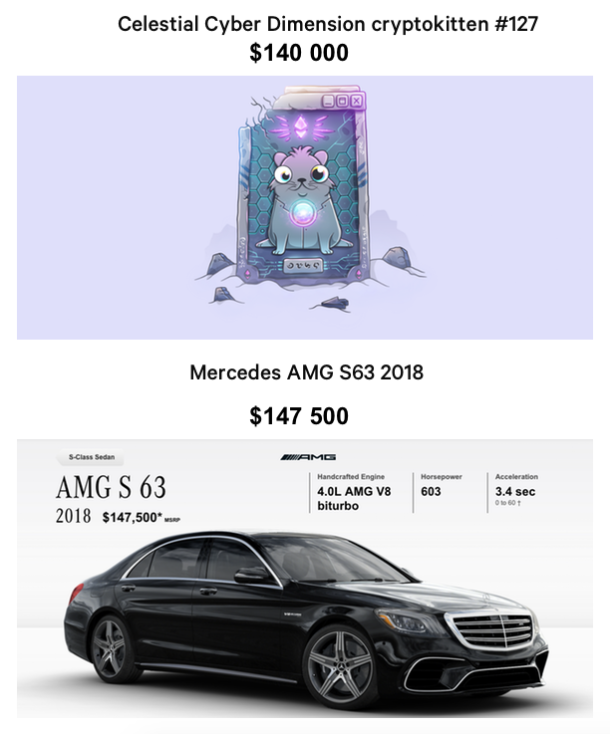

One of the many crypto-collectible marketplaces

One of the many crypto-collectible marketplaces

CryptoKitties raised $12M from a list of respected VC funds, but it’s clear that the money was invested in the hopes that the team behind CK — Axiom Zen would make a new viral hit that earns them even more money. And while some crypto-cats were allegedly sold for six figures, it is still remains to be seen whether they were real sales or merely a money put from one pocket to another within a small group of people or even one person.

The $140,000 CryptoKitty

In May, an article appeared in The New York Times stating that “The art piece ‘Celestial Cyber Dimension,’ with a CryptoKitty … sold for $140,000 at the Codex Protocol Ethereal Live charity auction.”

I managed to ask the man behind the purchase of the most expensive CryptoKitty, Igor Barinov, a few questions:

Q: What motivated you to purchase the CryptoKitties piece?

There were lots of factors:

- The cat is awesome! It’s beautiful, rare, with a unique shape and background. It’s cat number 127 which is a prime number and has some particular meaning for geeks like us.

- It was the first auction in real life for the cryptokittie. The auction created a story of its life, a trail of bits and stories. That’s important for crypto assets to be connected with real life and have provenance records.

- Out of the ten lots on the auction, only this one CryptoKitty was a digital asset on auction.

- I’m a big fan of crypto art, e.g., t-shirts and stickers from artists like Cryptograffity. It’s great that the proceeds from the auction will go to support blockchain art projects.

- The digital CryptoKitty included a physical hardware wallet which in itself can be seen as an art object.

Q: Mike Novogratz said that he expects the value of the work to go up. Do you agree or disagree?

Mike Novogratz has proven to be a very successful entrepreneur and it was a pleasure to participate in the auction with him. We, as software developers and collectors, are not concerned with whether the value goes up or down. We are just happy that we were able to get this unique artwork.

Q: You could buy the Mercedes S63 with this money, but a cat? Come on!

I have a Toyota Prius, I do not need a Mercedes.

Final Thoughts

- DApps are not ready for the prime time. The available infrastructure consists mainly of Metamask for desktop users and Toshi on mobile. Despite all the improvements, it is still very far from being used by my grandmother.

- The hype wave that started somewhere last year hasn’t brought any real benefits to the real users, but rather enriched a bunch of ICO founders, who became very wealthy. Just consider that the total volume of transactions of the top fifty DApps combined is comparable to a statistical error for a mediocre taxi app.

- As a result, I think that it makes little to no sense for developers to focus on the creation of decentralized applications for now. More value can be found in the development for L1/L2, improving the foundation rather then building sand castles no one’s playing with.

- There are other blockchains on the market (EOS, Cardano, etc.) and they could become the necessary base for building fast and convenient decentralized applications. But even EOS, having raised $4 billion, has yet to resolve all of its growing problems and speculations.

Ivan Bogatyy (GP@Metastable Capital)

A more bullish take: I don’t think we should demand the same scalability constraints from dApps as we do from regular apps. Analogy: Bitcoin was originally positioned as the peer-to-peer payment system that you can buy coffee with. Turns out, it doesn’t work for that, but solves a much more important problem of digital gold. Now may be the time to accept that Ethereum is not a platform to trade CryptoKitties and run a decentralized Twitter on, it is instead a platform for high-powered financial derivatives that trustlessly operate hundreds of millions of dollars, like EtherDelta, 0x or MakerDAO. For these use-cases, a $1 transaction fee is still negligible compared to the possibilities unlocked.

I would love to hear your thoughts in comments.

State of the dApps (hint: way too early) was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.